Investment Opportunities in the Biopharma Industry

The industry faces pressure from expiring patents, but we think innovation will offset these losses.

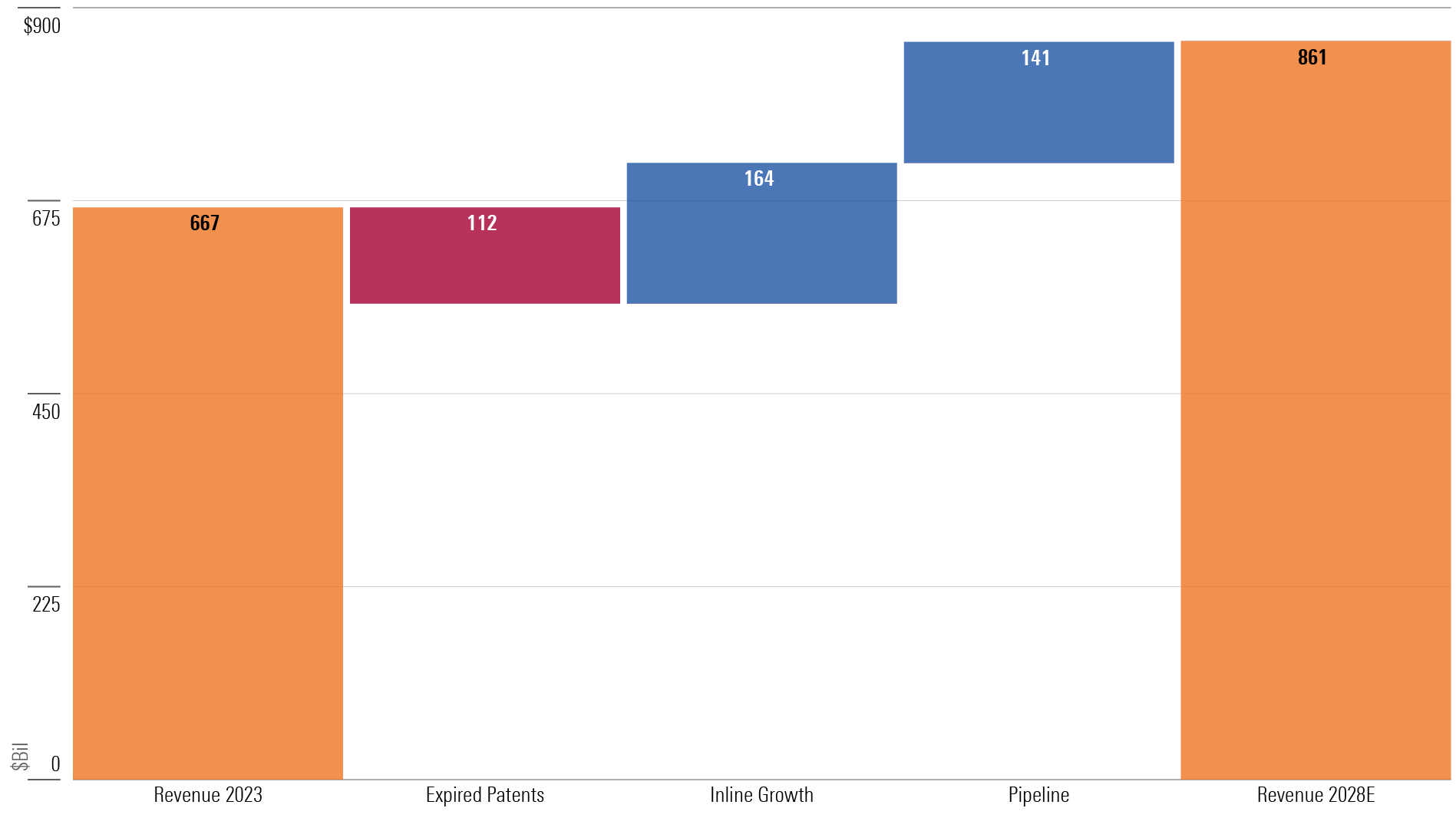

We expect erosion in sales from expired or expiring patents to result in a $100 billion headwind for the biopharma industry over the next five years. However, we think the headwind will be more than matched by growth of other approved drugs as they expand market share and gain approval in new indications.

Growth will be further increased by the contribution from pipeline products at the top 18 biopharma companies under our coverage.

Branded Drug Sales at Top Biopharma Firms Poised to Grow at 5.2% CAGR Through 2028

We expect three key themes to drive the biopharmaceuticals industry:

- Innovation offsetting sales lost to patent expirations.

- Sales at risk from patent losses.

- The drug pipeline, driven primarily by obesity drugs, will add $141 billion by 2028.

We outline our expectations for the industry through the lens of these themes and share a few investing opportunities.

3 Key Themes for the Biopharma Industry

Our outlook for the biopharma industry is centered on three key themes:

- Innovation offsetting sales lost to patent expirations. We expect revenue at the top 18 biopharma firms we cover to grow at a 5.2% compound annual growth rate through 2028. We expect declines from older drugs with expiring patents to be more than countered by growth from newer products and launches of new drugs from the pipeline. Drugs in the fields of immunology and oncology are the biggest drivers of approved product (in-line) sales growth but also key areas for patent expiration headwinds over the next five years.

- Sales at risk from patent losses. The outlook for patent losses is moderate except for 2028, which will bring one of the heaviest patent loss years since 2012-14. The biggest upcoming patent cliffs are for Johnson & Johnson’s JNJ immunology drug Stelara and oncology drugs Keytruda (Merck MRK) and Opdivo (Bristol-Myers Squibb BMY). Our forecast for sales declines from patent losses could fluctuate if weaker patents hold up in court.

- The drug pipeline, driven primarily by obesity drugs, will add $141 billion by 2028. Sales growth from the pipeline over the next five years is driven by obesity, including Eli Lilly’s LLY launch of Zepbound and Novo Nordisk’s NVO phase 3 CagriSema. In oncology, industry investment remains high because of significant unmet need and strong pricing power. Innovation in oncology includes novel types of treatments like modified antibodies, cell therapy, and gene-based therapies. Advancements in rare diseases and neurology are also driving significant industry growth from the pipeline through 2028 and beyond.

14 Biopharma Companies With Wide Moats

In the biopharma industry, the top five companies represented only 22% of total industry sales in 2023. Johnson & Johnson had the highest share at 6%, followed by Roche RHHBY, Merck, Pfizer PFE, and AbbVie ABBV. However, several of the companies in the biopharma industry hold non-biopharma divisions that can also contribute to total sales.

Overall, we view the market as lightly concentrated. However, the Federal Trade Commission has increasingly pushed back on major mergers such as the 2023 Amgen AMGN/Horizon deal, suggesting more elevated regulatory concerns around industry concentration risks.

The table below maps out the 13 large-cap biopharma companies and one mid-cap biopharma company within our coverage that earn a Morningstar Economic Moat Rating of wide.

| Stock | Ticker | Fair Value Estimate (as of April 5, 2024) | Price/Fair Value Ratio (as of April 5, 2024) | Uncertainty Rating |

|---|---|---|---|---|

| Amgen | AMGN | $268 | 1.00 | High |

| AstraZeneca | AZN | $78 | 0.86 | Medium |

| Bristol-Myers Squibb | BMY | $63 | 0.82 | Medium |

| Eli Lilly | LLY | $500 | 1.54 | Medium |

| Gilead Sciences | GILD | $97 | 0.72 | Medium |

| GlaxoSmithKline | GSK | $54 | 0.76 | Medium |

| Johnson & Johnson | JNJ | $164 | 0.93 | Low |

| Merck & Co. | MRK | $114 | 1.12 | Medium |

| Novartis | NVS | $98 | 0.99 | Low |

| Novo Nordisk | NVO | $84 | 1.48 | Medium |

| Pfizer | PFE | $42 | 0.63 | Medium |

| Roche | RHHBY | $55 | 0.56 | Low |

| Sanofi | SNY | $61 | 0.78 | Medium |

| Biogen | BIIB | $303 | 0.68 | High |

Our Outlook in Key Therapeutic Areas

Our forecast for the next five years spans 11 main therapeutic areas:

- Oncology. IQVIA forecasts oncology as the fastest-growing area of drug spending: Spending is expected to more than double between 2023 and 2028. Checkpoint inhibitors maintain a particularly large share of cancer drug sales, and we also expect innovation in drugs for breast cancer and blood cancer.

- Neurology. One of the biggest areas of drug spending in neurology is in multiple sclerosis, a neuroimmunological condition. We expect other neurological innovation to target neurodegenerative diseases such as Alzheimer’s disease, neurovascular conditions such as migraines, and neuromuscular conditions such as muscular dystrophy.

- Immunology. We think the immunology market for the top biopharma firms is poised to start slowly shrinking by 2029, as biosimilar versions of Humira, Stelara, Actemra, and Simponi reduce sales of the most established drugs. Patent expirations will hit the rheumatoid arthritis market the hardest, with some pressure on the psoriasis and psoriatic arthritis markets.

- Respiratory. The branded respiratory market should grow slightly as new drugs offset generic pressures in older drug classes of doublet therapy. The generic declines will likely be more gradual, given the complexity of inhaled administration. The new classes of biologics offer significant benefits but generally target more-severe patients.

- HIV. The global HIV market has continued to grow as new combination regimens have launched with superior safety and efficacy profiles to older drugs. Gilead GILD and GSK GSK are the two dominant players: Gilead’s Biktarvy is now the top daily pill for HIV treatment, and we expect GSK’s two-drug combination Dovato and injectable Cabenuva to continue to grow, though several patent expirations in the late 2020s should tilt branded market share back to Gilead.

- Anticoagulants. The current anticoagulant market is poised for generic erosion between 2026 and 2028 as the main players approach patent losses. More data is needed before suggesting next-generation drugs can replace these sales, but two new drugs look promising: Bristol Myers and Johnson & Johnson’s milvexian and Bayer’s BAYRY asundexian.

- Diabetes. Massive demand for GLP-1 therapies and subsequent delayed progression to insulin are shifting the diabetes drug landscape. Both Novo Nordisk and Eli Lilly, which share the GLP-1 market, are aiming to improve their positioning with higher doses and combinations.

- Obesity. Recent obesity medication launches have increased expected efficacy: Both Novo Nordisk and Eli Lilly are studying higher doses and new combinations that could bring weight loss closer to 25%, which is comparable to bariatric surgery.

- Vaccines. We expect the vaccine market to contract in 2024 as fewer covid-19 vaccines are needed, but then steadily increase. Since vaccine pricing tends to increase very slowly, most of our forecast gains are volume-based.

- Genetic Therapies. We expect sales of mRNA vaccines to extend beyond covid: first to other infectious diseases but also to cancer and rare diseases.

- Rare Diseases. Outside of oncology, rare diseases are often triggered by genetic mutations, so this area is particularly focused on innovation from gene therapy or gene editing. Two diseases that have seen substantial progress with gene-based therapies are hemophilia and ATTR amyloidosis.

MORN DODFX VINIX VWILX TSVA EGO WU Brightstart429plan MRO VZ MOAT T NKE CMCSA GOOG

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)

/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_d0e8253d77de4af9ae68caf7e502e1bf_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)