Morningstar® Advisor Workstation℠

Simplify your financial research and reporting with business intelligence

Introducing the new smartphone companion app.

Optimize your time and grow your business with the app's intelligent digital assistant.

Add color to your client communications.

Communicate your plan for your clients easily. You can confidently show them your unique strategies with our Finra-reviewed reports.

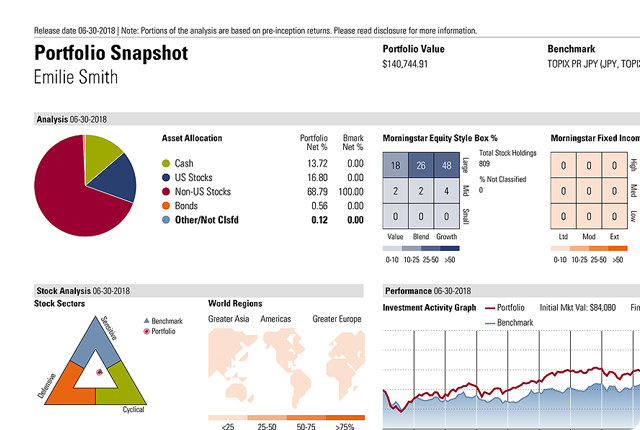

Client Reporting

Aggregate your client accounts with custom integrations to create compelling reports and show your clients what you bring to the table.

Show what your investment advice can do.

Walk through the process behind your recommendations so potential clients can see what’s possible and how you’ll help them reach their goals.

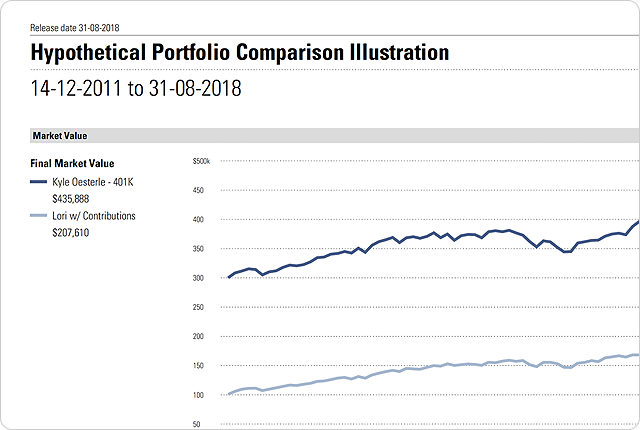

Reporting Hypothetical Illustrations

Demonstrate how your recommendations would have affected a prospect’s wealth to secure new business with hypothetical sales illustrations that can include details such as investments, withdrawals, reinvestment of dividends, taxes, and more.

Go beyond what your clients are expecting with financial data integration.

Exceed your clients’ expectations. Build portfolios that help them reach their financial goals.

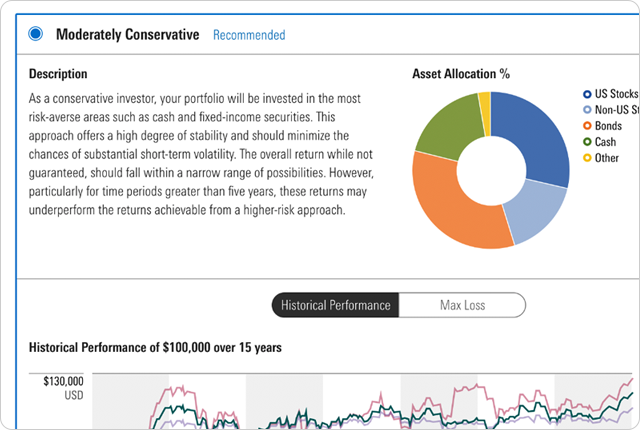

Investment Proposal Tools

Match your client’s goals with firmwide strategies that drive towards their financial objectives using investment models, lists, and strategies. You can also run Monte Carlo projections to illustrate how different strategies might succeed.

Financial goals are easier to meet if you know what they are.

Connect financial goal-setting with data integration. Morningstar’s Goal Bridge shows you how.

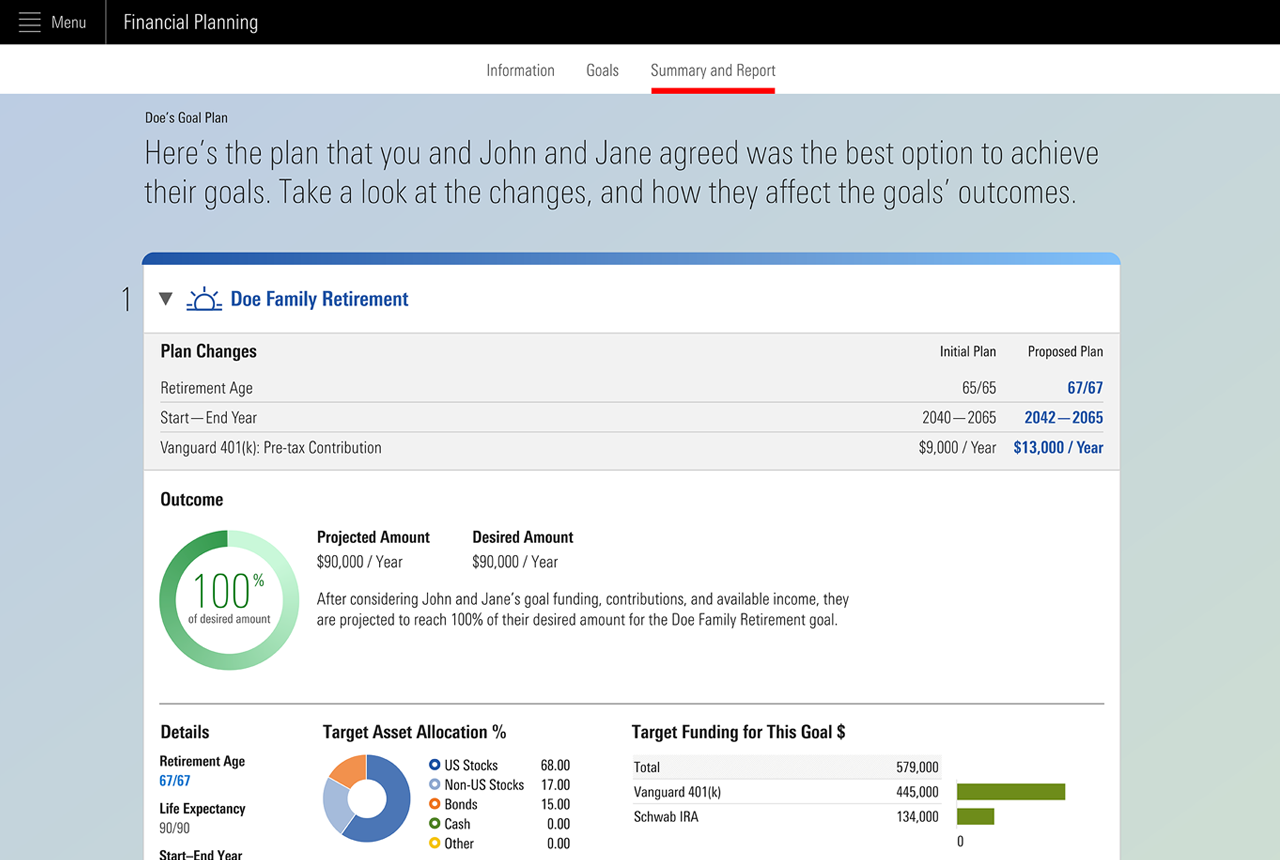

Planning Tools

Help your clients identify meaningful goals and take action to make them a reality.

Morningstar Goal Bridge enables you to have goals-based conversations with clients, then quickly connect those goals to a straightforward investment plan in a simple, but powerful workflow.

More Financial Tools for Tomorrow’s Advisor

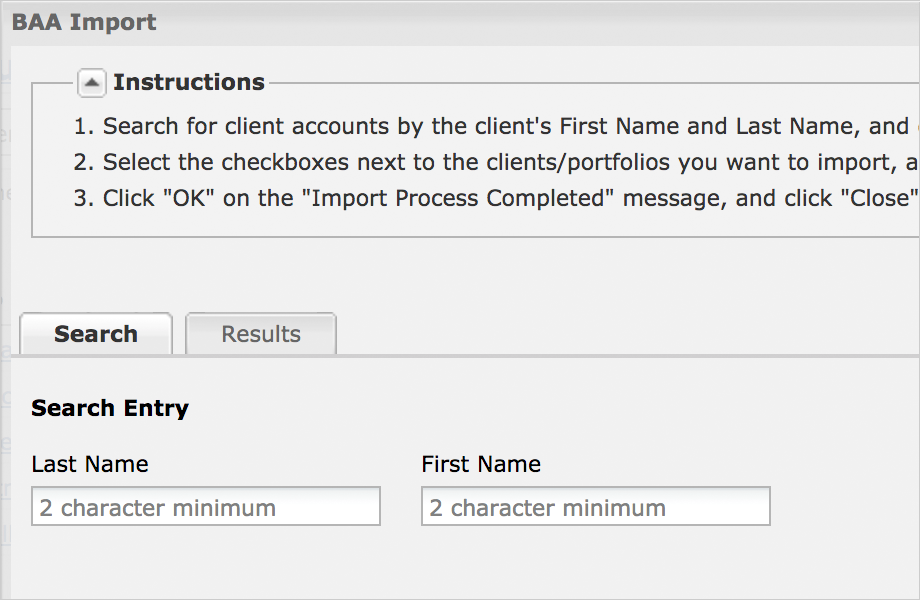

Data Integration

Reduce manual client and portfolio data entry with a platform built to support your firm’s client data.

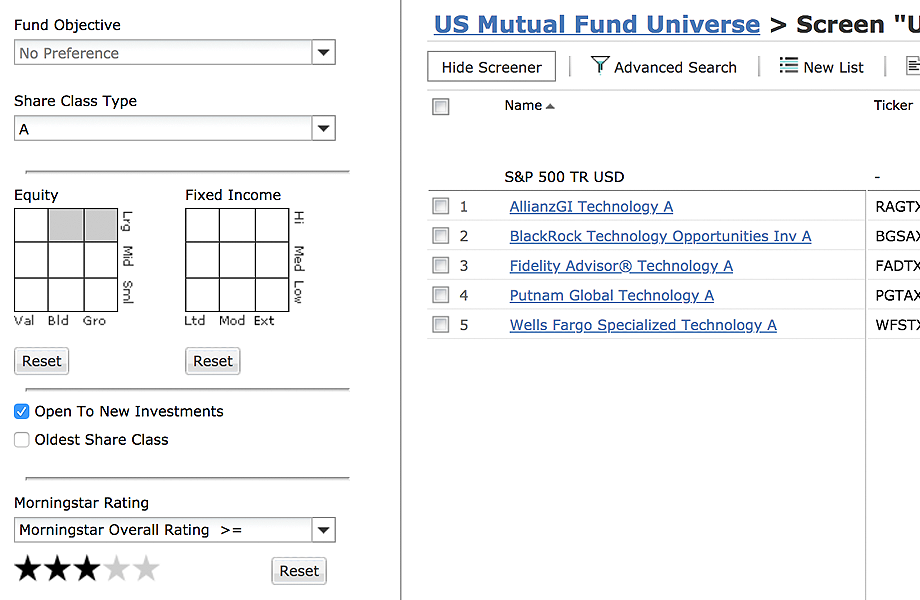

Security Research and Screening

Screen and evaluate multiple security types to find investments that fit, spot market trends, and build model portfolios using our research and analytics.

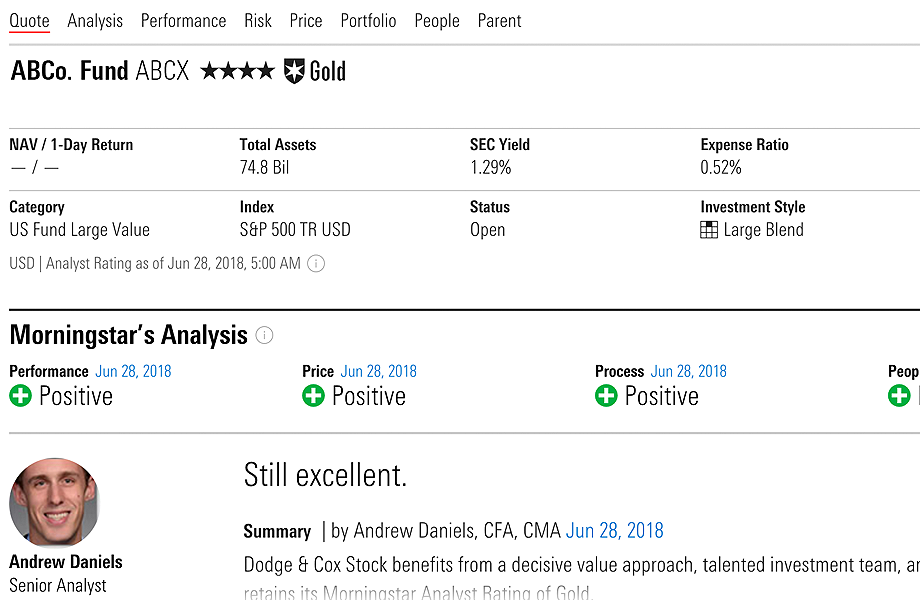

Analyst Research

Back your investment proposals with the same data and insight that our global analysts use to follow the market by accessing videos, reports, and more on thousands of stocks, ETFs, funds, and IPOs.

Ready to See for Yourself?

Try Morningstar® Advisor WorkstationSM to grow and sustain your business.

A Seamless Experience

Our platform fully integrates with third-party tools to support the way you want to work.

More Tools for Financial Advisors

Morningstar DirectSM

Deliver great investment advice with independent data, proprietary portfolio analytics, and personalized reporting.

Learn more ›

Morningstar® ByAllAccountsSM

Aggregate your custodial and held away accounts for a holistic view of your clients holdings.

Learn more ›

Morningstar® Managed PortfoliosSM

Professional guidance and access to strategies that advisors can use to help meet investor needs at each stage of their lifetime.

Learn more ›

Morningstar Due Diligence and Manager Selection Services

Make portfolio decisions built on a best ideas list of suitable funds and ETFs vetted by our global manager selection team.

Learn more ›

By using these tools, we’re doing a better job of building diversified portfolios—ultimately helping increase the likelihood of success for our clients.

Andy Mohn

Vice President

Waddell & Reed, Inc.

Overland Park, Kansas

Easing the Retirement Crisis

Did you know 75% of working American households are not on track to achieve their retirement goals? Our latest research analyzes eight changes advisors can make to help their clients build a better financial future.

Learn more about Morningstar’s solutions for financial advisors.

In the United States, Morningstar® Managed PortfoliosSM are offered by Morningstar Investment Management LLC or its wholly-owned subsidiary, Morningstar Investment Services LLC, both registered investment advisors, as part of various advisory services offered on a discretionary or non-discretionary basis. Morningstar Managed Portfolios are intended for citizens or legal residents of the United States or its territories and can only be offered by a registered investment advisor or investment advisor representative.