Will PEPs Address the Retirement Plan Woes of Small Employers?

As the debut of pooled employer plans draws near, the current MEP system provides a useful test case for what can go right--and wrong.

One downfall of our retirement saving system is the cost and quality of the plan that you have access to can be significantly dependent on the size of your employer. Small employers have fewer employees to join their plans and generally fewer collective assets to invest, resulting in limited bargaining power to negotiate low fees and barriers to accessing low-cost investment options that may have higher minimum investments. Allowing many small plans to pool their resources in one plan sounds like a good way to help small employers offer better plans--and it will be possible starting Jan. 1, 2021. But what is a realistic outlook for these new pooled plans?

Currently, small plans can only combine with other employers that share a "common nexus" (an industry, for example) to form a multiple-employer plan, or MEP. As created by the SECURE Act, pooled employer plans, or PEPs, will remove this requirement and address a couple of MEPs' known logistical issues. While MEPs are in many ways the precursor to PEPs--and therefore could shed light on how PEPs can succeed and what pitfalls to avoid – there is relatively little research on MEPs. We look to illuminate the picture of the MEP landscape and identify key policy implications in our new research.

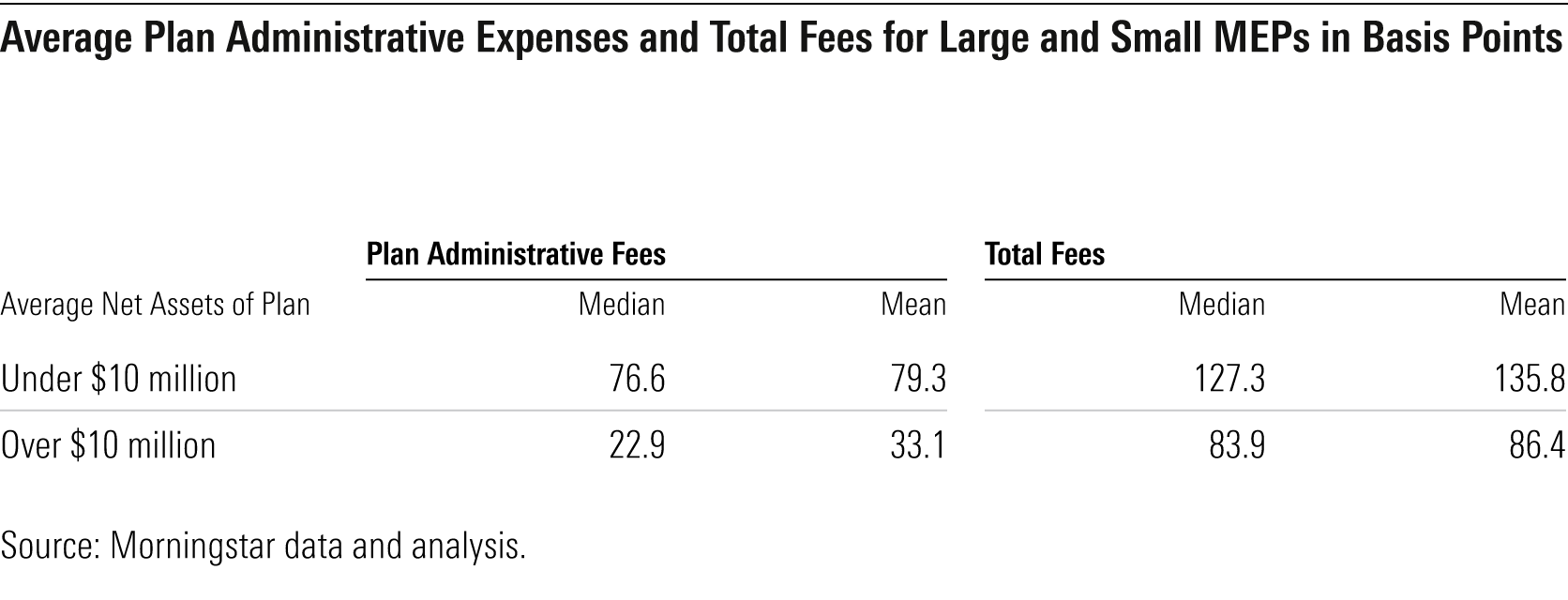

Large MEPs Are Generally Cost-Effective and a Good Option for Small Employers We find that MEP costs decrease and become more predictable as they scale up their assets. Encompassing both the plan administrative expenses and the average net expense ratio of the investments in the plan, the total cost is a good estimate of what an individual participating in the plan pays. Among MEPs, large plans are cheaper for participants than small ones on average, which is consistent with other retirement plan structures. The median MEP with more than $10 million in assets is a third cheaper than the median MEP with less than $10 million in assets, a difference of 43 basis points. Further, the dispersion of costs is much narrow for larger plans, meaning that participants in larger plans are less likely to be in a plan with high fees relative to other MEPs. Evaluating MEPs in isolation is helpful to understand the marketplace, but comparing them with the world of single-employer plans provides meaningful context.

Large MEPs are marginally more expensive than comparably sized single-employer plans, but they are much cheaper than the single-employer plans that most small employers could offer on their own. We find the median overall cost for MEPs with at least $10 million in assets is at most 5 basis points higher than the median cost for a single-employer plan in a similar range of assets, as illustrated in Exhibit 1. The difference in fees is generally captured in a higher plan administrative fee owing to the additional complexities of operating a multiple-employer plan. While it is convenient to compare similarly sized MEPs and single-employer plans, this does not capture the decision that faces companies participating in a MEP. Rather, most participating companies would be choosing between a midsize MEP that might cost 78 basis points and a small single-employer plan that would cost 111 basis points on average. Here, the advantage of combining resources is clearer.

Large Population of Expensive Small MEPs Shows How PEPs Could Fail The biggest pitfall of the MEP marketplace that should be avoided as PEPs develop is the prevalence of small plans. While MEP costs scale effectively with size, almost 50% of MEPs are under $10 million in assets. These plans vary significantly in cost, with a roughly 100% higher standard deviation than in plans with over $10 million in assets. This places 68% of small MEPs within 65 basis points of the mean compared with the narrower spread of 68% of plans within 34 basis points of the mean for larger plans. Another way to look at it, over 30% of these small plans have total fees surpassing 150 basis points.

Further, looking at plans by the number of participants, many plans that start small stay small. Of MEPs that reach 100 participants, 87% stay below 1,000 over the next five years. While some of this might be attributable to the common-nexus requirement stunting the growth of these plans, it is unlikely that is the only contributing factor. Similar to plans with under $10 million in assets, plans with 100-1,000 participants struggle to offer competitive fees and have a higher variance in their fees than larger plans with over 1,000 participants.

The range of 100 to 1,000 participants may seem arbitrary, but it has important policy implications. The SECURE Act allows the Labor Department to extend annual reporting relief that is currently available to retirement plans with fewer than 100 participants to PEPs with up to 1,000 participants. This reporting relief means that assessing the quality of these plans will be significantly hindered as information on their investment lineup will not be included in the filing, and therefore not publicly available. The plan would also be exempt from an annual audit, reducing some of the participant protections. While we think the extension of the audit relief is a good carrot to entice entrants to the pooled plan provider space to offer PEPs, we recommend that the department consider time bounding this relief if plans do not scale up effectively within a few years of inception.

Opportunity for PEPs to Improve Individual Outcomes With workplace retirement plans representing the primary--or only--way many Americans invest for retirement, improving the availability and quality of these plans is crucial. PEPs should help do that. While the intricacies of PEPs are different than those of MEPs, our analysis shows that the pooling of small plan resources can effectively result in access to lower-cost plans for employees. Avoiding the fragmentation of the PEP marketplace so as not to recreate the large number of small plans will be key in ensuring a successful and competitive marketplace.

/s3.amazonaws.com/arc-authors/morningstar/f3c31470-cc00-45ac-b20f-d2928ec12660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YBH7V3XCWJ3PA4VSXNZPYW2BTY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WNDFS2S4FNA6LEJDB2Y6E4XHYQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/f3c31470-cc00-45ac-b20f-d2928ec12660.jpg)