Meet the New Landlord: Your Target-Date Fund

Several target-date fund families invest directly in real estate. Why?

Recently, Fidelity, manager of the Silver-rated Freedom target-date complex, announced that it would expand access to its Freedom Plus collective investment trusts, making those CITs available to a broader swath of investors than before. One thing new investors might notice about the series is that it sports an unusual attribute: a 5% sleeve that’s invested directly in real estate assets—that is, apartment buildings, office parks, and warehouses.

Fidelity is the latest to offer a target-date series that invests directly in real estate, joining J.P. Morgan (manager of the Bronze-rated SmartRetirement and SmartRetirement Blend series) and TIAA-CREF (manager of the Bronze-rated Lifecycle Index and Neutral-rated Lifecycle series).

What Do I Mean by ‘Direct Real Estate’?

How do these target-date suites access the real estate they directly invest in? Are they scouring Zillow and heading to open houses on the weekends? Not quite—The short answer is these target-date providers invest through a manager who buys properties (typically commercial) outright on their behalf. This is different from how most target-date series get exposure to real estate, typically by allocating to a manager that buys publicly listed securities on an exchange, like real estate investment trusts.

While this might seem novel, it’s not. Indeed, plan sponsors that customize their plans have long demonstrated an appetite for direct real estate, and the percentage of retirement plans with a custom target-date fund that included private/direct real estate assets as an inflation-sensitive allocation rose to 23% in 2021 up from just 3% in 2017. Outside the construct of target-date mutual funds, many pension plans have exposure to real estate as well. On average, pension plans allocate around 9% of assets to private real estate.

The list of investment managers that have opted to plug a direct real estate strategy into their target-date offerings is much shorter, though. J.P. Morgan was the first to market, including a direct real estate allocation in its flagship target-date CIT series when it debuted back in 2005. TIAA-CREF joined the party in 2016, incorporating direct real estate into its Lifecycle mutual fund series.

As previously mentioned, Fidelity recently took the plunge, offering direct real estate in its target-date CITs via multiple managers it has chosen to invest on its behalf. J.P. Morgan and TIAA-CREF both tap in-house teams to run the real estate sleeves of their portfolios. Fidelity invests with outside managers instead.

Direct real estate holdings are illiquid—one can’t log on and quickly unload an apartment building, storage facility, or other type of property with the same ease as selling stocks or bonds. Given that, target-date managers who allocate directly to real estate must surmount a whole host of implementation challenges. I’d like to probe why these managers might feel those challenges are worth surmounting.

What Are the Benefits?

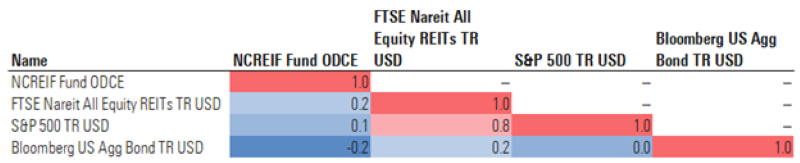

Why do so many retirement plans invest in strategies that buy the properties outright, in lieu of or in addition to publicly traded REITs? The primary benefit is diversification. Direct real estate investments don’t behave like other securities, including publicly traded REITs. Over the past 20 years, the NCREIF ODCE Index has exhibited a correlation of roughly 0.2 to the FTSE NAREIT All Equity REIT index of publicly traded REITs.

Correlation of Asset Classes, October 2003 to September 2023

That diversification is partly a result of lower price volatility. Pricing a piece of real estate is an entirely different beast from pricing a security. In between transactions, real estate valuations are computed by a third-party expert based on entirely different assumptions. Since broader market trends and price movements aren’t a huge weighting in those models, it means that a piece of directly held real estate is not as closely linked to market risk as a security like a public REIT that’s traded daily via an exchange.

Separately from diversification, interest in direct real estate is also a result of higher potential income. Direct real estate investments can have higher yields than publicly traded REITs. There are a lot of reasons, but at least two are structural: Private strategies have a higher capacity for leverage than public REITs and can invest in lower-quality properties than publicly traded REITs can. Because they’re in less-desirable areas or have less up-to-date infrastructure, these properties’ values generally are not as likely to appreciate over time, but investors get a better yield as a reward.

What Are the Challenges?

Liquidity is the biggest challenge a target-date manager faces when considering an allocation to direct real estate. Mutual funds can only invest up to 15% of their assets in illiquid securities before running afoul of regulatory limits, and managers have cash coming in the door and rotating out almost constantly.

Given this, target-date managers have to think carefully about the commitments they make to, and redemptions they seek from, their direct real estate manager. If a target-date manager needs to rebalance, they can’t simply ask their real estate manager to go out and sell a fraction of each property they hold. If a target-date series’ cash flows call for actively reducing or adding to the real estate portfolio outside of forecast commitments, it may mean that a manager has to go out and source a new property or pick an existing one to sell.

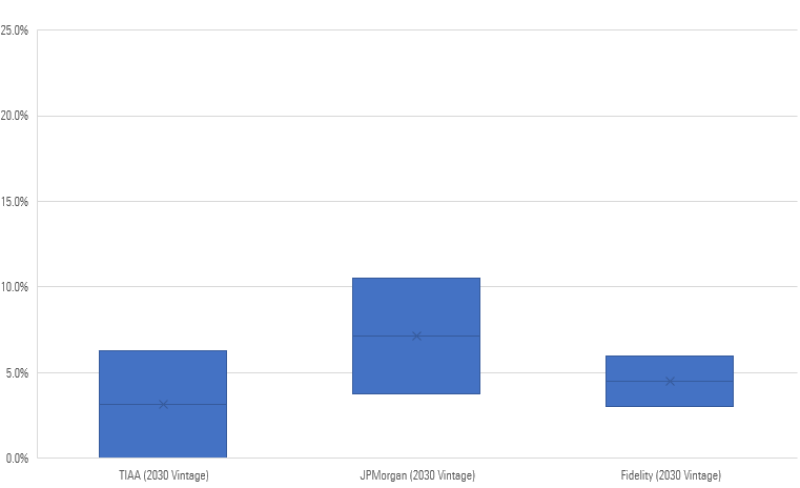

Most managers have tackled this problem by sticking to very modest allocations. TIAA-CREF and Fidelity manage to a 5% strategic weight. J.P. Morgan initially started out with a 10% strategic weight but reduced it to 7% in 2009. Weights may drift based on the movements in other asset classes or based on the managers’ own conviction level, but on a long-term basis, those allocations are lower than the roughly 9% that studies have found pension funds dedicate to the asset class.

Maximum and Minimum Historical Allocations to DRE

Why Has Direct Real Estate Broken Through?

Broadly speaking, plan sponsors haven’t made a beeline to invest in private assets outside real estate, such as private equity and private credit. Such strategies are by their very nature costlier, more opaque, and less liquid than public markets. But the diversification benefits and performance characteristics that direct real estate confers are difficult to ignore.

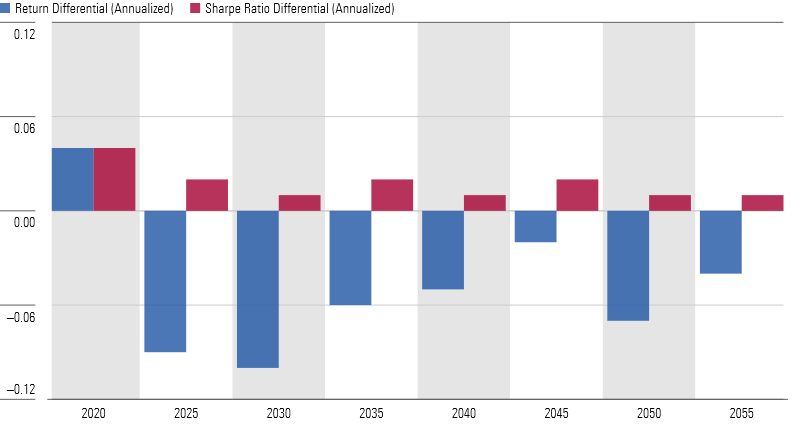

J.P. Morgan, for example, has two CIT series that can be directly compared: J.P. Morgan SmartRetirement DRE (which has direct real estate) and J.P. Morgan SmartRetirement, which was launched in 2016 without access to direct real estate. Since common inception in July 2016, the SmartRetirement series that features direct real estate has fallen short on total return but has delivered lower volatility and higher Sharpe ratios across every vintage.

JPMorgan SmartRetirement Return and Sharpe Differentials, 2016-23

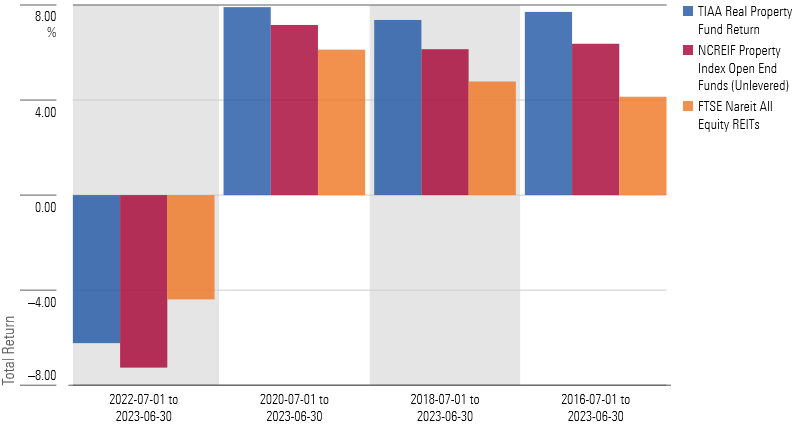

While TIAA-CREF does not have a comparable series without direct real estate, the performance of its Real Property Fund can be evaluated against the NCREIF Property Index — Open End Funds (which measures public nontraded REITs like the Real Property Fund) and the FTSE NAREIT Index (which measures publicly traded REITs).

Return of TIAA Real Property Fund, Inception - Second-Quarter 2023

Of course, it’s only a seven-year window, and private market strategies carry other risks that can’t be measured through performance analysis.

So, why is real estate the first private asset to really break through? I can’t say for sure, but it is hard to dismiss the fact that it is the largest private market. According to NAREIT, public REITs only own about $2.5 trillion in U.S. real estate today. That’s a fairly small number relative to the overall market capitalization for U.S. commercial real estate, which the DCIIA estimates to run around $16 trillion, according to 2019 figures. Meanwhile, McKinsey’s estimated $7.6 trillion in global private equity assets under management represents less than 10% of the estimated $101 trillion in public equity markets. This, in combination with the fragmentation inherent to properties, makes it easier to construct a diversified portfolio. Relative to other markets like equity and fixed income, real estate deals are easier to chew, and target-date managers are starting to bite.

The views expressed here are the author’s.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WNDFS2S4FNA6LEJDB2Y6E4XHYQ.png)

/d10o6nnig0wrdw.cloudfront.net/05-01-2024/t_17b16ff580be466186dfca2760195b1f_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BZ4OD6RTORCJHCWPWXAQWZ7RQE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)