Markets Brief: Why Q1 Was a Triumph for Optimists

Insights into important market performance and economic trends from Dan Kemp, Morningstar’s global chief research and investment officer.

Q1 Market Performance

The first quarter of 2024 was a triumph for optimists. Investors finished the quarter in high spirits after a 10.24% rise in the Morningstar US Market Index. Smaller companies lagged their larger peers, with the US Small-Mid Cap Index rising 8.09%.

International markets were noticeably more subdued, with the Developed Markets ex-US Index up 5.22% and the Emerging Markets Index up 2.07%. While some of their relative weakness can be attributed to the strength of the US dollar, the key driver of higher prices in US markets is the ongoing optimism for large technology companies, illustrated by the US Technology Index rising 13.07% over the quarter.

The Week Ahead

This week is dominated by speeches from Federal Reserve officials, including chair Jerome Powell, and it ends with the closely watched jobs report on Friday. Any of these events could pose a challenge to the current consensus and create volatility in asset prices. However, it is worth remembering that volatility is not always the start of a momentum reversal!

Inflation Data Supports Fed Cut Expectations

Investors in technology companies were buoyed at the end of last week by benign inflation data (represented by Personal Consumer Expenditures). Despite being a little higher than the January result, inflation remains in line with investor expectations and supports the market consensus of favorable economic conditions for technology companies. Companies that can grow their profits at a high rate for a long period are more sensitive to interest rates, which can be thought of as the price of time. Expectations of lower interest rates therefore support higher valuations.

Consensus Is a Double-Edged Sword

The alignment of stock price movements, economic data, and expectations can create momentum independent of the evolving characteristics of the underlying companies. Eventually, this momentum will subside and prices can move sharply in the other direction. However, a focus on price movement encourages short-term thinking from investors, resulting in behavioral challenges that can derail their success. Morningstar behavioral researcher Samantha Lamas highlighted some of the challenges of portfolio changes in this great article.

Seeking Diversification

Rather than timing the market, it’s better to seek diversified forms of return that can reduce the overall volatility in your portfolio and help maintain a longer-term perspective. For those who want to maintain their exposure to equities, Morningstar’s chief US strategist Dave Sekera highlights the opportunities in smaller companies and those with less exciting long-term growth prospects in his latest market outlook.

This Week’s Key Market and Investing Events:

Monday, April 1: March ISM Manufacturing

Wednesday, April 3: March ADP Employment Survey

Wednesday April 3: Fed Chair Powell speech on economic outlook

Friday, April 5: March Employment Situation Report

Click here for our weekly calendar of economic reports and corporate earnings.

Stats for the Trading Week Ended March 28

- The Morningstar US Market Index rose 0.50%.

- The best-performing sectors were utilities, up 2.76%, and energy, up 2.20%.

- The worst-performing sector was technology, down 0.99%.

- Yields on 10-year US Treasury notes fell to 4.20% from 4.22%.

- West Texas Intermediate crude prices rose 2.34% to $83.00 per barrel.

- Of the 704 US-listed companies covered by Morningstar, 555, or 79%, were up, three were unchanged, and 147, or 21%, were down.

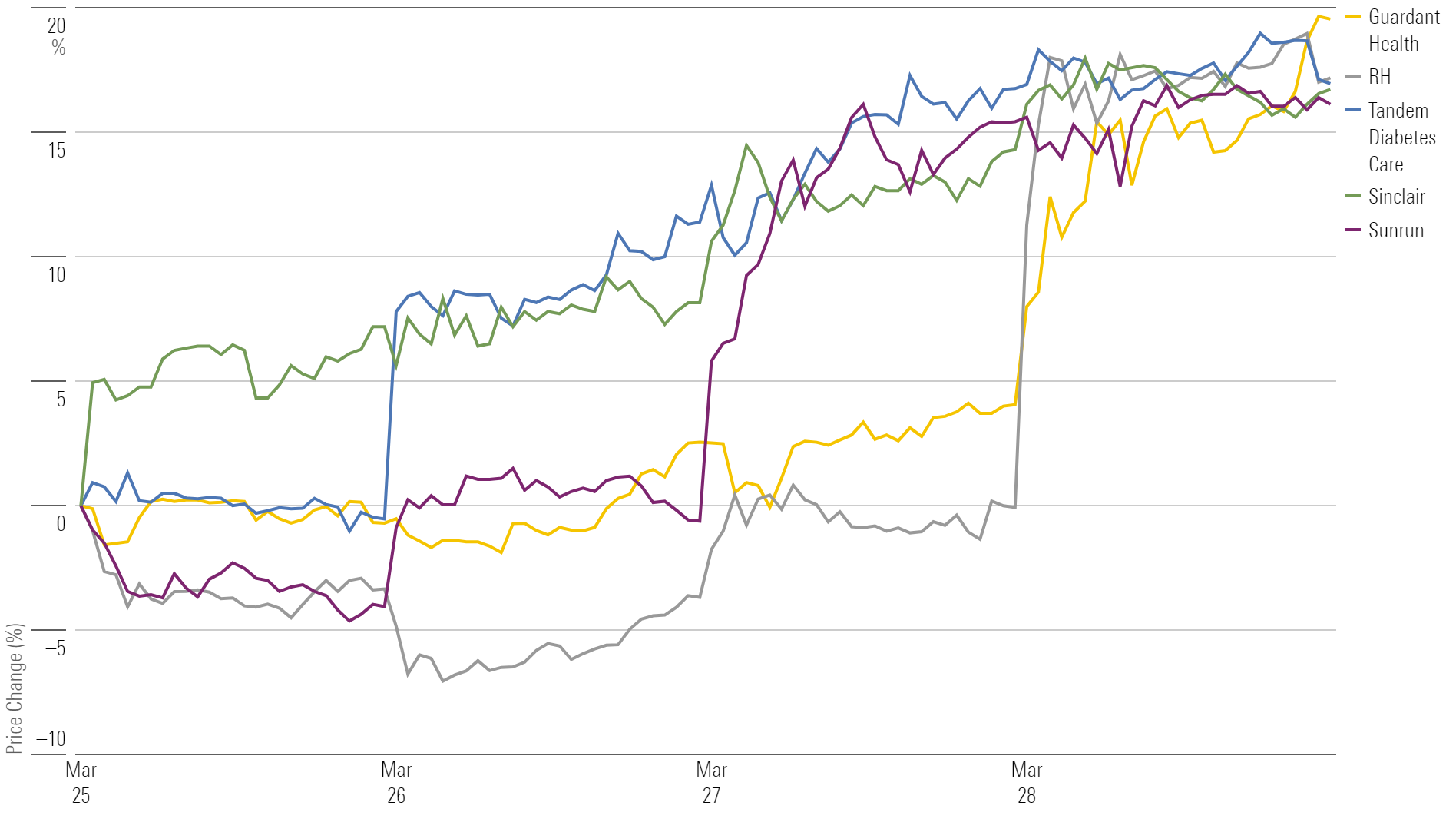

What Stocks Were Up?

Guardant Health GH, RH RH, Tandem Diabetes Care TNDM, Sinclar SBGI, and Sunrun RUN.

Best-Performing Stocks of the Week

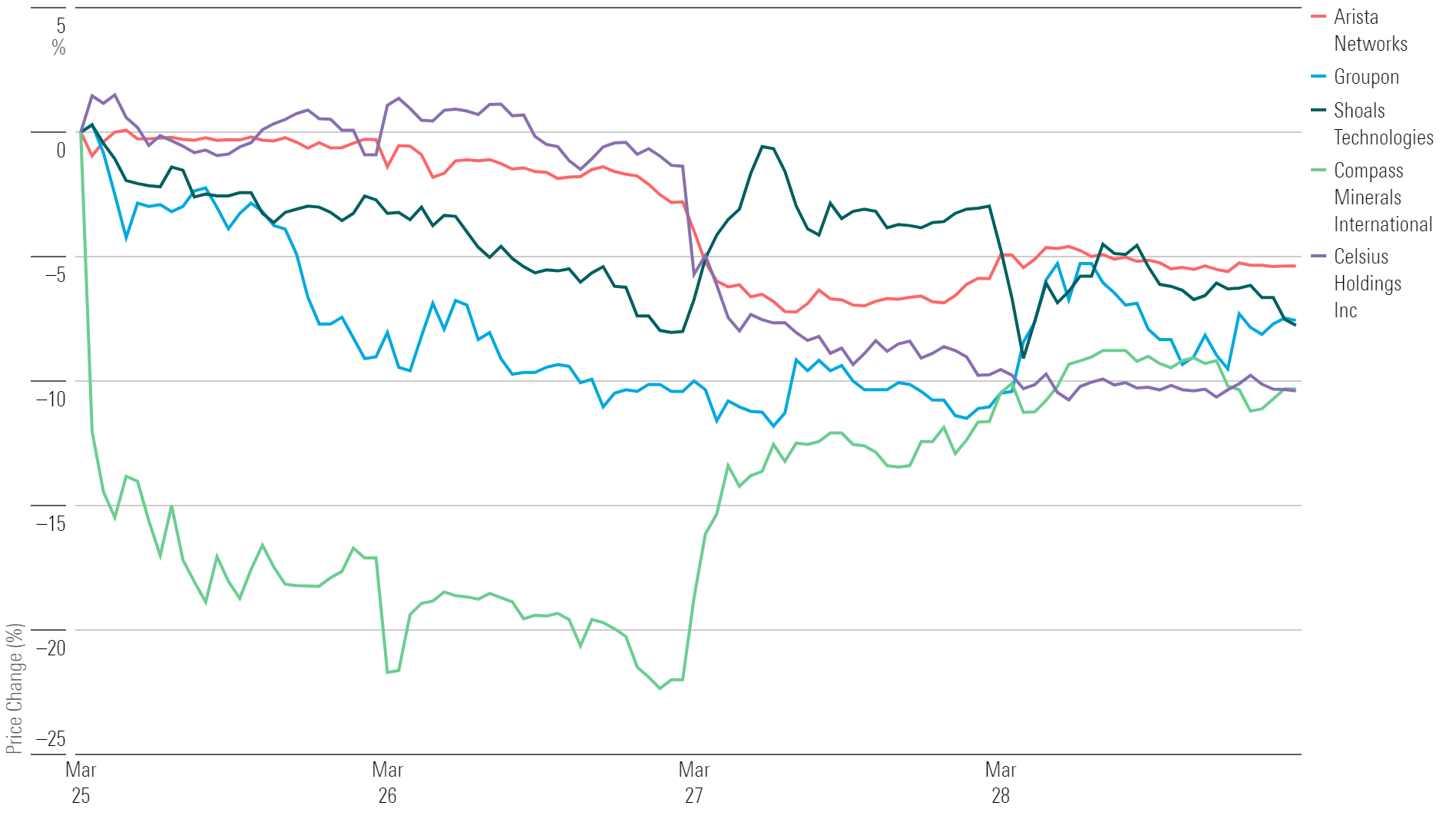

What Stocks Were Down?

Celsius Holdings CELH, Compass Minerals CMP, Shoals Technologies SHLS, Groupon GRPN, and Arista Networks ANET.

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)