Markets Brief: Will the ‘Magnificent Seven’ Stocks Keep Carrying the Market After Earnings?

Tech giants like Amazon, Microsoft, and Meta have the power to pull the market along with them.

In this past week’s earnings reports, the companies behind the “Magnificent Seven” stocks mostly showed why they’re the powerhouses driving the stock market’s rally.

But the reaction from the market was mixed, even though all six companies that have reported beat Wall Street’s forecasts. That’s a sign that two years of blockbuster performance have created a seriously high bar for the mega-cap tech sector to clear.

The Magnificent Seven comprises Nvidia NVDA, Tesla TSLA, Meta Platforms META, Apple AAPL, Amazon.com AMZN, Microsoft MSFT, and Alphabet GOOGL/GOOG. Together these stocks account for roughly one-quarter of the Morningstar US Market Index.

Despite the nascent optimism that the rally could broaden to include other sectors and smaller stocks, the Magnificent Seven’s performance has an outsized impact on the market as a whole, along with the performance of the vast majority of investors’ portfolios. Five of these stocks (excluding Apple and Tesla) were responsible for a staggering 98% of the index’s gains in January.

“We came in with remarkable expectations,” says Steve Sosnick, chief strategist at Interactive Brokers, with the lion’s share of the expected earnings growth for the entire stock market in the fourth quarter attributable to this group of companies. Here’s how it went.

How Did the Magnificent Seven Perform In Earnings Season?

Amazon, Apple, Microsoft, Meta, and Alphabet all reported their results last week. Tesla’s earnings came earlier this month, and Nvidia has yet to report.

For the most part, earnings and guidance from these companies have been better than expected as online advertising revenues and enterprise tech spending recover. “Revenue growth for these companies is accelerating,” says Naveen Jayasundaram, a senior research analyst at ClearBridge, while they continue to slam the brakes with costs. That’s giving investors confidence. “The market reactions have been very solid,” says Morningstar chief U.S. strategist Dave Sekera.

One notable performer was Meta, whose shares soared 20% following the company’s blockbuster report and announcement of its first-ever dividend. Meta’s revenue guidance was “very, very good,” Jayasundaram says, which sent the stock “off to the races.”

Amazon saw its stock jump 7% on the back of its strong results, which Jayasundaram attributes to the company continuing to gain share in the retail sector.

Magnificent Seven Stock Performance: Earnings Week

“The bar was set really high,” says Sosnick. “It’s quite impressive that those two companies cleared the bar, and cleared it with some finesse.”

Apple, Google, and Microsoft saw strong results as well, but lofty expectations weighed on the stocks anyway. “The market tends to overanalyze when expectations are this high,” Sosnick says.

Investors seized on worries that Microsoft’s cloud business wasn’t growing as quickly as hoped, and mulled over lower-than-expected revenue at Alphabet. Meanwhile, Sekera points out that Apple shares sold off on weaker-than-expected guidance, but have since regained some ground. “If you’re priced for perfection,” Sosnick says, “it has to be perfect.”

Tesla was an outlier. The firm saw a major selloff after warning of slowing growth in its earnings call earlier this month, but it has since regained some ground.

Will the Magnificent Seven Stocks Drive Market Gains In 2024?

Magnificent Seven Stock Performance

A year ago, market watchers were warning that an ultra-concentrated market could be dangerous for investors. Many saw that danger firsthand as the Magnificent Seven lost ground in the summer of 2023, dragging the major indexes down with them before rebounding again at the end of the year. That concern persists today.

“These companies are so big that they really can pull the market along in their wake,” Sosnick says. “The problem is: What happens if and when these companies have a real miss? It could be very detrimental to the broader market because of their size and their weight in these indices.”

Valuations, on the other hand, are a different story compared with a year ago. Heading into 2023, six out of the seven stocks in this category were considered undervalued by Morningstar analysts, according to Sekera. Today only Apple makes the cut, while the rest of the group is considered fairly valued or expensive. For now, investors seem to be willing to pay a premium for well-established, profitable companies.

On the other hand, Sekera points out that value and small-cap stocks are trading at significant discounts. “The Magnificent Seven was the story for 2023,” he says. “I don’t think it’s going to be the story for 2024.”

Magnificent Seven Stock Earnings Recap

Here’s a closer look at how the Magnificent Seven fared in the fourth quarter, along with commentary from Morningstar’s analysts.

Alphabet

- Fair Value Estimate: $171.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Fair Value Uncertainty: High

“The network effect continued to drive growth at Google search and YouTube during Alphabet’s fourth quarter. In addition, as we expected, increasing demand for artificial intelligence accelerated cloud revenue growth. However, continuing weakness in Google’s advertising technology business, or Google network, pressured total advertising growth a bit.

“We expect further declines in the network segment this year and next, as we still think that Google’s owned and operated properties remain the top priority for advertisers. We also believe that more advertisers will likely use non-Google ad-tech platforms when they purchase non-Google properties. This has been a trend for more than 10 years, during which network revenue has declined to 13% of total advertising revenue from nearly 23%.

“We have increased our revenue projections for Alphabet as the acceleration in cloud revenue growth, further monetization of YouTube, and the continuing steady growth in search likely will more than offset the impact of declining network segment revenue. In addition, we have increased our margin assumptions through 2028, given the cloud segment’s margin expansion and the success of the firm’s overall cost-control and efficiency efforts. Our model adjustments result in a $171 fair value estimate, up from $161.”

—Ali Mogharabi, senior analyst

Amazon.com

- Fair Value Estimate: $185.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

- Fair Value Uncertainty: High

“Wide-moat Amazon reported strong fourth-quarter results and offered a mixed outlook relative to our expectations, including in-line revenue and better profitability. Improvements in fulfillment and cost to serve continue to drive stronger-than-anticipated profitability in retail. Segment results were good overall, with advertising coming in the strongest relative to our model. After several quarters of strong performance on the profitability front, we are raising our operating margin outlook by 160 basis points for 2024 and similar margin expansion over the next several years. In turn, we raise our fair value estimate to $185 from $155. After a strong run in the shares over the last year, we see the stock as fairly valued.”

—Dan Romanoff, senior research analyst

Apple

- Fair Value Estimate: $160.00

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Wide

- Fair Value Uncertainty: Medium

“We maintain our $160 fair value estimate for shares of wide-moat Apple as we lower our short-term revenue forecast but raise our expectations for profitability. Apple’s December-quarter iPhone revenue and gross margin exceeded our expectations. Still, we believe the iPhone will see a softer adoption cycle this year and lower our fiscal 2024 forecast for iPhone revenue to a modest decline. Apple is also facing revenue headwinds in China. In the short term, we see demand headwinds for Apple relating to elongating personal device replacement cycles and more aggressive domestic alternatives in China. In the long term, we maintain our view that Apple can drive growth from its unique combination of hardware, software, and services that also elicits steep customer switching costs and underpins our wide moat rating. Apple shares went about 3% lower following results, likely due to weaker China results and lower iPhone expectations, but we continue to see the stock as overvalued.”

—William Kerwin, analyst

Meta Platforms

- Fair Value Estimate: $400.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

- Fair Value Uncertainty: High

“We are increasing our Meta fair value estimate significantly to $400 from $322, as we are more optimistic about its profit margin expansion. Meta’s fourth-quarter results showed strong network effects, which attracted more users and increased engagement while allowing it to sell more ads at higher prices with lower user and advertiser acquisition costs, impressively expanding margins. We also commend Meta for instituting a dividend alongside share buybacks.

“However, we think the stock remains overvalued. Meta’s advertising growth may benefit in 2024 from easier comparisons and political ad spending, but we foresee a slowdown in 2025-28 as economic growth moderates.”

Microsoft

- Fair Value Estimate: $420.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

“Wide-moat Microsoft continues to impress with solid second-quarter results, including upside on both the top and bottom lines. Even though management will not admit as much, we continue to see indicators that the demand environment has improved at least modestly. Artificial intelligence stole the show again this quarter as it contributed 600 basis points to Azure growth, twice the contribution from just last quarter, and helped land larger and longer-term Azure deals. Azure growth, then, was meaningfully better than expected. We find Microsoft’s outlook encouraging, especially for Azure. These factors drive us to raise our revenue growth and margin estimates by approximately 1 percentage point each over the next five years, which increases our fair value estimate to $420 per share from $370. Despite this increase, we see the shares as fairly valued.”

Tesla

- Fair Value Estimate: $200.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Very High

“Our key takeaway from the Tesla earnings call was the firm’s strategic shift to the development and ramp-up of the new affordable sport utility vehicle while focusing on cost cuts for its existing vehicles. This marks a change from the 2023 strategy, which was to cut prices to generate strong volume growth. We updated our forecast for lower near-term deliveries growth and lower near-term automotive gross profit margins. As a result, we reduce our fair value estimate to $200 per share from $210. We maintain our narrow-moat rating.

“Tesla shares were down 6% in aftermarket trading. We think the market reacted negatively to management’s outlook that Tesla will enter a period of lower growth in 2024. At current prices, we view shares as fairly valued, with the stock trading a little below our updated fair value estimate but in 3-star territory. Accordingly, we recommend investors wait for the stock to offer a solid margin of safety before considering an entry point.”

—Seth Goldstein, strategist

Nvidia

- Fair Value Estimate: $480.00

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Very High

Nvidia’s earnings release is scheduled for Feb. 21.

For the Trading Week Ended Feb. 2

- The Morningstar US Market Index rose 1.28%.

- The best-performing sectors were consumer cyclical, up 2.61%, and consumer defensive, up 2.04%.

- The worst-performing sector was energy, down 1.39%.

- Yields on 10-year U.S. Treasury notes fell to 4.02% from 4.15%.

- West Texas Intermediate crude prices fell 8.22% to $72.17 per barrel.

- Of the 844 U.S.-listed companies covered by Morningstar, 414, or 49%, were up, three were unchanged, and 426, or 51%, were down.

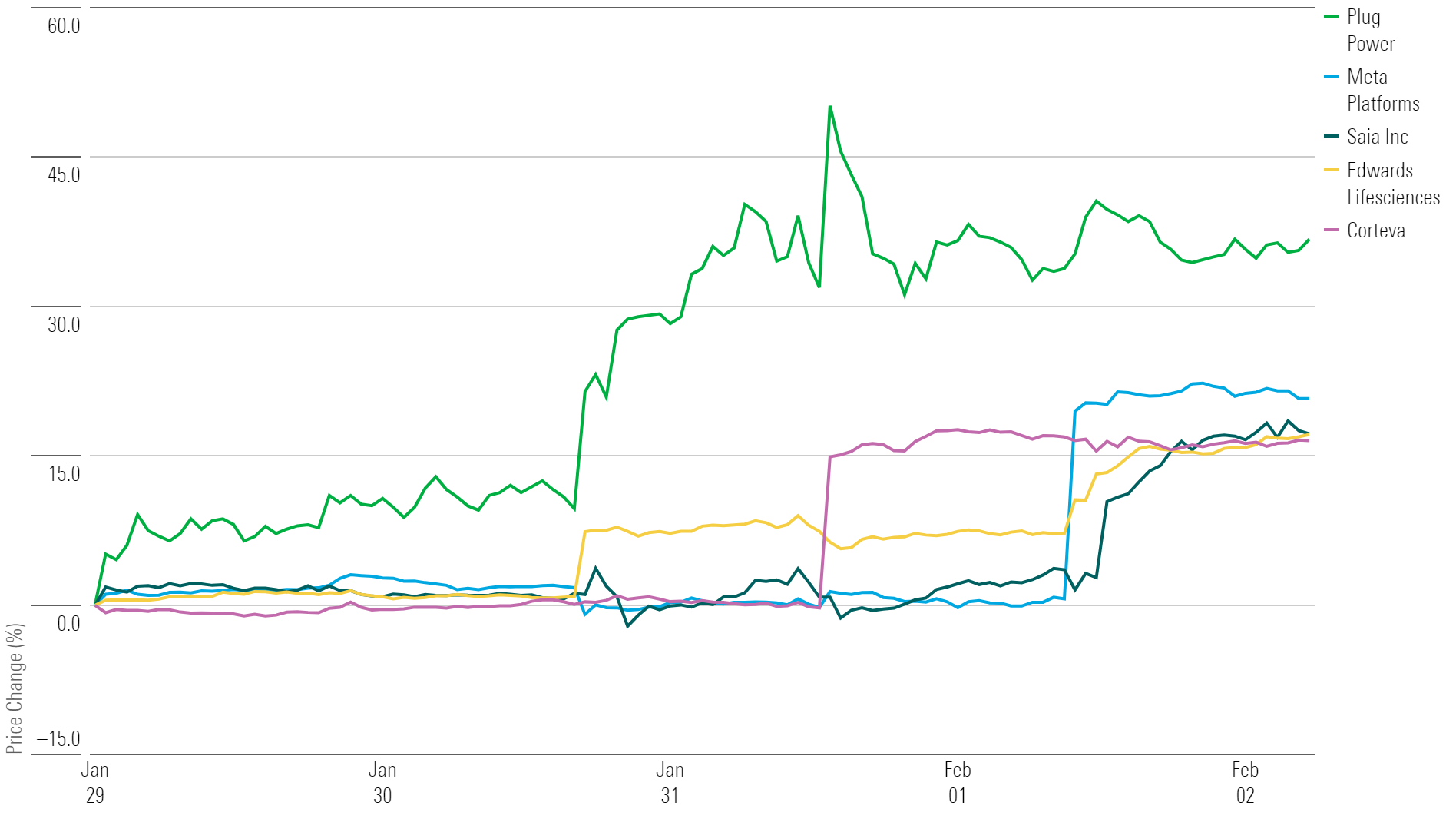

What Stocks Are Up?

Plug Power PLUG, Meta Platforms META, Saia SAIA, Edwards Lifesciences EW, and Corteva CTVA.

Top-Performing Stocks of the Week

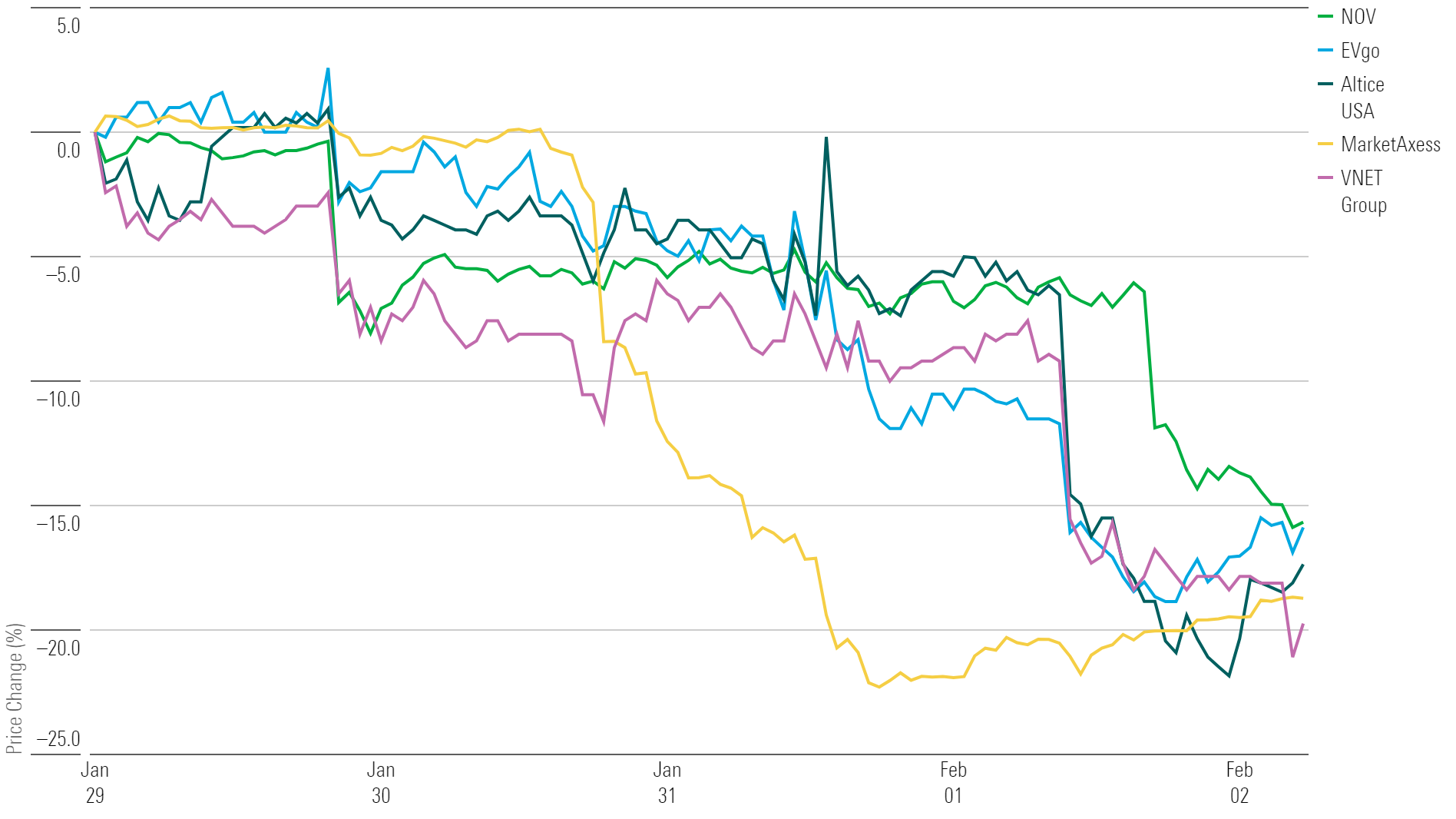

What Stocks Are Down?

VNET Group VNET, MarketAxess MKTX, Altice USA ATUS, NOV NOV, and EVgo EVGO.

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)