After Earnings, Is Adobe Stock a Buy, Sell, or Fairly Valued?

With the Figma merger falling flat, here’s what we think of Adobe’s stock.

Adobe ADBE released its fiscal first-quarter earnings report on March 14, 2024. Here’s Morningstar’s take on Adobe’s earnings and outlook for Adobe stock.

Key Morningstar Metrics for Adobe

- Fair Value Estimate: $610.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

What We Thought of Adobe’s Earnings

- We are maintaining our fair value estimate of $610 per share after Adobe reported good first-quarter results, but offered perplexing guidance for the second quarter that is ultimately slightly disappointing. The problem with guidance is threefold in our opinion. First, management refused to simply reiterate its full-year outlook for net new annual recurring revenue, which it repeatedly said it “felt really good” about. Second, it implies the second half of the year will be even more back-end-loaded. Third, multiple moving parts made the outlook overly confusing. We think these factors are driving a steep after-hours selloff. However, given recent pricing actions that should roll out in the rest of the world, pending important product launches, and rapid generative artificial intelligence adoption, we are not making material changes to our model and think shares are back in the “attractive” category.

- With the stock selling off we see this more as a temporary dislocation. The quarter itself was pretty good, but the guidance for digital media net new annual recurring revenue was concerning and management kept stepping on rakes every time they tried to explain it.

- Management guided to $440 million in net new annual recurring revenue for the second quarter after doing $432 million this quarter. On the December call management guided to $1.9 billion in net new ARR for the year. Last quarter they also explained some puts and takes about how net new ARR would evolve throughout the year. Specifically, price increases from the last two years would be a headwind to growth early this year, more recent pricing actions would become a tailwind this year as the year progresses, and a variety of new products that are in beta right now would be released later this year, contributing to ARR growth.

- On top of that, the size of upside to net new ARR this quarter was smaller than it was for all of last year and revenue growth for the first quarter was mildly disappointing. In each of four quarters last year the average upside vs. guidance on this metric was 11%, vs. 5% this quarter.

- We share the concerns, but management has repeatedly proven that they are capable of delivering products on time and against guidance. With new products launching, strong recent subscriber additions, strong AI adoption and engagement, and new price hikes, we believe there is enough support for the second-half story.

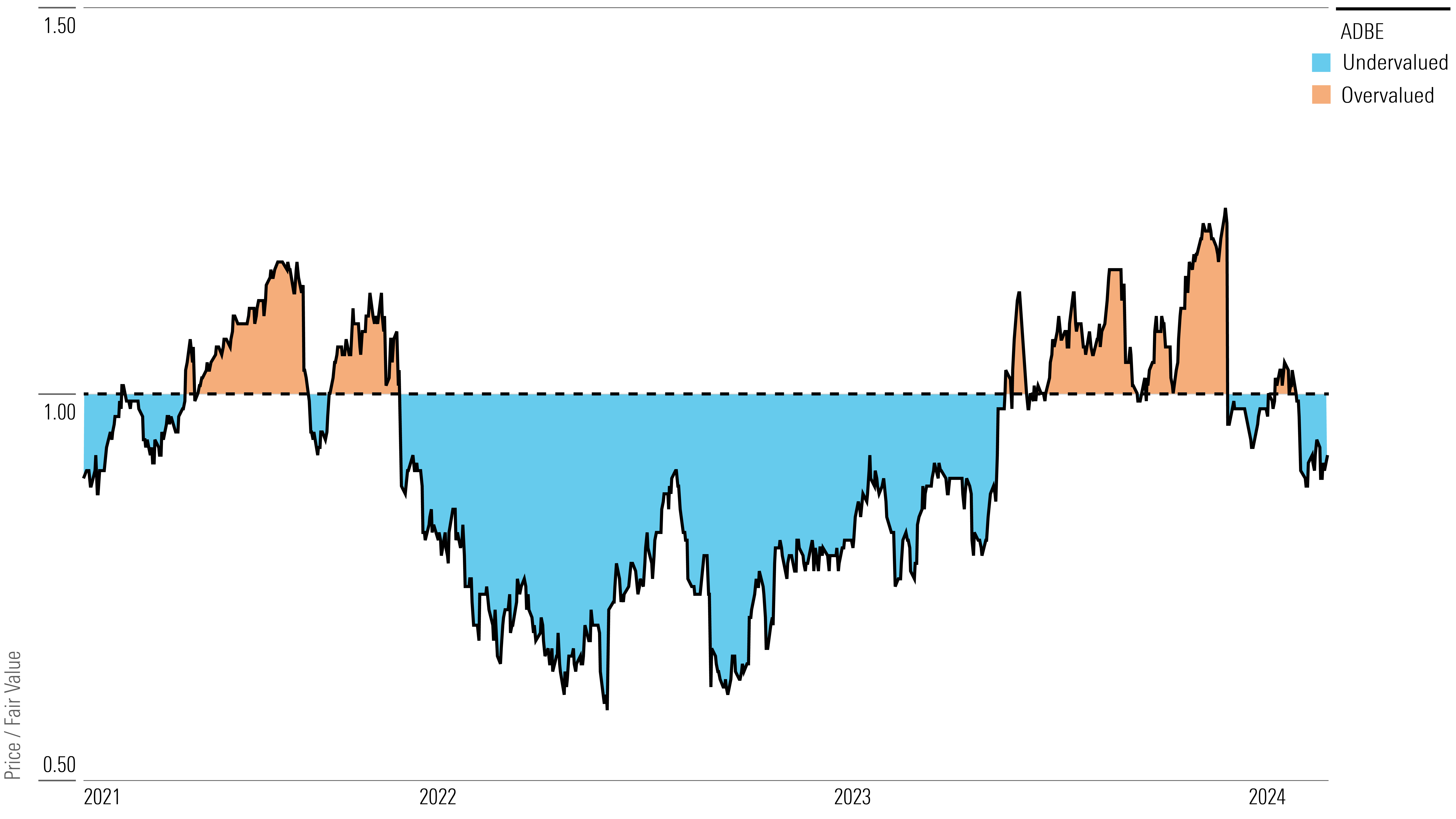

Adobe Stock Price

Fair Value Estimate for Adobe

With its 3-star rating, we believe Adobe’s stock is fairly valued compared with our long-term fair value estimate.

Our fair value estimate for Adobe is $610 per share, which implies a fiscal 2024 enterprise value/sales multiple of 13 times and an adjusted P/E multiple of 34 times.

We model a five-year revenue compound annual growth rate of approximately 12%. We foresee solid growth in both digital media and digital experience, even as both steadily slow over time. Digital experience should benefit both from 2023 price increases that should filter in over the course of several years and increasing penetration into an enormous market as defined by Adobe. We believe a relatively frictionless cross-selling opportunity exists for the company, as creative professionals are already steeped in Adobe products. The desire to consolidate vendors makes Adobe an obvious choice to turn to for needed marketing software solutions, and the fact that Adobe’s products are strong should help initially in what we believe is a large greenfield opportunity. Within digital media, we have been impressed by Adobe’s ability to draw in new users that many did not believe existed. We believe some of this is related to piracy, which is effectively eliminated in the software-as-a-service model. Additionally, the company has had success upselling existing users to higher price point products and cross-selling acquired technologies, such as Workfront and Frame.io. We believe continued innovation, gathering new users, and upselling existing users in Creative Cloud should help drive strong growth for the next several years.

Read more about Adobe’s fair value estimate.

Adobe Historical Price/Fair Value Ratio

Economic Moat Rating

For Adobe overall, we assign a wide moat, arising from switching costs and network effects. Based on the company’s segments, we believe digital media has a wide moat from switching costs and network effects, digital experience has a narrow moat arising from switching costs, and publishing has a narrow moat from switching costs.

Digital media represents approximately 70% to 75% of revenue. This segment contains Creative Cloud, which is nearly 50% of revenue, and Document Cloud, which is approximately 10% of revenue. While both product groups generate strong revenue growth, growth in Creative Cloud is materially higher. Creative Cloud is composed of the iconic products Photoshop, Premiere, Illustrator, InDesign, After Effects, Fireworks, XD, and Dreamweaver, among others, and a variety of mobile versions of these products and additional discrete mobile solutions. Document Cloud consists of the Acrobat family of products, including Scan and Sign.

Since its introduction in 1989, Photoshop quickly became the industry leader and eventually the industry standard for image-editing software. Rather than remaining complacent, Adobe has consistently invested in the solution, introducing new features and adding applications that could be sold to existing users of Photoshop. These features and products were both internally developed and as a result of acquisitions. Notably, Fireworks and Dreamweaver came from the 2005 Macromedia acquisition, while InDesign and PageMaker came from the 1994 acquisition of Aldus. More recently, Adobe acquired Allegorithmic for 3D texturing, Workfront for workflow management, and Frame.io for video workflow. Over the years, Photoshop, Illustrator, Premiere, InDesign, and After Effects were the company’s most popular products and, beginning in 2003, were available as the Creative Suite bundle. While that bundle no longer exists, we believe these same products drive the bulk of demand in Creative Cloud. Other products serve more-specialized needs or tend to be in more emerging technology areas within graphics, such as 3D illustrating.

The high switching costs moat source is the primary driver of the wide moat surrounding Creative Cloud. While there is a wide variety of competitive products, Adobe Creative Cloud is so pervasive within the creative world and the educational system that replacing it would be an insurmountable barrier, in our view. Further, because nearly all creative professionals use it, it makes it so all other creative professionals must use it. While the Creative Cloud has its issues, particularly premium pricing, and any one organization or freelance professional might be willing to switch, they would find it difficult to work within an entire industry that has standardized around it. Similarly, it helps ensure that when Adobe releases or acquires a related new solution, it, too, becomes widely adopted.

Read more about Adobe’s moat rating.

Risk and Uncertainty

We assign Adobe a Morningstar Uncertainty Rating of High. It faces risks that vary by segment. Creative Cloud’s high market share over the last 25 years means a significant portion of high margin revenue is at risk, however slight that risk may be, if a competitor were to make inroads in the space. The damping of cross-selling opportunities with Digital Experience would likely then be diminished, which would be problematic, as Digital Experience represents the larger growth opportunity over the next five years in our view. While Adobe is generally considered a leader in the various categories included under its Digital Experience umbrella, it did not create any of these categories and does not dominate them the way it does with Creative Cloud.

Adobe has built the Digital Experience business largely through acquisitions. The two recent acquisitions of Magento and Marketo also pose risks, as those were on the larger side for the company. Any integration missteps could potentially cause delays in new contract signings. Further, material missteps could possibly result in substantial write-downs regarding these (or other) acquisitions. Further, while the margin structure may ultimately be lower in Digital Experience relative to Creative Cloud, the company has worked to improve margins over time, and we believe Adobe must continue to drive down costs and expand margins to meet investor expectations.

Read more about Adobe’s risk and uncertainty.

ADBE Bulls Say

- Adobe is the de facto standard in content creation software and PDF file editing, categories the company created and still dominates.

- Shift to subscriptions eliminates piracy and makes revenue recurring, while removing the high upfront price for customers. Growth has accelerated, and margins are expanding from the initial conversion inflection.

- Adobe is extending its empire in the creative world from content creation to marketing services more broadly through the expansion of its digital experience segment. This segment should drive growth in the coming years.

ADBE Bears Say

- Momentum is slowing in Creative Cloud after elevated growth driven largely by the model transition to SaaS.

- There is greater uncertainty in digital experience, given this is an emerging space and one that Adobe neither created nor dominates. Growth could be slower than we anticipate, or margin expansion may not materialize.

- Digital experience has been built largely through acquisition, including Magento and Marketo in 2018. This raises the possibility of disruption from inadequate integration efforts and lends credence to concerns that Adobe may overpay for increasingly large deals.

This article was compiled by Quinn Rennell.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)