5 Short-Term Bond Funds That Disappointed Investors

These funds made a bad year worse, offering a lesson for investors.

Investors expect short-term bond funds to be a haven during times of rising interest rates and turmoil in the markets. But when fund managers take on riskier bets in search of higher yields, that can backfire on investors.

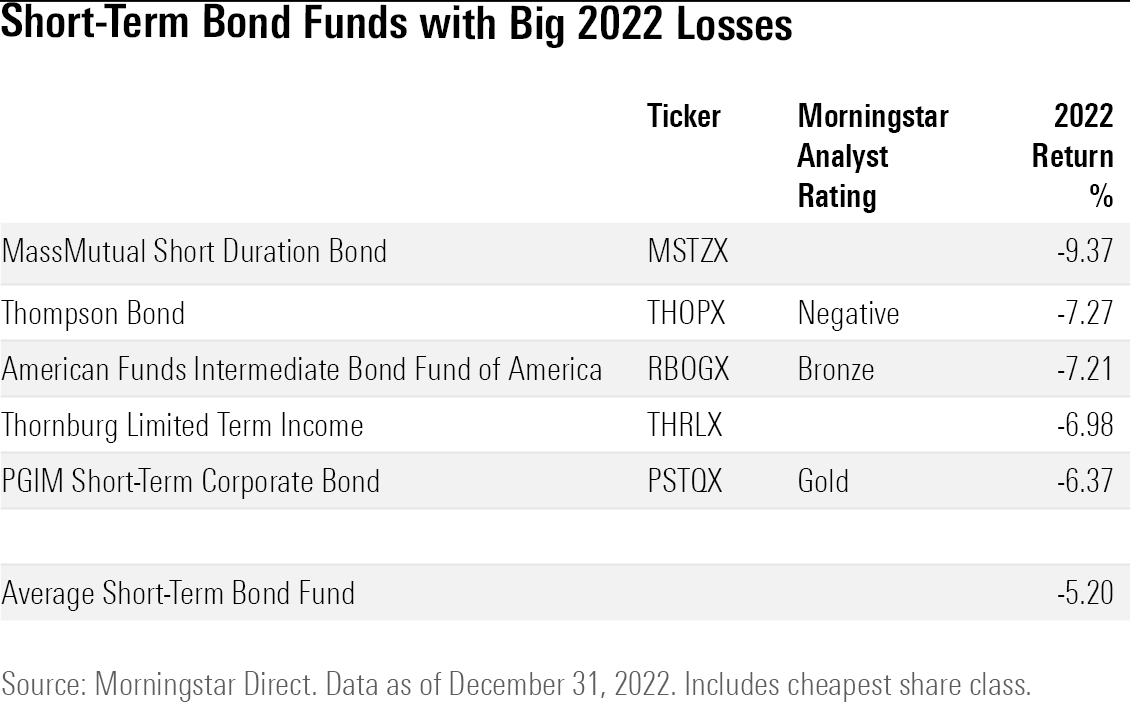

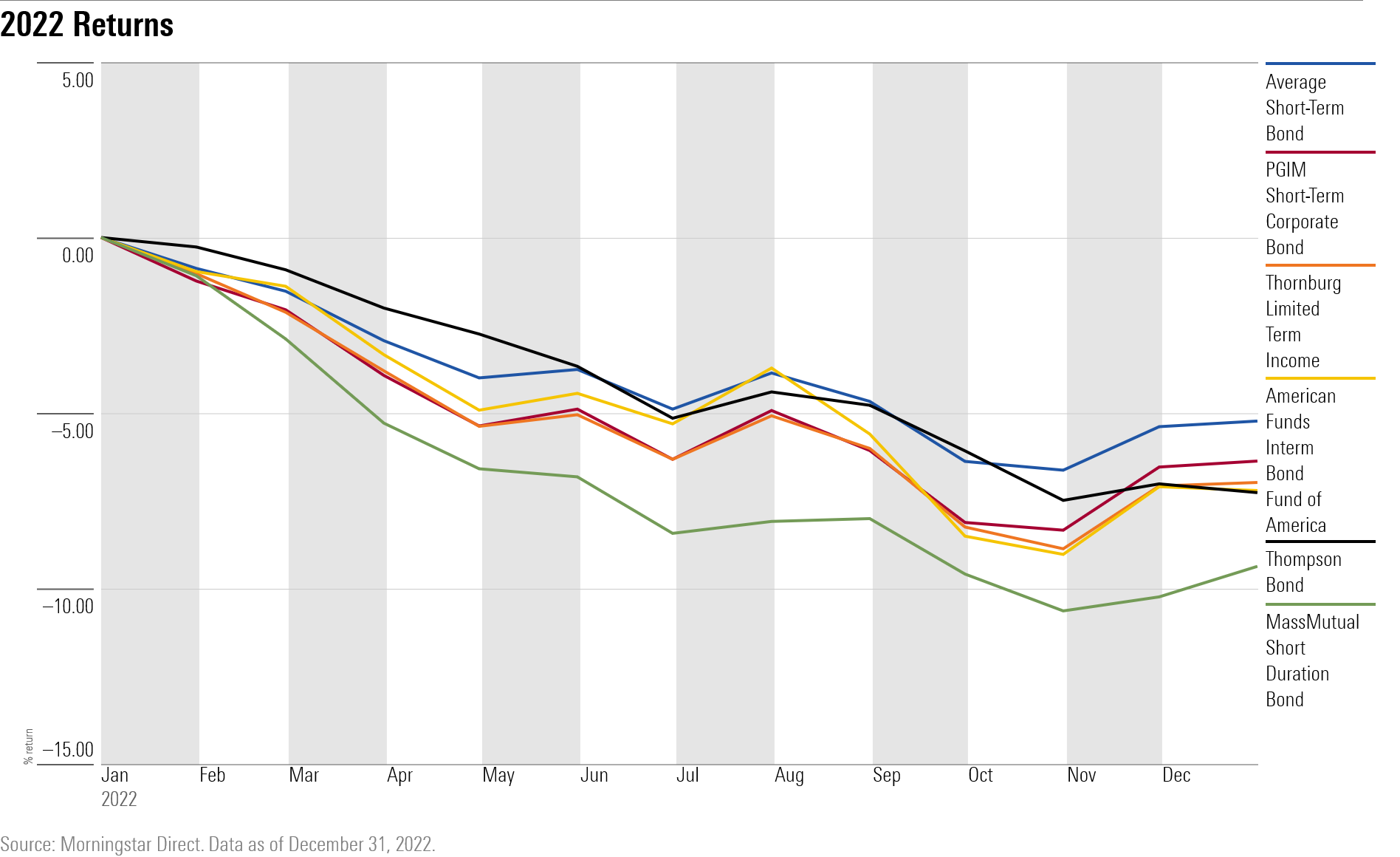

During last year’s beatdown in the bond market, even conservatively managed short-term bond funds lost money. The average fund in the short-term bond Morningstar Category posted a 5.2% decline, the biggest average annual decline in history, according to Morningstar Direct.

However, added losses in some funds made a bad situation worse, offering a lesson for investors.

“It’s worth looking under the hood of a short-term fund,” says senior manager research analyst Sam Kulahan. “Short-term funds aren’t all made equal.”

What Are Short-Term Bond Funds?

Short-term bond funds invest in shorter-term debt, which means they carry less interest-rate risk and rarely post outsize gains—or losses. As a result, investors don’t expect big returns from them. For most, they act as a temporary store of cash for investors where they can pick up higher yields than from a money market fund, or they act as ballast against swings in riskier corners of the stock and bond markets.

“It was a rough year for the bond market all round, but short-term bond funds did better than intermediate or longer funds on a relative basis,” says Kulahan. “Higher yields now bode well for future returns,” he adds.

These funds mainly hold a mix of investment-grade government and corporate bonds. The average short-term fund allocated around 30% of its portfolio to government securities and 34% to corporate securities as of Jan. 31, 2023. (Data on how a fund’s portfolio stacks up against its peers can be found in the portfolio section on its Morningstar.com page).

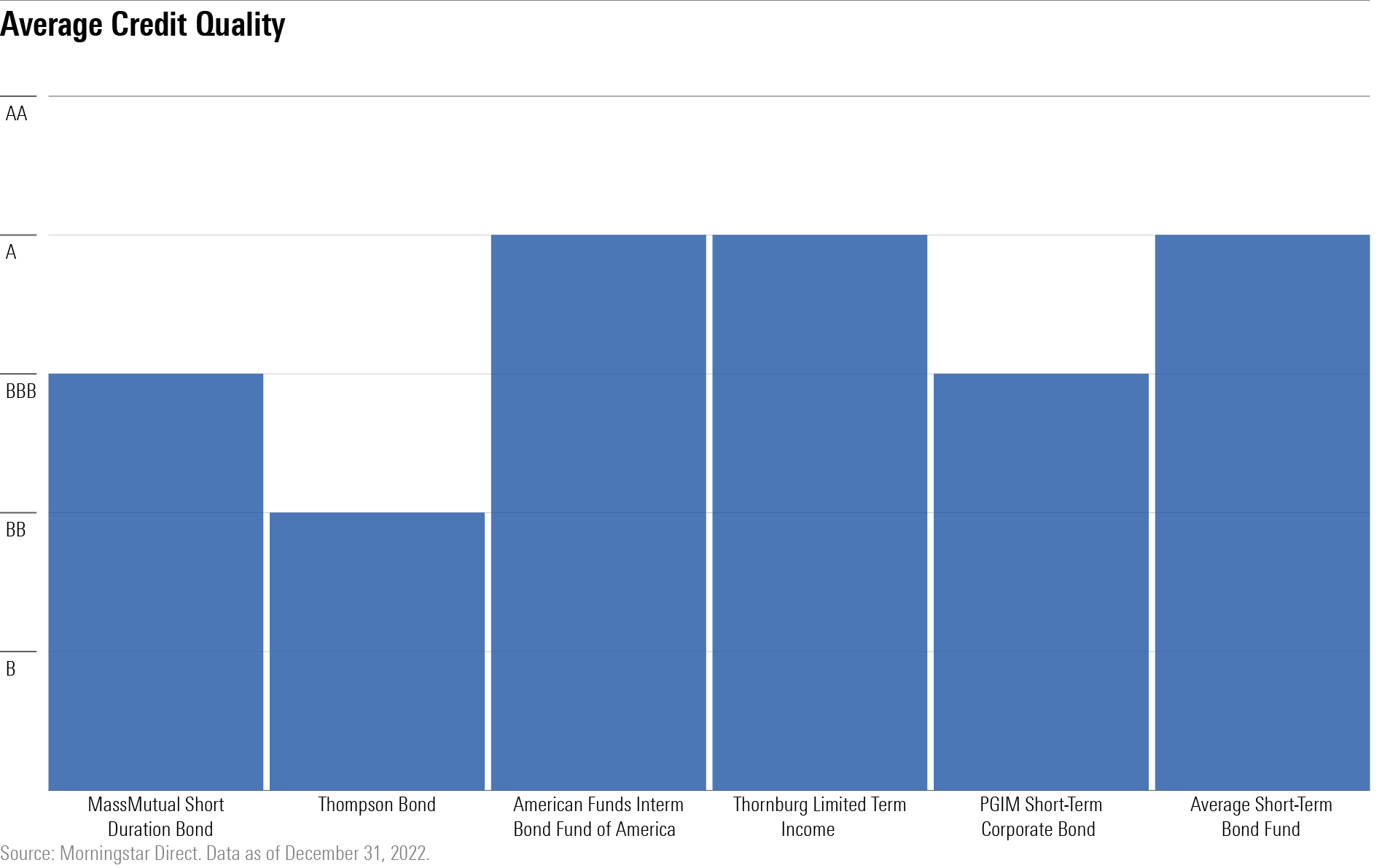

Some Short-Term Bond Funds Take Riskier Bets

However, some fund managers venture out of investment-grade securities into areas with lower credit quality, such as securitized debt, which can be backed by auto and home loans. These bonds can perform poorly in an economic downturn as borrowers struggle to pay back their loans. This strategy paid off for some managers in previous years when government bonds were offering only low yields. However, last year lower-credit-quality bonds were a drag on performance in 2022 as investors grew increasingly worried about the prospects of recession and as inflation took a bigger bite out of consumers’ paychecks.

Now with yields higher across the board, investors might not need a riskier bond fund to generate income, even though short-term bonds are still susceptible to rising interest rates.

“If you prize safety, it’s best to opt for a fund that has a healthy stake in cash and Treasuries and is moderate or conservative with respect to credit risk,” says Kulahan.

2022′s Bottom-Performing Short-Term Bond Funds

Even though short-term bond funds yields are very attractive, last year’s losses show that short-term funds can vary in scope and still cause pain for investors.

These are some of the largest funds that posted larger-than-average losses last year.

Short-Term Bond Funds That Took Greater Credit Risk

Hurt by exposure to residential mortgage-backed securities, $880 million Mass Mutual Short Duration Bond MSTZX posted a loss of 9.4%, 4.2 percentage points larger than the average short-term bond fund. In a commentary from December the managers write that in the fourth quarter performance was negatively affected by sector allocation, driven by residential MBS.

Thompson Bond THOPX also suffered from taking on more credit risk last year. The $2.1 billion fund fell 7.3%. “Though managers are not making interest-rate bets and typically keep interest-rate risk relatively low, they take on significant credit risk, which may not be appropriate for an investor seeking stability and liquidity in a short-term bond portfolio,” writes Morningstar analyst Thomas Murphy.

PGIM Short-Term Corporate Bond PBSMX, which earns a Morningstar Analyst Rating of Gold, also underperformed. The $11.7 billion fund declined 6.4%. “The fund falls in the short-term category given its interest-rate risk profile, but even there its heavy focus on corporate bonds, rather than a more diversified sector allocation, makes it something of an outlier,” says Morningstar strategist Eric Jacobson. “Heavy corporate exposure mixed with a bit more duration than average would likely have combined to knock the fund off course relative to its peers.”

Short-Term Bond Funds With Higher Interest-Rate Risk

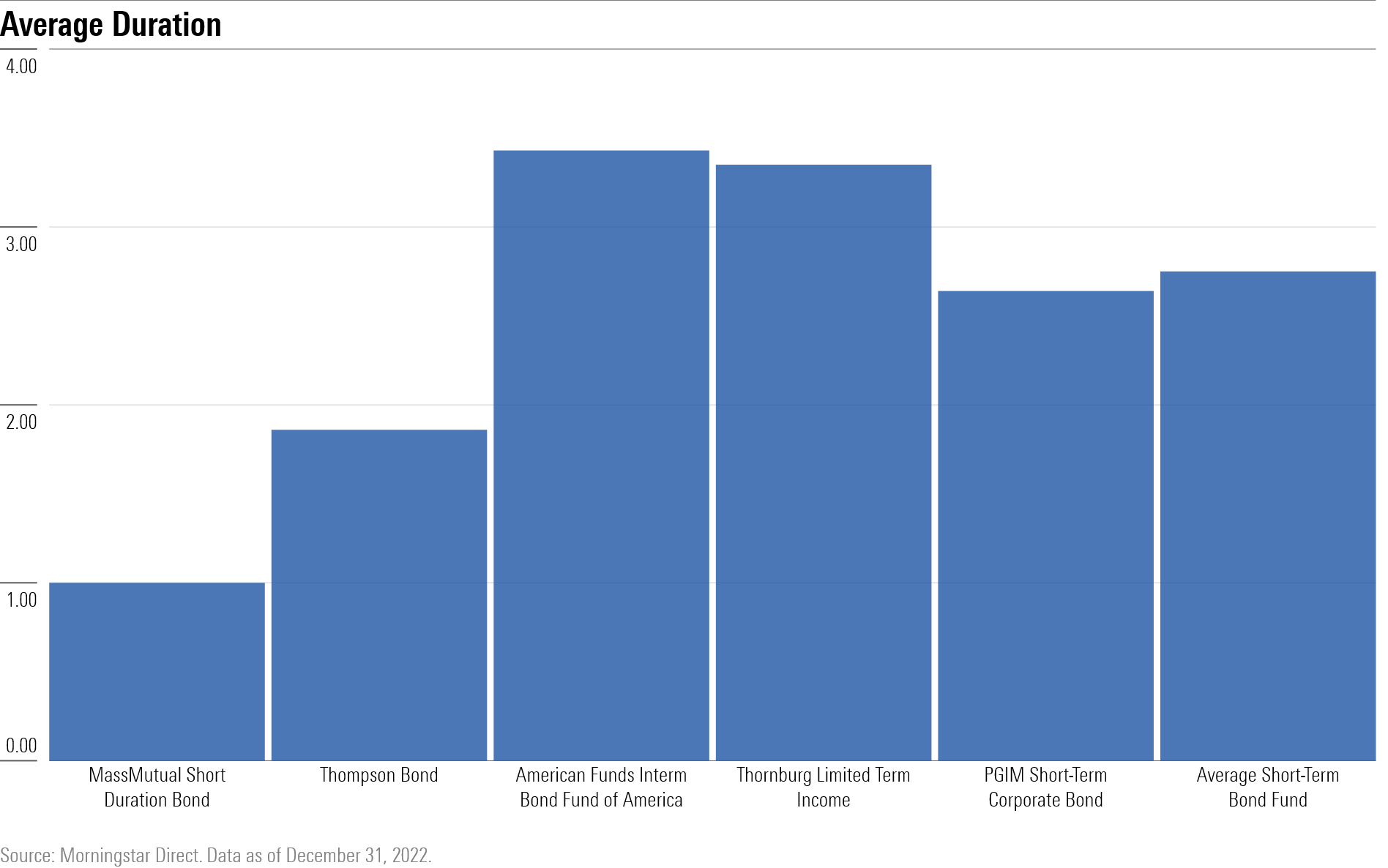

Interest-rate sensitivity was another important variable in 2022, as the Fed raised interest rates multiple times.

Funds with longer durations (a measure of a bond’s sensitivity to changes in interest rates) suffered larger losses. The average duration of a fund in the short-term bond category was 2.8 years as of Dec. 31.

For example, Thornburg Limited Term Income THRLX increased its duration throughout the year. “Over the course of 2022, in response to the drastic move higher in rates, the fund’s duration was increased to approximately 3.5 years, which represents an overweight versus our historical duration range,” write the managers in a commentary. As of Dec. 31, 2021, it stood at 2.73. They’ve since reduced their interest-rate exposure, “expressing a view that Treasury yields are near if not slightly below fair value,” they write.

In addition, they write that “the fund’s securitized exposure modestly detracted from relative performance, particularly in the RMBS (CMO) space.” The $7.4 billion fund posted a 6.98% loss for the year.

Another of the worst-performing funds in the category was American Funds Intermediate Bond Fund of America RBOGX, which lost 7.2% last year.

Although the fund has “intermediate” in its name, it’s duration of 3.43 years is closer to that of the short-term category than the intermediate categories. That worked against the fund in 2022, says Kulahan.

“A longer duration has been consistently a feature of the strategy; it is a more intermediate-like offering than most short-term funds, but its duration is low enough to keep it out of the intermediate core bond category,” he says.

“The fund is also pretty conservative with credit risk, which helps balance out its higher rate risk,” he says.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7WLK3HWLZBFR7NKI45PXWUD6OI.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)