Target-Date Funds and Annuities ... It’s Complicated

A new wave of target-date strategies with annuities is here.

Asset managers are using a new strategy to help investors to manage their retirement spending: target-date funds featuring annuities.

Since the introduction of defined-contribution plans in the 1980s, almost everyone has been focused on encouraging investors to save more. Although that’s still a relevant issue, the record number of Americans hitting retirement age (sometimes referred to as the ‘silver tsunami’) means that another nasty problem has reared its ugly head: helping people manage their retirement spending.

This means that retirees must precariously stay balanced between two extremes: running out of money and enjoying the assets they’ve painstakingly saved over the years.

Although there’s plenty of guidance out there on what retirees can withdraw from their retirement portfolio, many still struggle to manage their income in retirement because of the psychology of spending decisions—namely, the slew of biases that come into play when deciding and implementing spending.

With all these issues swirling around, the industry has responded with the creation of target-date strategies with guaranteed income.

Although investor interest has been relatively muted to date (comprising less than 2% of target-date assets), we think BlackRock’s newly launched LifePath Paycheck target-date series will make a splash in this space.

The Good, the Bad, Well … It’s Complicated

Since 2020, around a dozen new target-date series that include a form of guaranteed income have launched or have planned to launch. At their most basic level, these funds substitute a portion of a person’s portfolio that is usually reserved for fixed income with an annuity.

The funds use one of two types of annuities: an income annuity, which provides a steady stream of cash flows, or a savings annuity, which focuses on accumulating an account balance.

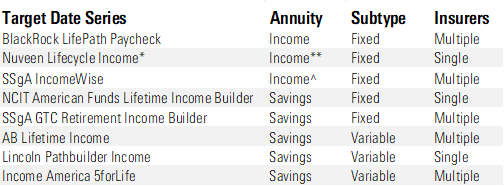

The table below shows a sample of series that are available or set to launch soon, which type of annuity each target-date strategy uses, and if there are one or more insurers.

TDF With Annuities

*There are three versions of the Nuveen series: one that uses all actively managed funds, one that uses all passive index funds, and one that blends both. **Technically a savings annuity that converts to an income annuity. ^A qualified longevity annuity Contract; payments start at age 78.

There are many things to consider when looking into these strategies. Here are a few key takeaways that we explore in our research.

Target-Date Funds With Annuities: The Good

- Manage your biases. These investments can help retirees manage their biases when making spending decisions, given the inclusion of guaranteed income. The annuity portion helps curb in spending, automates payments, and provides a steady paycheck for those who prefer a smooth income.

- Simplify guaranteed income. For those interested in including guaranteed income, these products simplify the process. Target-date providers choose the type of annuity, which varies by series, and do the due diligence on insurance companies.

- Reduce the risk of buying at a bad time. Some of these products spread out the purchase of an annuity over a decade or longer, which may help lower the risk of locking in an annuity in unfortunate market conditions.

- Access all savings. With these products, investors still have full access to the nonannuitized portion of their savings. If the product features a savings annuity, they may even access the annuitized portion (though that will lower their monthly payment).

Target-Date Funds With Annuities: The Complicated

- Fees are confusing. Fees are a big obstacle for target dates with annuities. Income annuities, for example, don’t have an implicit fee attached to them. Instead, the fee is baked into the guaranteed payment. Savings annuities, on the other hand, may have both explicit and implicit fees. These factors make comparing the fees of target dates with income annuities to traditional target dates nearly impossible.

- They’re complicated. It’s true that these products are simpler than other guaranteed income options, but they’re still fairly complicated for the average investor—especially the annuities portion. There are plenty of details that may be hard to make sense of (something we, as authors, faced when sorting through the various strategies available). Also, each product does things a little differently, in terms of the type of annuity used, when the fund starts purchasing the annuity, how much it allocates to the annuity, the fees involved, how the payment is determined, and so on.

- Investors tend to lack education on these products. In line with the previous point, education may be a problem concerning these products. The individual investor must still be fully engaged in the process and, as history has shown (for example, the Empower IncomeFlex Target series example found in the full paper), choosing the right allocations may be difficult.

Still No ‘Easy’ Button for Retirement Income

Target dates with annuities are promising, but they aren’t the “set it and forget it” solution that target-date funds are for retirement saving.

That’s because retirement-income decisions are very personal. Some retirees may not benefit from annuitizing a portion of their assets or may wish to have more control over their asset allocation.

Our research indicates the industry is stumbling to catch up to the problem that is retirement income. Although target dates with annuities show promise, they may not be the right solution for all retirees. Many investors may still need the help of expert advice or technological solutions to make retirement-income decisions.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YBH7V3XCWJ3PA4VSXNZPYW2BTY.png)

/d10o6nnig0wrdw.cloudfront.net/04-24-2024/t_a8760b3ac02f4548998bbc4870d54393_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)