WATER STOPPAGE

Businesses use water for heating, cooling, cleaning, transportation and as a raw material. When it becomes scarce, it can stop a company’s operations. Yet compared with carbon risk, investors have paid less attention to water risk than it deserves. Unlike fossil fuels, where other sources exist, alternatives for freshwater are not always feasible. Corporate disclosure is poor, and risk is often hidden in supply chains.

KEY MEASURES

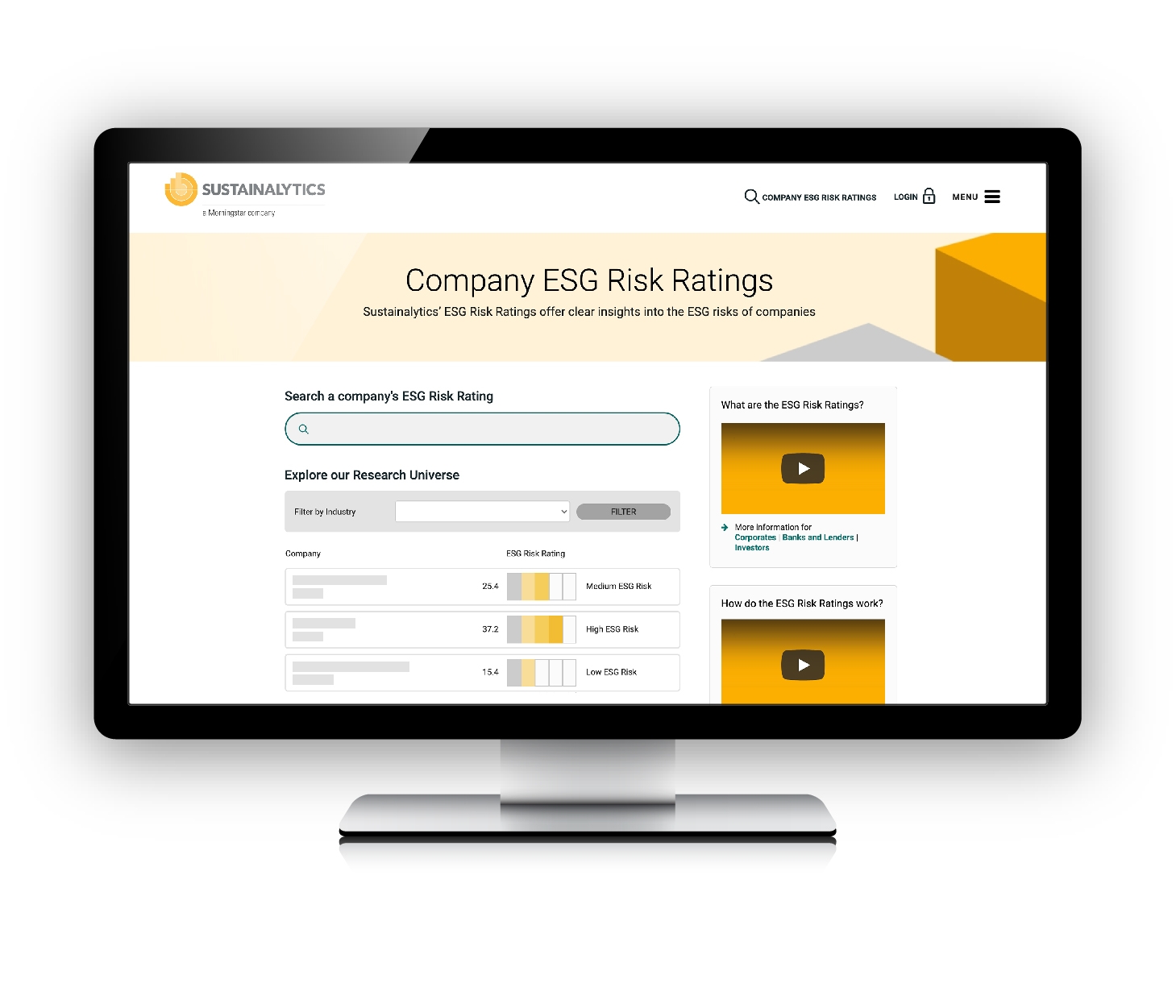

Investors who want to limit the water risk in their portfolios can use environmental, social, and governance ratings to understand them. Morningstar Sustainalytics considers three key risk measures: withdrawals, consumption, and intensity. Withdrawals measure the total amount of water a company uses; consumption is a measure of water that is not returned to its source once withdrawn; and finally, intensity measures the water input for every dollar of revenue generated.

At-Risk Industries

The materials industry consumes the most water, a reflection of the steel producers and mining companies found within this sector. Utility companies are the most water-intensive: They need more than 1,000 times more water to generate a dollar of revenue than companies in financials, for example. More surprisingly, the medical-services, automotive retail, and travel and leisure industries are also water-intensive.

GEOGRAPHY MATTERS

Water stress, the governance of water resources, and the reputational risks of high consumption vary widely by region, so investors need to consider geography. In India, for example, water shortages are among the most common reasons for power shortages. About 23% of the companies Sustainalytics covers for water metrics in our most recent study have at least 1% of their assets or revenues tied to India.