BIG DIFFERENCES

Despite a shared belief that increasing the participation of women in management improves corporate performance, gender inequality persists. Globally, women represent 26% of board members, 5% of CEOs, 18% of executives, and 37% of the workforce. Only 17% of companies publish their gender pay gap, and less than 1% have closed it. But behind these averages sit big differences. Australia, France and Singapore outperform. Japan and the United States do poorly. Some companies lead. Others lag.

AUSTRALIA RULES

Investors who believe there is an opportunity to profit from the leaders can consider gender equity as a sustainability theme. Equileap, a data provider, ranks more than 4,000 companies globally on 19 measures of gender equity. Mirvac, an Australian property developer, performed the best in 2022. It has achieved gender balance at the board, senior management and workforce levels, and offers 20 weeks of paid leave to primary caregivers. Of the top 100 companies, 23 are Australian.

EMPOWERING WOMEN

Launched in 2018, the Morningstar Women’s Empowerment Index tracks the top-scoring 200 US companies (from a universe of large and mid-cap stocks) based on Equileap’s gender equality score. The index had risen by 52% in the four years since launch as of August 3rd, 2022, outperforming the S&P 500 (43%). Yet only a handful of funds have targeted gender equity as a theme. These include exchange-traded funds from the YWCA (WOMN), which tracks Morningstar’s index, and State Street Global Advisors (SHE).

DIRECT INDEXING

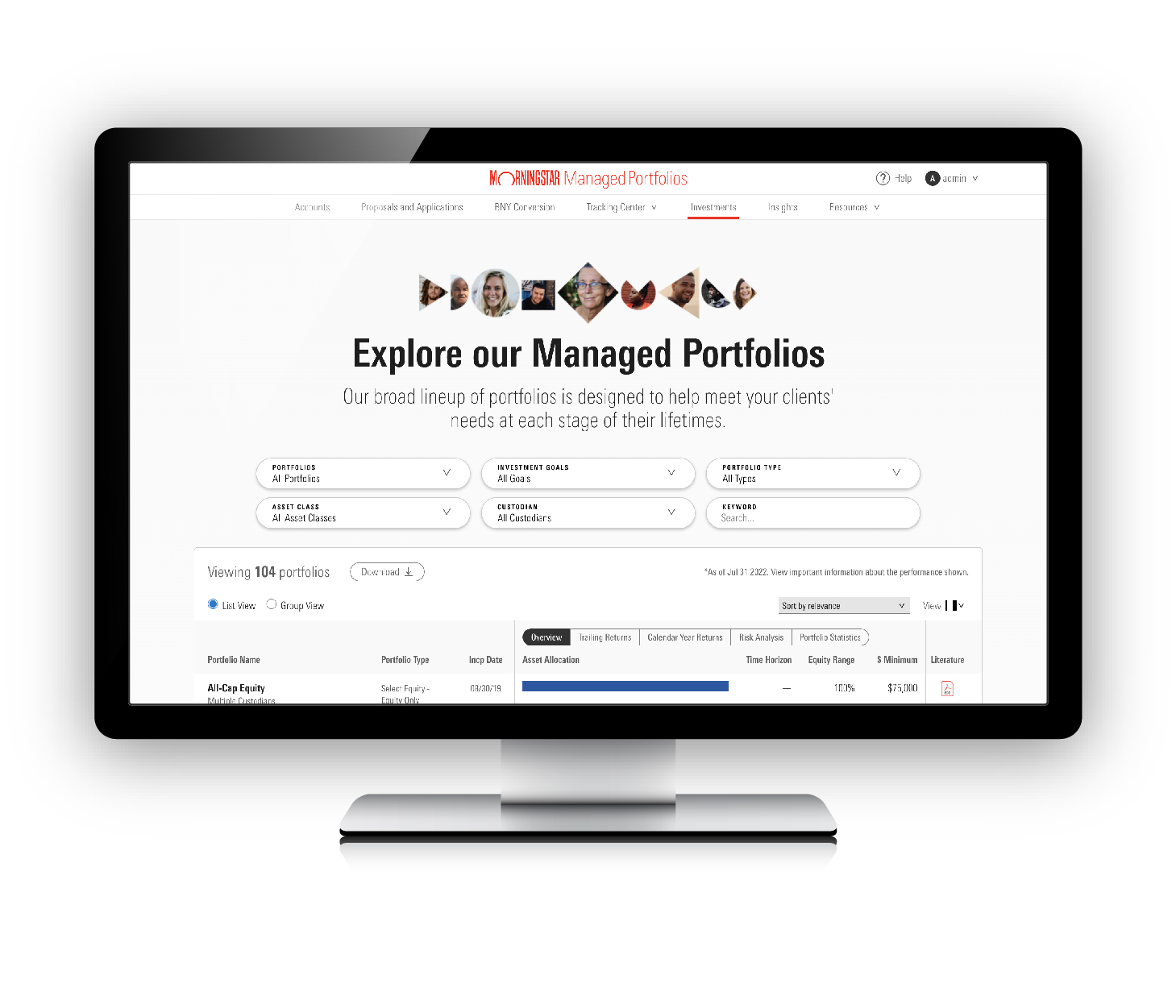

Investors can also use direct indexing to build a personalized portfolio that targets gender equity as a sustainability theme. Investors can start with an index-based product, such as the Women’s Empowerment Index, and add a personalized overlay, specifying sectors, industries, and even companies they wish to avoid. Morningstar’s direct indexing offering also unlocks tax mitigation strategies like offsetting portfolio gains through tax-loss harvesting.