PALM OIL

In 2015, The Wall Street Journal broke a story describing worker extortion, debt bondage, and human trafficking at a palm oil mill owned by FGV, a Malaysian agribusiness. In 2020, the U.S. Customs and Border Protection banned FGV palm oil imports following a nongovernmental organization investigation into allegations of forced labor. The CBP has also implicated the company in potential child labor.

MODERN SLAVERY

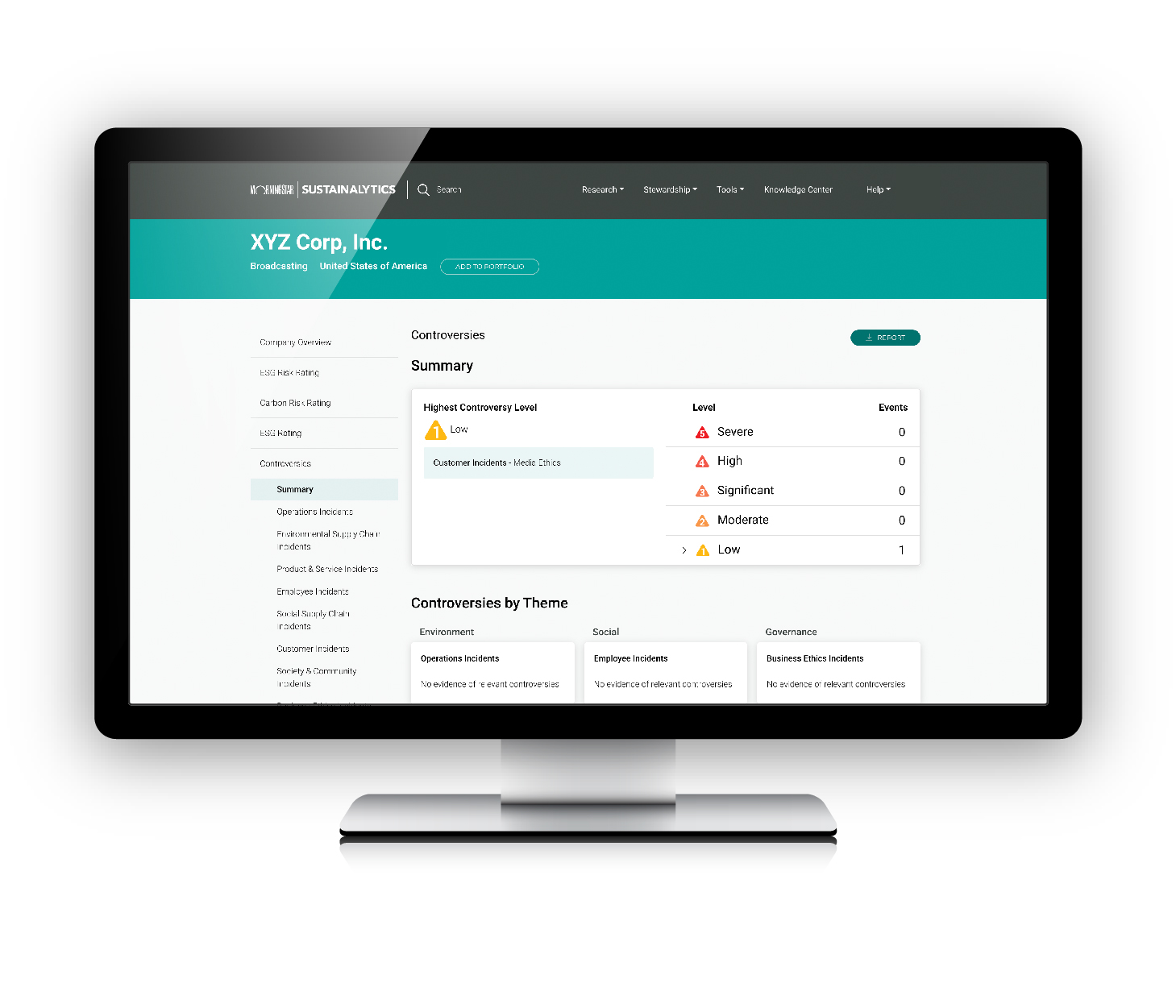

Investors who want to exclude companies that are exposed to modern slavery controversies from their portfolios can use controversies research to identify and monitor them. Morningstar Sustainalytics synthesizes its controversies research into a five-level hurricane scale. FGV’s controversy gets assigned to Category 4 (high), with a Negative outlook that anticipates a downgrade to Category 5 (severe) in the next 12 months.

VULNERABLE WORKERS

Modern slavery is typically defined to include forced and child labor, debt bondage, and human trafficking, as well as coercion, violence, and the abuse of power to exploit vulnerable people. The global agriculture and fishing industries, the apparel sector, and construction and property companies are especially exposed. Worldwide, over 40 million people are estimated to live in conditions of modern slavery, with two thirds of them in Asia-Pacific.

SCOPE AND SEVERITY

Across the agriculture, diversified metals mining, luxury and retail apparel, and textiles subindustries, Sustainalytics gives 22 companies a controversy assessment of 3 or higher for human rights-related employee events (either in their own operations or in their supply chains) as of August 2022. The agriculture industry has the largest number of companies involved, at eight. Diversified metals mining has the most severe controversy—a Category 5 event arising from the involvement of The New Reclamation Group, a South African manufacturing company, in Zimbabwe’s Marange diamond fields.

COMMODITIES TRADERS

The palm oil industry’s forced-labor abuses influence Sustainalytics’ assessment of both producers and commodities traders like Cargill, Archer-Daniels Midland, and Olam International. Sustainalytics gives FGV a Negative outlook in part because the CBP’s ban is likely to lead commodities traders and other business partners to reconsider their relationship with the company.