8 Stock Picks in the Apparel Industry

The industry has struggled to find any consistency, but there are attractive long-term opportunities.

The past few years have been challenging for apparel firms.

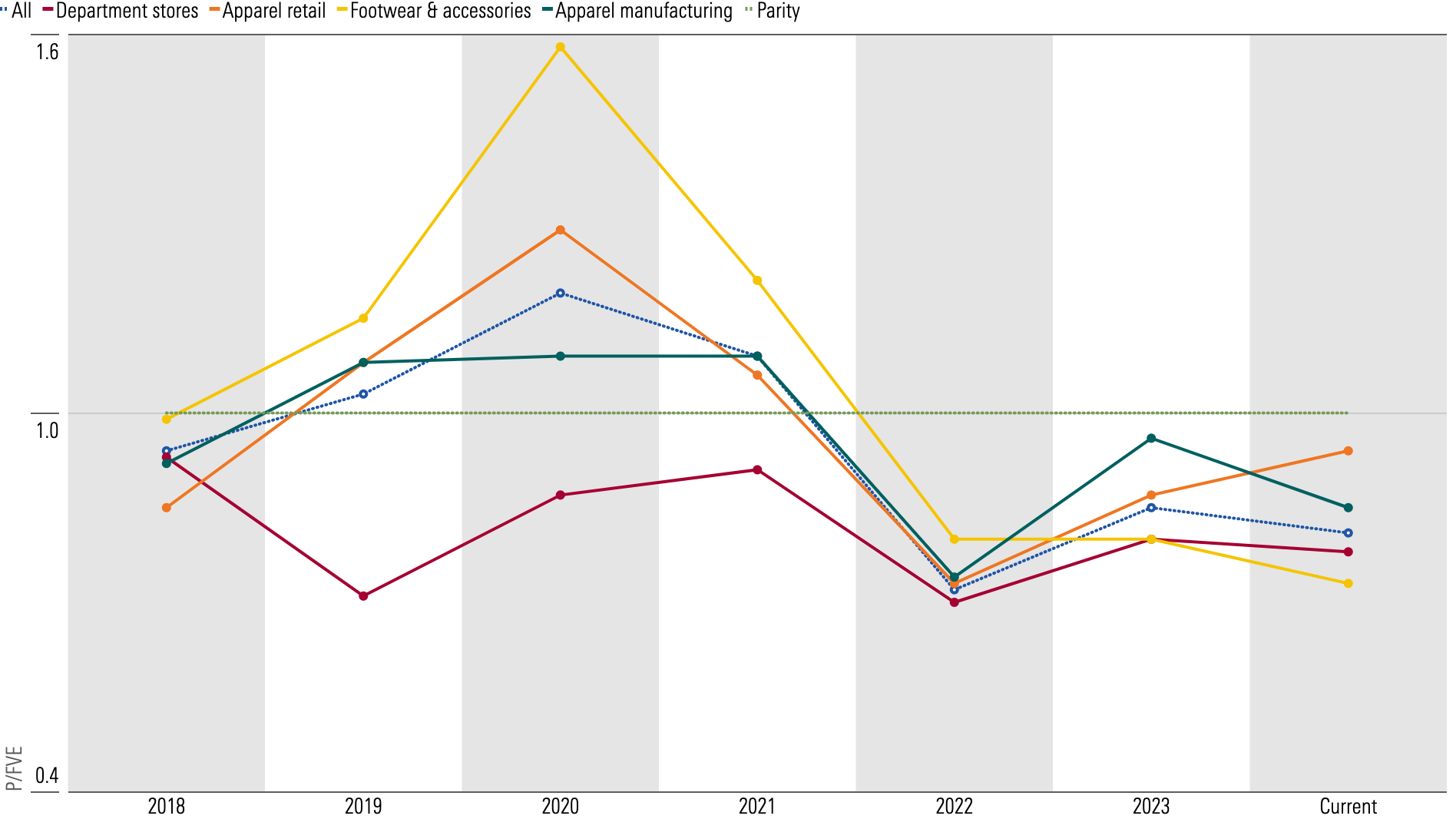

Most apparel stocks were trading above our fair value estimates in 2021, but a series of challenges since 2022 have led to inconsistent results and compressed valuations. Some apparel stocks followed the market higher in the first half of 2023 and moved closer to our fair value estimates.

Unfortunately, an expected turnaround in the second half of the year did not materialize, and many companies issued disappointing 2024 guidance owing to spending shifts away from clothing and macroeconomic challenges in North America, China, and Western Europe. Even so, comparisons will get easier as the year progresses, and there is optimism for a turnaround in 2025.

In Contrast to Prior Years, Most Apparel Stocks Now Trade at Discounts to Our Fair Value Estimates on Softer Results and Expectations

4 Key Themes to Know in the Apparel Industry

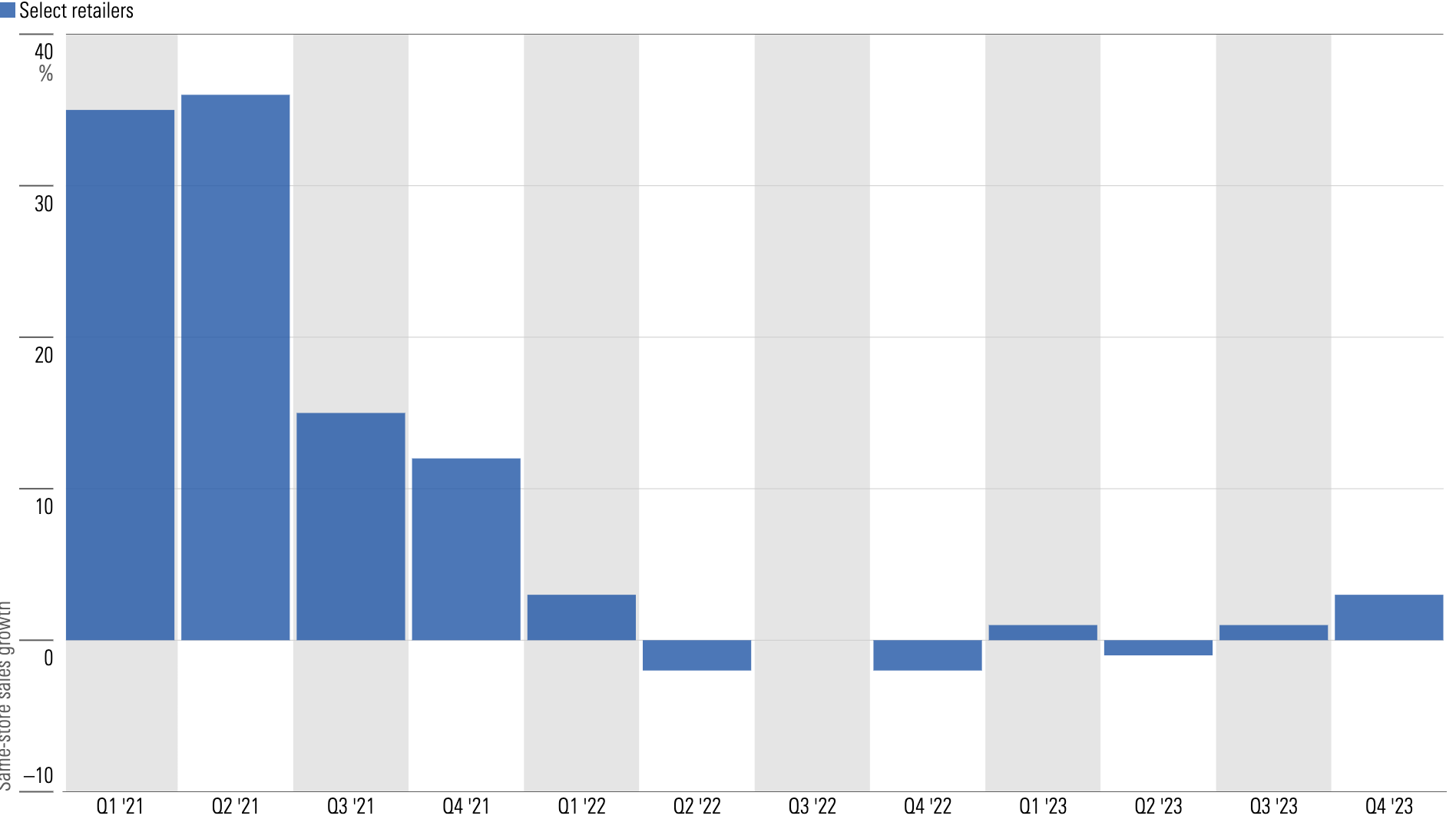

Consistent same-store sales growth has been elusive for most apparel and footwear sellers. Some issues, such as elevated inventory, have begun to abate in 2024. Ultimately, though, apparel is not a growth industry in the developed world, and same-store sales growth is likely to be in the low single digits in the long run. Recent outliers in terms of comparable sales include those catering to wealthier consumers; mass-market stores, especially department stores, have disappointed.

Select Group of Retailers' Sales Results Demonstrate the Industry's Recent Struggles

More work is necessary for apparel firms struggling with excess inventory. Many clothing firms have been plagued by excess inventory as they have struggled to match production with demand from wholesale partners and consumers. Most of these companies have invested to improve the productivity of their inventory, but progress has been slowed by market conditions.

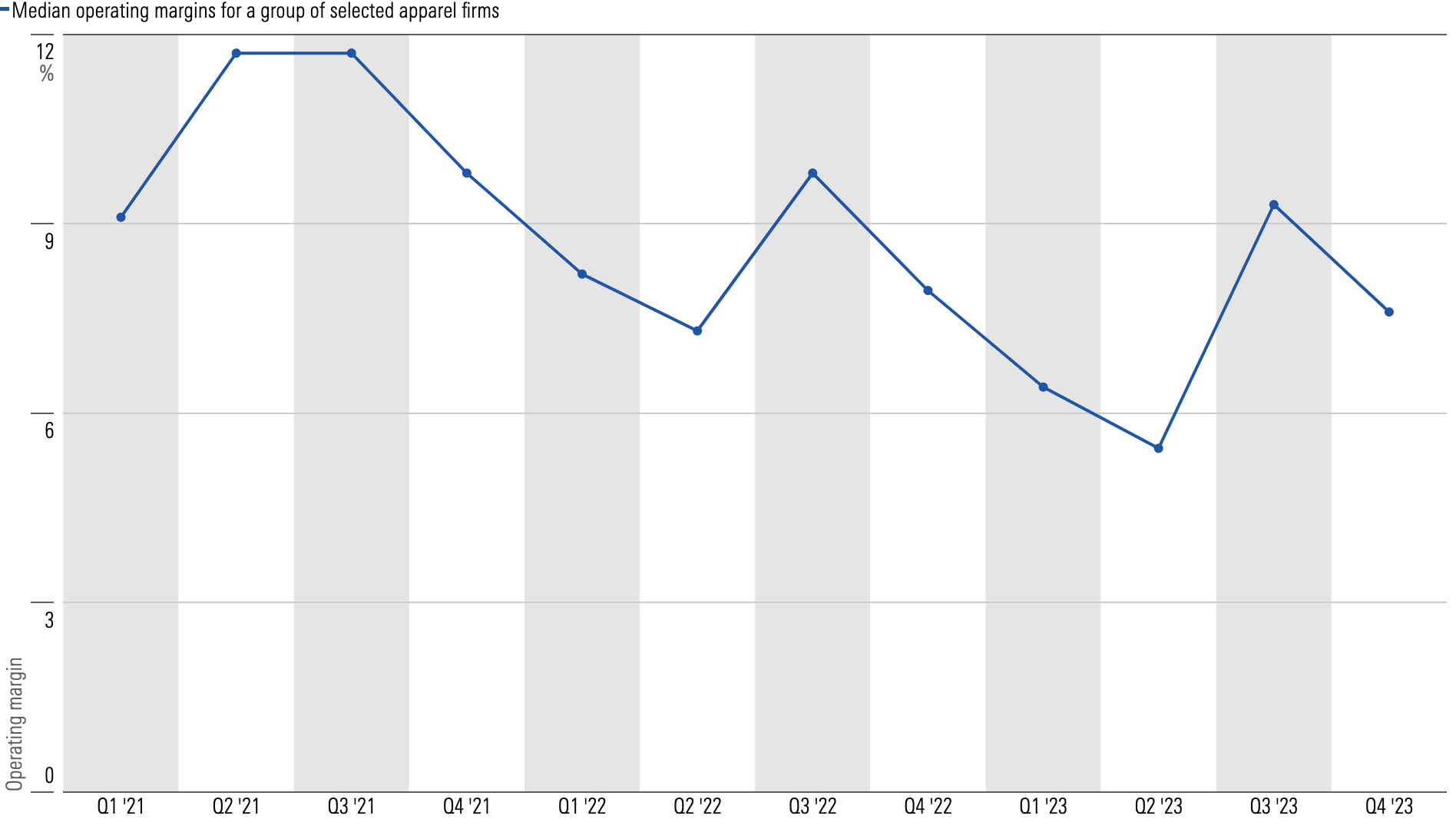

Apparel firms are looking for ways to boost profitability after a period of inflation and disappointing demand. Coming off strong results in 2021, it was almost inevitable that operating margins for many apparel firms would weaken in 2022 and 2023. As it happened, they dropped even more than expected in an environment of high inflation and slowing consumer spending. Also, the strength of the US dollar against the euro and other currencies has affected profitability for many multinationals.

Slowing inflation is beginning to benefit apparel firms’ margins as they have sold through much of their higher-cost merchandise.

Operating Margins Have Declined From Lofty 2021 Levels, but Cooling Raw Material Inflation and Cost Cuts Are Beneficial

Altman z-scores demonstrate distress by some apparel firms, but improvement is possible. The Altman z-score is a metric used to predict financial distress, based on profitability, balance sheet, and market data. According to this score, nearly 40% of apparel firms currently have scores that show they’re in danger of distress. Most of these firms currently have Morningstar Economic Moat Ratings of none and are undergoing significant restructuring and debt reduction to improve their financial positions.

8 Stock Picks in the Apparel Industry

Although the share prices of most apparel companies under our coverage have rallied over the past year, about half of them are presently trading at 4 or 5 stars. This high percentage reflects investors’ concerns about the industry returning to typical patterns of excessive merchandise and discounting as well as the debt levels of some, including 5-star-rated firms Hanesbrands HBI and VF VFC.

While we share investors’ view that the apparel industry has seen better days, we also believe that inventory levels are poised to decline and that some participants are operating more efficiently than in the past.

Here are eight companies that we like:

- Nike NKE

- Accent Group AX1

- Zalando ZAL

- Under Armour UA

- Shenzhou International 02313

- VF

- Hanesbrands

- Nordstrom JWN

| Stock | Ticker | Morningstar Rating | Moat Rating | Fair Value Estimate (as of May 17, 2024) | Price/Fair Value Estimate (as of May 17, 2024) | Uncertainty Rating |

|---|---|---|---|---|---|---|

| Nike | NKE | 4 stars | Wide | USD 129.00 | 0.71 | Medium |

| Accent Group | AX1 | 4 stars | Narrow | AUD 2.40 | 0.76 | High |

| Zalando | ZAL | 4 stars | None | EUR 41.00 | 0.62 | High |

| Under Armour | UA | 5 stars | None | USD 15.50 | 0.43 | High |

| Shenzhou International | 02313 | 4 stars | Narrow | HKD 124.00 | 0.67 | High |

| VF | VFC | 5 stars | Narrow | USD 53.00 | 0.25 | Very High |

| Hanesbrands | HBI | 5 stars | Narrow | USD 17.30 | 0.30 | Very High |

| Nordstrom | JWN | 4 stars | None | USD 38.50 | 0.55 | Very High |

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35cad34a-5a55-4541-88e4-5464951e9ae1.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-31-2024/t_99626deb19c94bd4a5c406e19350f0ee_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/U4OLR5WQ3JFYDHD76KVW6URKTU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOFK3IUSBRF5XHSFKBZHOG4J5A.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35cad34a-5a55-4541-88e4-5464951e9ae1.jpg)