U.S. Oil and Gas Doesn't Need a Trump Win to Thrive

Weaning America off fossil fuels will take decades, even if Democrats sweep Congress in November.

Tackling climate change has become one of the central pillars of Democratic presidential candidate Joe Biden’s election campaign. The former vice president’s $2 trillion investment plan covers infrastructure, transit, the automobile industry, and the power sector, with the ultimate goal of making the United States carbon neutral by 2035. A Biden administration would also bring the U.S. back into the Paris Agreement and reverse Trump-era rollbacks on various public health and environmental rules. However, that doesn’t mean America’s gas-guzzling days are over.

The executive branch can enforce existing legislature, such as the Clean Air Act and the Safe Drinking Water Act, but efforts to regulate the production or consumption of fossil fuels this way would meet considerable resistance in the courts. Retaking control of the Senate would give Democrats more options to restrict the oil and natural gas industry, but lawmakers would probably hold off on the more aggressive policy options, such as an outright ban on fracking. The U.S. still needs fossil fuels for transport and electric power generation, even if the Democrats prioritize electric vehicles and renewables, so an all-out assault on domestic producers would do more harm than good.

- A Biden win would reduce U.S. gasoline consumption. His climate-oriented policies would support adoption of electric vehicles and raise fuel efficiency in internal combustion engines. But the demand impact would be modest initially: 3% by 2025 and 9% by 2030. As only U.S. demand would be affected, this isn't a needle mover for global oil prices.

- Natural gas demand would also trend lower, since Biden would push for energy efficiency, coupled with heavy subsidies for renewables in the electric power sector. However, renewables are intermittent, and gas is a better backup fuel than coal. By 2025, we'd expect an incremental gas demand decline of 3%.

- The executive branch can halt permitting for new oil and gas wells on federal land. But it cannot ban fracking on private land, where most shale companies operate. A Democrat-controlled Congress would probably still oppose anti-fracking legislation, as a complete ban is likely to drive up fuel prices, hurting the economy, while driving up imports and making the U.S. beholden to foreign suppliers.

- A congressional sweep could lead to a repeal of the Tax Cuts and Jobs Act, which could modestly hurt U.S. energy companies via increased corporate taxes and reduced allowances for deductions, but it would neither affect the marginal cost of supply nor alter the global cost curve for crude oil.

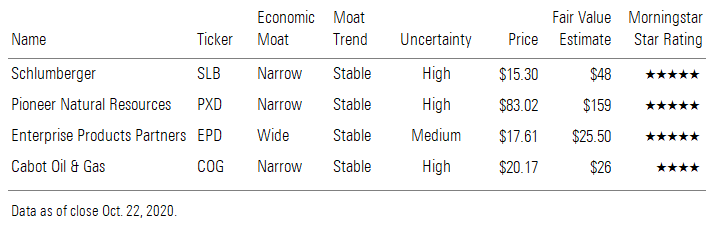

- A Democratic presidential win would not change our view that most oil and gas stocks are deeply undervalued, even if the Senate flips as well. The potential outcomes in our analysis could reduce fair value estimates by 10%-20% at the most, typically. Our top picks--Schlumberger SLB, Pioneer Natural Resources PXD, Cabot Oil & Gas COG, and Enterprise Products Partners EPD--would all still look cheap in such scenarios.

- It would take some fairly extreme policy shifts, unpalatable to moderate Democrats and Republicans alike, to affect our midcycle forecasts of $55/barrel West Texas Intermediate and $2.80/thousand cubic feet Henry Hub.

Oilfield Services Extremely Undervalued Oilfield-services stocks look extremely undervalued, as our median covered stock trades around 60% below our fair value estimate. The market appears to have written off a recovery in oil and gas capital expenditures. By contrast, we forecast capital expenditures to eventually surpass pre-COVID-19 levels, with our 2024 forecast up 14% versus 2019. This robust rebound in capital spending will lift results for oilfield-services companies. Our top pick is Schlumberger, whose diversified exposure presents a good way to play the industrywide recovery.

This bright outlook for oilfield services isn’t seriously dimmed by the prospect of a Biden presidency. Raising the U.S. corporate tax rate to 28% from 21% would have a low-single-digit percentage impact on the fair value estimates for our coverage. At the higher end, we estimate about a 7% impact for Helmerich & Payne HP and Patterson-UTI Energy PTEN as their operations are almost entirely U.S.-based.

If a total U.S. fracking ban did occur, this would be bad for U.S.-focused companies (especially Helmerich & Payne and Patterson) but a boon for everyone else. Global oil prices would rise, reflecting a higher marginal cost of oil production. Average costs of production would also increase to some degree, meaning higher levels of global capital expenditure, thereby boosting results for the average oilfield-services company. Those with highest exposure to markets other than U.S. shale would benefit disproportionately. The greatest benefit would be seen for offshore-focused companies like TechnipFMC FTI, Subsea 7 SUBC, Saipem SPM, National Oilwell Varco NOV, and Frank’s International FI.

Valuation Risk for E&Ps Modest, Unless Total Fracking Ban Enacted For the exploration and production companies we cover, price/fair value ratios are generally well below 1, indicating undervalued stocks. This follows a multiyear slide for the group, culminating in steep losses at the outset of the pandemic (commodity prices and stocks all fell with the broader markets, but did not recover to the same extent over the balance of 2020). But with oil entrenched well below our midcycle forecast ($55/barrel WTI), we think investors should play defense by prioritizing balance sheet strength as well as valuation. Our top picks are Pioneer and Cabot.

The most likely outcome of a Biden win is a moratorium on permits for new drilling on federal land. This would leave most E&Ps unscathed, especially if the former vice president opts to limit this restriction to companies operating onshore (as we suspect he might). Concho Resources CXO and EOG Resources EOG are the only companies with significant onshore exposure to federal land; Hess HES and Murphy MUR are exposed if the ban extends to the Gulf of Mexico. If the Democrats also pass a tax reform bill, all companies would be affected, with an average decline in fair value of 12%-14%.

Though we think it is unlikely, a total fracking ban would be ruinous for the U.S. E&P industry, which could not survive without this technology. However, it’s worth noting that such a ban would probably drive up oil prices at the same time. With WTI at $80, a handful of companies with significant assets outside the U.S. would avoid total losses, and if WTI sustainably spiked to $100 following a U.S. fracking ban, Apache APA and Hess could actually see a net benefit.

Midstream MLPs Benefit From Higher Taxes, but Pipelines Could Struggle With Approvals We expect the U.S. midstream space would see mixed impacts under a Biden administration. Even if Democrats manage to win the Senate with positive items including higher taxes, we see threats to new pipeline approvals and existing pipelines.

In terms of positives, we see higher tax rates as favoring the master limited partnership structure through a lower cost of capital over the double taxation of the corporate structure, as well as the potential to expand investments into renewables once added to MLP qualified income, an opportunity for our top pick, Enterprise Products Partners. While renewables investment is unlikely to be material in the near term, it provides pipeline companies with a long-term path to pursue value-accretive renewables projects. Currently, Williams WMB (a corporation) is the only midstream player with a sizable investment in renewables.

On the negative side, we do expect greater hurdles for obtaining pipeline approvals, particularly at the federal level, where the Federal Energy Regulatory Commission has oversight. However, FERC approvals would only affect interstate gas projects. We are not assuming any major U.S. gas pipelines are needed in the near to medium term, so this would not change our outlook. Oil, natural gas liquids, and intrastate gas pipelines can proceed with less interference, provided there are no local and state objections. Thus, Permian pipeline projects located in Texas, which we expect to be one of the largest sources of incremental supply, would face limited, if any, tougher standards.

The bigger risk for existing pipeline projects--as we have seen with Energy Transfer’s ET Dakota Access Pipeline--is that standards for environmental impact statements could be increased substantially to include items such as secondary carbon impacts, adding more complexity and expense to pipelines in operation. That said, we do see an opportunity for pipeline developers like Williams and Kinder Morgan KMI to highlight the amount of coal plant shutdowns related to a new gas pipeline project in the Southeast and Mid-Atlantic, thus reducing the overall carbon cost toward net zero, which would help meet any tougher environment standards.

This information was published Oct. 16 as part of an oil and gas special report, which is available to Morningstar’s institutional clients.

/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T3EAFJW3NJBYXAZPUNRE4KHLA4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CWMPLAZER5HFBGFDFB45VCOUHI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2RGHQJTF4ZEURNSAGBY7CSHCUQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)