After Earnings, Is Occidental Stock a Buy, a Sell, or Fairly Valued?

With extra domestic oil delivery and efficient operating performance, here’s what we think of Occidental stock.

Occidental Petroleum OXY released its second-quarter earnings report on Aug. 3 during trading hours. Here’s Morningstar’s take on Occidental’s earnings and stock.

Key Morningstar Metrics for Occidental Petroleum

- Fair Value Estimate: $56

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Very High

What We Thought of Occidental Petroleum’s Q2 Earnings

Outperformance by domestic assets: Occidental’s oil and gas business delivered the equivalent of 711 thousand barrels of oil per day in the second quarter, exceeding midpoint and top-end estimates by 3.6% and 1.8%, respectively. All domestic assets contributed to the outperformance, but operations in the DJ Basin were particularly impressive.

Successful operating performance: Encouraging oil well results in the DJ Basin (utilizing techniques the firm pioneered in the Permian Basin) enabled Occidental to lift guidance and might indicate better-than-expected production potential, though other firms have been showcasing similarly impressive advances.

Oil bulls: Our fair value estimate is driven by a long-term oil price assumption of $60 per barrel for Brent and $55 per barrel for WTI. Occidental would look more attractive to investors with a more bullish take on oil.

Occidental Stock Price Chart

Fair Value Estimate for Occidental

With its 3-star rating, we believe Occidental’s stock is fairly valued compared with our long-term fair value estimate.

Our primary valuation tool is our net asset value forecast. This bottom-up model projects cash flows from future drilling on a single-well basis and aggregates across the company’s inventory, discounting at the corporate weighted average cost of capital. Cash flows from current (base) production are included with a hyperbolic decline rate assumption. Our valuation also includes the mark-to-market present value of the company’s hedging program. We assume oil (WTI) prices in 2023 and 2024 will average $71/bbl and $66/bbl, respectively. In the same periods, natural gas (Henry Hub) prices are expected to average $2.90 per thousand cubic feet and $3.60/mcf. Terminal prices are defined by our long-term midcycle price estimates (currently $60/bbl Brent, $55/bbl WTI, and $3.30/mcf natural gas).

Based on this methodology, our fair value estimate is $56 per share. This corresponds to enterprise value/EBITDA multiples of 5.3 times and 4.8 times for 2023 and 2024, respectively. Our production forecast for 2023 is 1.19 million barrels of oil equivalent per day, which is consistent with guidance. That drives 2023 EBITDA to $14.1 billion, and we expect cash flow per share to reach $11.50 in the same period. Our 2023 estimates for production, EBITDA, and cash flow per share are 1.21 mmboe/d, $13.7 billion, and $10.98, respectively.

Read more about Occidental’s fair value estimate.

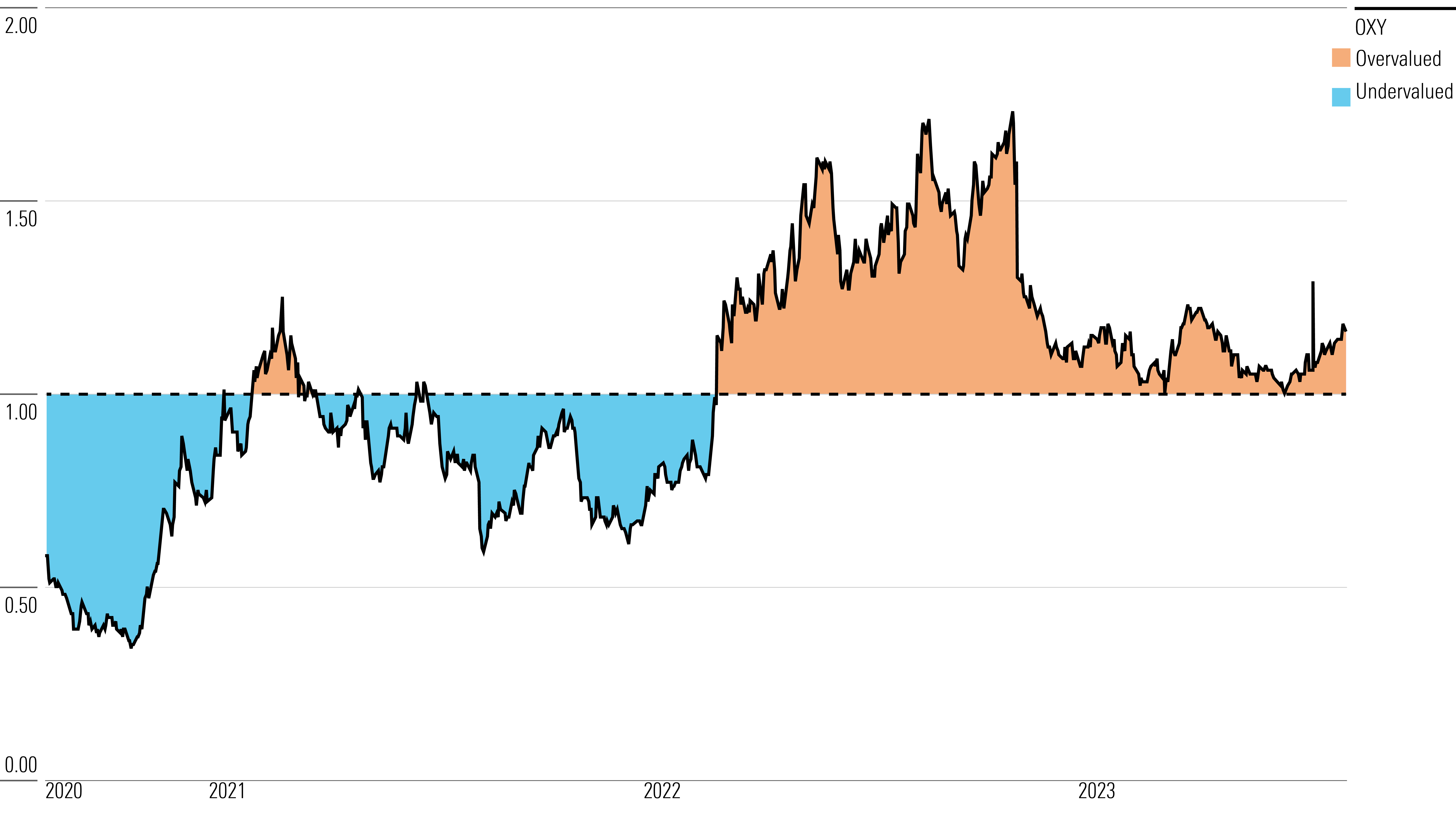

Occidental Price/Fair Value

Economic Moat Rating

We do not award Occidental an economic moat.

Like all oil and gas exploration and production firms, Occidental is exposed to a range of potential environmental, social, and governance issues that could hurt its ability to generate strong returns. The most significant ESG exposures are greenhouse gas emissions (both from extraction operations and downstream consumption), and other emissions, effluents, and waste (primarily oil spills).

Oxy has credibly positioned itself as a net-zero champion within the industry, and its Low Carbon Ventures unit has ambitious plans to construct 70-135 direct air capture plants in the areas in which it operates. The first of these, to be constructed in the Permian Basin, is expected to go online in 2024. Unlike most peers, Oxy has adopted an explicit net-zero target including scope 3 emissions, and it aims to hit this milestone before 2050. The firm has an advantage over peers in this area because it uniquely benefits from both its chemicals business, which can supply potassium hydroxide and PVC for its plants, and from its enhanced oil recovery operations (a technology that boosts productivity in mature oil fields by injecting CO2 into the reservoir, creating a sink for the CO2 that gets captured and thus eliminating sequestration concerns).

But greenhouse gas emissions are still a threat. Consumers are becoming more averse to fossil fuels, increasing the probability of widespread substitution away from them. The industry’s poor reputation also makes value-destructive regulatory intervention more likely in the future (think fracking restrictions or carbon taxes). And while Oxy can reasonably claim it is aiming to be a better corporate citizen than most, given its extensive carbon capture plans, the resulting impact of such interventions on oil prices would be equally painful. Such a scenario is not likely enough to be included in our base-case forecasts, but because the impact would be material, it does further erode the firm’s moat potential.

Read more about Occidental’s moat rating.

Risk and Uncertainty

Due to the volatility of oil markets at this time, we assign Occidental a very high uncertainty rating.

As with most E&P firms, a deteriorating outlook for oil and natural gas prices would pressure its profitability, reduce cash flows, and drive up financial leverage. An increase in federal taxes, or a revocation of the intangible drilling deduction that U.S. firms enjoy, could also affect profitability and reduce our fair value estimates.

Material ESG exposures create additional risk for E&P investors. In this industry, the most significant exposures are greenhouse gas emissions (both from extraction operations and downstream consumption), and other emissions, effluents, and waste (primarily oil spills). In addition to the reputational threat, these issues could push climate-conscious consumers away from fossil fuels in greater numbers, resulting in long-term demand erosion. Climate concerns could also trigger regulatory interventions, such as fracking bans, drilling permit suspensions, and perhaps even direct taxes on carbon emissions.

Finally, as an offshore producer in the United States, Oxy has an additional vulnerability. The firm’s drilling campaign in the Gulf of Mexico requires ongoing approvals from the Department of the Interior. As this entity is controlled by the executive branch of the U.S. government, it can suspend permitting activity without congressional approval. In the past, President Joe Biden has hinted at legislation withholding future oil and gas permits, which could hurt Oxy’s growth in the Gulf.

Read more about Occidental’s risk and uncertainty.

OXY Bulls Say

- Oxy has a dominant position in the Permian Basin, which is the cheapest source of production in the U.S. and is expected to be a major growth engine in the next few years.

- Oxy’s conventional assets in the Gulf of Mexico and the Middle East complement its shale operations nicely by generating stable cash flows from assets with a much lower base decline rate.

- The low-carbon ventures segment is synergistic with Oxy’s chemical business, and Oxy’s EOR portfolio holdings and expertise give it a natural advantage in carbon capture.

OXY Bears Say

- Though Oxy’s Permian wells exhibit high initial production rates, they also decline very quickly.

- The Anadarko acquisition bolstered Oxy’s Permian footprint but left it with other assets it didn’t really want, such as its WES Midstream stake or its North Africa operations.

- Oxy will have to share the spoils from its ambitious carbon capture plans, and since it isn’t providing financing or engineering, it will have to give away a sizeable working interest.

This article was compiled by Saaketh Tirumala.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)