Investing With Our 2020 Healthcare Policy Outlook

We see risks for managed care but also opportunities to own moatworthy companies at sizable discounts.

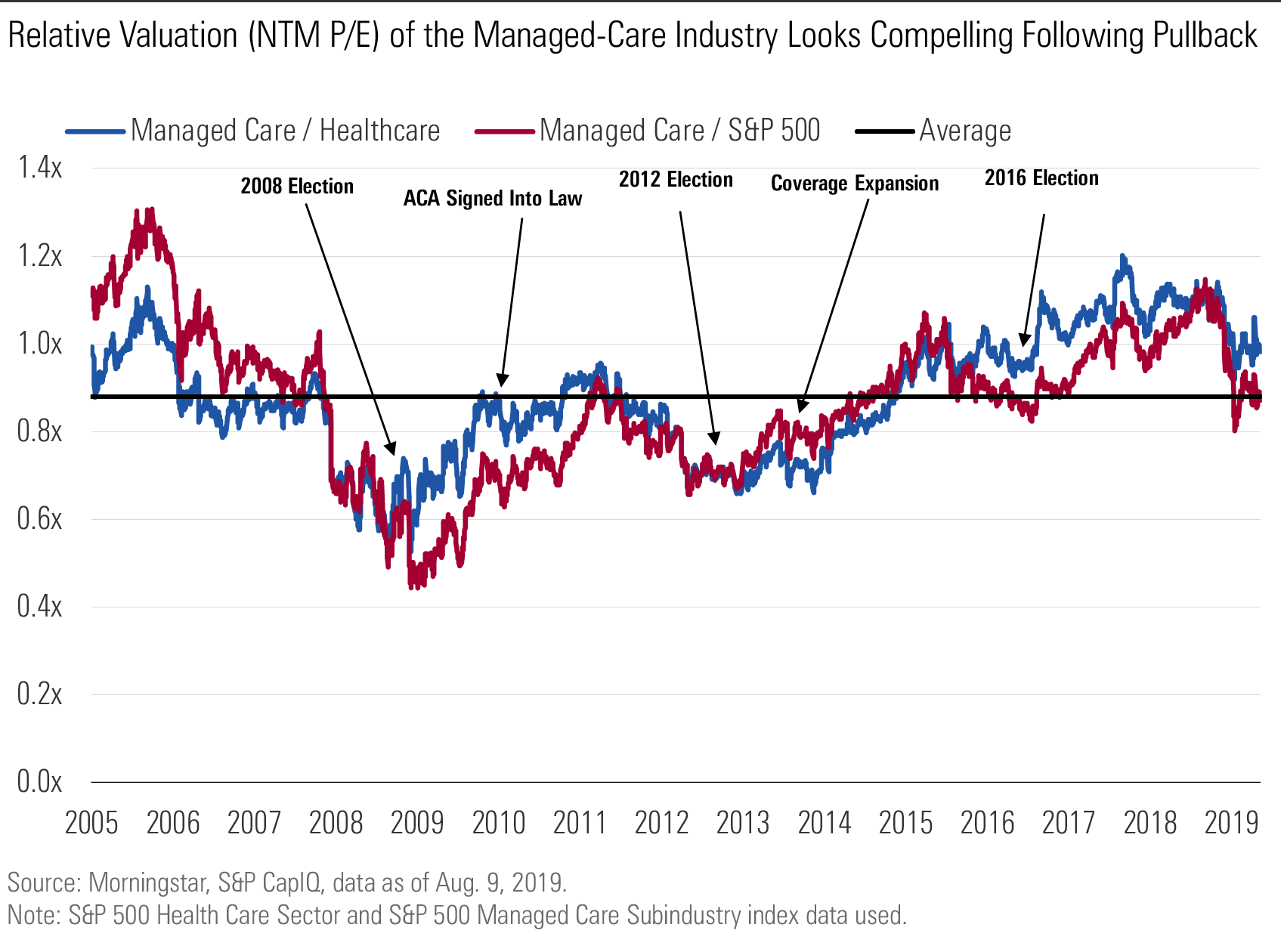

Managed care remains an attractive industry, allowing incumbent leaders to carve out sizable economic moats. Companies have built advantageous business models around monthly premiums and fees that generate recurring revenue, and we like the consistent midteens returns on equity the industry has generated over the past decade. However, company valuations across the space have compressed over the past year as concerns about policy and regulation have clouded investors’ outlook.

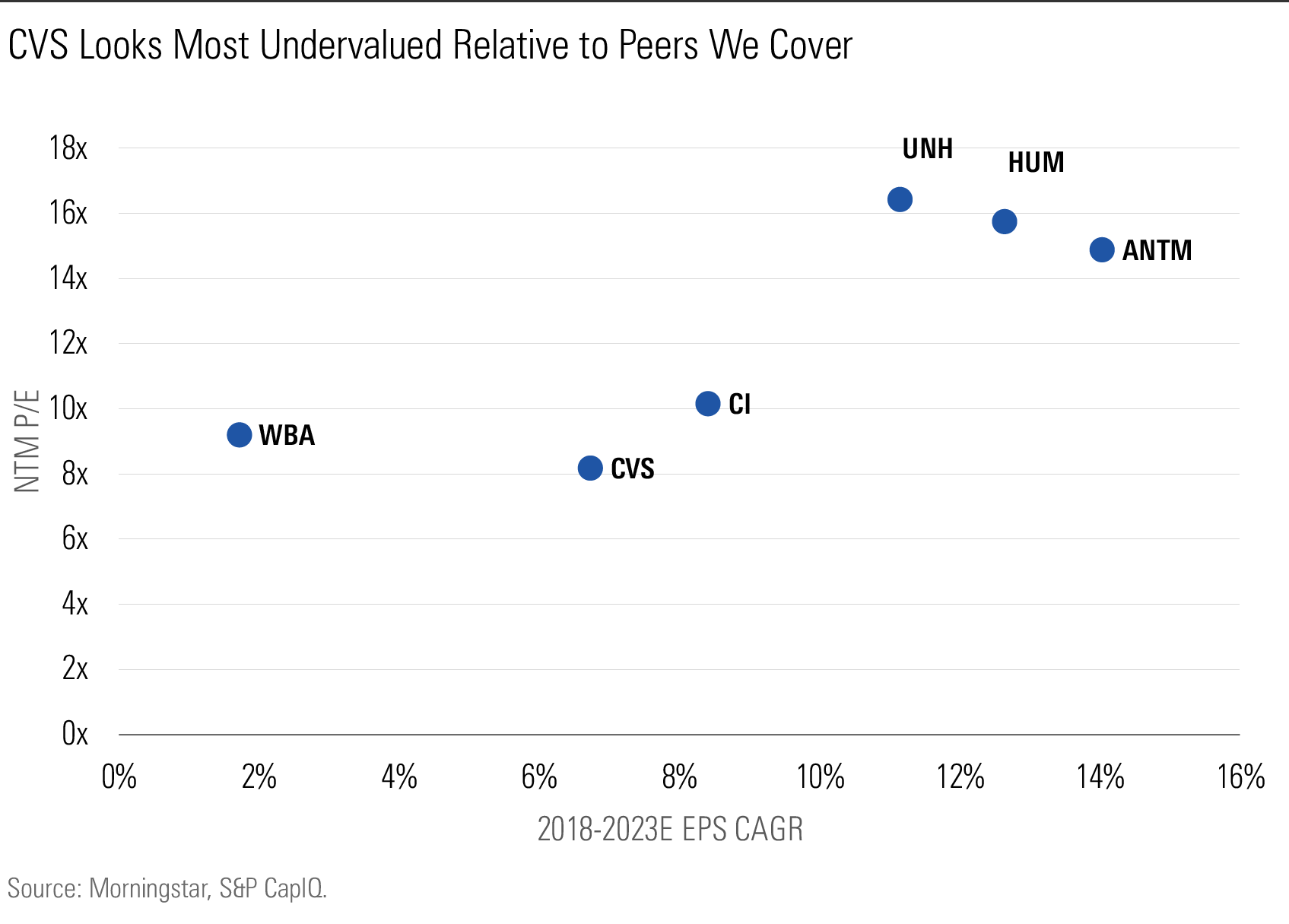

Despite many companies’ improved competitive position, the industry’s relative multiple is falling in line with its long-run average, and the companies we cover are largely trading at a discount to our discounted cash flow-derived fair value estimates. We think investors have an opportunity to own these moatworthy businesses at attractive valuations, and we expect the companies we cover to increase earnings per share at a 10% compound annual rate through 2023, while currently trading at a weighted average forward price/earnings ratio near 14 times. CVS Health CVS is the most deeply discounted company in the group following its acquisition of Aetna in late 2018, and UnitedHealth Group UNH is the widest-moat company offering an attractive discount to our fair value estimate.

We think the payer industry within the healthcare sector is readily conducive to economic moat formation, most frequently supported by the cost advantages afforded players with scaled insurance offerings and the network effects present among the health plan, provider, and patient.

Although it’s a frequent refrain on the campaign trail, we think Medicare for All or similar policies promising universal coverage are unlikely to see success over the next decade. After analyzing the policy positions of the leading candidates seeking the Democratic Party presidential nomination in 2020, the U.S. Senate landscape in the upcoming election, and the preferences of likely voters on both sides of the aisle, we think investors should consider the probability that a policy similar to Medicare for All will see success to be in the 5%-10% range at best.

Aside from the political barriers to broader support of a universal healthcare system, cost remains a key hurdle. Current estimates suggest federal outlays would need to increase by roughly $2 trillion annually, on average. For context, a doubling of the dollars collected through current personal and corporate income taxes wouldn’t quite be sufficient to cover this budget increase.

Allowing an age-restricted buy-in to the Medicare program would likely boost industrywide enrollment in Medicare Advantage by roughly 5%, by our estimate, with UnitedHealth and Humana HUM best positioned to benefit. A public option offered via Medicaid, on the other hand, would probably encourage a mix shift away from plans already offered through an exchange.

We’ve refreshed our thinking regarding the Affordable Care Act’s efficacy following our initial review in 2015. While incremental evidence suggests that the law has made some progress in improving the healthcare cost burden since our last assessment, metrics associated with accessibility and quality of care have seen less progress. Despite these positive trends, cost remains the most pressing hurdle to obtaining coverage for those who remain uninsured.

Uncertainty Abounds, but We'd Bet on the Status Quo As we contemplate the investment case for businesses in the U.S. healthcare sector, nothing generates more uncertainty in our outlook than potential policy changes following the 2020 election cycle. While Republican lawmakers have fallen short of offering a comprehensive alternative to the ACA, Democratic presidential hopefuls have made various healthcare proposals a core tenet of their candidacy and the broader Democratic Party platform. Members of Congress have introduced legislation that spans the gamut, from offering an option to buy into the Medicare program early to reaching universal insurance coverage through a newly designed and compulsory federal program. Each of these proposals would have a different but sizable impact on companies throughout the sector, but we view the managed-care and service provider industries as most directly affected by the policies that appear to be gaining the most incremental traction. However, while the data suggests universal healthcare plays well to the Democratic Party base during the primary season, it could be a difficult sell to the electorate at large during a general election campaign.

While polling data for 2020 is limited, and probably not too informative this far out, we can make some inferences from last year’s midterm and early data from the Democratic primary race. Healthcare was a top issue for voters last year, with 75% of registered voters saying it was a “very important” consideration in their decision during the 2018 election. This was driven primarily by Democratic supporters with nearly 9 out of 10 respondents citing healthcare as a top concern, but 60% of Republicans also shared this sentiment, based on a Pew Research Center poll conducted in September 2018. More recent data published by Morning Consult supports this notion, with healthcare polling as the top issue among Democratic voters likely to participate in the party’s primary.

A Wall Street Journal/NBC News poll conducted April 28 to May 1 uncovered a similar sentiment, with 24% of all respondents citing healthcare as the number-one issue for the federal government to tackle. Roughly 18% of those surveyed ranked healthcare as the number-two issue. These percentages are up from 13% and 15% found in a similar question posed in April 2015. It's not surprising, then, to see healthcare policy mark the cornerstone of many Democratic candidates' platforms. However, there seems to be a divergence between those advocating for dramatic reform and those taking a more moderate policy approach, likely driven by perceived voter preference.

Voters’ priorities have shifted largely from concerns about insurance coverage and access to issues around cost and affordability. In a review of polling data published by the Kaiser Family Foundation, in 2003, only 33% of respondents with employer-sponsored insurance suggested cost factors were the most important feature in a health insurance plan, with 60% favoring coverage-related aspects. Based on a similar survey conducted in 2018, the response rates largely flipped, with 59% considering cost-related features the most important component of plan design and only 26% favoring coverage-related factors. This is at least partly explained by expanding deductibles and patient copay responsibility in the employer-sponsored market to combat increasing premiums and better control healthcare utilization rates.

More Moderate Policy Considerations See Broad Support Looking at broad measures of approval among the electorate and within various wings of the Democratic Party, it's clear Medicare for All lacks the support that more moderate policies enjoy. Further, the proposal remains poorly understood by partisans regardless of party affiliation. We see more broad-based support for proposals advocating a Medicare buy-in or public option administered through Medicaid, which would likely prove less disruptive to industry and potentially provide a positive catalyst for insurers with a strong Medicare Advantage or Medicaid plan offering.

Despite a slight majority of respondents favoring Medicare for All, support wanes when offered additional information regarding how the program would likely affect the overall healthcare system. Net favorability improves when discussing the program as guaranteeing healthcare as a right for Americans while also reducing premiums and out-of-pocket costs. However, when offered details around many of the negative externalities associated with such a program, net favorability declines rapidly. Respondents reacted quite negatively to the notion that taxes would be raised, private health insurance companies eliminated, or potential delays created within the system under a federally administered program. Voter education will be a critical aspect of the primary and general election season for any candidate who wants to make healthcare reform front and center in the debate.

Support is further fragmented within various wings of the Democratic Party, with more moderate voters signaling much lower support for pushing an agenda featuring universal coverage as a key consideration on the campaign trail. A more recent Kaiser Tracking Poll suggesting moderate Democrats favor more marginal changes to cost and access, while developing policy targeted at protecting and strengthening the progress made under the ACA. Those in the more liberal wing specifically focus on developing a single-payer system as the primary pathway to improved cost and access. While the liberal cohort has grown in popularity in recent years, a recent Gallup study suggests that roughly 51% of Democrats and only 22% of independents self-identify with the liberal moniker versus the moderate or conservative labels.

We’ve been skeptical regarding the likelihood of sweeping policy change, but recent valuations across the managed-care space seem to imply an embedded discount likely related to heightened political and regulatory concerns from investors. While there have been a handful of different policies floated by the administration and Congress, including those related to drug rebates and overall price transparency, a move to universal healthcare by far poses the biggest risk to private business.

Handicapping election outcomes seems to have turned into a fool’s errand following the 2016 result, but we do try to sketch out the what the base-case expectation for 2020 should be for investors.

Aside from the favored policy position of the Democratic presidential candidate that ultimately advances to the general election, we think looking at the likely outcomes in the Senate is the most important consideration in assessing the potential for legislative success. There are 34 seats up for re-election, with the majority unlikely to face much competition. According to the Cook Political Report, 11 of the 12 Democratic seats and 19 of the 22 Republican seats up for grabs are more or less shoo-ins for their respective parties. This leaves only one competitive race for the Democrats and four Republican senators whose seats are in a relatively precarious situation.

With Republicans currently holding a 53-47 majority, the math quickly becomes difficult for a Democratic majority. While the outcome of these closer races will probably correlate with the presidential result, the bottom line for investors is that sweeping healthcare reform will almost surely be gated by the filibuster--there’s no realistic path to 60 seats for either party in this election. The likelihood that a partisan legislative agenda sees success will hinge on the Senate majority’s willingness to bypass the legislative filibuster and move to a simple majority process. The likelihood that the Senate becomes a completely majoritarian institution increases should one party gain control of the White House and both chambers of Congress, but this decision ultimately rests with the Senate majority.

While the down-ballot congressional results will probably trend alongside the presidential outcome, rough probabilities as they stand today map in line with our thinking that the base-rate likelihood of Medicare for All (or a functionally similar policy) becoming a realistic possibility is somewhere near 5%-10% at best. According to www.predictit.org betting markets, Democrats currently have the edge to win the presidency, while facing an uphill battle in the Senate. As of Aug. 8, the probability that the Democrats win in the presidential race stood at roughly 53%, while the likelihood the party regains control of the Senate fell near 30%. These measures put the chances of seeing a Democratic win in both the White House and Senate at approximately 16%. After considering both the policy positions of the Democratic front-runners and the need to bypass the legislative filibuster, it seems that potentially half might have the political will to take this agenda to the finish line. The resulting base-case probability is roughly 8%, before considering the cost and logistical concerns associated with implementing such a program. We acknowledge the many weaknesses in this analysis (it assumes each variable is an independent outcome, probabilities are imputed from a single, high-friction marketplace, and the policy preference of leading candidates is crudely estimated), but it seems to be an effective starting place for investors to attempt to both parse outcomes and update expectations as more robust polling data becomes available over the coming months.

While Congressional Budget Office has yet to provide an official cost estimate associated with either of the Medicare for All bills currently proposed, a handful of economists and think tanks have been willing to take a stab at the analysis. The New York Times gathered a handful of incremental assumptions underlying these research pieces and put together an informative overview of the numbers that has been widely cited in the press. While most estimates peg the net annual cost of universal coverage moderately ahead of current national spending rates, the need for the federal government to raise roughly $2 trillion each year in incremental funding is a nontrivial concern.

For perspective, CBO currently estimates mandatory spending (Medicare, Medicaid, Social Security, and other safety net programs) will approach $2.7 trillion in 2019, with aggregate federal spending nearing $4.4 trillion. The aforementioned estimates imply that a program along the lines of Medicare for All would probably require an annual increase of roughly 70% in mandatory spending and 40% in total federal outlays relative to current law. For context, a doubling of income tax collections from both individuals and corporations wouldn’t quite raise enough incremental revenue to pay for the added cost of the program. This will make passing the legislation exceedingly difficult, especially considering the program’s net favorability among voters declines from positive 14% to negative 23% after survey respondents hear that the proposal would require a tax increase on most Americans.

Republicans also contend that they have a vision for what the future of U.S. healthcare should look like. However, following the 2017 failure of the House’s American Health Care Act and the Senate’s slimmed-down Health Care Freedom Act, it seems Republican interest in renewing the healthcare debate in the legislature ahead of the upcoming election is limited. As we look beyond 2020, we expect a Republican-controlled agenda would look much like what we’ve seen under the current administration. With the financial penalty associated with the individual mandate effectively removed, the party’s focus would likely return to containing growth in Medicaid spending and repealing or continuing to defer various industry taxes set to return in the coming years.

Policy Outcomes Have Varying Implications for Healthcare Sector The specific impact on various industries and businesses in the U.S. healthcare system will depend heavily on which proposal and specific bill might ultimately garner enough bipartisan support to see success. Although potential changes are near universally negative for the industry, we think the most feasible policy, an early buy-in for Medicare, could prove to be a positive for payers able to capture incremental enrollment share through well-positioned Medicare Advantage offerings.

Expanding access to Medicare through an age-restricted buy-in seems to be one of the most widely supported proposals across party lines. This would likely be least disruptive to the system, further the goals underlying the ACA, and potentially be cost-effective (although we have yet to see a CBO analysis of any of the bills currently being considered). We detail the main industry considerations of such a policy that would be most relevant for investors below.

Payers. This proposal would likely prove to be positive for large public insurers such as UnitedHealth, Anthem ANTM, Humana, WellCare WCG, Centene CNC, and CVS' Aetna segment, which have built sizable businesses offering Medicare Advantage plans to seniors. With roughly 6 million uninsured falling in the 50-64 age cohort versus the over 22 million beneficiaries currently enrolled in a Medicare Advantage plan, broadening eligibility criteria creates an opportunity to capture incremental membership growth. While the uninsured represent greenfield opportunity for managed-care organizations, companies are also at risk of existing members moving between plan offerings. Should the policy encourage members currently enrolled in an employer-sponsored risk-based plan to shift into Medicare early, plan sponsors would see margin dilution given the lower payments received by CMS. However, this represents a minority of the commercially insured with most employers opting for a self-insured program, only paying the plan sponsor a fee for claims adjudication and network access. To the extent that lives covered under fee-based arrangements transition into the expanded Medicare program, plan sponsors should see an uptick in profits as they onboard more risk.

Providers. The trade-off for hospitals, surgical centers, physician groups, and other provider categories would be similar to what the industry faced under ACA regulations and Medicaid expansion. Adverse payer mix would be offset to an extent by less uncompensated care, assuming uninsured admissions and visits decline, and higher treatment volume as more stable coverage encourages utilization. The ongoing trend toward consolidation would probably persist under this policy as operators continue to search for scale and operating efficiencies.

Devices and diagnostics. In a similar vein to our views on the space throughout the ACA rollout, the medtech industry would probably face indirect headwinds stemming from the ripple effects of lower provider reimbursement rates. Pricing pressure throughout the industry would likely persist. Large, moatworthy businesses seem best positioned to retain their incumbent advantage over smaller peers. With limited ability to gain share in a market gated by group purchasing organizations and value assessment committees, smaller businesses tend to find more success selling to an established franchise rather than going it alone. This dynamic reinforces the intangible asset and scale-derived advantages enjoyed by industry titans.

Drugs. Both Medicare buy-in bills currently introduced strike the Part D noninterference clause, giving the Health and Human Services secretary authority to directly negotiate drug prices for legacy Medicare beneficiaries and those newly enrolled in the expanded program. However, neither authorizes the use of a formulary, which severely handicaps the negotiating power of Medicare. Without the ability to tier preference of similar therapeutics and encourage the use of generics, it's unlikely that the HHS secretary would secure deeper discounts than are already achieved through the negotiating power of private-sector pharmacy benefit managers. The CBO has provided consistent guidance on this matter following several congressional inquiries since the creation of Part D. Without the authority to use a formulary, the CBO believes that the ability to negotiate would generate negligible savings for the program.

Public Option Would Pressure Insurer and Provider Margins While a lack of specifics makes crafting potential scenarios difficult under any of these policies, a public option is particularly tough given the nuanced interaction among the decision-making of consumers, employers, plans, and providers. There are currently two proposals that embody the spirit of a true public option: the federal program outlined in the Medicare for America Act and a Medicaid buy-in system run by the states. The former would probably prove more disruptive, although it does allow for employer-sponsored coverage and Medicare Advantage plans to remain in the market. However, lifetime enrollment and auto-enrollment for newborns sets the stage for a phase-out of private plans over time. The latter is an evolution of the nongroup market and aligns with what some states, such as Washington, have been working toward creating. There seems to be healthy support among the electorate for something along these lines. However, the attractiveness of such a plan depends on how the program is administered and the contractual rates it would pay providers.

The Washington plan, set to begin enrollment in 2021, will be privately administered by Medicaid managed-care organizations and include many compromises to make it a viable offering. Notably, it caps provider reimbursement at 160% of Medicare rates, which is expected to result in 5%-10% lower premiums compared with competing plans offered in the nongroup marketplace.

The CBO came to similar numbers in its analysis of adding a public plan to the existing exchange framework. However, it also concluded that most enrollees would come from the pool of individuals currently covered by an exchange plan along with roughly 2 million additional members who would lose employer-based coverage; it assumes the program would have little effect for those currently uninsured. Ultimately, the CBO estimated that roughly 35% of exchange enrollees would choose the public option. However, its assessment that the public option would have premium rates set roughly 7%-8% below other plans offered on exchange seems conservative under the assumption that the program would pay Medicare-equivalent rates to hospitals and other providers while compensating physicians at only 105% of Medicare reimbursement levels.

Should states to elect to offer an exchange plan operated through Medicaid, currently contracted payers seem best positioned to gain incremental membership. Exchange membership has been below expectations to date, but consumers’ out-of-pocket exposure via a Medicaid offering would likely be more attractive than current nongroup plans, given the lower rates paid to providers. Creating a plan with comparable network adequacy may prove difficult, however, and the mid-single-digit percentage improvement in premiums might not be enough to entice individuals who would prefer to preserve access rather than lower costs.

While this shift toward Medicaid enrollment would come with lower margins, the net effect on private insurers’ cash flow generation would be mixed. If, as suggested by the CBO, most would tend to move from existing on-exchange plans to the Medicaid option, we could see this policy being a net positive for enrollment growth of the large carriers. Following inconsistent profitability in the few years following the rollout of the insurance exchanges, most public insurers dramatically reduced their exposure to these markets. However, if more competitive premium rates on the Medicaid-sponsored plan begin to pressure margins in other areas of business, or if employers decide to dump membership onto the nongroup market, cash flow is likely to suffer.

From a provider perspective, the financial effect of a public option will depend heavily on how the statute is ultimately written. If a national plan trends toward what we’ve seen pass in Washington, with a payment cap of 160% of Medicare, providers would fare all right--the policy would result in negative payer mix but nothing that couldn’t be managed over time. In the event a public option follows the CBO framework, capping provider reimbursement at 100%-105% of Medicare payment rates, providers would likely struggle to offset the lost revenue. At 35% of exchange enrollees, this would result in nearly 4 million members (equivalent to roughly 6%-7% of current Medicare enrollment) shifting from higher-margin commercial coverage to low- or no-margin reimbursement levels. This mix shift would be particularly pronounced as the CBO estimates no coverage gains for the uninsured, resulting in limited improvement in bad-debt levels or increased procedure volume to help offset provider margin pressure.

Medicare for All Would Shock Company Economics The two universal coverage bills that have been introduced in the Senate by Sen. Bernie Sanders and in the House by Rep. Pramila Jayapal would upend the U.S. healthcare system as it stands today. Private insurance would be effectively eliminated, the use of the Medicare price deck or a national global budget reimbursement framework would pressure provider viability, and drug manufacturers would have no choice but to negotiate with the HHS secretary to get their therapies into the hands of patients. As an offset to these negatives, improved coverage and elimination of cost-sharing responsibilities would eliminate bad-debt expense throughout the system and likely encourage greater consumption of healthcare services.

Managed-Care Companies Present Compelling Value for Long-Term Investors The risks associated with each of the aforementioned policies appear to be increasingly baked into the current valuations of the payers we cover. Well off cycle highs, the valuation of the managed-care index relative to either the healthcare sector or broader market index looks favorable compared with its trading history, especially when considering the improved competitive position of many constituent businesses. The wide range of policy potential policy outcomes, along with our expectation that disruptive change is unlikely, leaves us with a fairly optimistic outlook for U.S. health insurers--we expect the group to increase EPS at an approximate 10% compound annual growth rate between 2018 and 2023. The cash-rich nature of these business models leaves further room for upside to this estimate as management teams pursue bolt-on acquisitions and the industry continues its trend toward consolidation.

We favor CVS as the most deeply discounted name in the space, and we like UnitedHealth as the highest quality, widest-moat company despite its premium valuation. These companies sport more diversified service offerings and less market concentration within their insurance businesses. Companies like Cigna CI and Humana, on the other hand, have pursued a strategy of specialization--Cigna in the commercial market and Humana as a contractor for government-sponsored plans. As we consider the future of the industry, we view more-integrated companies able to offer more-comprehensive services at more-competitive prices as best positioned relative to niche or pure-play peers that lack comparable scale and scope.

MORN DODFX VINIX VWILX TSVA EGO WU Brightstart429plan MRO VZ MOAT T NKE CMCSA GOOG

/s3.amazonaws.com/arc-authors/morningstar/1b41fb8c-9182-4ce0-8c93-2a2a81e4f657.jpg)

/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZSPP5AYAJB2RIRVFE2XR23GUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NYUEHSFI4BDCJPQZJ76HH4PKSM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1b41fb8c-9182-4ce0-8c93-2a2a81e4f657.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)