Energy Sector Stock Outlook: With the Pullback of Commodity Prices, Buying Opportunities Have Started to Emerge in Energy

Russia and China remain concerns even as demand appears unchanged.

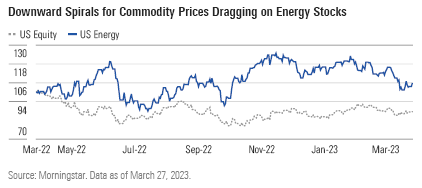

After last year’s run up in commodity prices, producers are now seeing increased downward pressure on prices across geographies and products. US natural gas has collapsed by 63% in a single quarter with mainly mild late winter weather suppressing domestic consumption while production continues to expand. And prices are likely to remain below our midcycle forecast of $3.30/mcf for most of 2023, as the next wave of incremental export facilities will not start coming online until 2024, so there is no relief valve on the horizon.

That said, most gas producers have significant hedging coverage for 2023. These producers tend to have at least 50% of their volumes hedged at prices near our midcycle forecast that should enable them to easily meet their reinvestment targets and generate free cash flow.

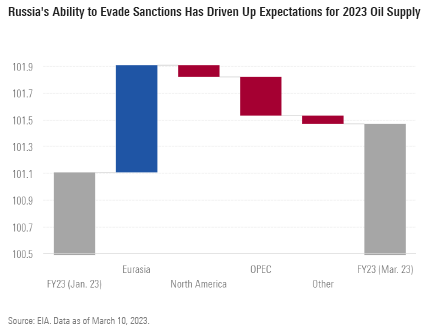

Oil prices have also been marching lower, with the Brent benchmark declining to $79.67 on March 13 (down .6% on the prior quarter). Supply estimates continue to be revised upward with increased confidence in Russian production evading sanctions and finding its way to market. And U.S. shale producers, while maintaining their steadfast commitment to capital discipline, will deliver low single-digit production growth in 2023 that still translates to significant expansion for overall U.S. volumes (.56 mb/d year-on-year growth). However, OPEC has, for now, reiterated its commitment to the cuts made at the end of last year. It has been resistant to calls to boost production from consumers in the US and Europe, a decision which has been borne out by the current market dynamics.

On Global Outlook, It’s Russia, Russia ... and China

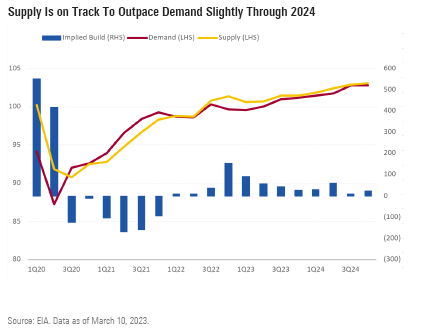

The outlook for demand on the other hand is largely unchanged. On balance, we expect to see inventories building slightly throughout 2023, though there are several moving parts that will determine that outcome. As always, the outlook for the global economy will be the biggest determinant.

In particular, it remains to be seen how quickly China can rebound out of its self-inflicted economic malaise. After nearly three years of COVID-19 lockdowns, the country is still struggling as local governments face acute funding constraints and major manufacturers used the downtime to shift operations out of China in order to meet demand. The Chinese consumer will therefore have to drive an outsize portion of the government’s planned 5% growth. Nevertheless, merely lifting restrictions bodes well for oil demand, since it enables people to resume commuting and other types of travel. China has also opened its borders for tourism again, supporting increased jet fuel consumption in the region.

Top Energy Sector Picks

TechnipFMC FTI

- Fair Value Estimate (USD): $18.00

- Star Rating: 4 Stars

- Uncertainty Rating: Very High

- Economic Moat Rating: None

TechnipFMC is the largest subsea service provider, and we foresee ample growth opportunities for the firm as investment in subsea engineering and construction strengthens over the next several years. The firm’s share price has rallied in recent months, but we still see upside potential moving forward. TechnipFMC stands out as a leader for its efficiency-boosting products and services such as Subsea 2.0 and integrated projects, which will create more value for the company than the market seems to appreciate at the moment.

TC Energy TRP

- Fair Value Estimate (USD): $47

- Star Rating: 4 Stars

- Uncertainty Rating: Medium

- Economic Moat Rating: Narrow

After several setbacks at the high-profile Coastal GasLink project, we think the focus will shift back to the attractive core business for TC Energy. We expect 2023 EBITDA to increase to CAD 10.6 billion from CAD 9.9 billion in 2022 and the dividend to increase 4%. TC Energy remains exposed to U.S. LNG, with its market share of U.S. feedgas on track to reach 35% by 2025. Next, we’re optimistic regarding Mexican gas, where earnings are projected to double over the next few years. Finally, Bruce Power offers ample renewables, hydrogen, and carbon capture opportunities.

Exxon Mobil XOM

- Fair Value Estimate (USD): $118.00

- Star Rating: 3 Stars

- Uncertainty Rating: High

- Economic Moat Rating: Narrow

Exxon remains our preferred integrated oil given its growth outlook and compelling valuation. Current plans call for a doubling of earnings and cash flow from 2019 levels by 2027 on a combination of structural operating cost reductions, portfolio improvement, and growth across its upstream, downstream, and chemical segments. Exxon estimates that under the current plan, it will generate about $100 billion in surplus cash, after funding investment and paying the dividend, during the next five years. Combined with currently higher than expected commodity prices, its current repurchase program of $35 billion through 2024, is likely just the beginning.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-09-2024/t_fab10267147f40fb93a1deb8a0b6553b_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/E3DSJ6NJLFA5DOKMPQRAH5STMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)