Coworking Can Work for Investors

Despite the WeWork debacle, flex space gives office real estate a new lease on life.

Amid the tumult of WeWork's implosion, investors may be forgiven for asking whether coworking will ever work for them. We are convinced the answer is a resounding yes. Although we think the current structure of the coworking industry involving risky long-term leases and high market share concentration will prove ephemeral, the demand drivers for flexible office space should endure. Among these, we point to the increasing pace of disruption in the economy and the evolving nature of how work is done, both deriving from the inexorable march of the digital revolution.

In concrete terms, these drivers manifest themselves in the emergence of the gig economy and the increasing acceptance of remote-work arrangements. Although these dynamics have left some to believe that the institution of the office is on the wane, it appears that the desire to conduct work in a dedicated space persists. What has changed has been the nature of how work is done and, consequently, how office space is being demanded. Once a staid industry relying on long-term leases, office real estate has been upended by users' voracious appetite for flexibility. As coworking emerges to meet that need, we think it will increasingly form an ever-greater portion of total office space.

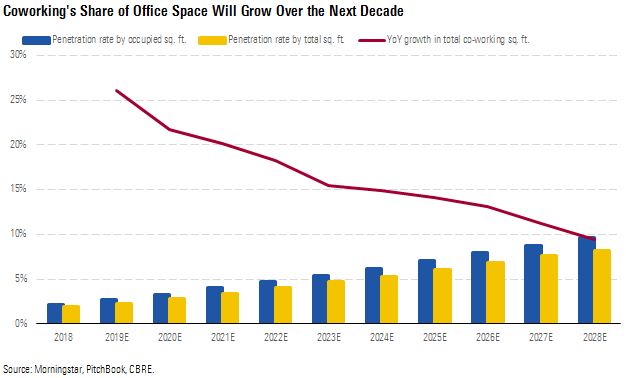

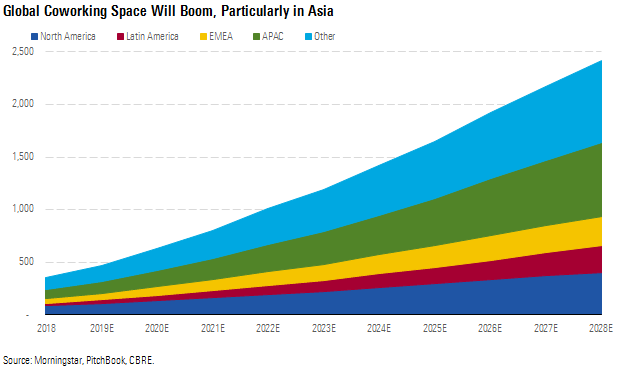

We expect coworking space in the United States to more than quadruple from around 80 million square feet in 2018 to over 360 million square feet by 2028. Globally, we expect coworking space to increase sevenfold, reflecting the ripe conditions for growth outside the U.S. Amid this breakneck pace of growth, we estimate that coworking will increase its overall share from around 2% of occupied office square footage in the U.S. in 2018 to around 8% by 2028, with this figure growing from 2.5% to 14.5% globally.

With Regus' parent company, IWG, representing the only publicly traded coworking company, investors may have to wait to fully share in the spoils. Nevertheless, companies across the real estate industry should benefit from the impending shift, including the office real estate investment trusts and the commercial real estate brokers we cover. In terms of valuation, New York office REIT SL Green SLG and commercial real estate broker Jones Lang LaSalle JLL are our top picks, with Boston Properties Group BXP and CBRE CBRE worth watching in the event of a pullback.

Key Takeaways In the U.S., we forecast that coworking square footage will grow from around 80 million square feet in 2018 to 360 million square feet by 2028, an increase of 4.5 times. Accordingly, we expect flexible office space will account for an ever-greater share of total office space, rising from 2% in 2018 to 8% by 2028.

Globally, we estimate that coworking square footage will increase from 363 million square feet to a staggering 2.5 billion square feet, an increase of 7 times. We expect coworking will go from 2.5% of occupied office space in 2018 to around 15% by 2028.

In the U.S., we expect total demand for office space to increase by a 0.5% compound annual growth rate through 2028, reflecting slower working-age population growth and the continued shift toward office-using employment.

Globally, demand will increase by a 1.5% compound annual growth rate in our estimates, with sluggish growth from developed economies being offset by elevated growth from developing countries with higher population growth, continued urbanization, and a shift to office-using employment.

Remote-work arrangements should provide a headwind to office demand, but the effect will be muted by the tendency for employees to work from home only part of the time, meaning they are still allocated office space. The rise of the gig economy should provide a tailwind. Incremental demand resulting from the availability of coworking should more than offset attrition of office employees due to gig employment.

The coworking industry is currently dominated by a few large players, such as WeWork and Regus, with many smaller companies. Competitive pressures and more judicious venture capital money should result in less-concentrated market share. We also expect the coworking industry to shift from treacherous traditional long-term lease agreements exemplified by WeWork to operating agreements that feature a management fee to operate space.

Because of the real estate focus of coworking companies, economic moats will be exceedingly hard to come by amid a struggle to find avenues for differentiation. However, a focus on real estate services rather than exposure to real estate economics remains the best bet, in our view.

At current prices, we think SL Green and Jones Lang LaSalle are compelling options for investors, with Boston Properties Group and CBRE meriting attention in the event of a pullback. The office REITs we cover stand to benefit from the rise of coworking in the form of increased demand for office real estate, but they should be wary of added risks attached to that exposure.

The commercial real estate brokers should see increased competition, but we expect narrow-moat CBRE and JLL will share in the spoils because of their position atop an industry benefiting from tailwinds related to consolidation and a rising appetite for real estate outsourcing.

This information was published Feb. 10 as part of a Financial Services Observer, which is available to Morningstar's institutional clients.

/s3.amazonaws.com/arc-authors/morningstar/17051f39-7c76-4673-a8dd-1762e21bcb33.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZSPP5AYAJB2RIRVFE2XR23GUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NYUEHSFI4BDCJPQZJ76HH4PKSM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/17051f39-7c76-4673-a8dd-1762e21bcb33.jpg)