After Its Big Rally, Is Arm Stock a Buy, a Sell, or Fairly Valued?

With Arm’s share price surging after its IPO, here’s what Morningstar thinks of the stock.

Arm Holdings ARM went public in September at $51 per share. The stock closed at a post-IPO high of $77.47 per share on Dec. 28, 2023, but has since fallen to around $72. Here is Morningstar’s take on Arm’s stock and the outlook for the company.

Key Morningstar Metrics for Arm Holdings

- Fair Value Estimate: $34.00

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

What We Think of Arm Holdings’ Outlook

Arm is a good business. It has a monopoly in smartphones and wearables (99% market share in the former, very high in the latter), and it has begun to gain share in data centers and automotive, which are very attractive markets. In easy terms, this is because Arm’s chips are less powerful than x86 chips (architecture used by Intel INTC and Advanced Micro Devices AMD) but more energy-efficient.

Since battery-powered devices are everywhere, chips that consume little power are important. The transition to electric vehicles makes it necessary to save car batteries. In the data center market, the trend toward containerization is favoring Arm-based CPUs, as they have enough computational performance in such an environment while consuming less power than x86 chips. Energy consumption is a data center’s main operating expense, so more efficient CPUs let one fit more of them, increasing throughput and reducing unitary power consumption. Amazon Web Services has developed and deployed its Graviton series of data center CPUs, which are based on Arm architecture.

We think Arm is in a financially healthy position, with $1.6 billion of cash on hand and no debt. The firm does not intend to pay any dividend on its ordinary shares, according to its IPO filing. We also don’t expect any significant M&A to happen, as Arm would probably face antitrust scrutiny for any mid- or large-sized deal, given its very high market share.

In the past five years, Arm has made several minor equity investments in semiconductor startups. The most relevant is its equity stake in Ampere Computing, a designer of Arm-based processors for data centers, which already has Oracle ORCL, Microsoft MSFT, and Alphabet GOOGL as customers. Ampere was founded by former Intel president Renee James in 2018, and it has an architectural license with Arm. We believe this investment will accelerate Arm’s entrance into the data center space. In December 2022, Ampere announced it had submitted a draft registration for an IPO, though there has not been relevant news since.

Given the lack of dividends and M&A opportunities, we expect Arm will use its internally generated cash flow to reinvest in the business through R&D, fund share repurchases, or simply bolster its balance sheet.

Read more of Morningstar’s take on Arm.

Arm Holdings Stock Price

Fair Value Estimate for Arm

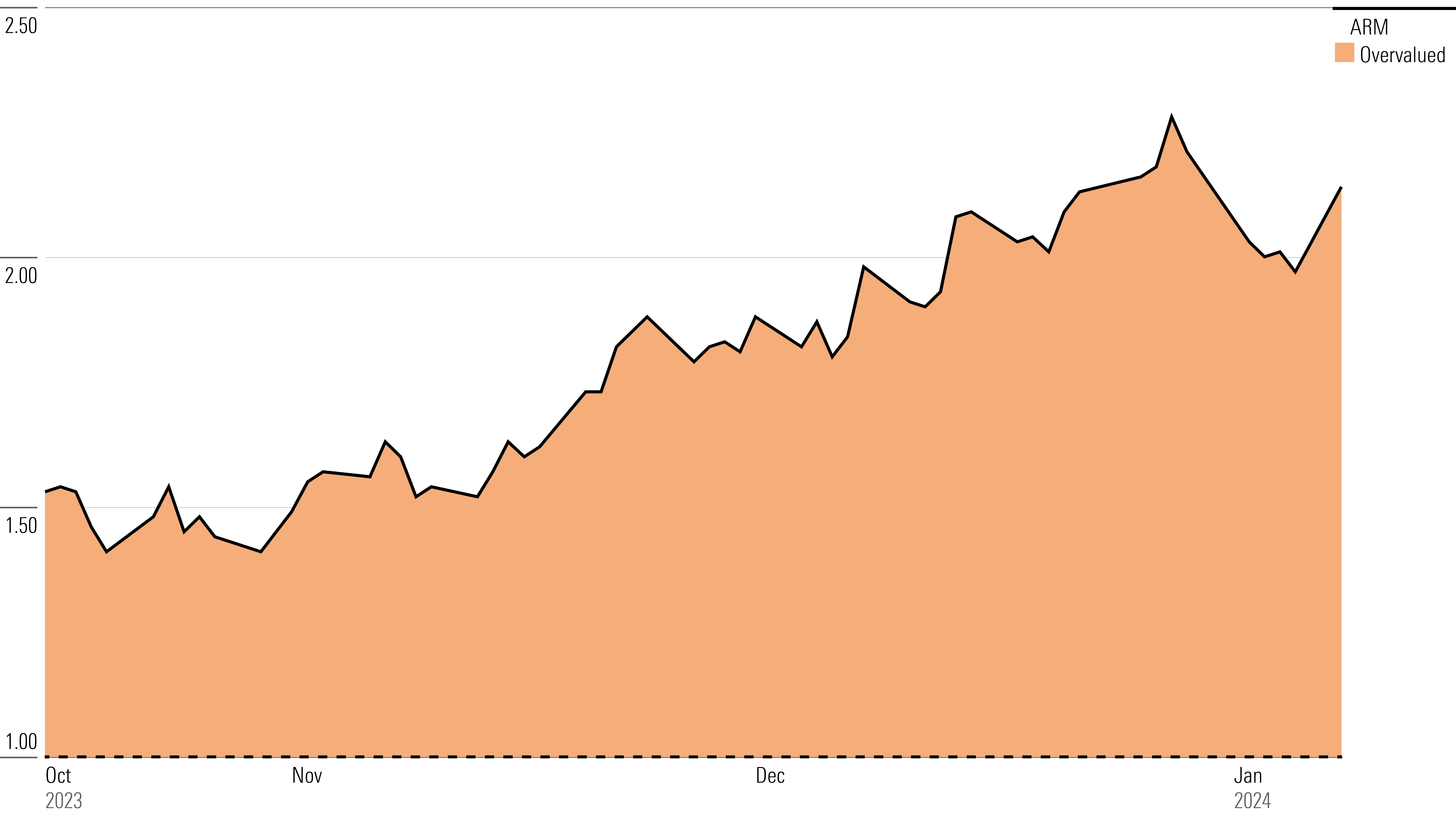

With its 2-star rating, we believe Arm’s stock is overvalued compared with our long-term fair value estimate.

Our fair value estimate for Arm is $34 per share, which implies an enterprise value to EBIT multiple of 41 times and 31 times for fiscal years 2024 and 2025, respectively. At Arm’s IPO price debut of $51 per share, the enterprise value to EBIT multiples would be 59 and 41 times for 2024 and 2025, respectively.

Overall, we model Arm revenue growing at an 11% compounded annual growth rate over the next 10 years. We expect royalty revenue will grow in the high-single-digit-to-double-digit range, and for licensing revenue to grow in the mid-single digits. Arm’s average royalty rate in 2022 was 1.7%, and we expect that to expand to 2.5% in 2030 after the introduction of v9 and architecture improvements.

We expect Arm will maintain a very high market share in mobile processors. However, we assume a slight decline to around 95% in 2030 from the current 99%, due to competition from RISC-V. Still, we believe mobile revenue will grow by double digits in 2024 and 2025, and will continue to grow by high-to-mid-single digits from 2025 onward, as we expect higher royalty rates after the introduction of v9.

Read more about Arm’s fair value estimate.

Arm Historical Price/Fair Value Ratio

Economic Moat Rating

We assign Arm a wide economic moat based on its intangible assets and switching costs. Arm is the IP owner and developer of the ARM (“Acorn RISC machine”) architecture, which is used in 99% of the world’s smartphone CPU cores. It also has high market shares in other battery-powered devices, such as wearables, tablets, and sensors.

Architectural license fees are a small part (around 15%) of the cost of chip design, so in our view, established players have little incentive to switch architectures just to avoid paying a few dollars per chip to Arm. The rationale is different for startups, as architecture is one of their first expenses when developing a new chip, so free options might be worthwhile.

Because of this, we believe RISC-V will be a challenger in cheaper, less-critical applications since it’s a young ecosystem that still needs to develop technically and economically. That competitor is growing and gaining support from established players, but its CPUs cannot match Arm in power efficiency, performance, or customer support. Even if RISC-V disrupts Arm in the long run, such a process could take decades, which gives us confidence in our wide moat rating.

Find out more about Arm’s moat rating.

Risk and Uncertainty

We give Arm a High Uncertainty Rating, with key risks coming from China and the slow but steady adoption of RISC-V.

More than 20% of Arm’s business comes from China. Arm China is the only entity allowed to sell Arm’s IP in the country, but it is not controlled by Arm Holdings. Rather, Arm licenses IP to Arm China, which then sublicenses it to Chinese customers like Xiaomi or Huawei. Arm’s revenue recognition from the country is dependent on the information Arm China provides, and financial reporting controls have historically been weak.

SoftBank (Arm Holdings’ main shareholder) still has significant influence over Arm China, but if it departs, it would leave an intricate web of corporate subsidiaries. There could be attempts to steal intellectual property from Arm China, given geopolitical tensions between the United States and China. 2022 saw a series of corporate fights at Arm China. Previous CEO Allen Wu was accused of unethical behavior. It took months for SoftBank and other anchor investors to get rid of him, and he still has a stake in the company.

RISC-V architecture also creates uncertainty for Arm, as it’s slowly but steadily gaining adoption. RISC-V is open source, saving costs for startups and adding flexibility for design. On the other hand, Arm provides a faster time-to-market (as it sells off-the-shelf blueprints) and better customer support, as it’s backed by a single company. We don’t see RISC-V challenging Arm’s architecture in the next 10 years, but beyond that, it could gain market share. The pace at which this happens would depend on customers’ willingness to change and how aggressive Arm becomes with its pricing. Since its inception 10 years ago, it is estimated that RISC-V has shipped 10 billion chips, compared with Arm’s 250 billion since its start in 1990.

Read more about Arm’s risk and uncertainty.

ARM Bulls Say

- Arm should keep gaining market share from x86 architecture in the data center business, as its chips consume less power and data centers need to minimize energy consumption. We also expect share gains in the automotive space, thanks to the transition to electric vehicles

- The overall trend toward the Internet of Things and battery-powered devices is a long-term tailwind for Arm, given that it has the most energy-efficient architecture.

- If Arm manages to change its business model and charge royalties on a per-device basis, this would provide huge revenue and margin upside.

ARM Bears Say

- If Arm charges royalties on a per-device basis, or if it were to meaningfully increase its royalty rates per chip, it could become a double-edged sword. Too much royalty revenue may encourage customers to adopt open-source RISC-V instead.

- Arm China is one of Arm’s largest clients, representing more than 20% of revenue. Its financial reporting has historically been opaque, and there could be attempts to steal intellectual property from Arm Holdings

- Arm’s revenue concentration is very high, with its top five customers representing close to 60% of sales.

This article was compiled by Jülide Sengil.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-20-2024/t_dc0763464c0a4191b876af1624b96f43_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IPKX4IWSDBD3VJC2Y34W6STFL4.jpg)