After Earnings, Is Uber Stock a Buy, a Sell, or Fairly Valued?

With better-than-expected fourth-quarter results and a $7 billion share buyback plan, here’s what we think of Uber’s stock.

Uber Technologies UBER released its fourth-quarter earnings report on Feb. 7. Here’s Morningstar’s take on Uber’s earnings and the outlook for its stock.

Key Morningstar Metrics for Uber Technologies

- Fair Value Estimate: $80.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Very High

What We Thought of Uber Technologies’ Q4 Earnings

- We have increased our fair value estimate of Uber to $80 per share, given the firm’s better-than-expected fourth-quarter results and the three-year outlook it provided on its analyst day on Feb. 14.

- Uber continues to execute on all fronts, further strengthening its network effect, as seen in its growth in users, requests, frequency, user monetization, and suppliers.

- Uber’s efforts to further diversify its services are bearing fruit. Grocery delivery is on pace to represent more than 5% of the company’s total gross bookings. With stronger cross-selling capabilities due to its network effect, we think Uber is likely to attract and maintain more users and limit growth on other platforms, including Maplebear’s Instacart CART.

- The firm also provided better-than-expected margin expansion guidance on its analyst day. Its expectations regarding its top-line growth and drivers were in line with our projections.

- While we already assumed lower future user acquisition costs due to Uber’s strong network effect, it was still above the company’s guidance. The company also expects the implementation of artificial intelligence to reduce its customer support costs as a percentage of gross bookings.

- Overall, Uber’s network effect, leaner operation, and continuing gross bookings and revenue growth will likely create further operating leverage and drive an impressive 30%-40% average annual adjusted EBITDA growth over the next three years, with more than a 90% free cash flow conversion.

- Uber’s board also announced a $7 billion share buyback authorization, which should further please shareholders.

Uber Stock Price

Fair Value Estimate for Uber

With its 3-star rating, we believe Uber’s stock is fairly valued compared with our long-term fair value estimate of $80 per share, which represents an enterprise value of 3.9 times our 2024 revenue estimate. We project that Uber’s revenue will grow 14% annually on average over the next five years.

We expect revenue to grow faster than portions of Uber’s cost of revenue—including hosting, transaction processing, and insurance costs—which will result in gross margin expansion. With its network effect, we think Uber should also be able to increase revenue more quickly than selling, general, and administrative costs (especially in the sales and marketing lines) while spending relatively less on operations and support.

However, we anticipate R&D will remain elevated, as Uber is likely to invest in new ventures within the on-demand delivery services market, though we expect declines in R&D as a percentage of net revenue. We assume the firm will remain profitable in 2024 and beyond, and we expect operating margin expansion to nearly 14% by 2028.

Read more about Uber’s fair value estimate.

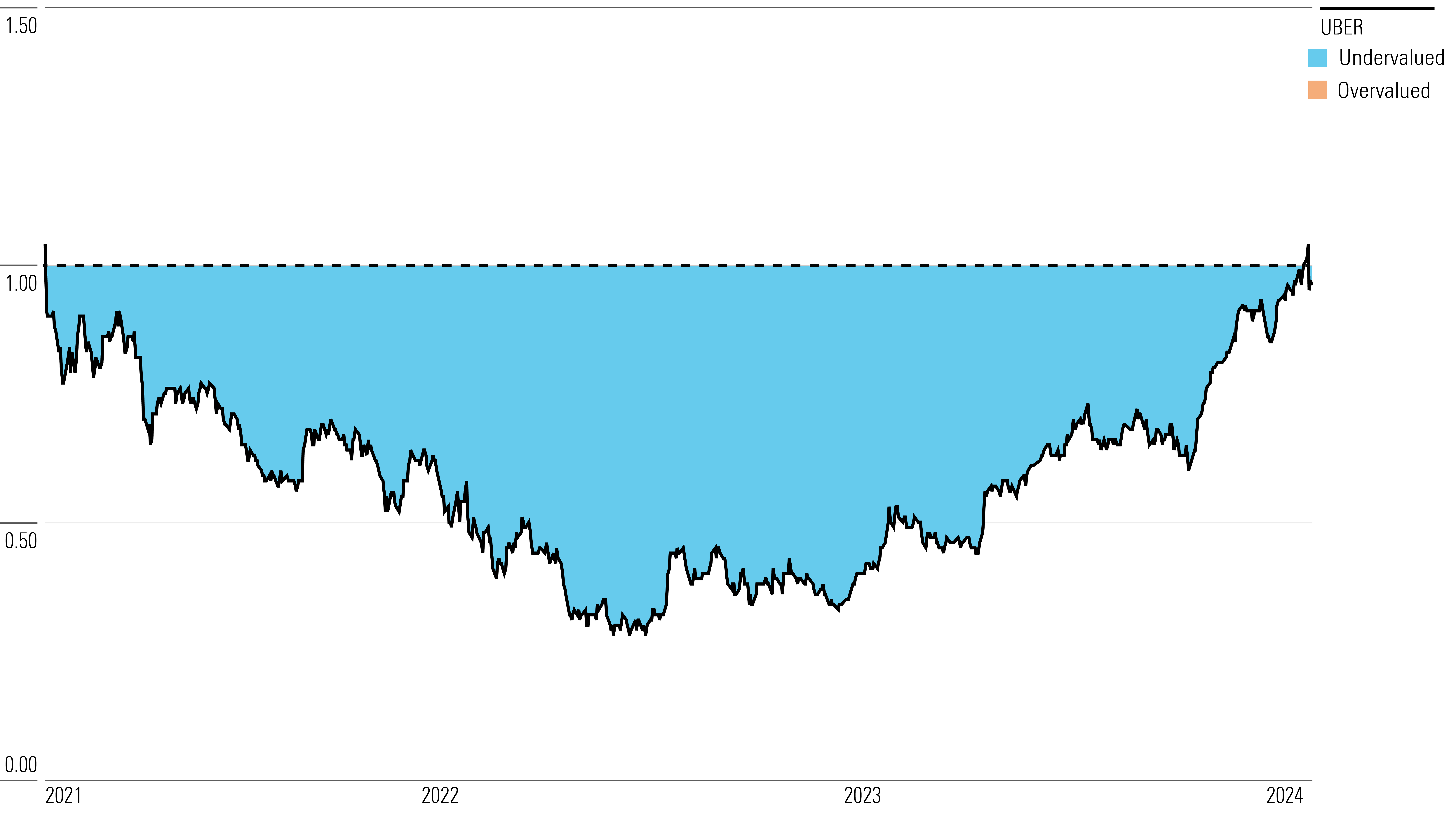

Uber Historical Price/Fair Value Ratio

Economic Moat Rating

In our view, Uber’s core business—its ridesharing platform—benefits from network effects and valuable intangible assets in the form of user data. We think these maintainable competitive advantages will help Uber become profitable and generate excess returns on invested capital. For this reason, we assign the company a narrow moat.

Uber’s network effects benefit drivers and riders, creating a continuous virtuous cycle. As a first mover in this market, Uber began to attract riders mainly via word of mouth. Growth in demand and further word-of-mouth marketing drew in drivers, increasing Uber’s supply of vehicles. As the number of drivers has increased, the timeliness and reliability of the service has improved, attracting additional users, which in turn attracts more drivers, all of which indicates a network effect. Uber was able to accelerate this network effect by focusing on smaller areas like San Francisco before expanding into more cities.

Globally, Uber’s monthly average platform consumers, or MAPC, and the number of trips provided support our assumption of a network effect. Since the COVID-19 pandemic, total MAPCs and trips have returned to solid growth rates, as have trips per MAPC.

Read more about Uber’s moat rating.

Risk and Uncertainty

Uber faces intense competition in the United States from Lyft LYFT, which has gained market share. It remains possible that Lyft out-innovates Uber to emerge as a winner-take-all (or most) ride-hailing provider. There are also concerns about whether Uber’s network effect can remain an economic moat source if the firm is forced to incur additional costs by municipal, state, and/or federal regulations. For example, the company may be forced to conduct more thorough background checks on all driver applicants. Such a concern is also an ESG risk related to human capital, as insufficient background checks may put riders at risk and lessen the quality of the firm’s services. At the same time, gathering more driver and rider data may increase the firm’s ESG risks around data privacy and security.

Read more about Uber’s risk and uncertainty.

UBER Bulls Say

- Uber’s position in the autonomous vehicle race could equalize gross and net revenue should it no longer need to pay drivers.

- Pressure to pay a minimum amount per trip to contracted drivers could create a barrier to entry for smaller players, helping Uber in the long run.

- Uber’s aggregation of multimodal offerings will drive in-app stickiness, making it a one-stop shop for all transport needs.

UBER Bears Say

- The development of autonomous vehicles, especially Alphabet’s GOOGL Waymo, could eliminate the need for all existing ride-share platforms, driving Uber and Lyft out of business.

- Ride-hailing is still a relatively new industry, which leaves plenty of room for increasing regulations that could hurt Uber.

- Uber’s public perception has suffered in recent years because of data breaches and reports about a bad culture of sexual misconduct and internal racial discrimination issues.

This article was compiled by Quinn Rennell.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/L4B22R7UFVDBJN2ZYJWBSMCIJA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IRAS2PNXWNDGRPQXLGHV6T7QWE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VZ75Y7YOWNC7PPE5HNPGTGWCUI.jpg)