After Earnings, Is Target Stock a Buy, a Sell, or Fairly Valued?

With consumers searching for low-cost substitutes, here’s what we think of Target stock.

Target TGT released its third-quarter earnings report on Nov. 15. Here’s Morningstar’s take on Target’s earnings and stock.

Key Morningstar Metrics for Target

- Fair Value Estimate: $132.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Medium

What We Thought of Target’s Q3 Earnings

- Despite a mid-single-digit decline in Target’s comparable sales, the retailer’s gross margin expanded by an impressive 270 basis points, exceeding our expectations. Consumer demand for discretionary product categories—such as home and apparel—remains tepid, but margins improved as prudent inventory helped limit the need for inordinate promotional destocking, as occurred last year. Target’s $2.10 in earnings per share well surpassed its guidance range of $1.20-$1.60, sending shares soaring over 15%.

- Target’s top line has expanded nearly 40% over the past three years as consumers spent heavily on high-margin general merchandise, such as apparel and home décor. However, precarious economic conditions and inflationary pressures have seemingly prompted consumers to pull back on spending, particularly in discretionary product categories. Without a clear low-price value proposition and a sales mix that relies more on discretionary product categories (about 45%-50% of Target’s sales are from higher-frequency categories such as food, beverage, beauty, and household essentials, whereas about 60% of Walmart’s WMT U.S. sales come from its grocery category), we surmise the retailer may face difficulty attracting consumers during more tumultuous economic times.

- Prior to reporting, Target traded in 4-star territory. However, with the stock now selling near $130 per share and our fair value estimate at $132 (down from $139 before the firm reported earnings), we view it as fairly valued. We expect Target’s financial results to remain constrained in the near term as consumer’s appetite for more discretionary product categories continues to abate.

Target Stock Price

Fair Value Estimate for Target

With its 3-star rating, we believe Target’s stock is fairly valued compared with our long-term fair value estimate of $132.

We have lowered our fair value estimate to $132 per share from $139 to account for a more gradual recovery in the firm’s operating margin and a more subdued midcycle margin forecast of 6.5%, down from 7.0%. In the near term, we expect competitive angst among retailers to intensify as demand wanes for higher-margin discretionary categories, keeping margins constrained. Our fair value estimate implies a forward 2024 adjusted P/E of 15.6 times and enterprise value/adjusted EBITDA of 8.8 times.

We expect fiscal 2023 and 2024 to be choppy as economic uncertainty and persistent inflationary headwinds pinch consumers’ wallets. Target grew rapidly across each of its product categories over the past three years, with sales increasing nearly 40% amid unprecedented consumer demand and abundant disposable income. However, as consumers work down excess savings and costs remain elevated, there have been signs of an imminent pullback in demand, prompting retailers to take a cautious approach to the second half of 2023. In the near term, we expect Target’s top line to face pressure as consumers trade down to lower-priced retailers such as Walmart, and we forecast operating margins to remain compressed as the retailer’s sales skew more toward lower-margin items in food, beverage, and household essentials.

Target’s days of rapid store expansion are behind it, implying that most growth will be derived from comparable sales. From 2010 to 2019, Target posted an average growth of 1% in both average ticket and transaction volume. While we expect long-term growth in transaction volume to modestly outpace Target’s historical rate due to a consolidating retail landscape and our expectation for continued obsolescence of pure-play department stores, we view long-term price growth of 1% as reasonable, due to significant online competition in discretionary product categories, which will likely make it difficult for the company to raise prices beyond inflation. As such, the back half of our 10-year forecast calls for 2.5% growth in comparable sales, coupled with modest growth via the expansion of smaller store formats in urban markets and on college campuses.

We expect Target’s operating margin to gradually improve from the abysmal 3.5% it posted in 2022—a year that featured heavy discounting across the retail industry amid burgeoning inventory levels. We forecast Target’s operating margin to reach 6.5% in 2028, about 20 basis points ahead of its 10-year average margin but 150 basis points below management’s long-term guidance.

Read more about Target’s fair value estimate.

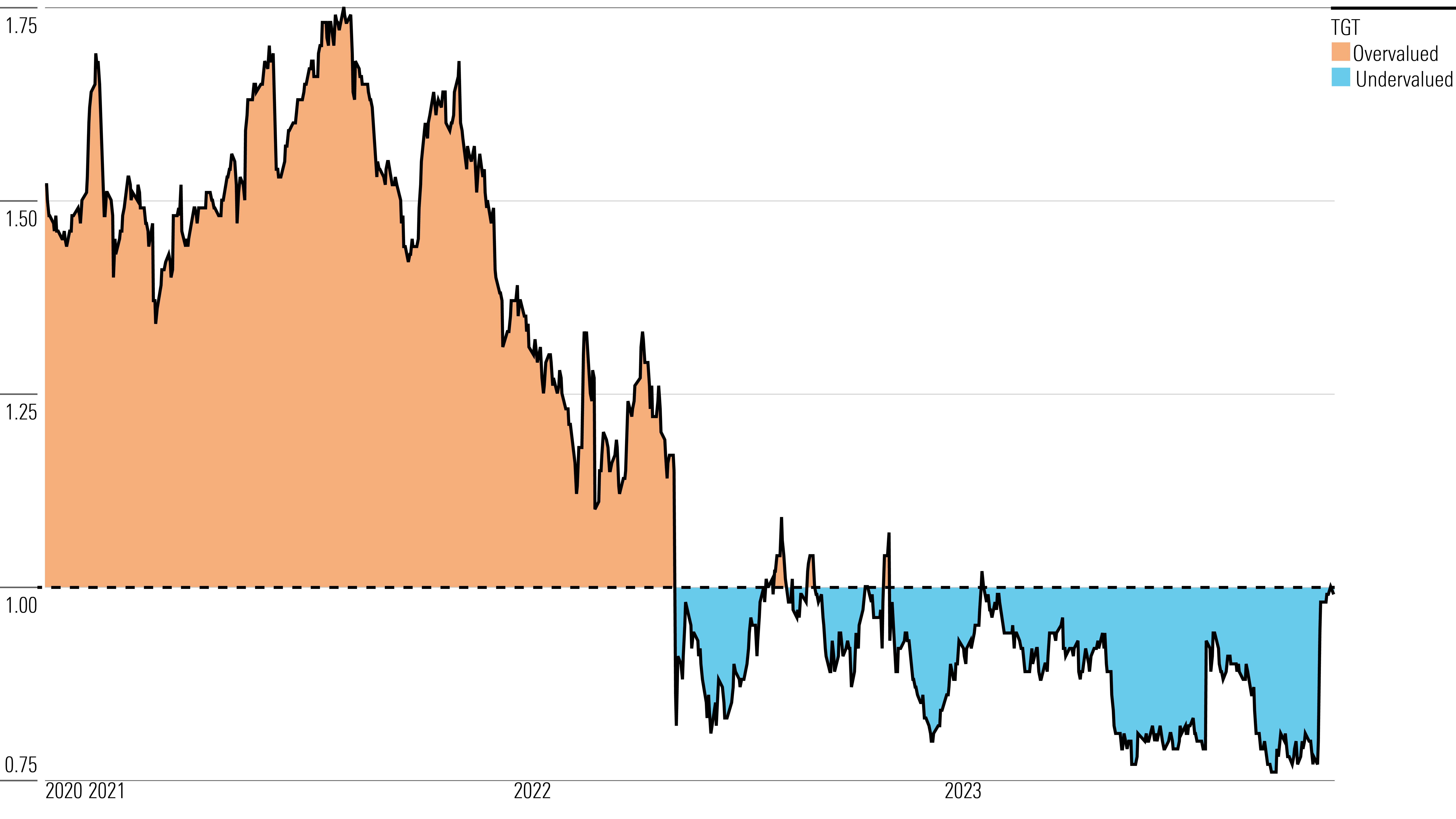

Target Historical Price/Fair Value Ratio

Economic Moat Rating

We do not believe Target warrants an economic moat. Despite its iconic and trendy brand, we view the firm’s position in the hyper-competitive retail environment as rather ambiguous, which dilutes our confidence that the brand can drive consistent store traffic.

We believe the retailer is at a crossroads, trying to balance an undifferentiated low-cost grocery portfolio, which drives recurring traffic but doesn’t dilute its reasonably priced trendy offerings in apparel and home goods. While we acknowledge Target’s wide array of products (according to Reuters, it boasted about 80,000 stock-keeping units per store in the early 2010s), we believe the firm’s goal of being a “cheap trick” retailer places inordinate pressure on the management team to properly balance the brand perception.

While Target is seemingly ubiquitous among American consumers, we do not believe its business model offers significant differentiation from other retailers that would warrant a durable brand advantage. Cognizant of its size relative to its fellow superstore competitor (Target’s $107 billion in 2022 sales were about one-fourth of Walmart’s U.S. sales), Target doesn’t attempt to be the nation’s lowest-priced retailer, and instead emphasizes an impeccable shopping experience. Its stores are clean, well-lit, adequately staffed, and full of seemingly trendy product offerings—elements of the customer experience that we view as replicable.

Read more about Target’s moat rating.

Risk and Uncertainty

We assign Target a Medium Uncertainty Rating.

The rise of retail digital penetration is a formidable threat to Target’s traditional brick-and-mortar model. Price shopping has become rather seamless as consumers increasingly begin their product searches via digital channels, making Target susceptible to price competition in an industry where consumers face virtually no switching costs. The leaders, Walmart and Amazon.com AMZN, boast unrivaled scale and an impressive ability to invest in supply chain automation to mitigate costs. We expect them to serve as disinflationary forces for years to come, putting pressure on retailers that lack a differentiated product offering, vast scale, or a concentrated geographic focus (we believe Target falls into all three categories). As such, we think gross margins may be pressured over the following decade.

Target’s business model also faces uncertainty due to its high mix of general merchandise like apparel, electronics, and home furnishings, which we believe is most susceptible to digital competition. Additionally, the company lacks a clear positioning in grocery, in our view. We surmise that the firm’s food and beverage products add a nice element of convenience, which helps drive recurring foot traffic, allowing it to serve as a one-stop shop, but it offers minimal differentiation from both a product quality and cost perspective.

While we are encouraged by Target’s improvements in its higher-turnover products (sales from the food and beverage and beauty and household essentials categories are up 52% and 43% respectively since 2019), these categories still pale in comparison to what’s seen at larger peers. Target’s food and beverage and beauty and household essentials combined are about one-fifth the size of Walmart’s domestic grocery category (excluding Sam’s Club) and a mere 40% of Kroger’s KR total sales, excluding fuel.

Read more about Target’s risk and uncertainty.

TGT Bulls Say

- Given its iconic brand, which attracts consumers due to its promise of a more gratifying experience compared with other low-cost retailers, we are confident in Target’s ability to drive recurring foot traffic.

- Based on its performance during the COVID-19 pandemic, we view Target as a formidable online retailer, putting to rest many concerns about its ability to compete in a digital retail environment.

- Target is poised to benefit from the continued decline of mall-based competition and department stores, which will drive strong growth in comparable sales.

TGT Bears Say

- Target lacks the scale and differentiation to drive significant market share across its product categories, since its product offerings lack a clear value proposition.

- Despite being the nation’s sixth-largest retailer, Target must constantly invest in cost-saving initiatives, product innovation, and store renovations just to keep up with Walmart and Amazon.

- Target’s higher-margin discretionary product categories, such as apparel and home furnishings, are susceptible to losing market share via digital retail penetration, which could weaken the firm’s margins.

This article was compiled by Brendan Donahue.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BG4IFJHA25B6RKD3XNUYKROBBM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4QBQ2NBJMFG5HGQTDEYCXY5OOI.jpg)