After Earnings, Is Coca-Cola’s Stock a Buy, a Sell, or Fairly Valued?

With an impressive increase in organic revenue growth, here’s what we think of Coca-Cola’s stock.

Coca-Cola KO released its fourth-quarter earnings report on Feb. 13. Here’s Morningstar’s take on Coke’s earnings and stock.

Key Morningstar Metrics for Coca-Cola

- Fair Value Estimate: $60.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Low

What We Thought of Coca-Cola’s Q4 Earnings

Coke’s 2023 results matched our estimates, with sales growth of 6% and adjusted earnings per share of $2.69. Impressively, the firm delivered a 12% organic revenue growth in 2023 based on a broad-based 2% beverage volume expansion, better than the 1% contraction at rival PepsiCo PEP. We attribute the volume resilience to Coke’s consumer-valued innovations in ingredients, formulas, and packaging, as well as smart digital marketing that resonates with consumers globally.

Dynamic region-specific pricing and agile channel strategies have helped Coke preserve its value proposition amid macro and geopolitical challenges. Adjusted operating margins expanded 40 basis points to 29.1% thanks to easing input cost inflation and better expense leverage, keeping the firm on track to increase this metric to 30% by 2026, according to our projection.

Despite a softening consumer backdrop and intense competition in the beverage aisle, we think Coke remains well-positioned to capture growth in the coming years, thanks to heavy investments in innovations and brands, as well as deft in-market executions that assert its competitive standing globally. We view management’s outlook for mid-single-digit sales growth in 2024 as reasonable after adjusting for the impact of refranchising, but we plan to trim our adjusted EPS estimate by a low-single-digit percentage due to worse-than-expected near-term currency headwinds. Our 10-year projections for mid-single-digit sales growth and low-30s average operating margins remain in place.

Coca-Cola Stock Price

Fair Value Estimate for Coca-Cola

With its 3-star rating, we believe Coke’s stock is fairly valued compared with our long-term fair value estimate, which we maintain at $60 per share. Our fair value estimate implies a 22 times multiple against our adjusted 2024 earnings estimate and a 2023 enterprise value/adjusted EBITDA multiple of 19 times.

Organic revenue grew 11%, edging our 10% estimate, while adjusted EPS growth of 7% matched our expectations. Coke nudged up 2023 organic revenue and adjusted EPS growth guidance ranges to 10%-11% (from 9%-10%) and 7%-8% (from 5%-6%), which we view as achievable. We are tweaking our own 2023 estimates to align with the improved outlook.

Our projected mid-single-digit compound annual growth rate for sales over the next 10 years is driven by strong emerging market growth (we forecast Latin America and the Asia-Pacific combined to make up 29% of overall sales by 2032, up from 22% in 2022), expansion in nonsparkling categories (water, sports, and energy drinks), and the Costa business steadily adding on offerings in the on-premises channel and for retail distribution. While 2022 revenue growth (of 11% on a reported basis) is largely driven by increases in price/mix as Coke flexes its pricing muscle amid cost inflation and currency headwinds, we forecast top-line growth to be more balanced between price/mix and volume in 2024 and onward. We also see growth settling back into the 4%-6% long-term target range set by management, which we believe is appropriate given industry dynamics.

Coke has historically augmented organic growth with strategic acquisitions, and we expect the company to continue doing so in the coming years. Given a lack of information about its acquisition pipeline, however, we will refrain from incorporating mergers and acquisitions deals into our financial modeling until we gain better visibility.

Read more about Coca-Cola’s fair value estimate.

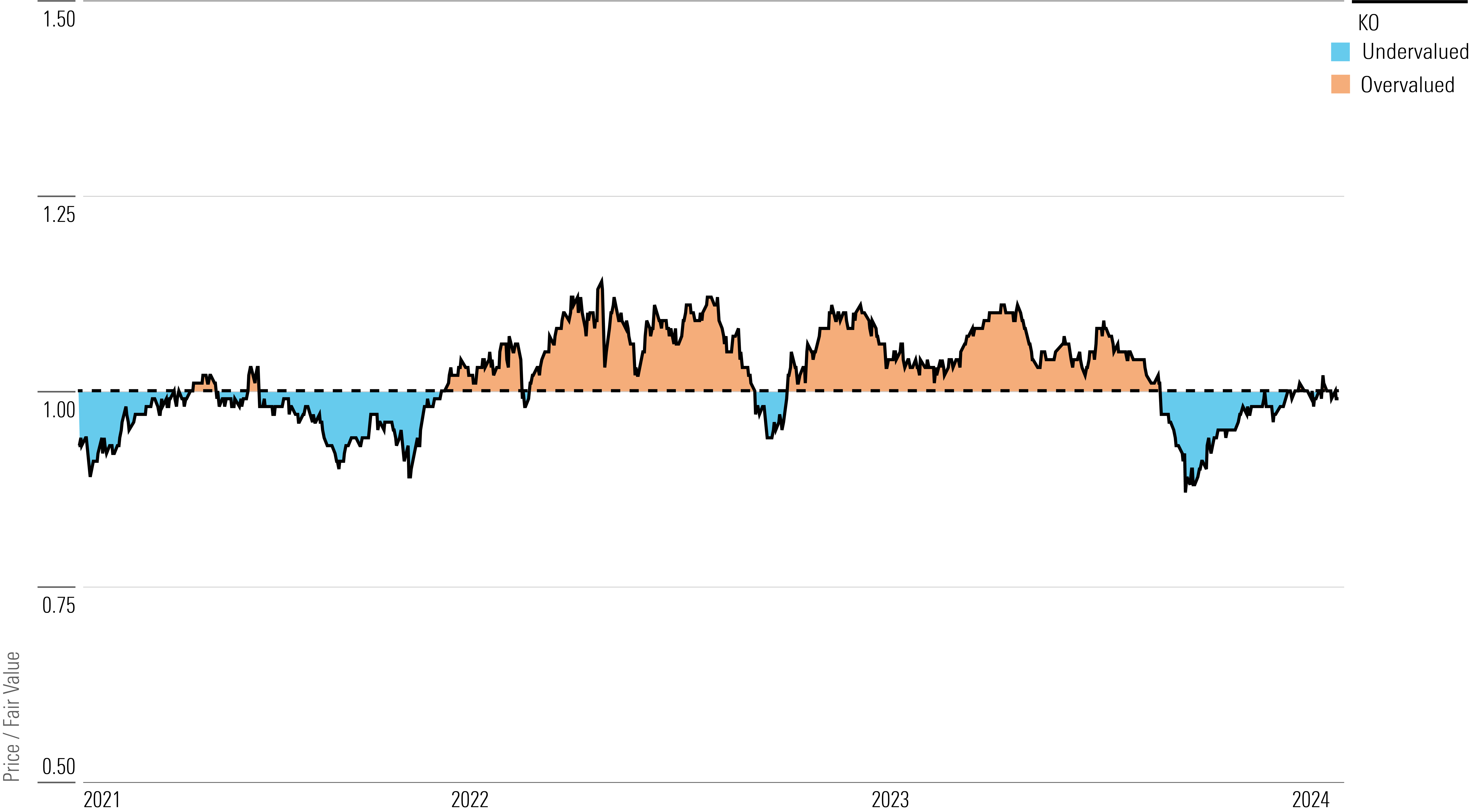

Coca-Cola Historical Price/Fair Value Ratio

Economic Moat Rating

We believe Coke has built a wide moat around its global beverage operations, based on strong intangible assets and a significant cost advantage that will enable the company to deliver excess investment returns above its cost of capital over and beyond the next 20 years. We have modeled the company to generate returns on invested capital, including goodwill, that average 32% throughout our 10-year explicit forecast, comfortably surpassing our estimate of its weighted average cost of capital at 7%.

As the world’s best-known beverage company, Coca-Cola owns a strong portfolio of storied and iconic brands that resonate with consumers, making its products the beverage of choice for both at-home and away-from-home occasions. The special connection Coke cultivates and maintains with generations of consumers has let it dominate the carbonated soft drink, or CSD, category at the core of its business (69% of its 2022 unit case volume sold). As evidenced by Beverage Digest data, Coca-Cola commands a convincing lead here, with a unit case volume share of 46.3% in the US market in 2021—more than 20 percentage points ahead of main competitor PepsiCo’s 25.6% share.

Besides the flagship Coca-Cola name, Sprite, Fanta, Diet Coke, and Coke Zero are also top-selling CSD brands with loyal followings. Leveraging its retail relationship, the company has been able to establish a strong position in adjacent categories as well, such as water, juice, and sports drinks, with brands such as Dasani, Minute Maid, and Powerade.

Read more about Coca-Cola’s economic moat.

Risk and Uncertainty

We assign Coke a Low Uncertainty Rating. We view strong bottler relationships as crucial to its business model and return profile. But in periods of high inflation, these relationships could come under pressure, since the bottlers tend to bear the brunt of cost increases. This is less of an issue in the US, where local bottlers are small and have limited bargaining power, but in emerging markets—which hold the key to healthy volume growth—Coke faces much larger bottlers, such as Arca Continental and Coke Femsa, that are likely in better positions to negotiate.

Although nonalcoholic beverage demand tends to be resilient through economic cycles, Coke has high exposure to international markets (over two-thirds of both revenue and profits), which leads to stepped-up volatility within its operations compared with domestically focused peers. Management’s international experience combined with global bottler collaboration can help the firm tackle these challenges.

Read more about Coca-Cola’s risk and uncertainty.

KO Bulls Say

- Coke can leverage strong bottler relationships in underpenetrated emerging markets to drive volume growth with classic recipes as well as new products tailored to local tastes.

- Heavy investments in a digitalized supply chain and data analytics have better aligned Coke and its bottlers in product planning, manufacturing, and go-to-market strategy.

- As Costa recovers from pandemic-related disruptions, this should help Coca-Cola gain a firmer footing in the coffee category and provide more consumer insights, given its global footprint.

KO Bears Say

- Secular headwinds in carbonated soft drink demand within developed markets challenge Coke’s long-term growth outlook.

- The company’s brand portfolio and product lineup in nonsparkling categories are less robust, and heavy investments are needed to bolster its competitive position.

- With two-thirds of its revenues coming from international markets, Coke faces constant currency fluctuations that drive volatility in reported earnings.

This article was compiled by Quinn Rennell.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6A6R4SGLDNGMXHAH3K2CIQTF3Q.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F5UMFVVKMVFRPGGUY4LONIK6OY.jpg)