Cash Is No Longer Trash, but the Opportunity Cost Might Be Greater Than You Think

Are long-term investors losing out?

There’s a concept in investing of “fighting the last war.”

A quick summary of the concept would be:

- Investors experience a bad outcome,

- Investors emotionally anchor themselves to that outcome, and

- It prevents them from acting rationally going forward.

Last year was one of those bad outcomes—the stock market experienced its worst year in a decade—and investors are having a hard time shaking the feeling.

The market has rallied nearly 30% since October, which, in theory, means we’ve entered a new bull market. However, many people simply do not care—last year’s scars are still fresh.

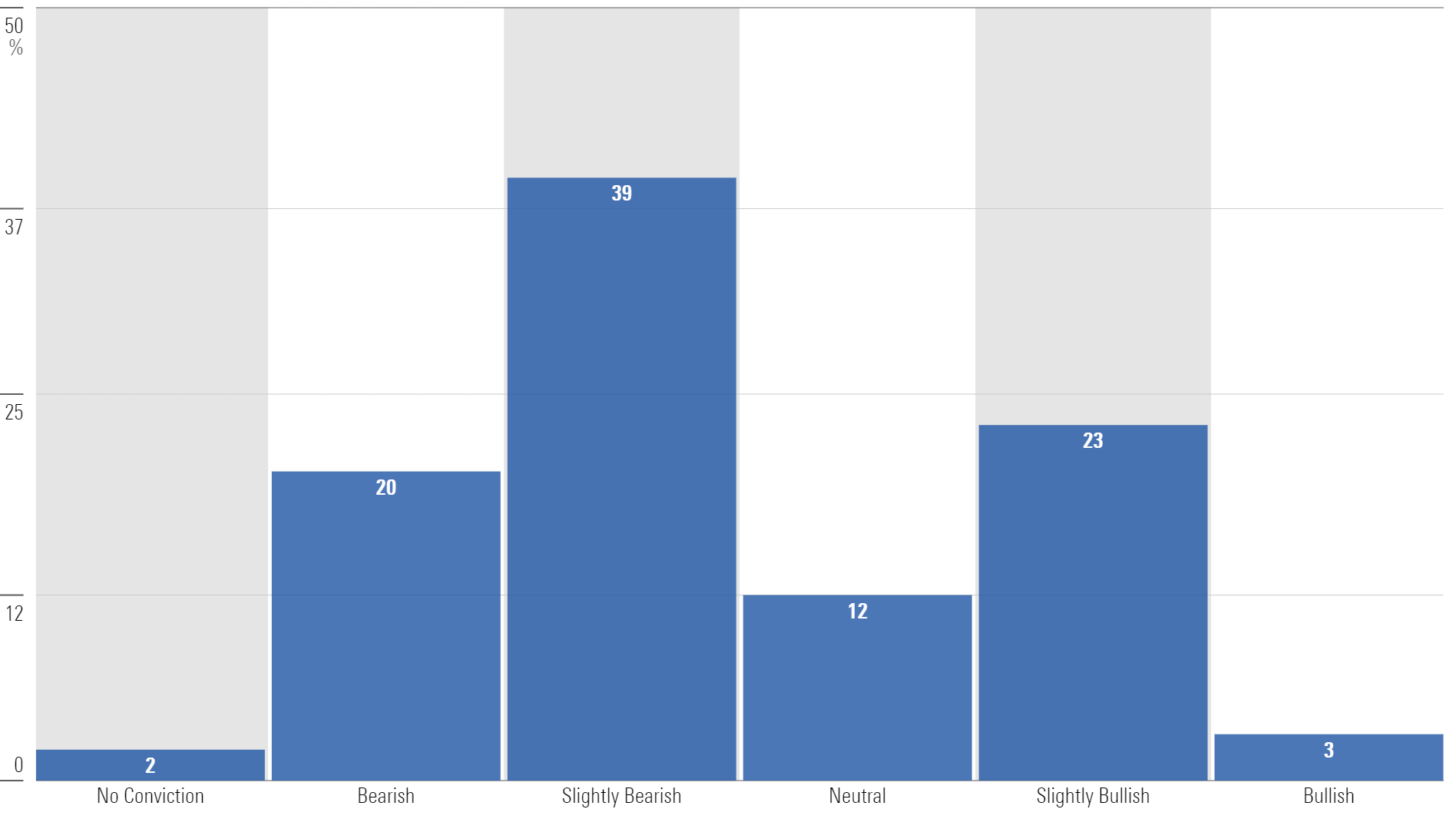

Taking the pulse of institutional investors finds that many remain downbeat about the market’s prospects. According to the June Marquee QuickPoll, which surveyed nearly 900 institutional investors, only 3% of investors classify themselves as “bullish.”

Survey Question: What's your view on risky assets?

In short, many investors don’t appear to be putting much faith in this rally. We see this in equity flows, which remain subdued and well below last year’s pace.

One point of contention: Cash is yielding more than it has in a decade—so are equities even worth the trouble?

We won’t bury the lede. The answer is still yes.

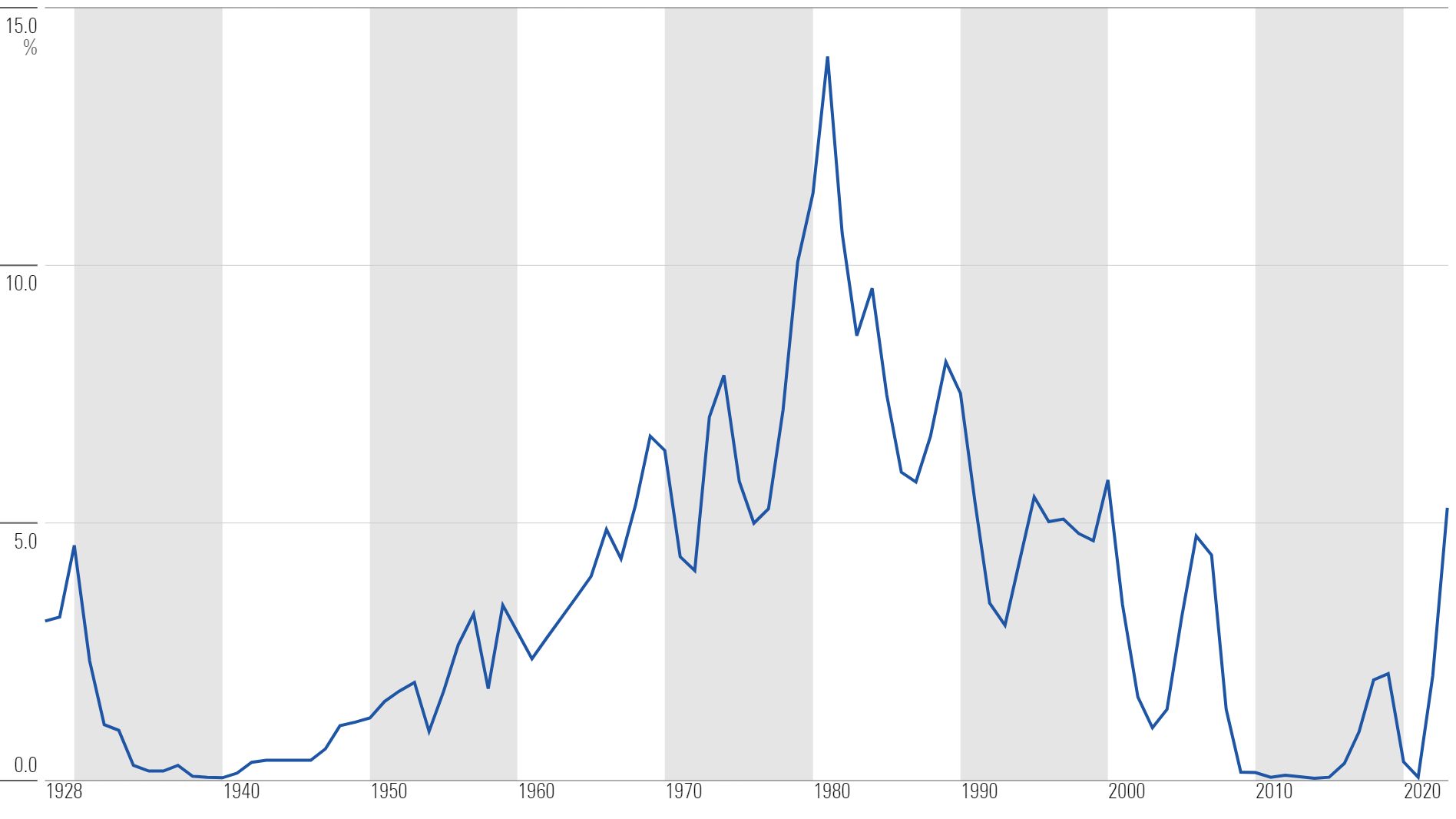

But it’s a fair question. Using three-month Treasuries as a cash proxy, investors can earn more than 5% on cash. This is the highest yield since 1995.

Three-Month Treasury Bill Yield

Only two years ago, three-month Treasuries were yielding nothing. The environment changed in a hurry.

Stating the obvious, it feels comfortable to earn 5% in cash while carrying a fraction of the risk of equities. But what feels comfortable is often not going to take you where you want to go. While holding cash may make you feel good in the short term, the long-term track record of that decision could have a major negative impact.

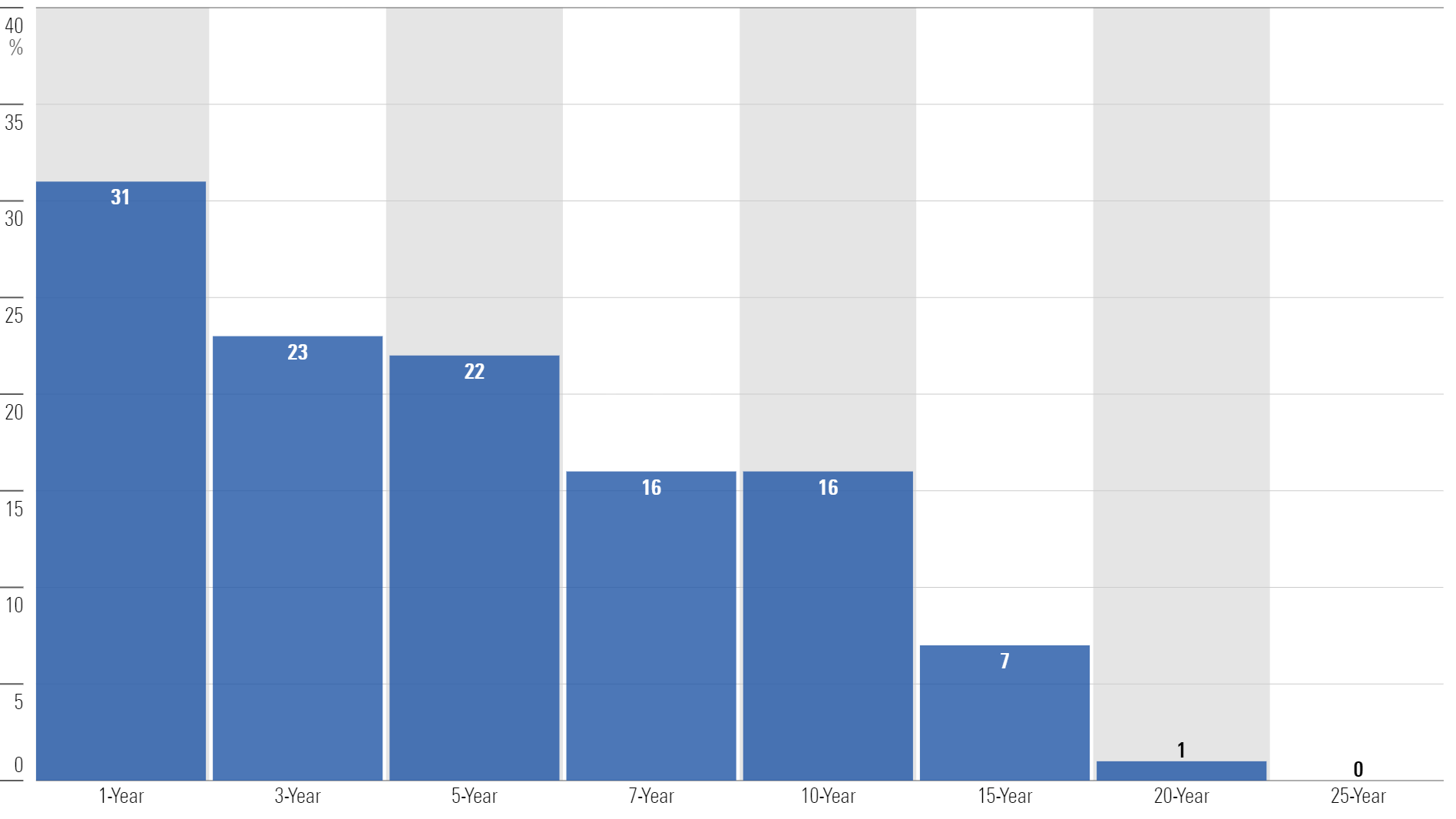

Since 1928, cash has beaten stocks 31% of the time over a one-year period. But as time goes on, the chance of cash beating stocks narrows significantly. In fact, there has never been a 25-year period where cash has outperformed the stock market.

Odds of Cash Outperforming Stocks (Total Returns, 1928-2022)

This data isn’t particularly profound. The stock market goes up more often than it goes down, so more often than not, stocks will outperform cash.

What Is It Costing Investors by Sitting in Cash?

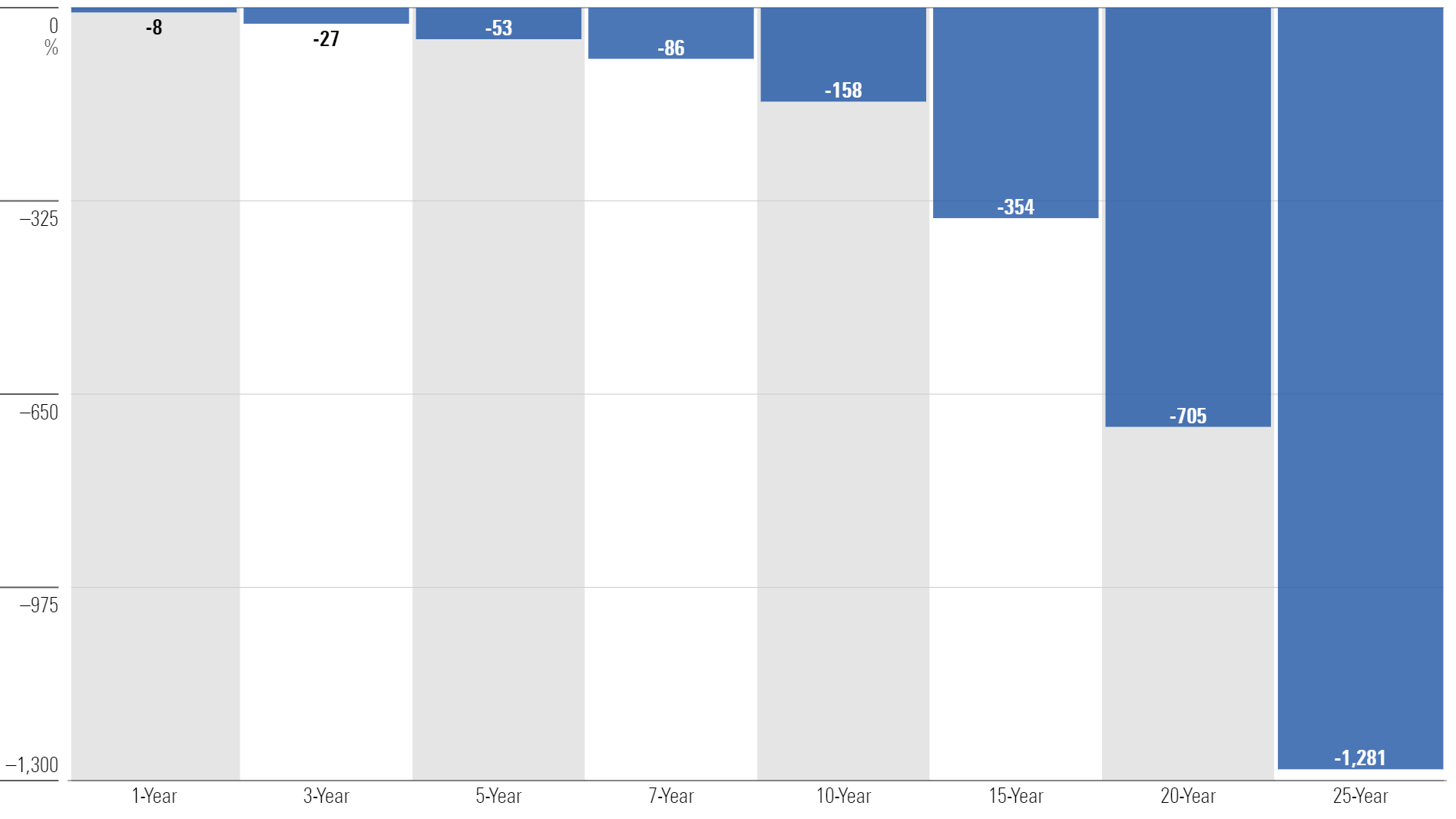

In the short term, the opportunity cost of sitting in cash is very little. On average, cash only underperforms the stock market by 8% over one-year periods. But the differential increases exponentially over time.

Over a five-year period, the difference between stocks and cash is more than 50%. Over 20 years, it’s more than 700%.

Average Underperformance: Cash vs. Stocks (1928-2022)

The lesson is clear: The opportunity cost of sitting in cash is huge and grows over time.

There are certainly caveats to make. Some investors have short-term cash needs—saving for a house, tuition payments, and so on—and that money should not be in the market. This is a welcome environment for those types of situations. But for those with longer time horizons, despite higher rates, cash should not be thought of as an equity substitute.

Investing is a game where success usually follows those who think using probabilities, rather than certainty.

There are no perfect allocations or times to invest in risk assets. The answer is only obvious with the benefit of hindsight. The best thing investors can do is figure out an allocation that works for them and avoid guessing what will happen based on one’s feelings.

Morningstar Investment Management LLC is a Registered Investment Advisor and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. Opinions expressed are as of the date indicated; such opinions are subject to change without notice. Morningstar Investment Management and its affiliates shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

Morningstar Investment Management LLC is a Registered Investment Advisor and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. Opinions expressed are as of the date indicated; such opinions are subject to change without notice. Morningstar Investment Management and its affiliates shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YBH7V3XCWJ3PA4VSXNZPYW2BTY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)