Why Is Everyone Always Wrong About the Fed?

Traders—and the Fed itself—are notoriously bad at predicting interest rate moves. Will expectations of rate cuts in 2024 be any different?

While Federal Reserve officials are expected to hold rates steady at this week’s meeting, the countdown to rate cuts is well underway. As evidence piles up of a soft landing for the economy and the outlook for inflation remains tame, market watchers are increasingly confident that the central bank will soon pivot to lowering interest rates.

Right now, bond market traders are pricing in six rate cuts throughout 2024, according to the CME FedWatch Tool. That would bring the federal funds target rate range down to 3.75%-4.00% from the current range of 5.25%-5.50%.

However, traders have a poor track record for predicting the central bank’s interest rate moves months in advance, though they tend to do better in the weeks immediately before a meeting. Even the Fed itself often doesn’t correctly predict the medium- and longer-term paths for interest rates. What’s behind this mismatch, and what does it mean for investors?

How Does the Fed Work?

The Fed’s mandate is to promote a healthy economy by keeping employment at a maximum and inflation low and stable. One way the central bank exerts influence is the federal funds rate, which is the rate that banks use to lend money to each other overnight. That rate reverberates throughout the entire economy, affecting everything from Treasury yields to mortgage rates to corporate profits.

In the bond market, traders buy and sell futures contracts that settle based on the federal funds rate. Prices on these contracts are indicators for traders’ views of the likely path for interest rates, and by extension what the economy might look like down the road.

Predicting When the Fed Will Raise or Cut Rates

It’s widely expected that the Fed will keep rates steady at its upcoming meeting. It is scheduled to announce its decision on Jan. 31 at 2 pm EST.

March is another story. Analysts are divided on whether the Fed will make its first rate cut since it started to raise rates in January 2022. Expectations for the meeting have swung widely among traders in response to comments from central bank officials and new data on inflation and economic growth.

Expectations for December 2024 Federal Reserve Meeting

For instance, a month ago, bond traders were pricing in a 70% chance of a rate cut at the March meeting, according to the CME FedWatch Tool. A week ago it was closer to 40%. Today that probability is less than 50%.

“Since there is a lot of data between now and March, rate cut expectations are likely to continue to gyrate,” Joseph A. Lavorgna, managing director and chief economist at SMBC Nikko Securities, said in a research note Thursday.

This isn’t an unusual dynamic. Ahead of the Fed’s meeting last July, investors struggled to synthesize tough talk out of the central bank (which didn’t want to appear overconfident to the market) with continued progress on inflation. Eventually, with lots of bumps along the way, traders priced in the Fed’s quarter-point rate hike. It was a similar story leading up to the rate hikes at the May and March meetings.

Market Probability of Rate Hikes Ahead

“You have to take a step back and separate what the market wants to happen versus what is probably going to happen,” says Carl Kaufman, portfolio manager of the Osterweis Strategic Income Fund. “When the Fed announced in September that they were done raising rates for now, what the market heard was, ‘I’m going to be cutting soon’ ... expectations clearly got a little out of hand.”

Why Are the Market’s Fed Rate Predictions Wrong?

Much is made of investor expectations when it comes to the Fed, even though most market watchers know to take such prognostications with a grain of salt.

“What they are is a snapshot of sentiment,” says Mark Hackett, chief of investment research at Nationwide. “They’re not very predictive.”

Some of that has to do with traders’ bias toward mean reversion—the idea that financial asset prices eventually return to their long-term average. “It is remarkable how mean reverting the error is,” Apollo chief economist Torsten Sløk wrote in an analysis comparing the actual feds funds rate with fed funds futures last fall. “When rates are low, the market is systematically pricing that the Fed will soon hike,” he says. “When rates are high, the market is systematically pricing that the next move from the Fed is to cut.”

Hackett explains it like this: “When you’re at 4% and you were at 8%, nobody thinks you’re going to 2%. Everybody thinks you’re going back to 6%.” Of course, mean reversion can’t account for the unpredictable.

Fed Predictions On Rates Are Also Often Wrong

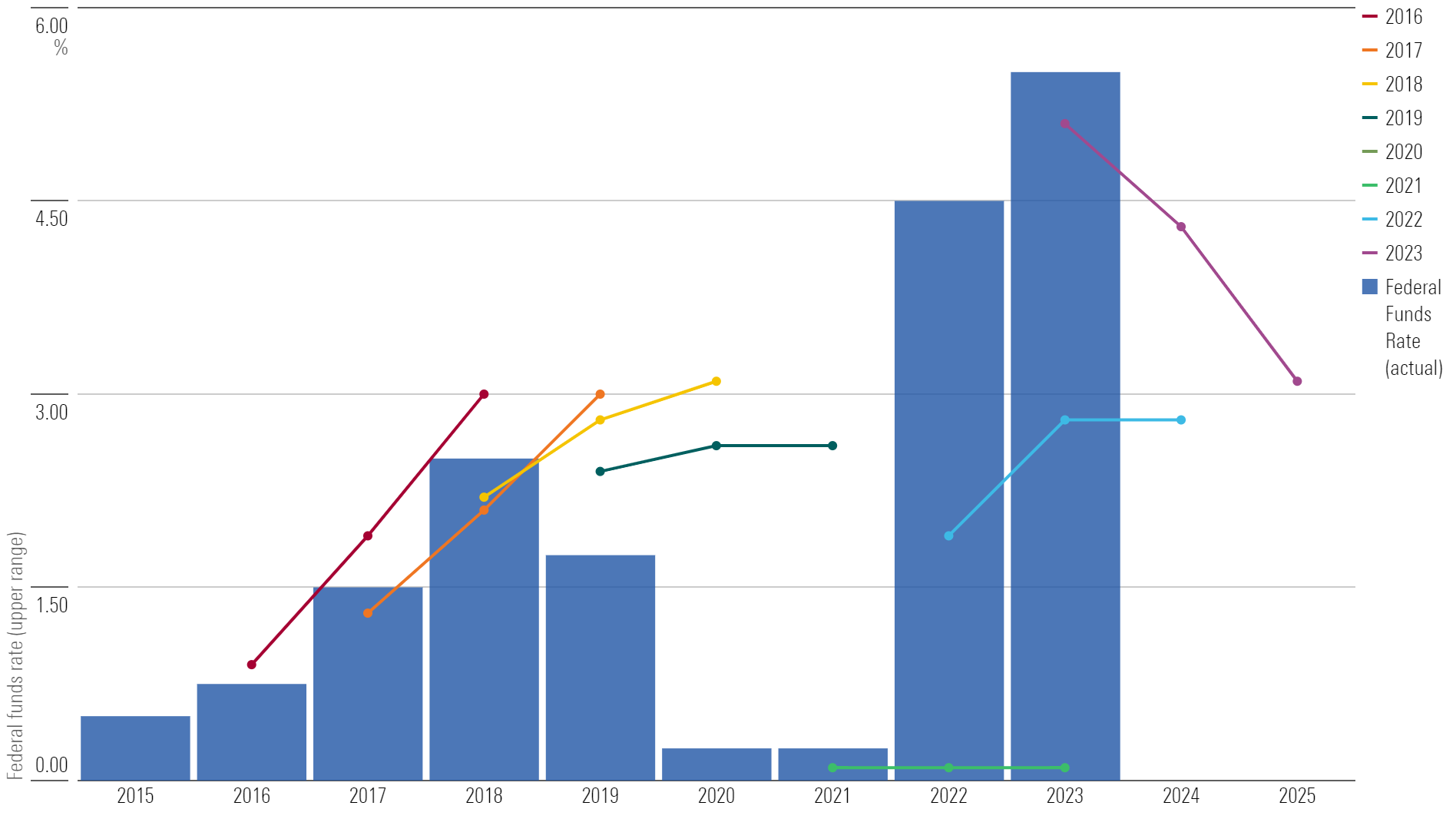

It’s not just traders; the Fed isn’t infallible when predicting its future either. When the Federal Open Markets Committee issues its forecasts for the federal funds rate in coming years, the actual path of interest rates often ends up deviating from those forecasts.

The Fed’s predictions come in the form of the “dot plot,” a collection of interest rate projections from the voting members of the FOMC. At each meeting, committee members share their forecasts for the federal funds rate at the end of the current year, for two years in the future, and for the longer term.

Federal Funds vs FOMC Median Projections

Of course, these unsuccessful projections shouldn’t be too surprising. The Fed has emphasized repeatedly that it strives to remain “data dependent,” meaning it will respond to changes in the economy as it shapes monetary policy rather than follow a predetermined course. When inflation was surprisingly strong in 2022, for instance, the central bank raised rates higher than it initially thought it would.

“You’re trying to change the tires on a Ferrari going 100 miles per hour,” Hackett says. He points out that over the past few years, the path of the economy was especially difficult to foresee. “You have a cycle that was driven by a global pandemic that shut the economy down for two years, and the government put in an unprecedented amount of fiscal stimulus, and the Fed went to zero [rates] plus a whole bunch of other monetary policy stimulus,” he says. “We’re operating without a history book with this cycle, and I think we tend to have overconfidence in our ability to tell the future.”

No wonder the Fed’s predictions didn’t pan out.

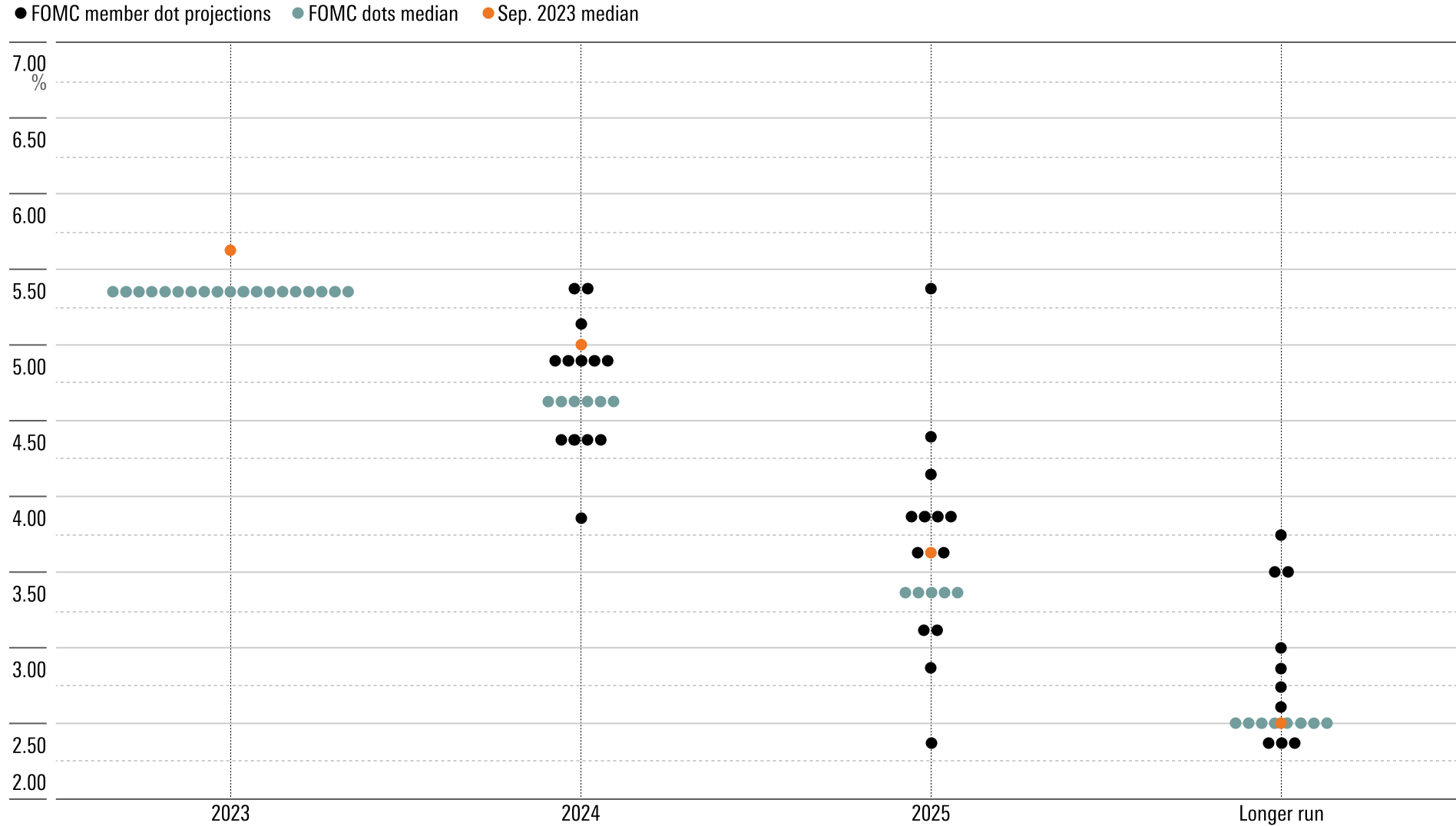

Fed and Market Disagree On Path of Interest Rates

It’s not just that market predictions and Fed predictions are often wrong; they’re often wrong in different ways.

As of its most recent meeting, the FOMC’s median prediction for rates at the end of 2024 was 4.6%. Meanwhile, futures markets are predicting a target range of 3.75%-4.00%.

The Dot Plot: Federal-Funds Rate Target Level

“There’s a historically large gap” between those numbers, says Bank of America rates strategist Meghan Swiber. She attributes much of that disconnect to how the market expects the Fed to react to inflation.

The market is anticipating a very quick path of disinflation, she says, and by extension a series of speedy cuts for the Fed. The central bank, on the other hand, might anticipate slower improvement or wait for signs that the inflation crisis is truly over. “The market is certain that it’s going to come down and stay,” Swiber explains, “and the Fed may be still perceiving some risks.”

Bond traders also think about rates differently than the Fed does. “Market prices are distributions of expectations,” Swiber explains. And when it comes to bond investors, those expectations often include a bias away from risk. Treasury bonds are considered a safer asset, she says, meaning investors often add them to portfolios when they are worried about the economy and the stock market. That means market rates can often trade lower than forecasts from the Fed might reflect.

When Is the Fed Expected to Cut Rates?

It’s deemed a near certainty that the Fed will keep interest rates steady at its January meeting. But the tone of the commentary around the decision could set the stage for a pivot to rate cuts later this spring. The central bank began hiking interest rates almost two years ago, as inflation soared to 40-year highs. Now, with inflation close to the central bank’s target and economic growth remaining robust, investors are eagerly awaiting the end of the aggressive tightening cycle.

“We’re not expecting the Fed to cut in January, but it’s going to be, in our view, a setup for them to be able to cut in March,” Swiber says. Other strategists say the cuts will come later, in the summer or fall.

It appears the market is already breathing a sigh of relief that cuts are finally coming. Equity markets have hit new highs as a soft landing comes into view and investor sentiment soars, says Kaufman.

Expressions of optimism from the Fed have helped as well, especially given Chair Jerome Powell’s dovish tone at its December meeting.

Hackett says, “I think that was the all-clear signal for the market” that cuts may be possible even without a recession. “That realization is what I think has caused the last three or four weeks of strength.”

For the Trading Week Ended Jan. 26

- The Morningstar US Market Index rose 1.04%.

- The best-performing sectors were energy, up 4.93%, and communication services, up 4.08%.

- The worst-performing sector was consumer cyclical, down 1.39%.

- Yields on 10-year U.S. Treasury notes fell to 4.14% from 4.15 %.

- West Texas Intermediate crude prices rose 5.94% to $78.07 per barrel.

- Of the 844 U.S.-listed companies covered by Morningstar, 569, or 67%, were up, three were unchanged, and 272, or 32%, were down.

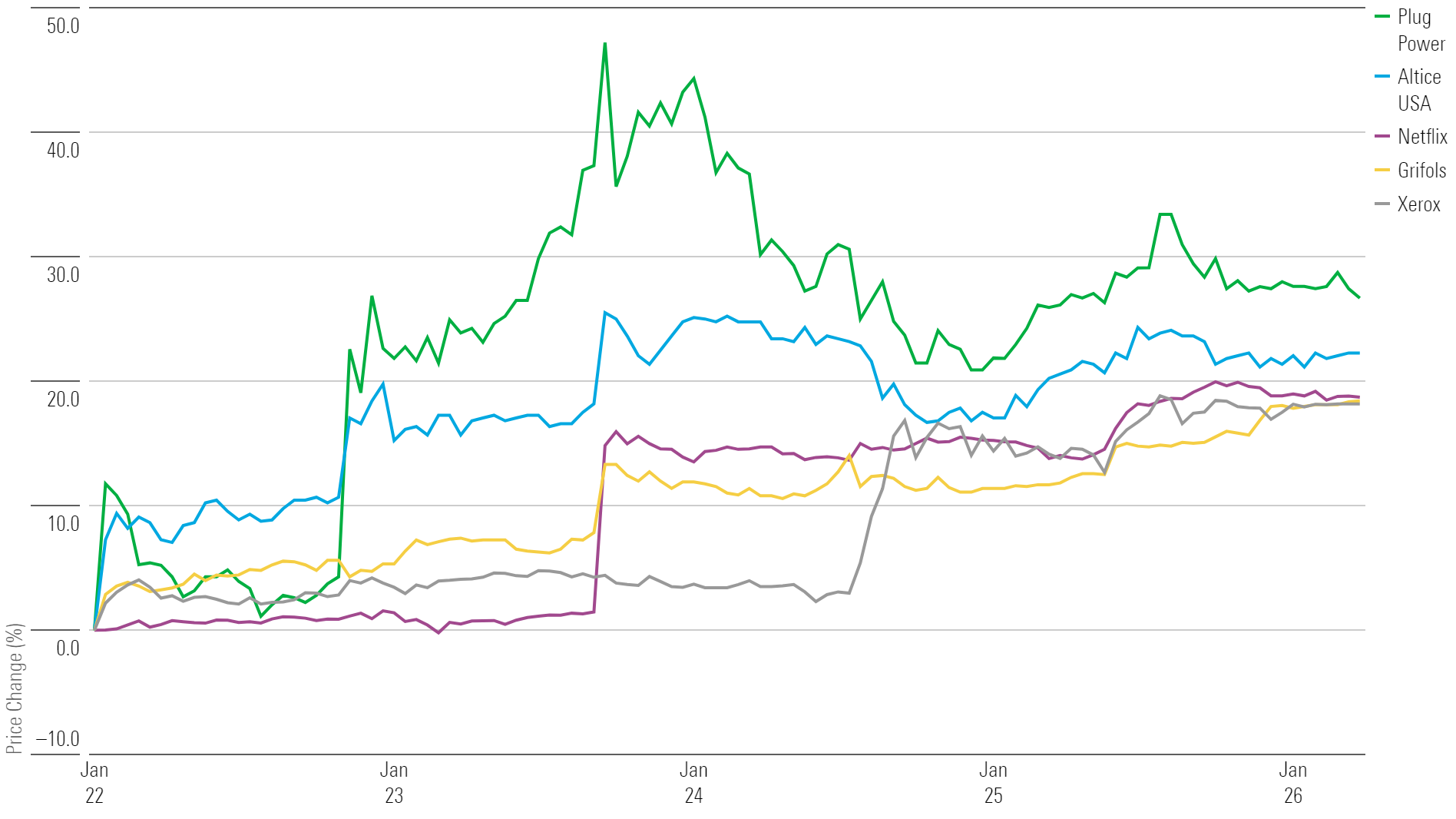

What Stocks Are Up?

Plug Power PLUG, Altice USA ATUS, Grifols GRFS, Xerox XRX, and Netflix NFLX.

Week's Top Winners

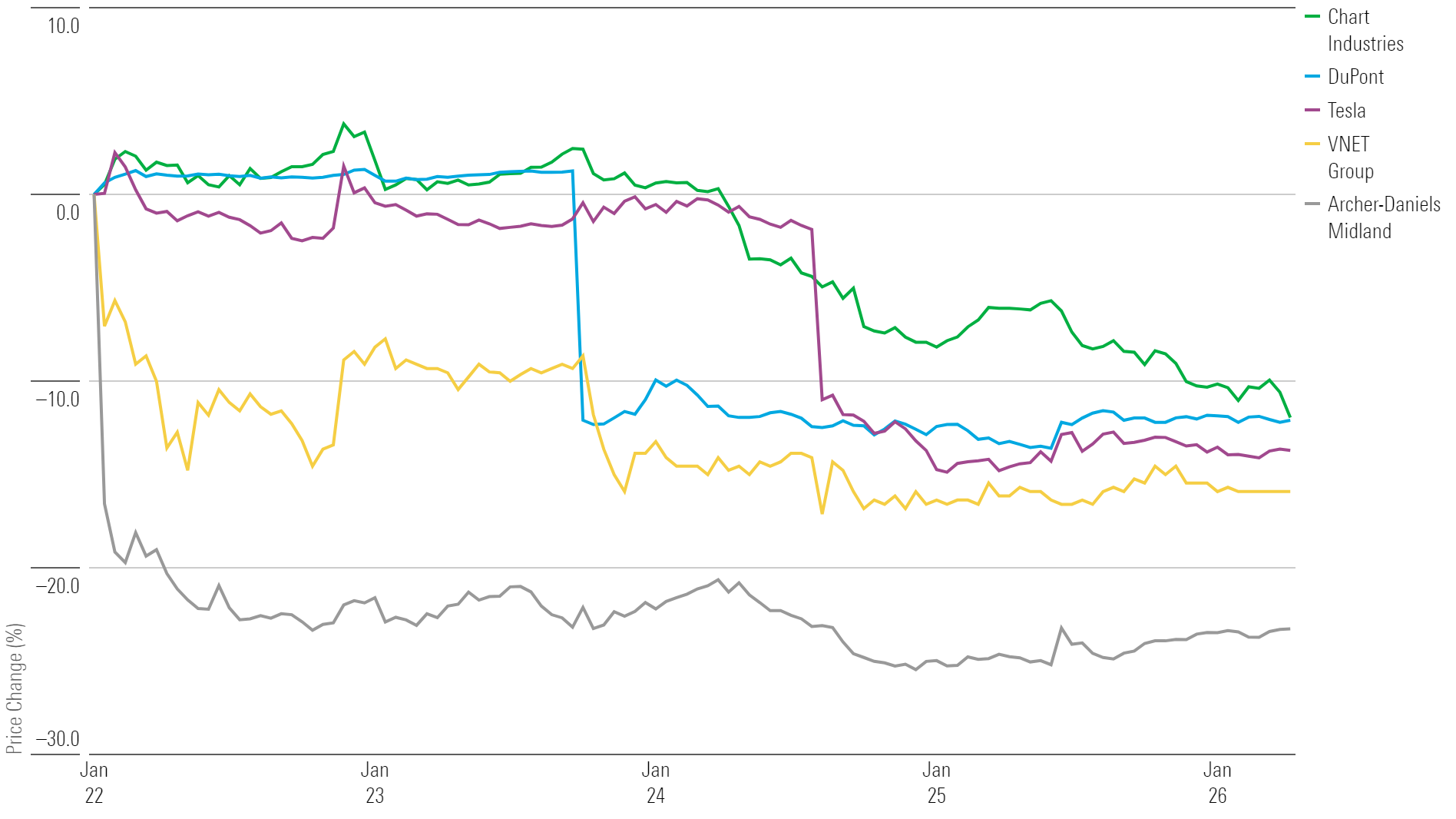

What Stocks Are Down?

Archer-Daniels-Midland ADM, VNET Group VNET, Tesla TSLA, DuPont DD, and Chart Industries GTLS.

Week's Top Losers

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/N7VBPGEKIZDBPEAHLKIWYNRLBE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)