Markets Brief: Is It Finally Time to Buy Small-Cap Stocks?

The Fed’s ‘higher for longer’ strategy could be a key factor for the smallest players in the market.

The stocks for small companies are at some of their cheapest valuations in recent history. After years of underperformance in this area, this could be a sign that it’s time for investors to back up the truck.

Judging from Friday’s session, some investors appear to think so. In the wake of the October jobs report, which showed a cooling of the hot labor market that could mean an end to the Federal Reserve’s interest rate increases, the Morningstar US Small Cap Index jumped 2.5%, well ahead of the 1.1% gain in the broader market.

However, some strategists say the prospect of the Fed keeping interest rates higher for an extended period and an uncertain economic outlook means small-cap investors will have to keep waiting for a rally.

Small-Cap Stocks Are Historically Cheap

According to Ed Clissold, chief U.S. strategist at Ned Davis Research, by some measures, “small caps are trading at near their steepest discount on record.” But just because a stock is cheap doesn’t mean it’s a good buy. “Right now, they appear to be cheap for a reason.”

Morningstar defines small-cap stocks as those in the bottom 10% of the stock market by capitalization. Investors like them because they tend to offer lots of growth potential, unlike larger, more established companies. But small caps also come with downsides. They’re more sensitive to changes in interest rates and the economy, and more volatile as a result. Plus, many aren’t profitable or are more reliant on debt compared with their larger counterparts.

Today, stocks in the Small Cap Index carry an average price/fair value estimate ratio of 0.78, while the average stock in the Morningstar US Large Cap Index has a ratio of 0.93. This means stocks in the small-cap index are relatively cheaper than their larger counterparts. Ratios over 1.00 indicate a stock is overvalued, while ratios below 1.00 mean it’s undervalued. The further away from 1.00, the more over- or undervalued the asset.

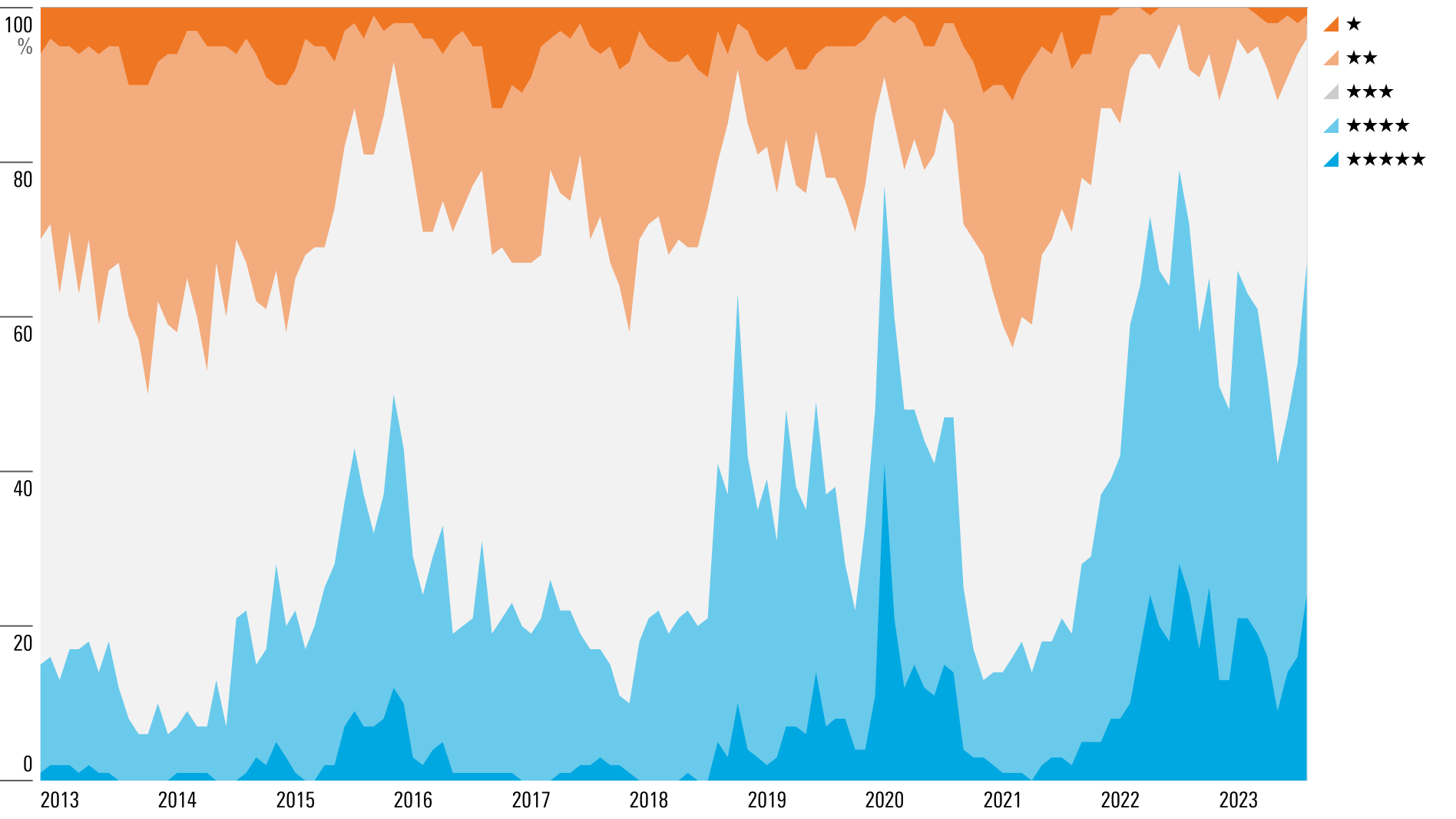

Historical Price/Fair Value Distribution of Small-Cap Stocks

It was a similar story at the beginning of 2022, with the Small Cap Index carrying an average price/fair value reading of 0.97, while the Large Cap Index was overvalued with an average reading of 1.12. But the relatively cheap price tags on small-cap stocks haven’t translated into investor enthusiasm.

Why Are Small Caps Doing So Poorly?

“The small-cap universe has significantly underperformed for a significant period of time,” says Jonathan Coleman, small-cap portfolio manager at Janus Henderson Investors. He adds that small-cap stock cycles can last more than a decade.

Over the past five years, the Small Cap Index has gained 9.3%. The Morningstar US Small Cap TME Extended Index, which tracks some of the smallest companies on the public market, has returned 21.5%. However, the Morningstar US Market Index is up nearly 50% over that same period.

Since January, the total market index is up about 8%, while the Small Cap Index has fallen 2.3%. The Small Cap Extended Index has fared even worse, with losses of 4.1%. Meanwhile, the Large Cap Index is up 12%.

Small-Cap Stocks vs. Large Caps and the Market

“The challenge for small caps is that they’re not providing the superior earnings growth” that would have justified owning them at other points in history, Clissold explains.

Strategists point to two main factors for that underperformance: high interest rates and an unfavorable economic cycle.

High Rates Take a Bite Out of Small Caps

Over the past 18 months, the Fed has embarked on the most rapid interest-rate-hiking campaign in its history to combat sticky inflation and a dangerously hot labor market. The central bank has also been clear that it intends to keep rates high for as long as it takes to cool the economy.

Treasury Yield and Federal-Funds Rate

Those hikes are designed to prevent a recession, but they also take a toll on stocks. The Fed’s “higher for longer” strategy has been a factor in small-cap underperformance because it makes these stocks’ balance sheets less attractive to investors, Coleman says.

That phenomenon is eventually true for all types of stocks, but it happens much more quickly for smaller ones. As William Blair macro analyst Richard de Chazal put it recently: “Smaller caps can generally be viewed as the speedboats of the equity world, compared to the larger-cap supertankers.”

One reason is that they’re generally more dependent on capital markets than their bigger and more stable counterparts, which tend to have more cash on their balance sheets, Clissold explains.

That means smaller companies usually must borrow more often to grow, and they tend to be the first firms to get less favorable conditions for that debt. As a result, small caps are more sensitive to interest rates than large caps.

Right now, borrowing conditions are far from favorable. Higher borrowing costs mean more expenses, and that takes a toll on earnings and profits. In fact, Clissold says, interest expenses for small-cap stocks are currently at a record high.

A Slowing Economy Could Keep Small Caps Down

Small-cap stocks are also more sensitive to economic cycles compared with larger-cap ones, for many of the same reasons they’re more sensitive to interest rates.

A slowing economy is “not particularly favorable for small caps,” Clissold says, as they tend to outperform at the beginning of a bull market or economic expansion.

Economists have been warning of a recession for months, but so far it hasn’t happened yet. And it isn’t clear exactly when it may happen, though analysts generally agree that economic growth will slow in the coming months. That means more uncertainty for small-cap stocks.

“The environment is going to get a little bit tougher,” says Jeffrey Buchbinder, chief equity strategist at LPL Financial. For that reason, investors may want to stick with “stronger balance sheets and higher-quality large caps” until there’s more clarity on how the economy will land.

Morningstar chief U.S. market strategist David Sekera says that with the economy likely to slow in the coming year, “small- and even mid-cap stocks will have a difficult time performing until the market begins to price in the economic rebound. We need a much more ‘normalized’ economic environment for investors to become more comfortable going back into smaller-cap stocks.”

Fund managers agree. A net 18% of respondents in Bank of America’s most recent fund manager survey said they expect large caps to beat small caps over the next year.

Investors Stick with Large-Cap Growth Ahead of Economic Slowdown

A discussion of small-cap stocks would be incomplete without talking about the behemoths at the other end of the spectrum: mega-cap tech stocks like Amazon AMZN, Nvidia NVDA, Alphabet GOOGL/GOOG, and Microsoft MSFT. The so-called Magnificent Seven have driven the majority of the market’s gains since 2022, and they’re still attracting investors despite their recent lackluster performance.

The same factors weighing on small-cap performance are pushing investors toward larger, more established stocks, which have a better chance of weathering a long period of high interest rates or an economic downturn. “We’ve seen the best earnings growth out of large caps,” Buchbinder says.

And the small-cap universe has changed dramatically over the past few decades. There are significantly fewer small-cap companies trading on public markets now, Clissold says, and a good portion are “probably not institutionally investable.” He explains that private companies stay private for longer and go public at higher valuations now, meaning the companies left in the small-cap indexes are not growing as fast as their larger counterparts.

What Will It Take for Small Caps to Break Out?

Just because small caps don’t seem likely to outperform in the near term doesn’t mean they’ll never break out.

A reduction in interest rates is one big factor that could turn the tide, according to Coleman. “That’s an environment where small caps could perform quite well,” he says.

Clissold points out that the Fed would need to lower rates without sacrificing economic growth, which could boost small-cap earnings. “That’s a very difficult needle to thread” for the central bank, he says.

More clarity around the path of the economy would also help the sector, according to Buchbinder. “We don’t think [a new small-cap cycle] will start until the market can get past this period of uncertainty,” he says, and economic headwinds are priced into stocks. “As economic growth accelerates coming out of this soft patch,” he continues, “then small caps should do well.” He expects to see that turnaround sometime in 2024.

For the Trading Week Ended Nov. 3

- The Morningstar US Market Index rose 5.98%.

- The best-performing sectors were real estate, up 8.92%, and communication services, up 7.47%.

- The worst-performing sector was energy, up 2.42%.

- Yields on 10-year U.S. Treasury notes fell to 4.52% from 4.83%.

- West Texas Intermediate crude prices fell 5.88% to $80.51 per barrel.

- Of the 852 U.S.-listed companies covered by Morningstar, 797, or 94%, were up, and 55, or 6%, were down.

What Stocks Are Up?

Roku ROKU, Shopify SHOP, and DoorDash DASH.

What Stocks Are Down?

Paycom Software PAYC, Lumen Technologies LUMN, and Match Group MTCH.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TNJY62P2RRG2PP5MMRLA5IZXYY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)