July Jobs Report Suggests Economy on Track for ‘Immaculate Disinflation’

Fed seen ending rate hikes, with solid but moderating job growth and easing price pressures.

With the July jobs report from the Bureau of Labor Statistics, the U.S. economy appears to be threading the needle. Hiring is slowing but still solid, even as inflation pressures retreat.

The July report showed that 187,000 jobs were added in July—slightly below FactSet’s consensus forecast for an increase of 200,000 jobs. This follows a revised 185,000 gain in June.

Nonfarm payroll employment has grown at a 1.7% annual rate over the last three months. While that’s down from a 2.4% rate in the first quarter, it’s in line with the 1.7% average annual growth from 2015 through 2019, notes Preston Caldwell, senior U.S. economist at Morningstar.

“While job growth is continuing at a healthy pace, increasing signs that inflation might return to normal without a recession should induce the Fed to refrain from further rate hikes,” Caldwell says. “This is better than a soft landing. This is an immaculate disinflation.”

Ultimately, Caldwell believes the jobs market will slow, and he points to hints of slackening in the July report. There’s evidence of employers cutting hours worked and declines in temporary help hiring—a job category that was a leading indicator of overall employment in the 2001 and 2008 recessions.

“Even while headline job growth remains strong, we do see signs that employers are trying to cut back their usage of labor,” Caldwell says.

July Jobs Report Key Stats

- Nonfarm payrolls rose by 187,000 versus a revised 185,000 in June.

- The unemployment rate declined to 3.5% from 3.6% in June.

- Average hourly wages grew by 0.4% to $33.74 after rising a revised 0.45% in June.

“Job growth is still decelerating, albeit at a slow pace,” Caldwell says. He cautions that routine annual preliminary benchmark revisions to the employment data will be reported on Aug. 23. The BLS will make corrections to its survey-based estimates of employment since March 2022. “That could shift the picture of job growth shown by the data,” he notes.

Healthcare Leads Hiring

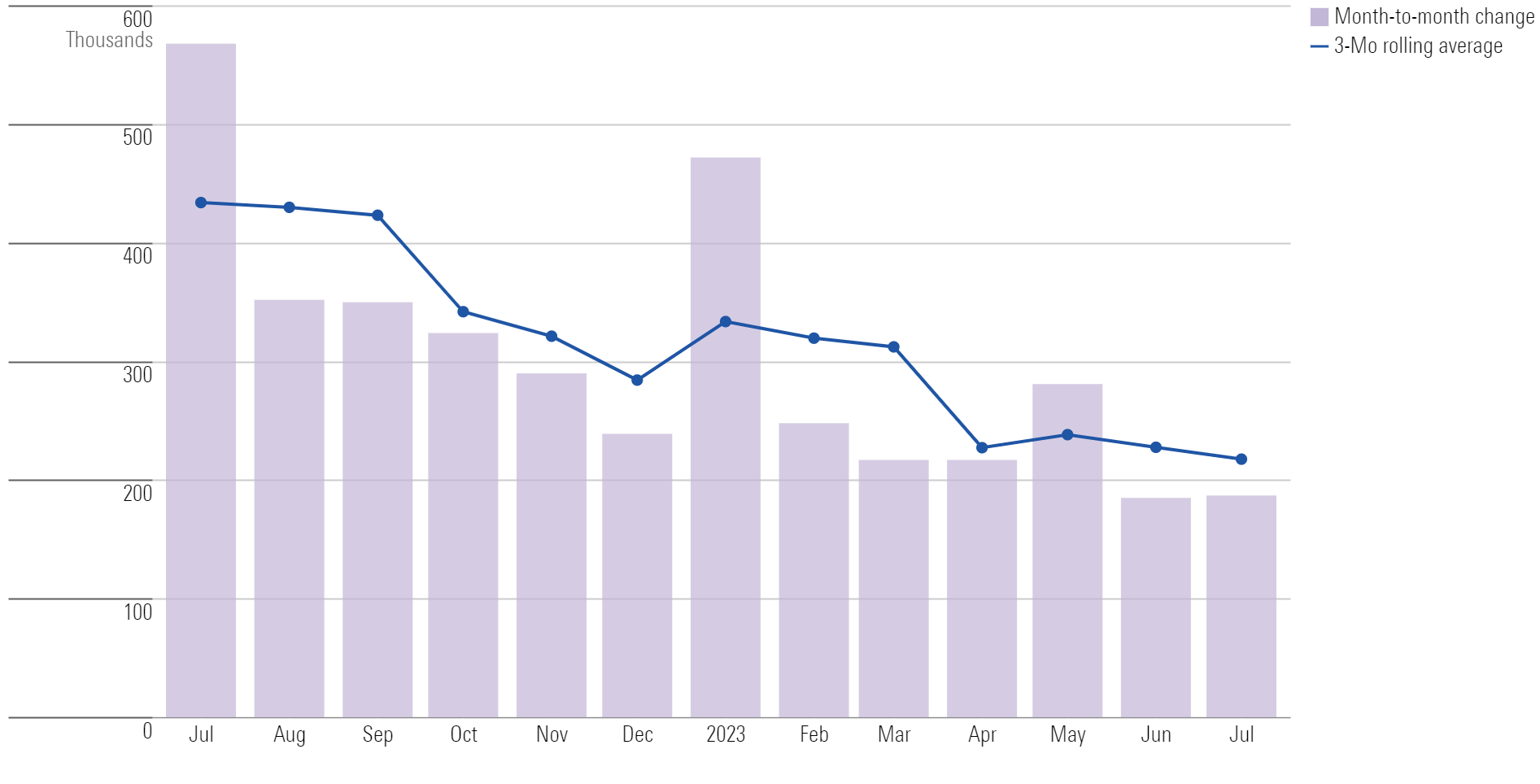

With the July increase in hiring, the three-month moving average of nonfarm payroll employment gains dropped to roughly 218,000 from 283,000 in June. The number of new jobs created in July is well below the average for the last 12 months, which stands at 312,000, according to the BLS.

Monthly Payroll Change

Hiring in July was led by the healthcare sector, which added 63,000 jobs—above the average monthly gain of 51,000 for the past 12 months. Healthcare has accounted for more than a third of the job gains over the last three months, with the sector adding jobs at a 4.4% annualized rate. “That’s likely to slow now that healthcare employment is well ahead of pre-pandemic levels,” Caldwell says.

Construction employment showed continued strength despite the substantial increase in interest rates over the past year. With nonresidential building construction adding 11,000 jobs, the overall sector saw growth of 19,000 jobs in June. Construction hiring has increased at a 3.6% annualized rate over the past three months, compared with 0.8% in the prior three months. Caldwell calls it “a solid rebound.”

The gains in construction employment are showing up in both residential and nonresidential hiring. “Residential construction employment ticking up again is consistent with a rebound in residential investment in Q3 and the seeming trend reversal in housing starts,” Caldwell says. “The increase in nonresidential construction employment makes sense, given the ongoing surge in factory construction.”

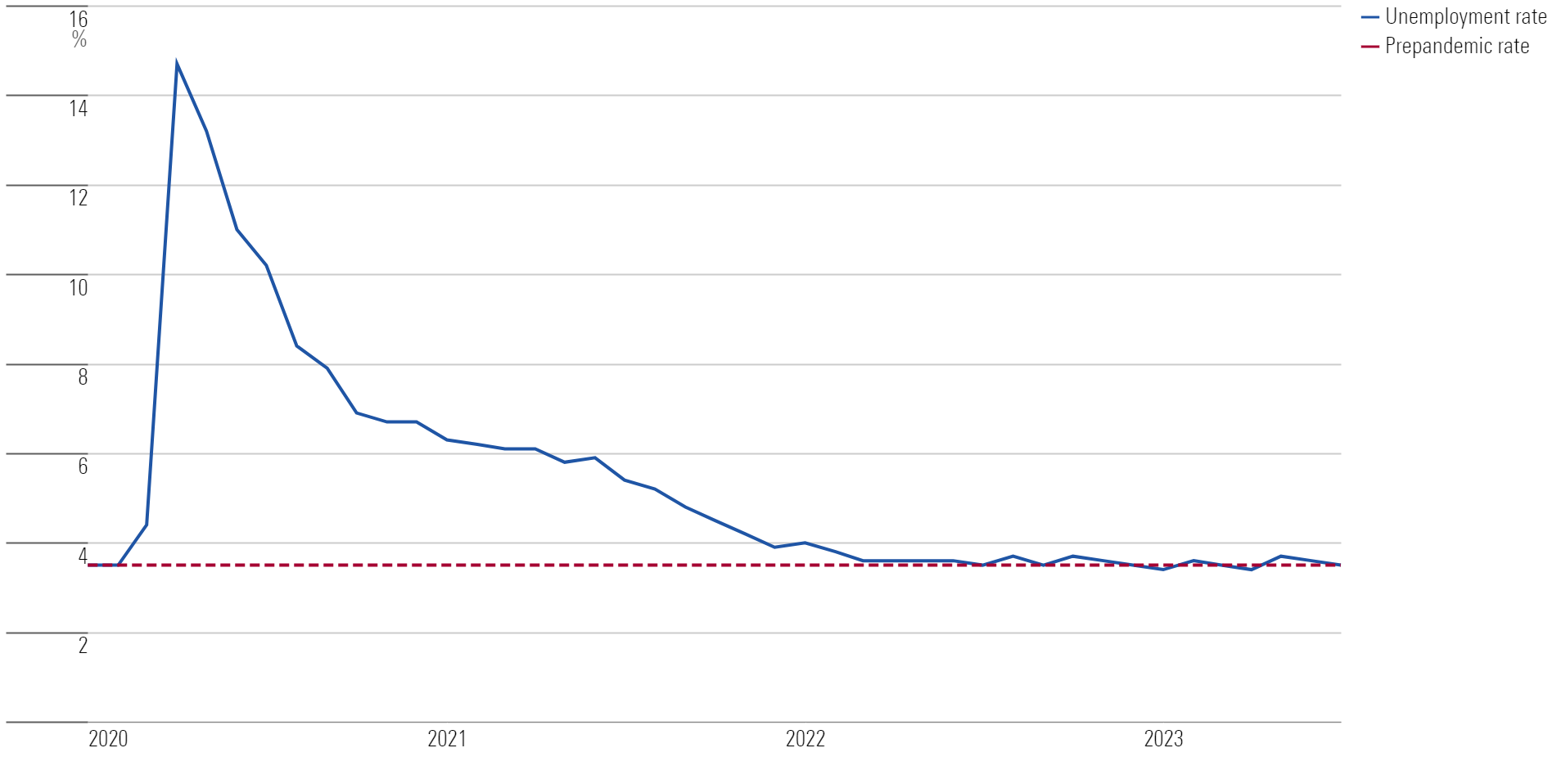

Unemployment Rate Remains Stable

The unemployment rate ticked down to 3.5% in July from 3.6% in June. Economists had forecast an unemployment rate of 3.6% for July. However, the jobless rate has held within a narrow range of 3.4%-3.7% since March 2022.

“The unemployment rate is basically stable over the past several months,” Caldwell notes. He points to the differences between the two methods of collecting data for the jobs report. The household survey employment data (which is used to determine the unemployment rate) has not seen much growth, in contrast to the gain seen in the establishment survey data (which is used for payroll statistics).

Unemployment Rate

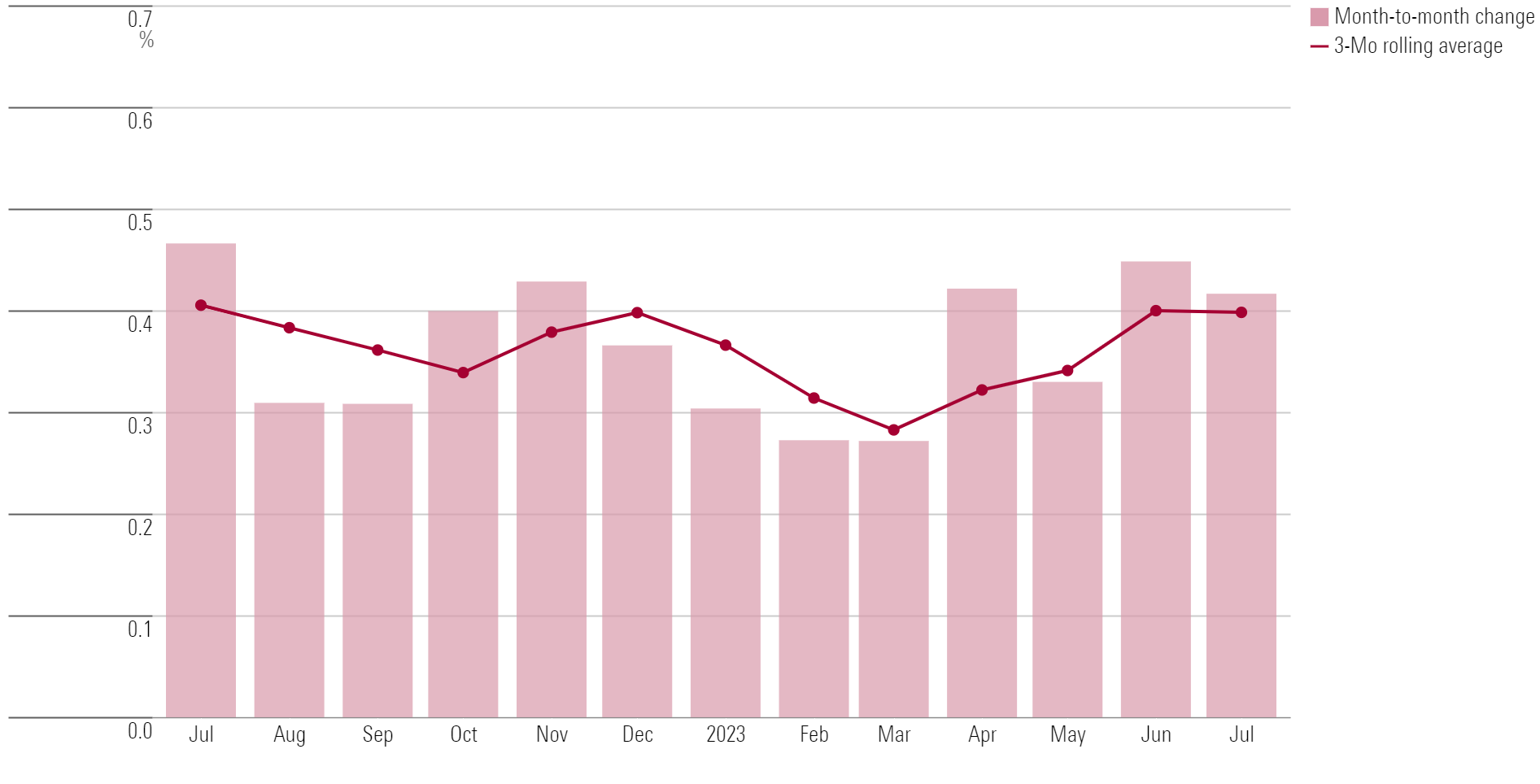

Wages Tick Higher

Average hourly earnings rose by 14 cents, or 0.4%, in July. Over the past 12 months, average hourly earnings have increased by 4.4%.

“The recent uptick in wage growth is something to watch, with that number accelerating to 4.9% annualized in the past three months, up from 3.9% in the prior three months,” Caldwell says. “However, this data series is very volatile, and growth is a somewhat milder 4.4% in year-over-year terms. Additionally, other measures of wage growth—other surveys, such as the employment cost index—are still showing signs of decelerating.”

Monthly Wage Growth

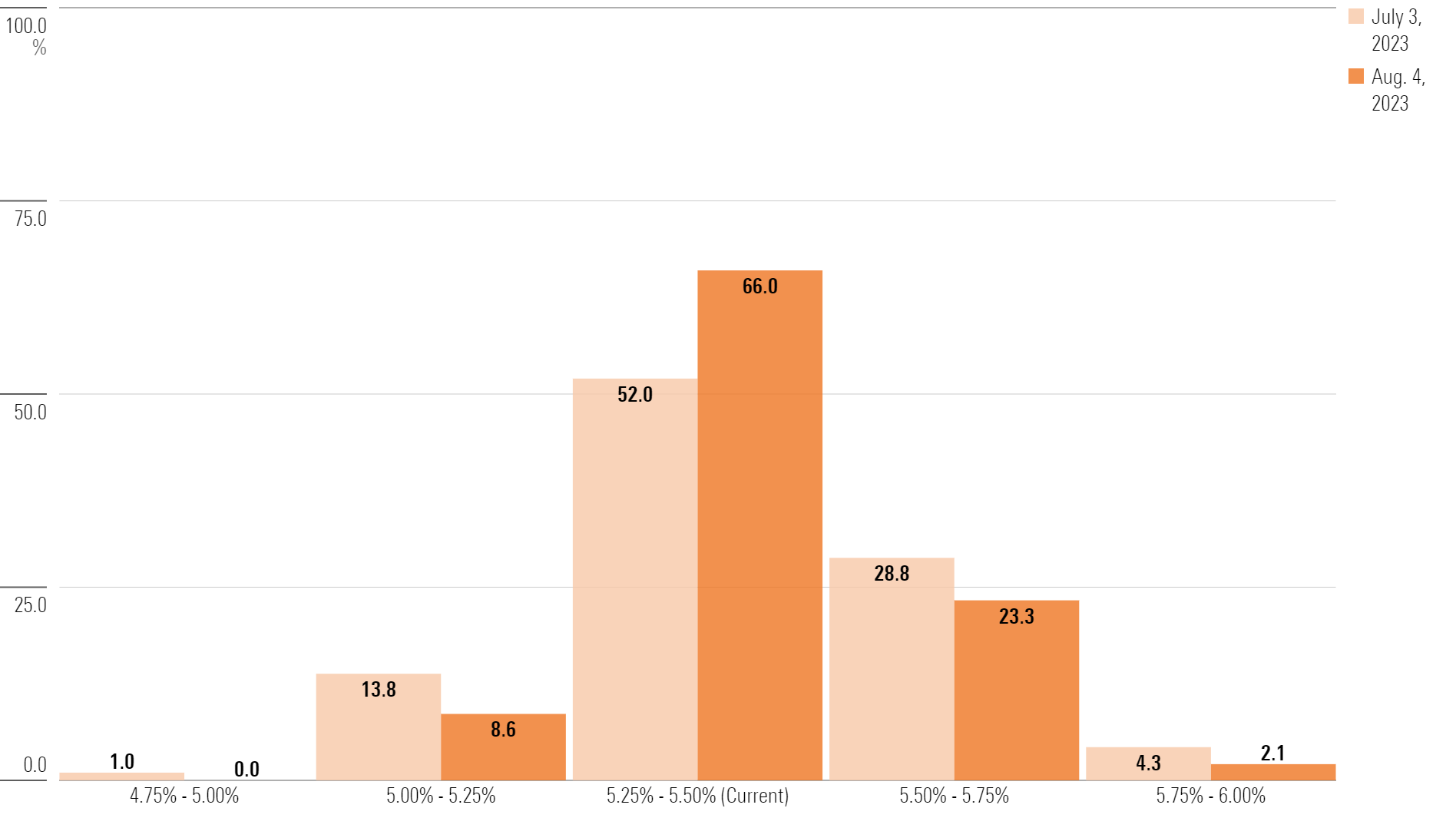

Fed Believed to Be Done Raising Rates

Against this backdrop, Caldwell thinks the Federal Reserve won’t need to raise interest rates any further. At its July meeting, the Fed raised the federal-funds rate target range by a quarter of a percentage point to 5.25%-5.5%. The question facing investors was whether Fed officials would feel the need to raise rates again before the end of this year.

“For now, growth in jobs and economic activity is eschewing the ‘below-trend’ pattern of growth which is usually held by economists as necessary to reduce inflation,” Caldwell says. “Yet inflation is nevertheless falling owing to supply side improvement and other factors.”

He continues: “The possibility that this can continue will induce the Fed to refrain from another rate hike in its September meeting.” Caldwell believes that in 2024, a slowing economy and declining inflation will lead the Fed to significantly lower interest rates.

In the bond market, traders see the Fed on hold through the rest of the year. According to the CME FedWatch Tool, which tracks investors’ bets on the direction of interest rates, there is a 66% chance the Fed will hold the federal-funds rate at its current level through the end of 2024.

Expectations for the Federal Reserve Meeting on Dec. 13, 2023

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/A7YHHS6HQJB7RJU76FB5C2TXV4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)