6 Top-Performing Large-Cap Value ETFs

Fully invested funds with heavier allocations to the tech sector have beaten the rest of the category.

2023 has been underwhelming for investors in large-value exchange-traded funds. So far this year, these funds have only gained 3.8% compared to the 15.1% gain of the overall stock market as measured by the Morningstar US Market Index.

The top-performing funds in this category tend to be overweighted in technology compared to their peers, as well as have a focus on increasing allocation to higher-yielding sectors at each rebalance. Currently, offerings from Vanguard, Schwab, and Fidelity are among these top performers.

Large Value Funds vs U.S. Stock Market

What Are Large-Value ETFs?

Stocks in the top 70% of the capitalization of the U.S. equity market are defined as large-cap. Value is defined based on low valuations (low price ratios and high dividend yields) and slow growth (low growth rates for earnings, sales, book value, and cash flow). Large-value funds invest in stocks of big U.S. companies that are less expensive or growing slower than other large-cap stocks.

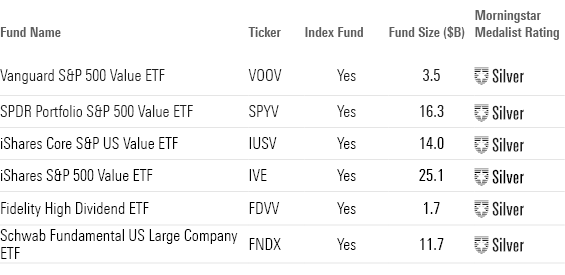

6 Top-Performing Large-Value ETFs

To screen for the best-performing ETFs in this Morningstar Category, we looked for the strategies that have posted top returns across multiple time periods.

We first screened for the ETFs that ranked in the top 33% of the category using their lowest-cost share classes over the past one-, three-, and five-year time frames. Then we filtered the list for ETFs with Morningstar Medalist Ratings of Gold, Silver, or Bronze for those classes. We also excluded funds with less than $100 million in assets and those with minimal or no Morningstar analyst input on their Medalist Ratings.

From this screen, we’ve highlighted the six ETFs with the best year-to-date performance. This group consists only of index funds, which mirror the market index’s portfolio.

Because the screen was created with the lowest-cost share class for each fund, some funds may be listed with share classes that are not accessible to individual investors outside of retirement plans. The individual investor versions of those funds may carry higher fees, which reduces returns to shareholders.

Top-Performing Large-Value ETFs

Vanguard S&P 500 Value ETF

- Ticker: VOOV

- Morningstar Rating: 4 stars

- Morningstar Medalist Rating: Silver

“This portfolio maintains a cost advantage over competitors, priced within the least expensive fee quintile among peers.

“Over the past five years, the strategy’s shares have returned an average of 9.1% per year, leading it in the 16th percentile of the category. For the last three years, the fund has returned an average of 13.6% a year, leading it to the 26th percentile. And for the past 12 months, the fund lands in the 5th percentile with a 7.8% gain.”

—Morningstar Manager Research

SPDR Portfolio S&P 500 Value ETF

- Ticker: SPYV

- Morningstar Rating: 4 stars

- Morningstar Medalist Rating: Silver

“Over the past 10 years through March 2023, this fund has outperformed its average peer by 1.28 percentage points annualized.

“The fund is always fully invested, while its actively managed peers may hold cash. This aids its performance during market rallies. However, being fully invested can become a liability during downtowns. That said, the fund held up better than its average peer by 78 basis points in 2022. The fund’s modestly lower exposure to technology stocks (before its December rebalance) and slight tilt into consumer defensive stocks buoyed performance.

“Being fully invested helped the fund when value stocks rebounded at the end of 2020 through March 2023. It outperformed its typical peer by 1.94 percentage points annualized with similar volatility. The fund’s low cash drag and underweighting of technology and communication services stocks aided its performance.

“The fund has tightly tracked the S&P 500 Value Index, trailing it by only 5 basis points annualized over the three years through March 2023, only 1 basis point higher than its 0.04% fee.”

—Mo’ath Almahasneh, associate analyst

iShares Core S&P U.S. Value ETF

- Ticker: IUSV

- Morningstar Rating: 4 stars

- Morningstar Medalist Rating: Silver

“Accurately representing the category average amplified the impact of this fund’s cost advantage, driving sound category-relative returns. In addition, it is always invested with a low cash drag. This aids performance when markets rally, but makes the fund more susceptible during downturns.

“The fund’s heavy stakes in consumer staples and communication-services stocks have buoyed performance, while its relatively lighter dose of energy stocks hindered performance as energy stocks paced the market.

“Stocks with increasing valuations and improving fundamentals receive increased exposure in the portfolio than those on the decline with deteriorating fundamentals. Market cap weighting has the added benefit of lower turnover and associated trading costs.”

—Mo’ath Almahasneh

iShares S&P 500 Value ETF

- Ticker: IVE

- Morningstar Rating: 4 stars

- Morningstar Medalist Rating: Silver

“Over a 10-year period, this share class outpaced the category’s average return by 1.5 percentage points annualized. It was also ahead of the category index, the Russell 1000 Value Index, by 1.1 percentage points over the same period.

“The fund’s sector allocations did not deviate from the category average by more than 7% as of March 2023. However, the fund’s sector allocations changed toward the end of 2022. Compared with its average peer, the fund now overweights technology and consumer cyclical stocks by 6 and 3 percentage points, respectively, while underweighting healthcare and energy stocks.

“The fund has historically traded at similar valuations to its average peer. However, the fund’s portfolio comes with higher valuations than peers after its recent rebalance into technology and consumer cyclicals. Still, the fund is better diversified than its average peer.”

—Mo’ath Almahasneh

Fidelity High Dividend ETF

- Ticker: FDVV

- Morningstar Rating: 4 stars

- Morningstar Medalist Rating: Silver

“This fund carved out most of its lifetime edge over the three years through May 2023, trouncing the Russell 1000 Value Index by about 4.5 percentage points annualized over that time. Its run partly owes to its larger stature and a heavy dose of mega-caps. The Russell Top 200 Index beat the Russell Mid Cap Index by about 5 percentage points annualized over the past three years.

“The strategy’s sector bets have also worked in its favor of late. Starting with broad-market weights prompts a heavier tech allocation, which has worked wonders in recent years. The fund raised its utilities stake to 10% from nil at the 2022 rebalance. It removed all utilities at the February 2023 rebalance after a strong year made the sector relatively pricier. Those stocks subsequently fell flat in 2023′s first half.

“This lean portfolio spanned 93 holdings at the end of May 2023. Only 26% of it overlapped with the Russell 1000 Value Index. This differentiation can pay off when it picks the right stocks (as it has over the past three years), but can also leave it well behind the broader category benchmark when the market’s top performers elude its grasp.”

—Ryan Jackson, analyst

Schwab Fundamental U.S. Large Company Index ETF

- Ticker: FNDX

- Morningstar Rating: 5 stars

- Morningstar Medalist Rating: Silver

“From its April 2007 inception through May 2023, this mutual fund’s 8.22% annualized return led the Russell 1000 Value Index by 1.98 percentage points annualized and ranked within the top 10% of its category.

“At its March 2023 rebalance, the fund boosted stakes in faster-growing stocks that tumbled at the hands of recent interest-rate hikes. Already into their recoveries, firms like Meta META and Alphabet GOOGL helped the fund beat over 85% of large-value peers for the year to date through May 2023.

“Compared with the Russell 1000, it tends to overweight energy, financials, utilities, and staples, and to underweight technology. The market may not reward these bets in the long run.”

—Ryan Jackson

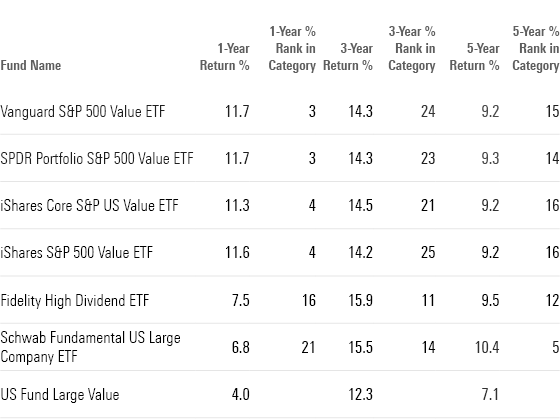

Long-Term Returns of Top-Performing Large-Value Funds

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KIQMCCUZ2RGWZKSCKM2Z4ZULFU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MGEDEFIRZJFHTAFNLDHG46SDXI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6HLXVGQ6DFCQDC3WHBZC6TLS2U.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)