Morningstar’s 2024 US Morningstar Outstanding Portfolio Manager Award Winner

JPMorgan Equity Income’s Clare Hart’s long, consistent, solid record wins the day.

JPMorgan Equity Income’s Clare Hart is the winner of Morningstar’s 2024 US Morningstar Outstanding Portfolio Manager Award.

Morningstar Manager Research analysts chose Hart from a list of three nominees who have run investment strategies that earn Morningstar Medalist Ratings of Gold or Silver on at least one vehicle or share class. They each had long, impressive track records, disciplined but adaptable philosophies and processes, and a proven record of putting investors’ interests first. Hart’s faithful and consistent application of a tried and true approach won the day, though.

Hart has taken the road less hyped at JPMorgan Equity Income OIEIX, and it has made all the difference. Since taking over this fund in August 2004, she has avoided high-flying disrupters that tend to get lots of attention and lofty valuations and has favored established and often unappreciated companies that pay reliable dividends and can sustain yields of at least 2%. The portfolio of about 100 stocks has given its shareholders exposure to yield-rich, value-leaning sectors, such as financials and industrials, but it has been no yield-chaser. Hart often has steered the fund away from areas and stocks that have enticing yields but deficient business models, such as utilities or basic materials. That speaks to her competitive advantage. There’s nothing special about Hart’s process—many rivals claim to practice similar dividend-focused approaches—but her steady discipline and temperament in applying it has made the fund a compelling core holding.

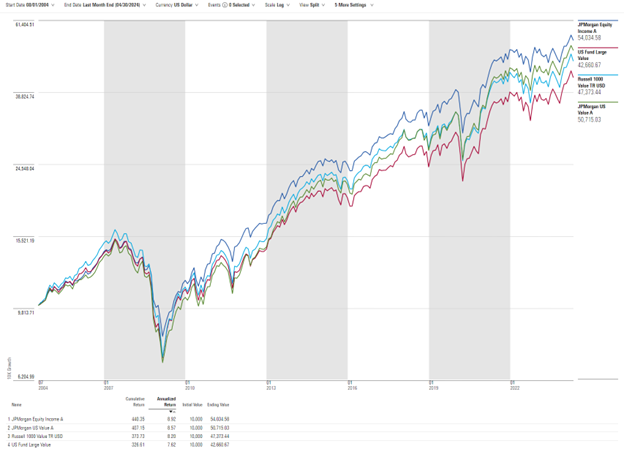

Hart plans to retire in the fall of 2024 but has instilled successors Andrew Brandon and David Silberman, her comanagers since 2019, with the same philosophy and ethos. And she’ll leave behind a sterling record in a very competitive part of the market. Since the August 2004 start of Hart’s tenure through the end of April 2024, the fund’s 8.9% annualized gain beat the large-value Morningstar Category by more than a percentage point and the Russell 1000 Value Index by more than 70 basis points. Since the November 2006 start of the FTSE High Dividend Yield Index through March 2024, JPMorgan Equity Income’s 8.3% return roughly matches the return of the dividend-yield-focused benchmark. Hart also has put up respectable results during her no less lengthy tenure at the smaller JPMorgan US Value VGRIX. Hart, who has more than $1 million invested in both funds she runs, has quietly and responsibly served investors well for two decades.

JPMorgan's Clare Hart Has Delivered Consistently Solid Results

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/b41a1177-9e6e-486c-bb45-434ac569d47e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-14-2024/t_958dc30e28aa4c8593f13c19505966e3_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b41a1177-9e6e-486c-bb45-434ac569d47e.jpg)