Is Now the Time for Munis?

Here are three municipal-bond funds we like.

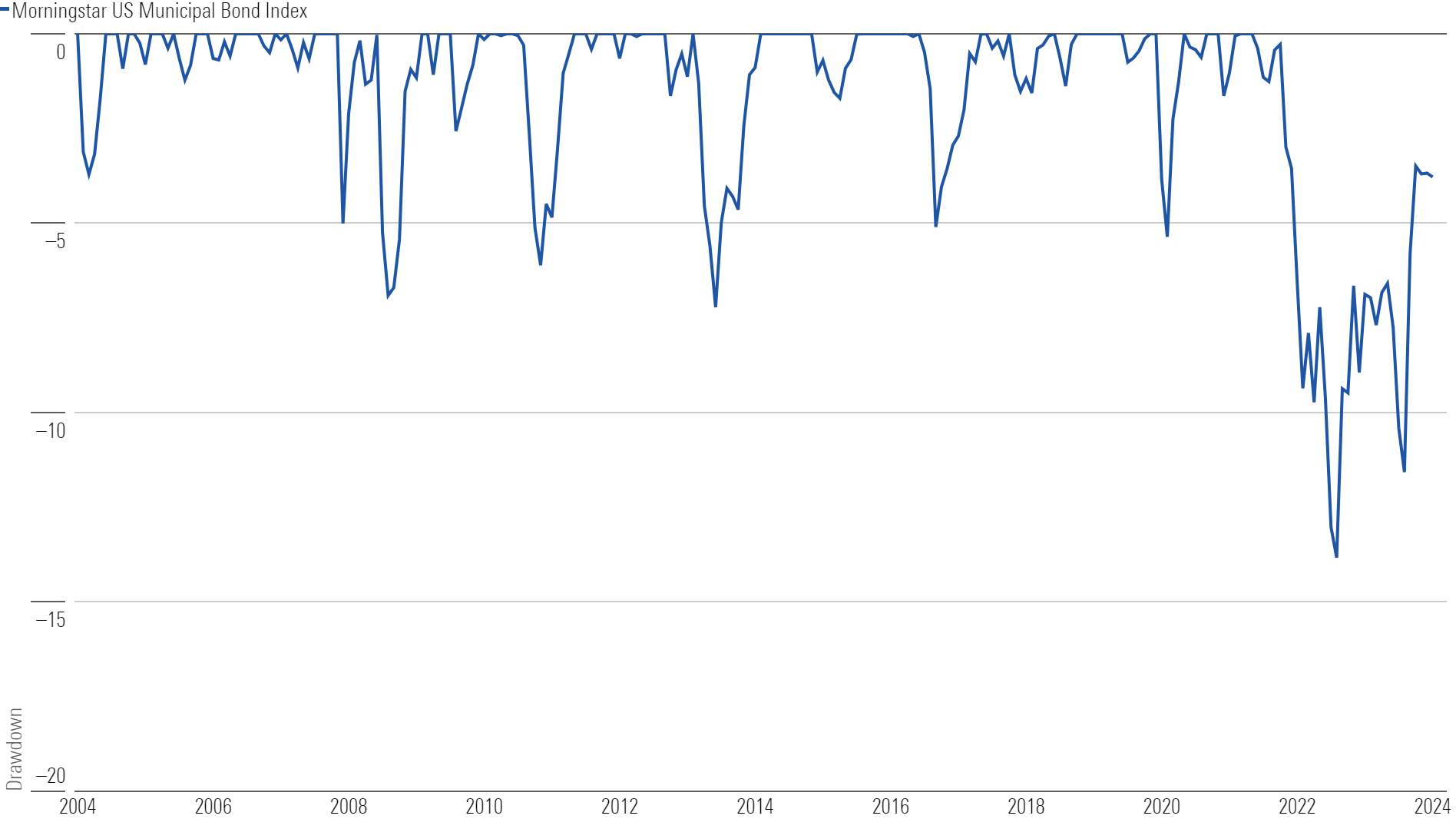

Municipal bonds’ challenges could provide an opportunity for investors. Those challenges were acute in 2022, when rising interest rates from a low base led to severe downward repricing of bonds. The Morningstar US Municipal Bond Index lost 9.2%, while muni funds experienced record outflows of $120 billion as investors had no appetite for assets that bore interest-rate risk.

The muni market historically recovers in equitylike fashion after a downturn like 2022, but this time was different. Interest-rate volatility and fears around a potential recession lingered in 2023, and performance and flows remained muted for most of the year. Through October of last year, munis were on pace for a second-consecutive year of losses for the first time since 1981 until the Morningstar US Municipal Bond Index rallied 9% during 2023′s final two months and finished the year in positive territory.

Munis Historically Had Steep Drawdowns but Swift Recoveries Until 2022

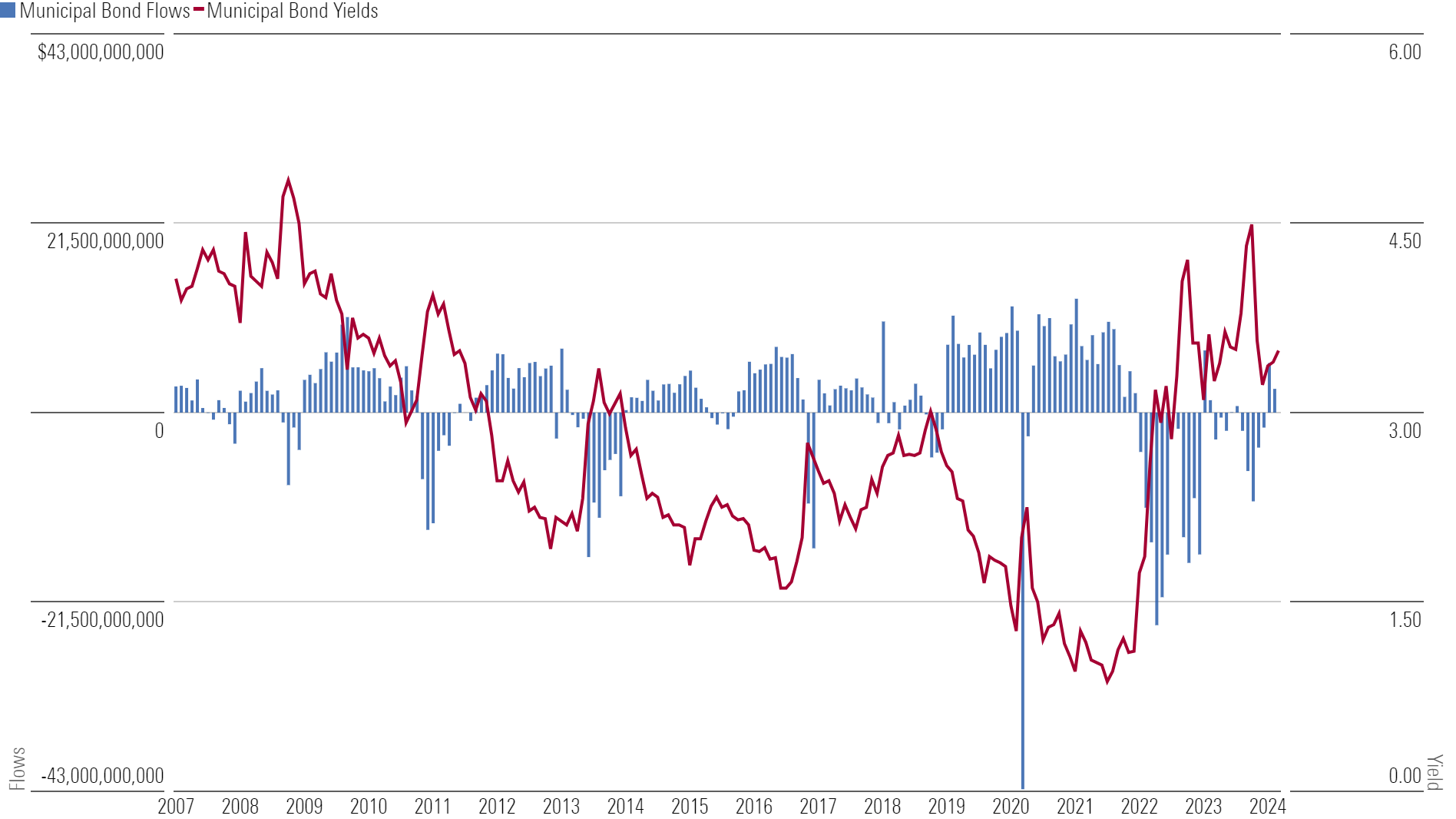

Munis look a little brighter in 2024. Tax-free income sets munis apart from their taxable-bond counterparts, including money market funds, into which investors have poured money over the past two years because of their safety and high yields. Now, after years of low interest rates, investors can enjoy the highest level of tax-free income since 2011. There’s also potential for price appreciation if interest rates follow the market’s expectations lower in the next year.

High Yield Levels Have Drawn Investors to Munis in the Past

But munis come with risks. If yields climb higher, their prices would fall. And while the market consists of mostly high-quality bonds with historically low default rates, credit risks still exist, especially if the US economy enters a recession.

Like all markets, timing munis is difficult, and they are best suited for long-term investors. Whether the muni market remains volatile or finds its footing, here are three time-tested muni funds that we like.

Fidelity Intermediate Municipal Income FLTMX, which earns a Morningstar Medalist Rating of Silver, is backed by an experienced team that draws upon comprehensive proprietary tools to identify mispriced bonds in the muni market. Strong security selection has delivered positive results over the long term, and the team’s focus on mid- and high-quality bonds has protected investors from big losses during previous periods of market volatility.

This team keeps a close eye on liquidity, steering clear of large stakes in troubled names, and eschews securities that can add volatility, such as tender option bonds. The team also keeps the portfolio’s duration close to its Bloomberg 1-17 Year Municipal Bond Index. These tactics should set the fund up for strong relative results if muni markets decline.

A well-resourced and highly collaborative team operates Silver-rated Vanguard Intermediate-Term Tax-Exempt VWITX. Its risk-aware and consistent process has delivered strong risk-adjusted returns over the long term and has kept the strategy out of trouble in tough muni market stretches.

The team aims to construct a diversified portfolio that typically has a much higher-quality bias relative to peers, with the bulk of the portfolio’s assets allocated to AAA and AA rated bonds. The team keeps its duration close to the Bloomberg Municipal 1-15 Year Index’s but will tactically move duration with guidance from a senior investment committee.

The strategy’s low price tag and risk-conscious positioning provide a modest advantage in stress periods and have served the fund well over time. The strategy doesn’t need to take large bets to remain competitive because of the ongoing advantage of ultralow fees.

Bronze-rated T. Rowe Price Summit Municipal Intermediate’s PRSMX standout team and compelling and repeatable process make it a strong pick. Veteran muni manager Charlie Hill prudently constructs this portfolio. The team uses in-depth research and solid quant tools to find value across the muni market, and it avoids heavy stakes in the riskiest bonds.

Hill avoids loading up on instruments that add volatility, such as leveraged inverse floaters and derivatives, and keeps duration close to its Bloomberg Municipal 1-15 Year Index. Returns may lag when muni markets are strong, but the research-intensive approach has cushioned the blow of market downturns and paid off long term. Over the past decade, volatility has remained muted, and risk-adjusted results are competitive.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)