Investors Didn't Flee All Equity Funds Last Month

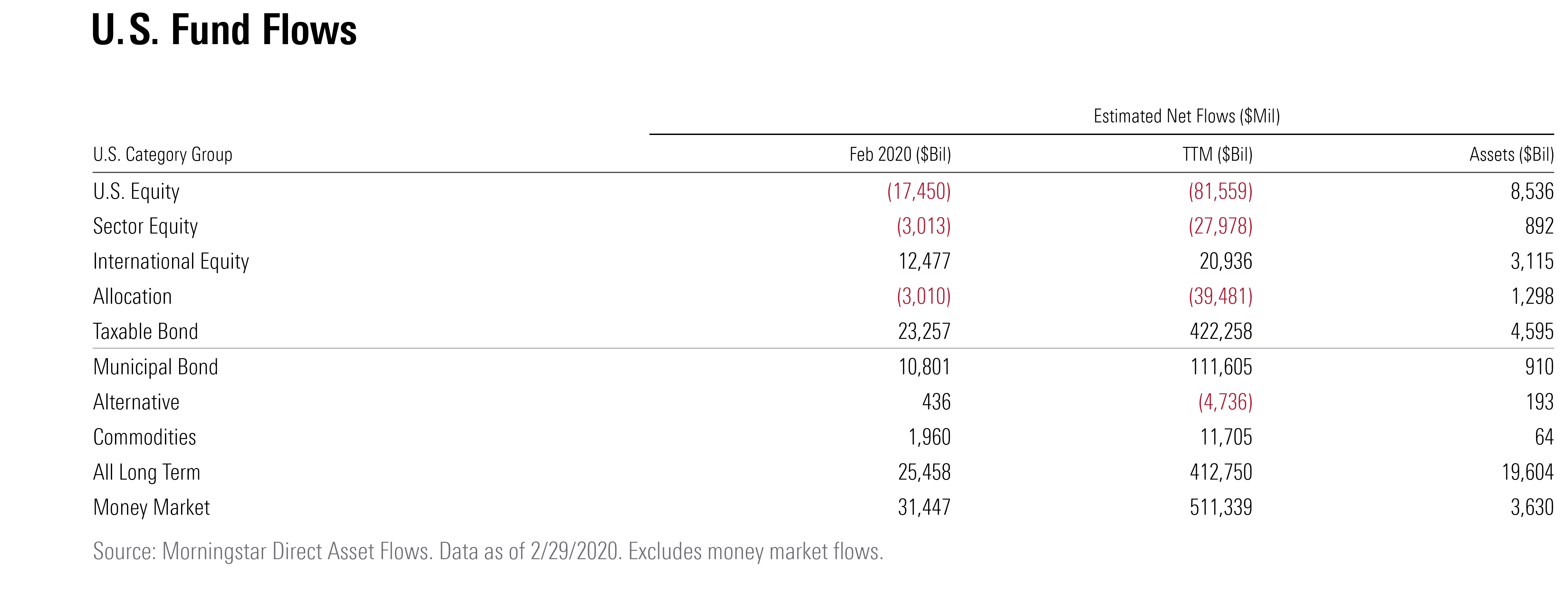

Investors left U.S. equity funds last month and turned to bond and money market funds instead.

Note: This is an excerpt from the Morningstar Direct U.S. Asset Flows Commentary for February 2020. Download the full report.

The S&P 500 closed at an all-time high on Feb. 19, 2020, only to fall sharply as fears of the coronavirus gripped the global economy. The index lost 8.2% for the month. As evidence of investors' lack of enthusiasm for U.S. equities, these funds shed $17.5 billion amid the stock market's turmoil, with that group's actively managed funds suffering nearly $20 billion in redemptions.

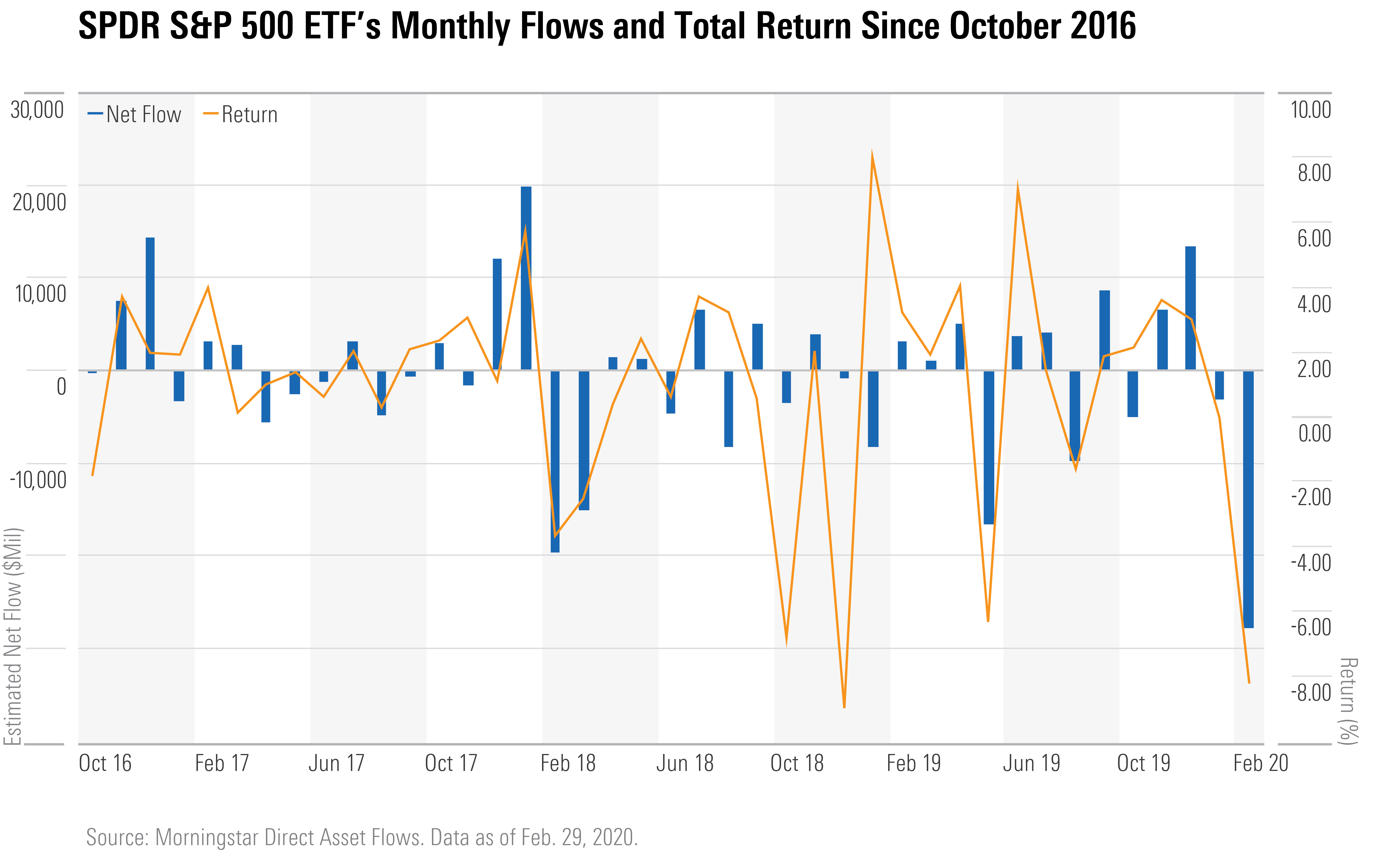

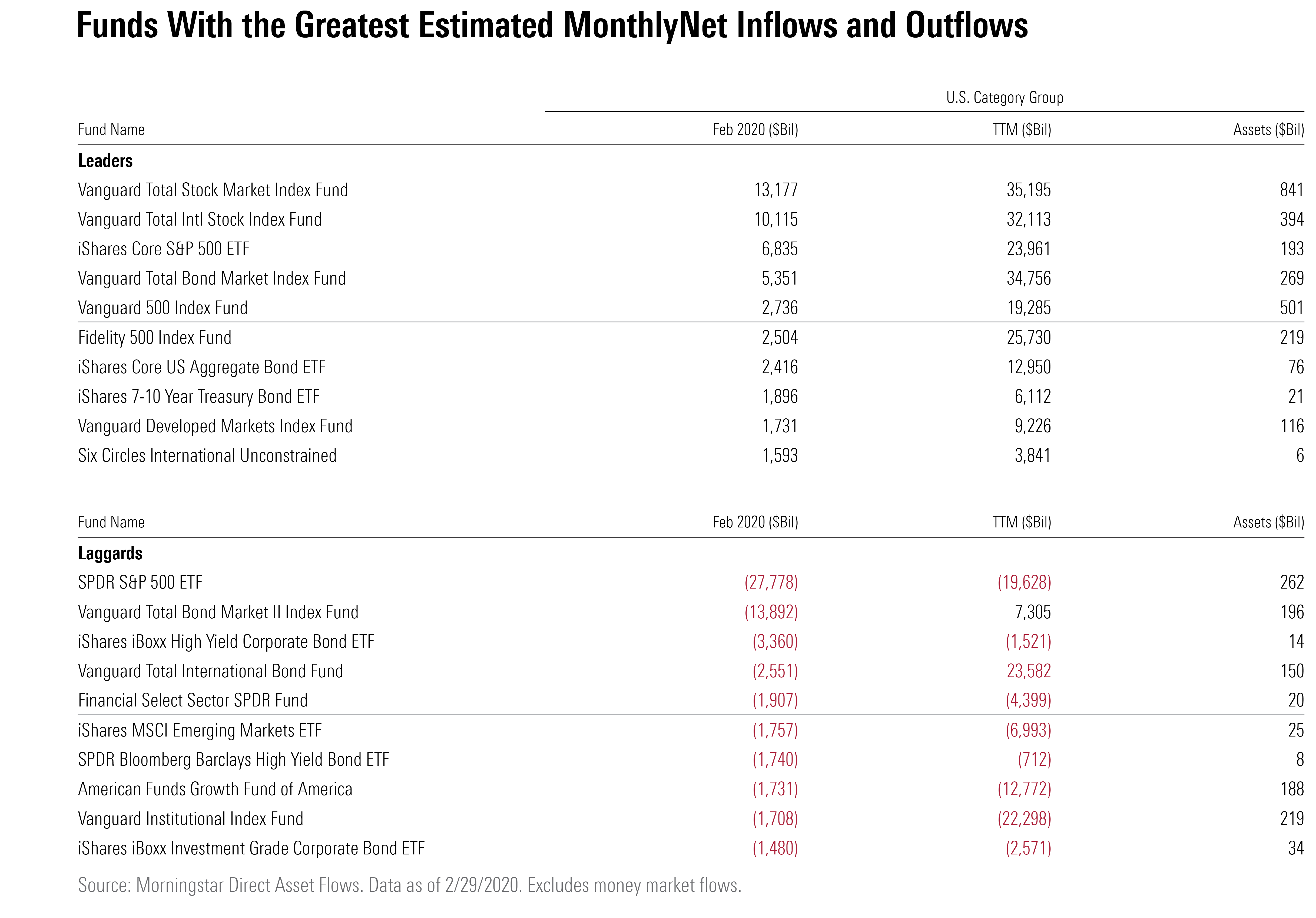

Among U.S. equity funds, SPDR S&P 500 ETF SPY saw a record $27.8 billion of outflows--its worth-ever month.

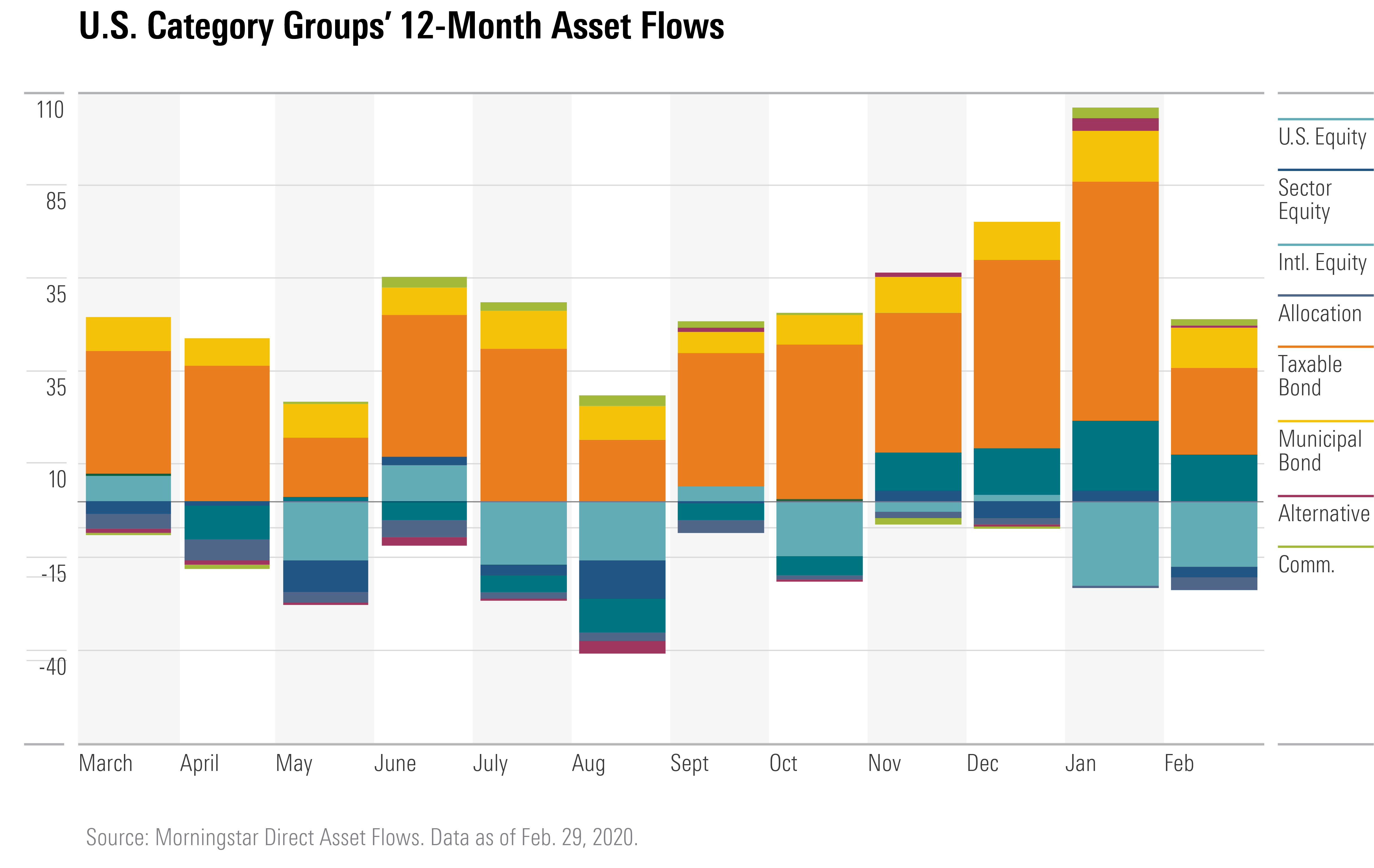

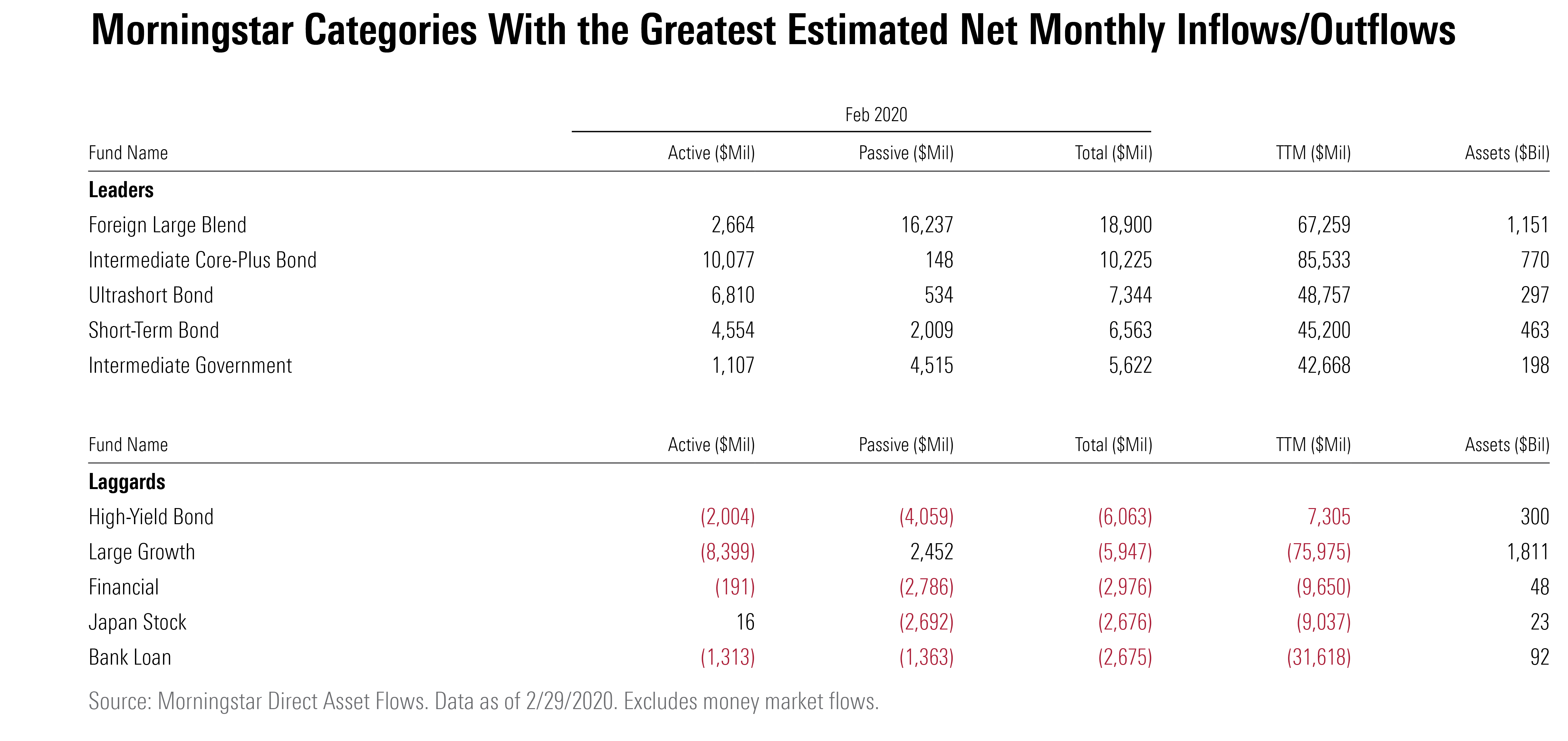

Investors turned to bond funds and money market funds instead. Taxable-bond funds posted their 14th consecutive month of inflows. Long-government funds had their strongest inflows since 2019 as investors hedged their equity positions and appeared willing to take interest-rate risk instead of credit risk.

Investors pulled more than $6 billion from high-yield bond funds, which court more credit risk and tend to be highly correlated with equity markets. The high-yield bond Morningstar Category's monthly outflows were its worst since December 2018, near the end of the last major correction in equity markets. Furthermore, for the first time since October 2019, money market funds gathered more assets ($31.4 billion) than long-term funds ($25.5 billion)

Not all equity categories suffered outflows. International-equity funds gathered $12.5 billion. With coronavirus worries affecting numerous international markets (such as China, South Korea, and Italy), investors sought core large-cap exposure. Foreign large-blend funds took in almost $19 billion in net long-term flows--their second-strongest monthly inflow behind July 2015's $21 billion. Investors withdrew about $2.7 billion from Japan funds during the month. At $22.5 billion in total assets, the Japan stock category is less than half its size at its peak in November 2015.

/s3.amazonaws.com/arc-authors/morningstar/a25c5a3e-6a5c-495e-9278-eb867855f392.jpg)

/s3.amazonaws.com/arc-authors/morningstar/c17460f8-595a-4e95-a06c-f1e4fd09d811.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a25c5a3e-6a5c-495e-9278-eb867855f392.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c17460f8-595a-4e95-a06c-f1e4fd09d811.jpg)