A Better Way to Look at Allocation Funds

We're moving from the three-category conservative-, moderate-, and aggressive-allocation system to an expanded five-category framework for allocation funds.

Morningstar periodically makes changes to the Morningstar Category system, and a number of updates took place at the end of April 2016. [Ed. Note: The changes will be fully reflected on Morningstar.com in the coming days.] These modifications generally occur when we create or retire a category or refine a category definition. Today's article covers the most common questions related to updates to the allocation categories. We'll cover the addition of various equity, fixed income, and alternative investments categories in tomorrow's Fund Spy.

Why does Morningstar change its category system? We strive to keep our categories relevant for investors and reflect the realities of the investments being used. We incorporate our internal research, academic research, industry trends, and stakeholder feedback into our decision process. Since categories were introduced around 30 years ago, we've regularly reviewed our classifications to ensure the assignments provide meaningful insight for investors. We now perform this analysis annually. Currently, we have around 120 categories for the 10,000 registered mutual funds that we classify in the United States. When we first launched categories around 1988, there were only eight.

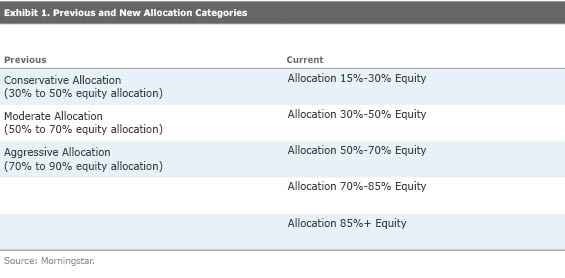

What's changing for allocation funds? Our allocation categories generally house funds that offer investors a mix of stocks and bonds, and they include the world-allocation, tactical-allocation, and target-date groups. The biggest change in this area was our move from the three-category conservative-, moderate-, and aggressive-allocation system to an expanded five-category framework. Exhibit 1 summarizes that category system, both before and after the April 2016 updates.

We globally reviewed the landscape for multiasset products and found that a more nuanced framework would better serve investors. Many firms offer more than three risk-tailored multiasset fund strategies, and, in fact, we've seen as many as nine in some multiasset models. After significant review and deliberation, we've concluded that five risk buckets will best serve investors. We evaluated the three-year average holdings and performance of all allocation funds and observed stratification in line with the new five-category allocation system. The change in naming convention--with the equity allocation ranges included in the name of the category--should also provide a clearer indication to investors of why the funds are grouped together within each category.

How much did the funds move among categories as a result of the new allocation framework? Even though we moved to a five- from a three-category system, changes to funds' categories were relatively marginal. That's because the equity allocation ranges that guided the prior system largely carried over to the new one. For instance, the moderate-allocation category included funds that had 50% to 70% equities, and those funds map directly to the new Allocation 50%-70% Equity group. As a result, traditional 60/40 equity/fixed-income balanced funds saw no category movement.

Some of the more notable changes resulted from funds that were part of a target-risk series moving from equity style box categories into the new Allocation 85%+ Equity category. They include funds such as

Although we use quantitative guides--such as funds' equity allocation ranges--when assigning funds to categories, we also qualitatively review category changes. A fund company may appeal its fund's categorization, but we ultimately determine each fund's Morningstar Category. We generally reject appeals that are based only on a philosophical difference in the category definition. Successful appeals typically provide information demonstrating that our analysis is incomplete or inaccurate.

How do the category updates affect Morningstar Ratings? Morningstar Ratings for funds, or star ratings, are relative to the category assigned for the month for which the rating was produced. Each month, funds hit their three-, five-, or 10-year anniversary or are merged or liquidated. Morningstar also monitors funds' portfolios and investment strategies to ensure that there hasn't been a change in the underlying strategy. About 15% of share classes--approximately 1,500 funds--saw a ratings change due to category reassignments. Of the funds that had a star-rating change, about 90% had a change of only 1 star.

What's not changing? Our review showed that multiasset funds tend to have a clear geographic tilt, with either a domestic or global focus. Our research also shows that funds that are measurably demonstrating tactical rotation offer a different investment proposition to investors. The additional trading and volatility common in these funds make them poor substitutes for other allocation products. As a result, the world-allocation and tactical-allocations categories remain intact. Funds in the world-allocation category typically have at least 40% of assets in non-U.S. stocks or bonds, while funds in the tactical-allocation group have to demonstrate material allocation shifts between asset classes. We define "material" in a few ways, including a cumulative shift between asset classes of 15% or greater using rolling average three-month periods.

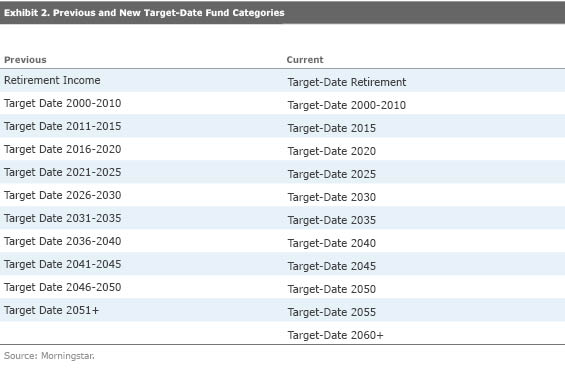

Did target-date fund categories see any changes? Updates to target-date fund categories were fairly straightforward. For one, we launched a Target-Date 2060+ category. It has been five years since we last launched the 2051+ category, and in that time, we've seen the launch of 36 distinct 2060 target-date mutual funds.

Additionally, we simplified the names to reflect the industry's settling on issuing target-date funds in five-year increments. This also included renaming the Retirement Income category to Target-Date Retirement to more clearly reflect that group's housing of target-date series' terminus funds. Exhibit 2 shows the current and previous target-date categories.

/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)