5 Top-Performing Core Bond Funds

Offerings from Baird, Fidelity, and JPMorgan are among the best intermediate core bond funds.

Bond fund investors continue to experience a seesaw market. After a rally in late 2023, 2024 has started on a sour note, with many funds posting losses. Still, their declines are minor compared with 2022′s record-setting ones.

The dominant force affecting bond fund returns continues to be swings in interest rates. As a result, funds that have outperformed in recent years tend to invest in higher-quality corporate debt or other debt that’s less susceptible to fluctuating interest rates.

We looked for the top-performing intermediate core bond funds over the last one-, three-, and five-year periods. The funds that made it through the screen are:

- Baird Aggregate Bond BAGIX

- Fidelity Intermediate Bond FTHRX

- JPMorgan Mortgage-Backed Securities JMBUX

- Fidelity Advisor Investment Grade Bond FIKQX

- Neuberger Berman Core Bond NRCRX

Notably, all these funds are actively managed.

Core Bond Fund Performance

Amid the rocky start to 2023, the intermediate core bond category beat the Morningstar US Core Bond Index by 0.08 percentage points over a 12-month period. Over a three-year period, the index and the category showed losses of 2.63 and 2.61 percentage points, respectively, due to 2022′s high interest and higher inflation rates.

Intermediate Core Bond Funds vs. the US Core Bore Index

What Are Core Bond Funds?

As the name suggests, core bond funds are a foundational investment in many investors’ portfolios, and they’re common options in 401(k) plans.

These funds typically hold around 40% of their portfolios in US Treasuries, 25% in mortgage-backed securities from government agencies, and 25% in investment-grade corporate bonds. Portfolios with core bond funds offer a diversified product that gives investors exposure to investment-grade securities within the fixed-income market.

Screening for the Top Core Bond Funds

To find the best-performing intermediate core bond funds, we looked at the ones that posted the best returns over multiple periods.

We first screened for funds in the top 33% of the category using their lowest-cost share classes over the past one-, three-, and five-year time frames. We then filtered for those with Morningstar Medalist Ratings of Gold, Silver, or Bronze for those classes. Any funds with asset bases of less than $100 million and analyst input percentages under 80% were excluded. Five funds made the cut.

Because the screen was created with the lowest-cost share class for each fund, some may be listed with share classes not accessible to individual investors outside of retirement plans. The individual investor versions of these funds may carry higher fees, reducing returns for shareholders.

Long-Term Returns of Top-Performing Core Bond Funds

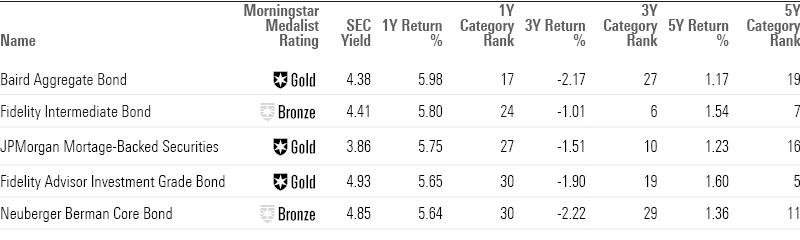

Top-Performing Core Bond Funds

Baird Aggregate Bond

- Morningstar Medalist Rating: Gold

- Morningstar Rating: 5 stars

- SEC Yield: 4.25%

“Citing the difficulty of predicting interest-rate changes consistently, Baird’s approach begins with matching this fund’s overall interest-rate sensitivity, or duration, to the Aggregate Index. Aiming to beat this by 25-50 basis points per year, gross of fees, the team tries to add value through yield-curve positioning, sector allocation, security selection, and competitive trade execution.

“Since its late 2000 inception, its institutional shares’ 4.32% annualized gain through January 2024 beat the Aggregate Index by 47 basis points while placing it in the top quintile out of roughly 65 distinct intermediate core bond category peers.

“The fund continually beats inflation as measured by the Consumer Price Index. From its 2000 inception through December 2023, the fund grew each initial dollar invested into $2.68, ahead of the roughly $1.77 required to maintain purchasing power.”

—Alec Lucas, director

Fidelity Intermediate Bond

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 5 stars

- SEC Yield: 4.41%

“Historically, the strategy has preferred corporate bonds, investing roughly 40% of its assets in them at any given point, while US Treasuries typically range from 20% to 40%. That said, to take advantage of current higher market yields while maintaining liquidity in the portfolio given the team’s expectation of potential market dislocation, the portfolio’s Treasury stake as of June 2023 stood at 45%. The strategy traditionally limits its out-of-benchmark securitized stake to 10%-20%, which is on the lower end for this strategy’s peer group.”

—Saraja Samant, analyst

JPMorgan Mortgage-Backed Securities

- Morningstar Medalist Rating: Gold

- Morningstar Rating: 5 stars

- SEC Yield: 3.86%

“The strategy’s relatively unique contours, including its absence of corporate bonds, cause it to lag most rivals in periods favorable to credit, but its high-quality, mortgage-centric holdings tend to give it a boost when credit is out of favor. This resiliency and strong security selection have paid off with compelling long-term results.”

—Paul Olmsted, senior analyst

Fidelity Advisor Investment Grade Bond

- Morningstar Medalist Rating: Gold

- Morningstar Rating: 5 stars

- SEC Yield: 4.93%

“Collaboration is central to the strategy’s relatively constrained but effective process. Moore and Plage, for example, adjust sector allocations and yield-curve positioning when they determine pockets of value in various sectors. In addition to its core holdings in US Treasuries, agency mortgages, and investment-grade corporate credit, the strategy may hold up to 10% in below-investment-grade debt, though exposure has typically been 5% or less.”

—Mike Mulach, senior analyst

Neuberger Berman Core Bond

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 4 stars

- SEC Yield: 4.85%

“Like most core bonds, this strategy often features healthy stakes in agency mortgage-backed securities, investment-grade credit, and Treasuries. Indeed, these core holdings accounted for 81% of portfolio assets as of January 2024. The managers’ willingness to dabble in less frequently trodden areas of securitized debt differentiates this strategy from its more conservative peers. Its yield tends to be higher than its average intermediate core bond Morningstar Category peers, in part because of these more adventurous stakes.

“The strategy stood tall through multiple market environments in 2023; its 6.09% gain was better than more than two-thirds of distinct competitors. Deft corporate credit security selection contributed to outperformance during the year’s first quarter when credit markets were under stress amid regional banking troubles. The strategy outperformed during the end-of-year rally as well, thanks partly to comanagers’ focus on high coupons within their agency MBS allocation.” – March 5, 2024

—Max Curtin, associate analyst

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)