Analyzing the Recent Performance of the Morningstar Quantitative Rating for Funds

We check in on our accuracy.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

Given recent market volatility, how has the Morningstar Quantitative Rating for funds performed?

In June 2017, Morningstar launched the Morningstar Quantitative Rating for funds to enlarge the universe of funds under coverage. This rating uses a machine-learning model that is trained on our analysts’ past ratings decisions and the data used to support those decisions. The model allows us to extend the reach of Morningstar’s research process to all the funds that our analysts don’t currently cover. The rating has the same Medalist iconography and can be interpreted in the same way as the Analyst Rating--higher-rated funds are those that we have more confidence to outperform over a full market cycle. Through the combination of both the Morningstar Analyst Rating and the Morningstar Quantitative Rating, we provide a forward-looking assessment for nearly every fund and exchange-traded fund globally.

In this piece, we examine the Quantitative Rating’s performance during the recent market events in first-quarter 2020 as well as the trailing one-year, two-year, and since-inception performance. For the purposes of this analysis, we do not include analyst-rated funds in this study.

Since launch, funds with Morningstar Medalist Quantitative Ratings (those funds with a Gold, Silver, or Bronze designation) performed better than their category average during all time periods analyzed.

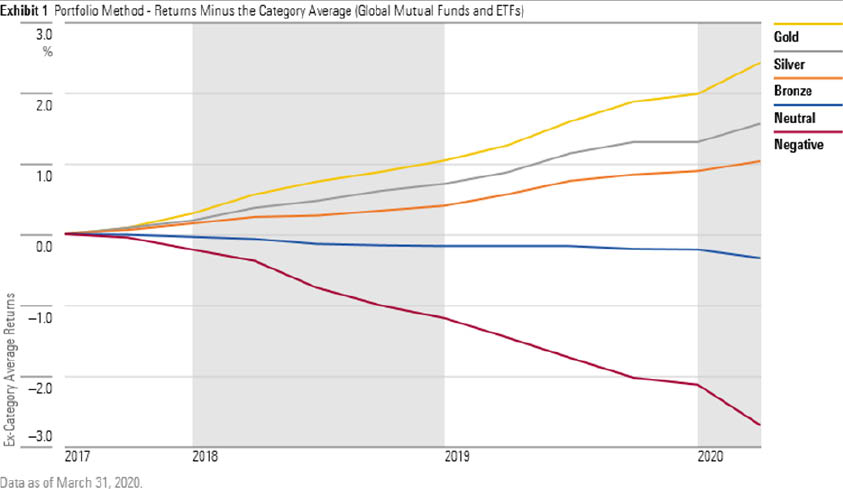

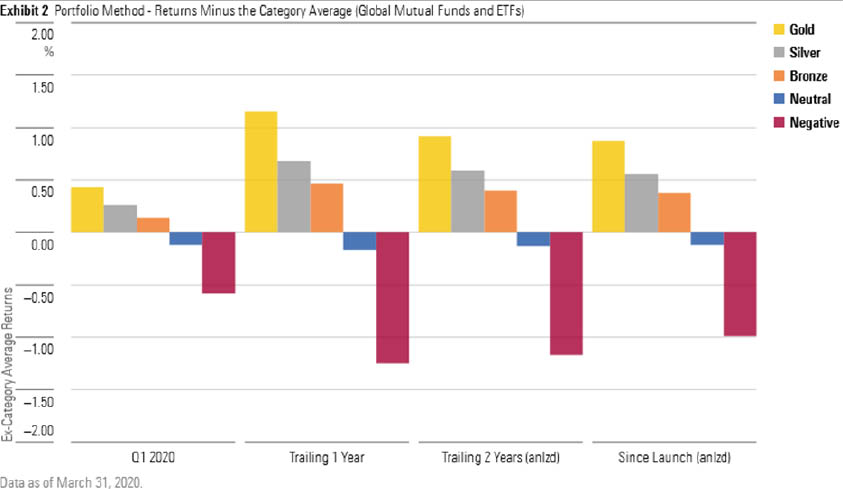

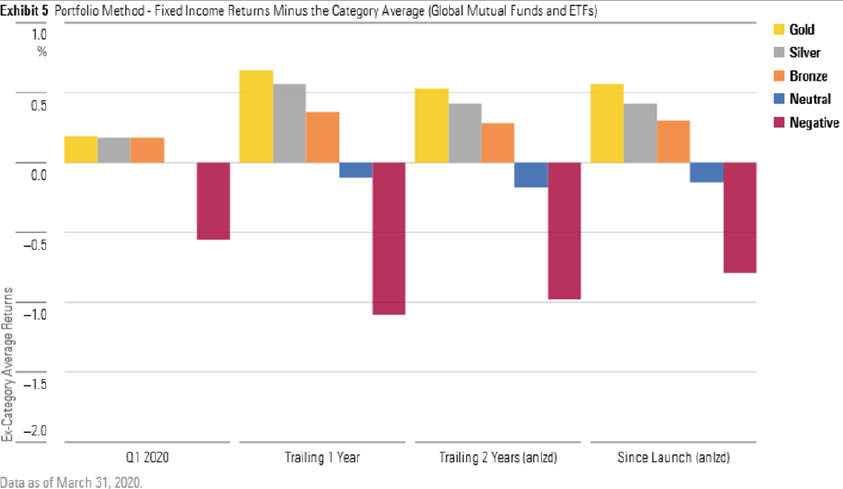

The portfolio method creates five portfolios that group the fund universe into distinct buckets based on their rating. Returns shown in all the charts are the fund’s returns minus the fund’s category average return. This allows us to group funds from different asset classes and categories together into the same ratings bucket. For example, the performance of the Gold portfolio would be the outperformance versus category of investing in every gold-rated fund each month on an equal-weighted basis.

In Exhibit 1, the performance of the different rating portfolios is very stable. Gold consistently outperforms and negative underperforms each month. The consistency means that the Quantitative Rating is a good selection tool regardless of the market environment. Exhibit 2 shows the same underlying data as Exhibit 1 but aggregates the returns into discrete time periods.

In first-quarter 2020, medalist funds outperformed their category peers monotonically by rating level, implying that the rating system is working as intended. The best-rated funds should perform the best.

Expanding to longer time periods, we see that this sorting behavior holds up--namely, that Gold-rated funds tended to outperform category peers by a little less than 1% per year, while Negative-rated funds underperformed their category peers by about the same margin. All rating systems hinge on their ability to identify winners and losers, so on this metric, it’s certainly a strong showing.

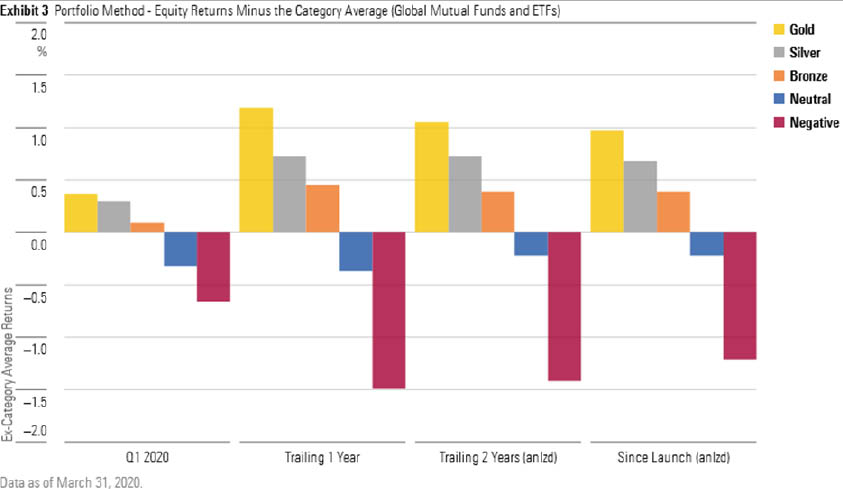

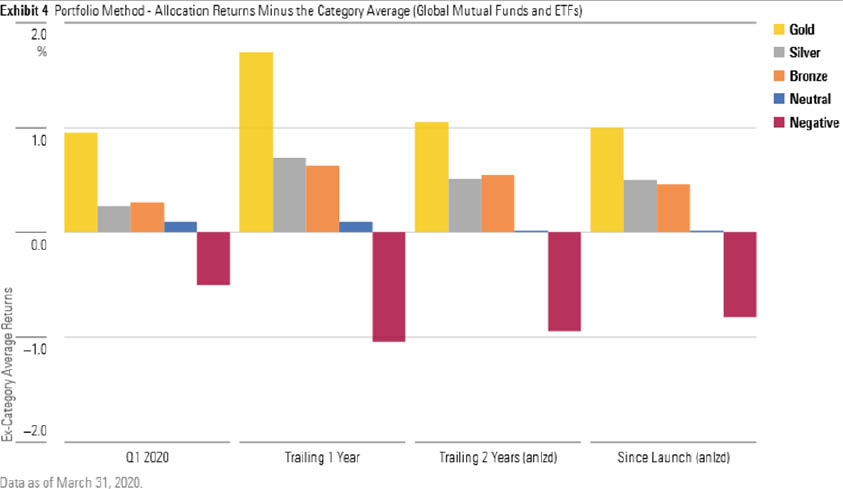

How does performance vary by asset class? The Morningstar Quantitative Rating performed quite superbly in each asset class and across time. But it performed the best in the equity asset class, followed by allocation and then fixed income.

Top-rated equity funds have consistently delivered positive excess category returns. What is especially notable is the performance of Bronze- and Silver-rated funds, where the annualized outperformance has hovered around 0.50% per year. Neutral-rated funds have also underperformed category peers, which implies that there is a density of winners among the highest-rated groups. This data is showcased in Exhibit 3.

In Exhibit 4, we see that the top-rated allocation funds performed the best among all cohorts during the first-quarter 2020 market volatility, with Gold-rated funds delivering on average 1% above category performance during the first quarter alone (not annualized). Across the longer time periods, we see a similar pattern emerge, with top-rated funds consistently beating their peer groups. Negative-rated funds, however, did not experience as significant average underperformance.

Of the three asset classes, fixed income performed the worst, with top-rated funds not beating category peers by as significant a margin. We believe that this is due to the lower return potential of fixed income. An asset class that has expected returns of 4% will have less opportunity for large outperformance than an asset class with 10% expected returns. In other words, the distribution of excess returns is tighter around the category average midpoint. However, the consistency of performance shows up well, with monotonic sorting observed in all time periods studied as evidenced in Exhibit 5. The one exception to this trend is that, in the first quarter of 2020, all Medalist-rated funds performed quite similar to each other.

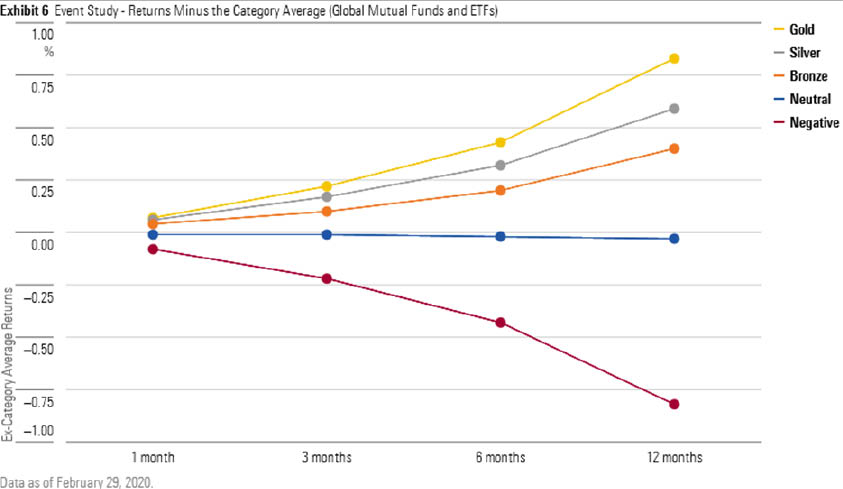

Is this what an investor would have experienced? A reasonable question to ask is whether an investor could actually experience this outperformance or whether these results are merely an artifact of carefully selected timing or coincidence. At Morningstar, one of the most important tests that we use to evaluate ratings efficacy is called an Event Study. It seeks to measure the typical experience an investor would have from using our ratings system on any given day. In other words, what would the typical investor on the typical day have experienced for different holding periods?

In Exhibit 6 below, we show that buy-and-hold investors of time periods from one month to one year have experienced immediate and lasting cumulative gains from investing according to the Morningstar Quantitative Rating for funds since its launch in June 2017. For the one-year holding period (regardless of start date), Gold-rated funds tended outperform category peers by nearly approximately 0.80%. Negative-rated funds underperformed category peers by a similar margin.

Conclusion The Morningstar Quantitative Rating for funds has proved thus far to be an effective tool for screening the fund universe and can be relied upon as an input to an investment decision when Morningstar analysts do not cover a fund.

/s3.amazonaws.com/arc-authors/morningstar/c74d4d3f-815a-4572-abc0-0c5949833461.jpg)

/s3.amazonaws.com/arc-authors/morningstar/54a49476-491f-4995-97f9-3a1f5e565321.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c74d4d3f-815a-4572-abc0-0c5949833461.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54a49476-491f-4995-97f9-3a1f5e565321.jpg)