Look to Equity ETFs for Income

The new Morningstar Yield data point shows that equity exchange-traded funds tend to be a promising option.

Morningstar's trailing 12-month yield data point was revolutionary when first introduced many years ago because it provided an estimate tailored to each share class that accounted for fees and capital gains distributions. While it remains useful today as a screening tool to compare one-year fund yields, the estimate has shortcomings. It doesn't always convey an investor's actual experience over the past year of holding a security, especially if a security makes an unusually large or small distribution, and the 12-month period is inflexible.

The new Morningstar Yield data point overcomes all these shortcomings and more. It taps Morningstar's granular distribution data to provide detailed income characteristics over any period. Morningstar Yield represents a more accurate look at an investor's actual experience by using an investment's net asset value on a theoretical purchase date rather than its most recent month-end price. Furthermore, it assumes income is not reinvested, unlike yield to maturity, aligning with typical assumptions made by actual income investors.

Morningstar Yield can also show the income volatility and the tax efficiency of managed products, which are important but largely unanalyzed characteristics for investors looking for income. Considering those elements, exchange-traded funds tend to be a better income option than open-end funds and can frequently provide more income than Treasuries in a depressed rate environment.

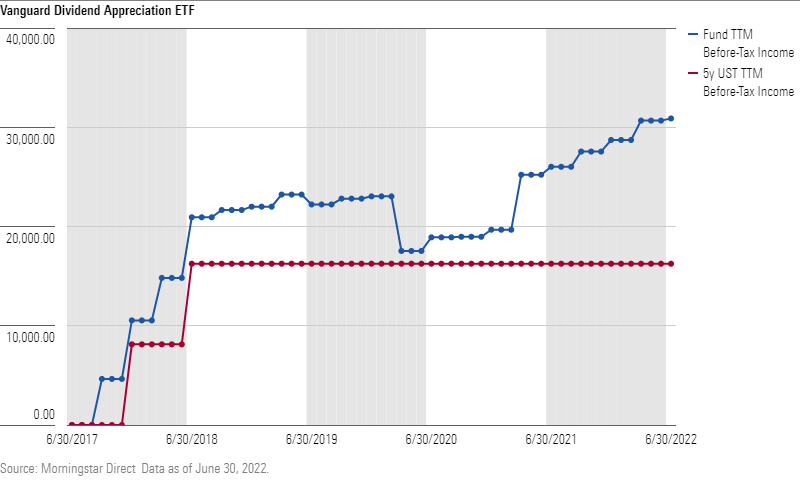

Equities Can Provide Steady Income Even Through Downturns

Despite a turbulent 2020, many equity funds were able to continue offering consistent and growing income payments. Investors would do well to consider such options as an income source, especially in a low-rate environment. Morningstar Yield suggests they may be superior income opportunities over a given period compared with Treasuries maturing after a comparable period, even over a volatile period such as the coronavirus drawdown.

Exhibit 1: Vanguard Dividend Appreciation ETF's Income History

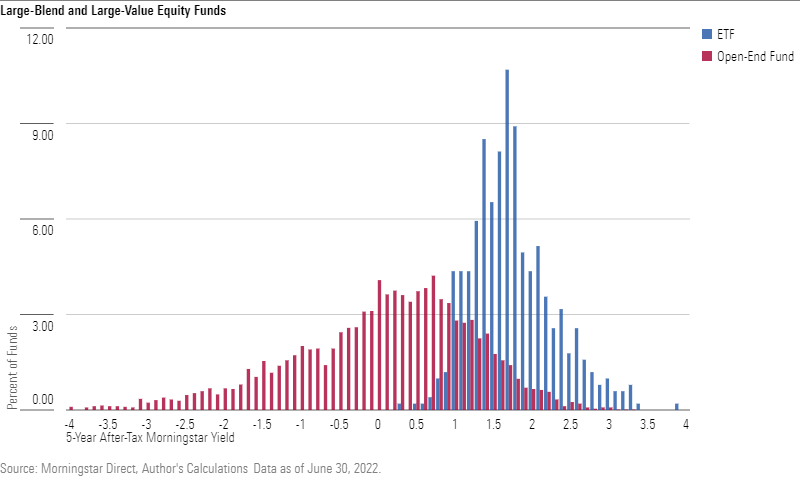

Vehicle Critical for Taxable Accounts

In a taxable account, open-end funds that lack an ETF share class, as many Vanguard index funds do, should not be relied upon as a source of income because of the large capital gains distributions they make as investors liquidate shares of the fund or managers sell profitable holdings to reinvest in more-attractive opportunities. Since Morningstar Yield assumes that all capital gains are reinvested to avoid eating into principal, capital gains tax bills must be paid with cash on hand and thus function as negative income to the end investor. Meanwhile, owing to the mechanisms of ETF share creation and in-kind redemption, equity ETFs rarely distribute capital gains, leading to much better aftertax income in taxable accounts.

Exhibit 2: Equity ETFs Are Superior for Aftertax Equity Income

A negative aftertax Morningstar Yield implies that investors had to pay more in capital gains tax than they received in income over the five-year period.

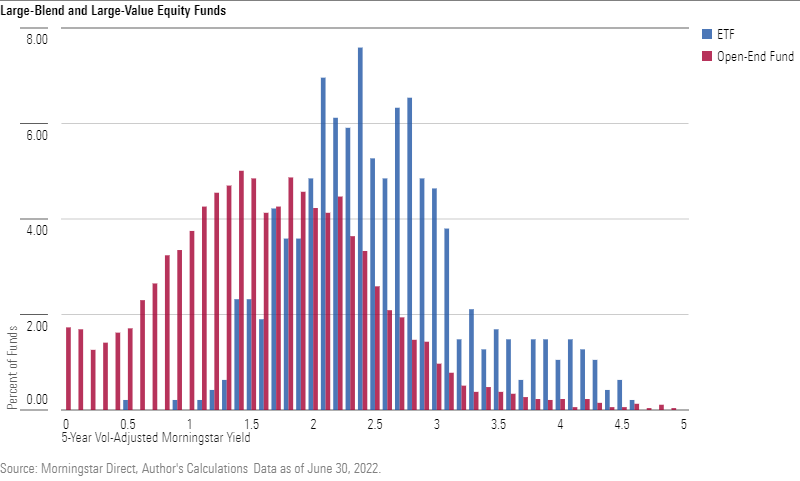

ETFs Have Higher Volatility-Adjusted Income

An income volatility adjustment can be applied to the rolling 12-month income streams to penalize managed investments, which force investors to endure sudden, sharp drops in income. ETFs typically have lower income volatility than open-end funds.

Exhibit 3: ETFs Provide Better Volatility-Adjusted Income

With lower income volatility, higher income distributions, and better tax efficiency, income-seeking investors would do well to consider equity ETFs with a strong history of raising dividends.

/s3.amazonaws.com/arc-authors/morningstar/a9934929-bc1b-4947-9568-208bd9d6ba90.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a9934929-bc1b-4947-9568-208bd9d6ba90.png)