Global Yields Continue to Collapse

ECB commences corporate bond purchases.

Last week saw new all-time lows in government bond yields across the globe, driven by central bank intervention. The 10-year German bund traded just barely in positive territory at 0.02%, the U.K. gilt 10-year fell to 1.22% ahead of the June 23 referendum to leave the European Union, and the Japanese 10-year pushed further into negative territory at negative 0.15%. This helped weigh on the U.S. 10-year Treasury yield, which retreated 6 basis points to 1.64%, its year-to-date low, which is only about 25 bps wide of its all-time low reached in mid-2012. This comes on the heels of this week's Federal Reserve meeting, which is expected to be a nonevent with the market pricing in only a 2% chance that the Fed will raise rates in June but a 23% probability in July.

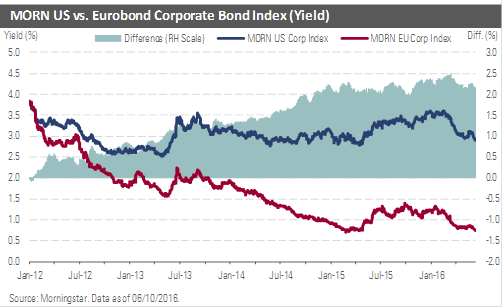

ECB Commences Corporate Bond Purchases Corporate bond spreads were fairly steady during the week, with the Morningstar Corporate Bond Index ending flat. Yields on the index compressed 5 bps along with Treasuries, ending at 2.91%, comfortably wide of the 2.52% low reached in May 2013. Yields on the Morningstar Eurobond Corporate Index continued to grind lower to 0.75%, bumping up against the all-time low of 0.72% in March 2015. The European Central Bank contributed to tight market technicals by commencing its European nonfinancial corporate bond purchase program. This is expected to be EUR 5 billion-10 billion per month, in comparison with an addressable market thought to be in the area of EUR 600 billion. The ECB reportedly dipped low into the investment-grade arena, even buying one name that contained only one of three ratings in investment grade. The chase for yield has brought global bond buyers to the United States, as thin European corporate bond yields provide limited upside.

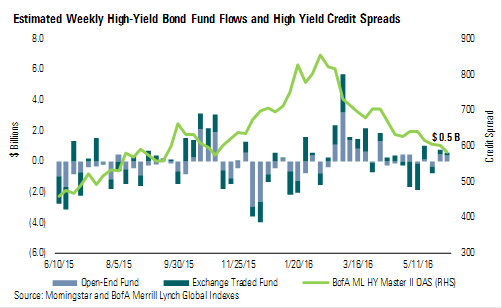

High-Yield Market Sustains Robust Returns In the high-yield space, the Bank of America Merrill Lynch High Yield Index tightened 11 basis points to an option-adjusted spread of +598 bps. Yields came in a like amount to about 7.27%. The index has produced a total return of 9.1% year to date, although we note that the B and BB buckets are somewhat lower at 7.6% and 8.0%, respectively. CCCs have produced an 18.4% return on a sharp recovery in the commodities space. Fund flows for high-yield funds and exchange-traded funds were positive for the second straight week at $0.5 billion, although modestly below last week's $0.8 billion.

The new issue market continued to be healthy, with total investment-grade and high-yield issuers covered by Morningstar at $11 billion. However, that was down meaningfully from the very strong $35 billion issued last week. Most deals priced in line with our fair values.

Rating Actions Slant to the Downside Morningstar had a number of rating actions last week. In the technology, media, and telecommunications sector, we downgraded CenturyLink CTL a notch to BB and brought Dish Network DISH down two notches to BB-, removing it from UR-. In the investment-grade space, we lowered Southern Copper SCCO two notches to BBB-. We upgraded Ford one notch to BBB and affirmed General Motors GM at BBB- but established a positive outlook.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)