Morningstar® EssentialsTM

Building investor confidence

with ratings investors trust.

We’re evaluating investments from the viewpoint of an investor. You can use our independent metrics to validate important details about your funds—like how your funds stack up to their peers or if we expect them to outperform over a full market cycle.

Expanded coverage to move the industry forward.

What do investors care about? Their preferences change over time. We too are constantly evolving, from our new sustainability metrics to the Morningstar Quantitative RatingTM for funds.

Showing the power of a fund beyond its returns.

There’s no limit to what you can do. With access to our full lineup of ratings and research you can promote the strengths of your fund in new ways, like pointing out its manager’s distinct approach to stock picking or to provide context for a rating.

What You Can Get With Essentials

Are you sending the right message to investors about your firm’s funds? Use trusted investment research to connect with them.

The Basics

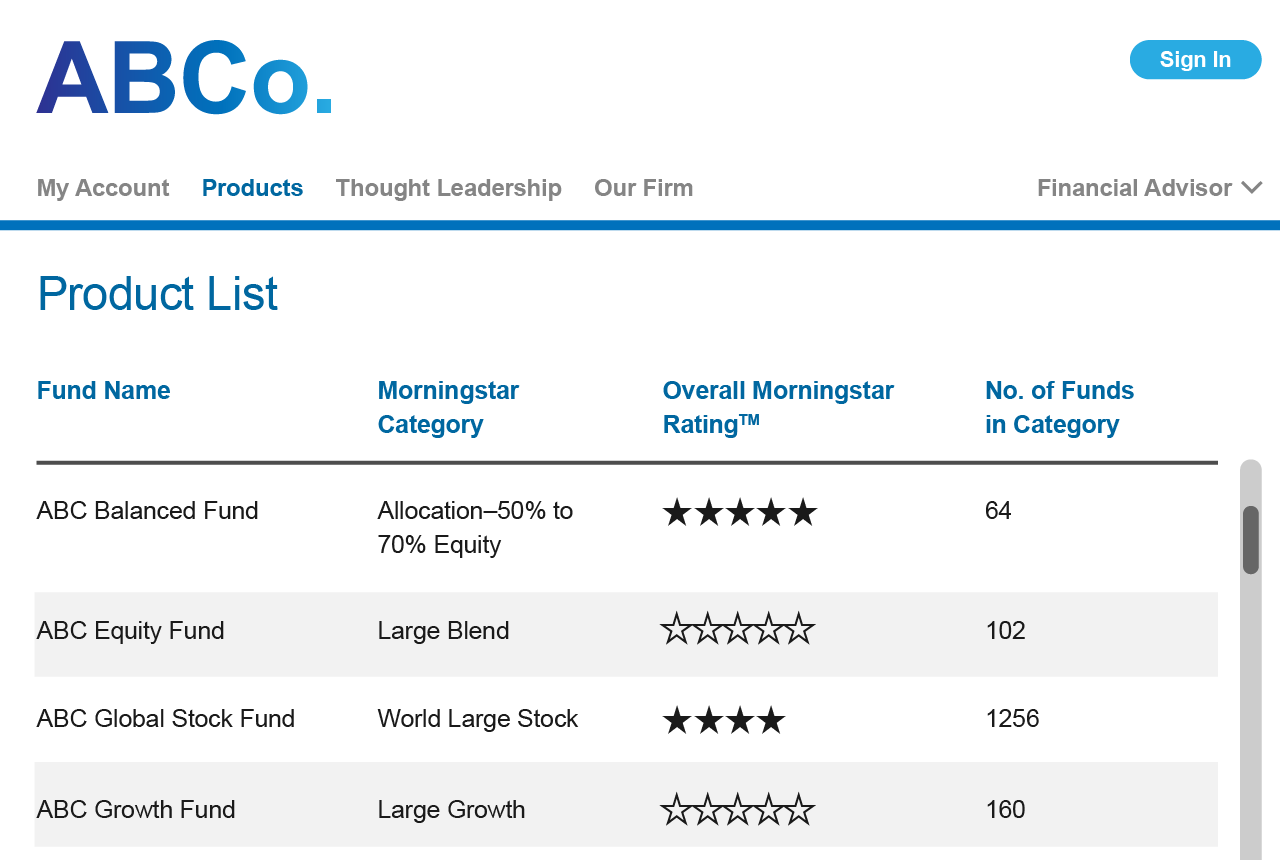

Use proprietary metrics you know, like the Morningstar RatingTM and the Morningstar Style Box.TM

Forward-Looking Ratings

Use our forward-looking analysis, including the new Quantitative Rating, as a powerful way to differentiate your products.

Sustainability and Carbon Metrics

Demonstrate how well companies in your fund’s portfolio manage the environmental, social, and governance—or ESG—investing factors.

Peer Comparisons

Use our category ranks and returns, ESG, and carbon peer comparisons.

Research Reports

Unlimited distribution of Morningstar reports including the Global Fund Report and our sustainability report.