Utilities: Is the Worst Over?

While these stocks have cooled after years of high valuations, their fundamentals are better than they’ve been in decades.

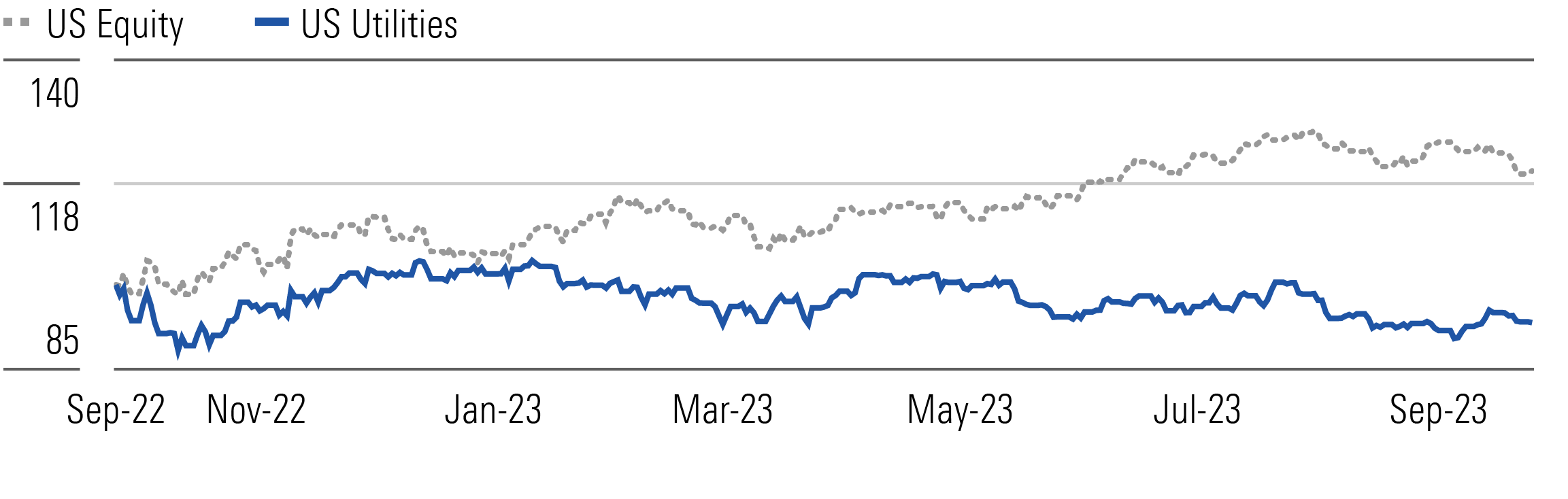

This year has been painful for investors in utility stocks. The Morningstar US Utilities Index is down nearly 7% over the past 12 months. This is by far the worst year-to-date performance of any sector, trailing the Morningstar US Market Index by 27 percentage points.

Utilities Have Trailed the Market In 2023 as Inflation, Interest Rates Hit Hard

Earlier this year, we thought utilities were bound to normalize after a decade of historically strong returns. These stocks have returned 11% annually since the 2008 financial crisis, nearly matching the total U.S. market return, including dividends. In 2022, utilities beat the market by 21 percentage points, the sector’s best relative performance since 2000. The big drop in utilities in late 2022 that has continued into 2023 has been tough to swallow. The upside is that valuations are back to what we consider fair for the sector. Some utilities have valuations more attractive than they’ve been in a decade.

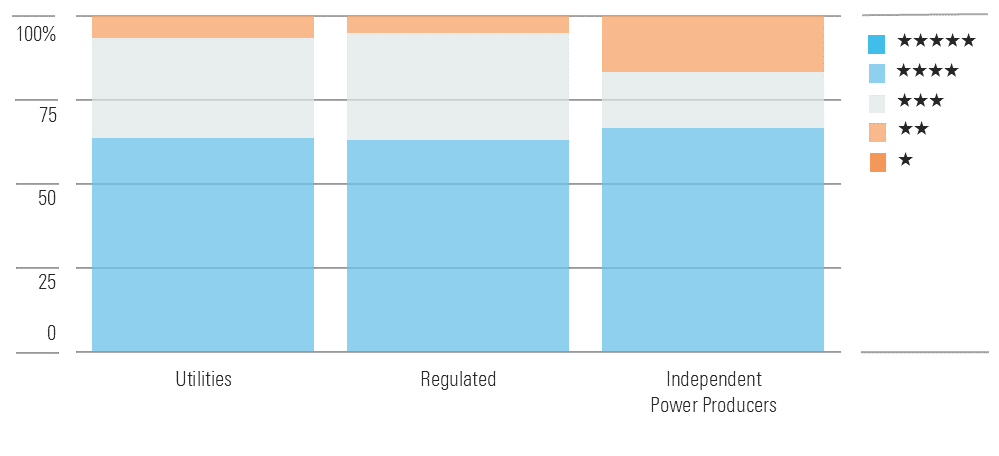

Falling Stock Prices, Growing Earnings Mean More Attractive Utilities Valuations

We think U.S. utilities have entered the Goldilocks zone—not too hot and not too cold. While things have cooled after years of abnormally high valuations, utilities’ fundamentals are better than they have been in decades. Earnings growth is robust for many, balance sheets are strong, and dividends are well-covered and growing. We expect total returns of 8%-10% from utilities at today’s valuations, including the sector’s 3.5% average dividend yield. We expect earnings and dividends to grow 6% on average. Our top picks have higher yields and/or higher growth, with solid underlying fundamentals.

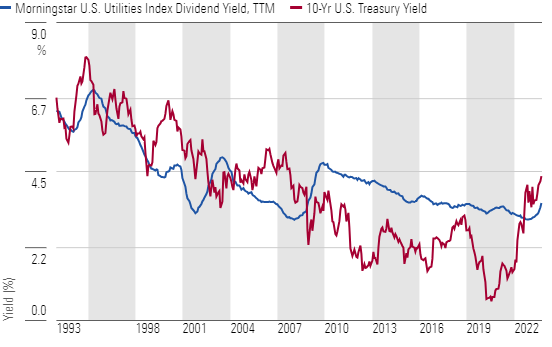

Interest Rates Top Utilities’ Dividend Yields for First Time Since 2008-09

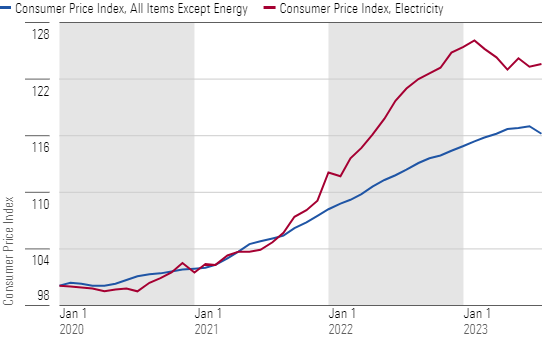

One drag on these stocks has been the sharp rise in interest rates, which makes utility dividends less attractive and increases financing costs. We think most utilities can adjust and won’t feel a huge earnings headwind yet, since they issued most of their long-term debt when rates were exceptionally low. However, trying to recover higher financing costs by increasing customer bills will be tougher when electricity prices already are climbing faster than core inflation. Regulatory risk will be a key factor to watch.

Electricity Prices Continue to Outpace Inflation for Nonenergy Items

Top Utilities Sector Picks

Entergy

- Fair Value Estimate: $120.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Low

Entergy ETR offers one of the most attractive combinations of yield, growth, and value in the sector with a 4.6% dividend yield and our 7% annual earnings growth outlook. Entergy’s 14 times P/E ratio is a 15% discount to the sector average. Above-average electricity demand growth, clean energy investments, and reliability/resiliency network investments are core growth drivers. Entergy also should benefit from industrial carbon emissions cuts, global energy demand, and green hydrogen development. We expect Entergy’s valuation discount to disappear as the market becomes comfortable with Entergy’s decadelong business transition away from commodity-sensitive businesses.

NiSource

- Fair Value Estimate: $33.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Low

Even though NiSource NI trades at a similar valuation as its peers, we think it has one of the longest runways of growth in the sector. The company’s transition from fossil fuels to clean energy in the Midwest supports at least a decade of growth potential. We expect the firm to invest $15 billion over the next five years and as much as $30 billion during the next 10 years, leading to 7% earnings growth and similar dividend growth. It plans to close its last coal-fired power plant in 2028 and add wind, solar, and energy storage. NiSource’s six gas utilities have ample near-term investment and regulatory support in areas that support gas.

Duke Energy

- Fair Value Estimate: $105.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Low

After divesting its renewable energy business, Duke DUK has a clear pathway to achieving management’s 5%-7% annual earnings growth target. Duke’s $65 billion capital investment plan for 2023-27 is focused on clean energy and infrastructure upgrades to reduce carbon emissions. New legislation in North Carolina supports the clean energy transition. Florida offers opportunities for solar growth. Duke’s 4.6% yield is among the highest in the sector, but dividend growth will lag earnings growth until its payout ratio comes down.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/s3.amazonaws.com/arc-authors/morningstar/689ab3b8-4029-4d7c-9975-43e4305e927a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6A6R4SGLDNGMXHAH3K2CIQTF3Q.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F5UMFVVKMVFRPGGUY4LONIK6OY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/689ab3b8-4029-4d7c-9975-43e4305e927a.jpg)