Is Charles Schwab Stock a Buy, a Sell, or Fairly Valued After Earnings?

Here’s what we think of Schwab’s earnings and stock.

Charles Schwab SCHW released its second-quarter earnings report on July 18, 2023. Here’s Morningstar’s take on what to think of Schwab’s earnings and stock.

Charles Schwab’s Stock at a Glance

- Fair Value Estimate: $70

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

What We Thought of Charles Schwab’s Second-Quarter Earnings

Schwab’s latest results arguably accelerate the positive aspects of our investment thesis. We knew savings from the integration of TD Ameritrade would soon be realized, but the additional cost savings, along with management likely reining in expenses in 2024, will provide greater potential for operating margin expansion. Cash sorting—when clients move cash from low-yielding bank deposits to higher-yielding alternatives like money market funds or CDs—was exceptionally high in the first quarter, so seeing actual signs of moderation in the second quarter provides more confidence that it’s not getting worse. The reduction in high-cost supplemental funding is also in line with our thesis that lowering high-cost funding will eventually bolster net interest income.

- Cost savings: The trends in many of the income statement lines were largely what we expected. What was surprising was the magnitude of the cost savings Schwab is targeting for this year, as well as the fact that operating expenses for next year may be flat to down from 2023. The firm’s earnings trajectory is turning positive faster than the market anticipated, helped by cost savings and a significant slowdown in cash sorting. A quarter ago, the company said it had found some additional areas to cut costs, but it didn’t provide a specific target. Now Schwab has said it expects $500 million of expense savings this year, in addition to $500 million next year related to the TD Ameritrade integration. Management also said expenses may be flat or even lower in 2024 compared with 2023.

- A slowdown in cash shorting: The significant moderation in cash sorting in May and June was also a positive. Earlier in 2023, clients were moving about $1.5 billion per day, which had to be offset by high-cost borrowing, but recently it’s been more like $300 million. At that pace, Schwab has been able to somewhat reduce its high-cost supplemental funding, though it was up on average for the whole quarter compared with the first quarter.

- Some uncertainty remains: The recent increase in the stock price is likely due to some of the short-term uncertainty over the speed and magnitude with which cash sorting has lessened. That said, it’s still happening, and uncertainty remains over the trajectory of interest rates and the economy, which can lead to volatility in share prices. But we still believe the company is fairly valued to modestly undervalued based on where it’s trading.

Charles Schwab Stock Price

Fair Value Estimate for Charles Schwab

With its 3-star rating, we believe Charles Schwab stock is fairly valued, or potentially modestly undervalued, in line with our long-term estimate.

Morningstar has reduced its fair value estimate of Schwab shares to $70 from $87. This value is determined based on a price/earnings multiple of around 20 times and a price/book multiple of about 5 times. The adjustments made to the model include increased usage of high-cost, short-term debt in the near term and the firm holding more client cash in lower revenue-yielding money market funds instead of more profitable banking deposits. In the medium term, we forecast a 6% compound annual growth rate for net revenue as trading revenue flattens, while client assets and deposits will increase after headwinds in 2023. Much of the revenue growth is attributable to higher interest rates.

We value Charles Schwab at $127 per share in our upside scenario and $44 per share in our downside scenario, which corresponds to a price/2023 earnings ratio of 27 times in the upside case and 15.5 times in the downside case. The main drivers of the difference in valuation between the scenarios are the normalized levels of interest rates, asset levels, and operating margins.

Read more about Charles Schwab’s fair value estimate.

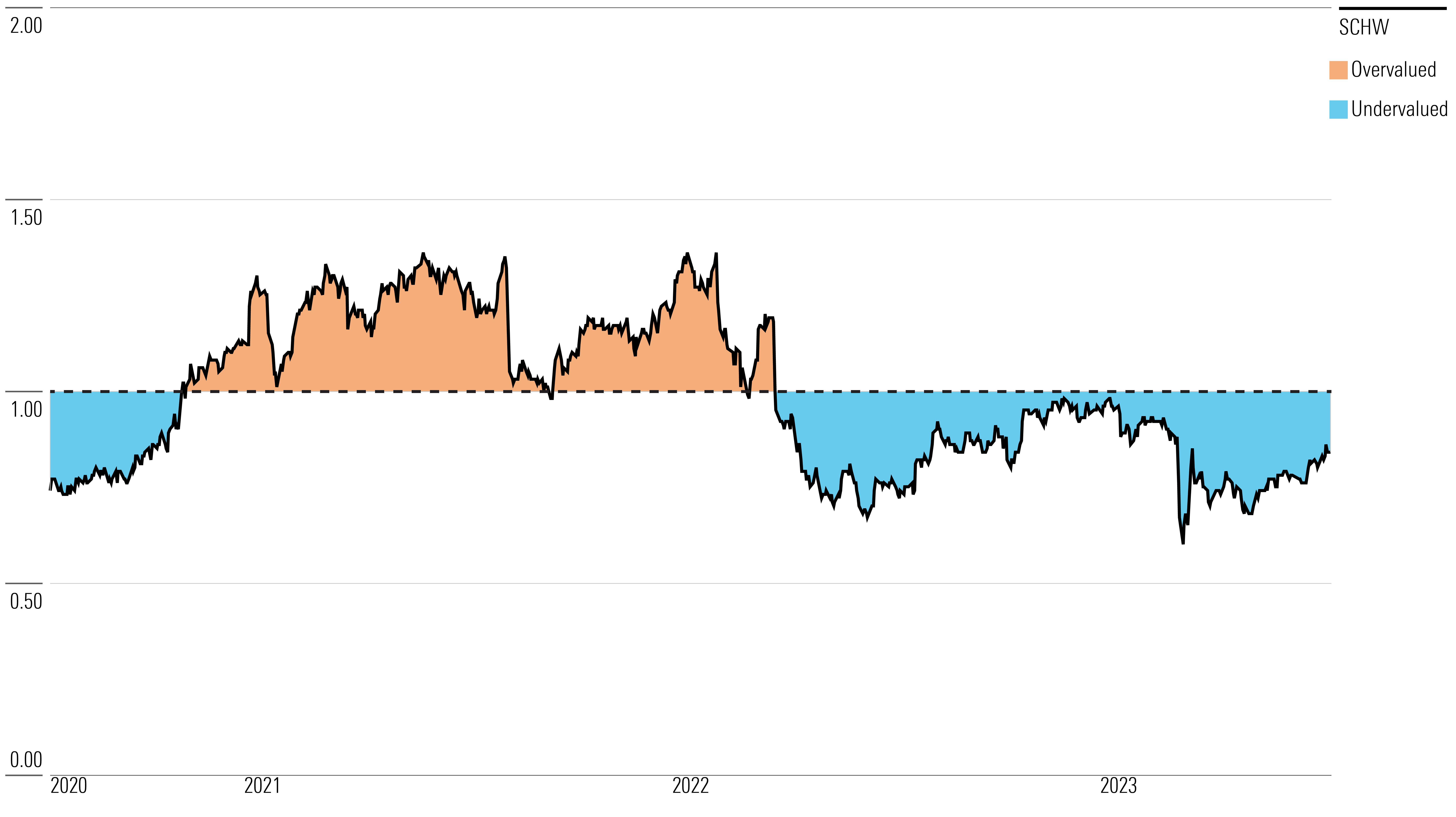

Charles Schwab Historical Price/Fair Value Ratios

Economic Moat Rating

Morningstar rates Charles Schwab’s Economic Moat as Wide due to its massive scale and industry-leading cost efficiency, which allow it to withstand competitive pressures and maintain returns above its cost of capital.

The company’s moat is primarily built on cost advantages, with scalable infrastructure processing trades at low costs, resulting in high incremental operating margins. Charles Schwab Bank benefits from low operating costs and credit risks due to its synergy with the brokerage business. The firm’s massive scale provides a significant cost advantage, evident in its industry-leading expense ratio per dollar of client assets. This cost efficiency allows Schwab to create products with a compelling value proposition, leading to growth in areas like its exchange-traded fund line and online advisory platform.

While the company benefits from a strong brand and some network effects, its primary moat source remains its cost advantage from scale.

Read more about Charles Schwab’s moat rating.

Risk and Uncertainty

Major risks to Charles Schwab include potential fluctuations in interest rates, which could impact its earnings and investment portfolio. A recession with low-interest rates may hinder the repricing of portions of the investment portfolio. Structural changes in developed economies could lead to permanently lower long-term interest rates and affect the profitability of Schwab’s banking business. Additionally, asset-management revenue may face pressure due to shifts in asset mix toward passive investment products.

Environmental, social, and governance risks include potential restrictions on payment for order flow and fiduciary duty risks. While regulation of payment for order flow is expected to focus on disclosure rather than restrictions, registered investment advisor firms that Schwab services could be more exposed to fiduciary breaches. Given the competitive nature of the investment services industry, uncertainties surrounding deposits, monetary policy, and the impact of a bear market, Morningstar assigns Schwab a High Uncertainty Rating.

Read more about Charles Schwab’s risk and uncertainty.

SCHW Bulls Say

- Charles Schwab is solidifying its position as a leader in investment services and may be able to expand into other financial services.

- Merging with TD Ameritrade will come with material revenue and expense synergies that will be realized over the next couple of years.

- Schwab’s scalable and vertically integrated business model should enable it to convert an increasing percentage of revenue into earnings and be in the better parts of the value chain as the investment services industry evolves.

SCHW Bears Say

- A loss of deposits and higher funding costs are potential near-term negatives for the firm.

- While Schwab has the resources to adapt, financial technology innovation has increased in recent years and could disrupt parts of the investment services industry. The $0-commission business models and robo-advisors are recent trends that challenged the status quo.

- A Europe- or Japan-like scenario of near 0% interest rates for an extended period would significantly reduce earnings and likely necessitate a change in the business model. The Fed may have to lower interest rates if a recession occurs.

This article was compiled by Saaketh Tirumala.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4QBQ2NBJMFG5HGQTDEYCXY5OOI.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2RGHQJTF4ZEURNSAGBY7CSHCUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EAAEIIRVVNE7HNVXBSGTD3WPSI.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)