Is Boeing’s Stock a Buy or a Sell Before Earnings?

With a focus on regaining prepandemic production levels for first-quarter results, here’s what we think of Boeing’s stock.

Boeing BA is scheduled to release its first-quarter earnings report on April 26, before the start of trading. Here’s Morningstar’s take on what to watch for in earnings and Boeing’s stock.

Key Morningstar Metrics for Boeing

- Fair Value Estimate: $220

- Morningstar Rating: 3 stars

- Morningstar Uncertainty Rating: High

- Morningstar Economic Moat Rating: Wide

What to Watch for in Boeing’s Quarterly Earnings

- What is left to solve so that Boeing can deliver more 737s and 787s per month? When will that happen, and how many can they deliver?

- There was already news about this in the last few days, as a new defect on some 737s came to light from Spirit Aero Systems, a supplier, but Boeing made positive statements at its annual shareholder meeting that seem to indicate a) that isn’t a huge deal and b) it is committing to building 737s faster again. The whole issue has been about its supply chain, the lingering effects of the pandemic on materials and people, and quality control.

- Are there any changes to the financial impact of upping those deliveries—for example, a change in pricing or demand for certain models or a change in the ability to deliver to China again?

- 737 is really the backbone of Boeing. As a very popular narrow-body jet, Boeing stands to sell thousands more of them globally. This is followed closely by 787 as the premiere wide-body; it has a smaller market but is very lucrative.

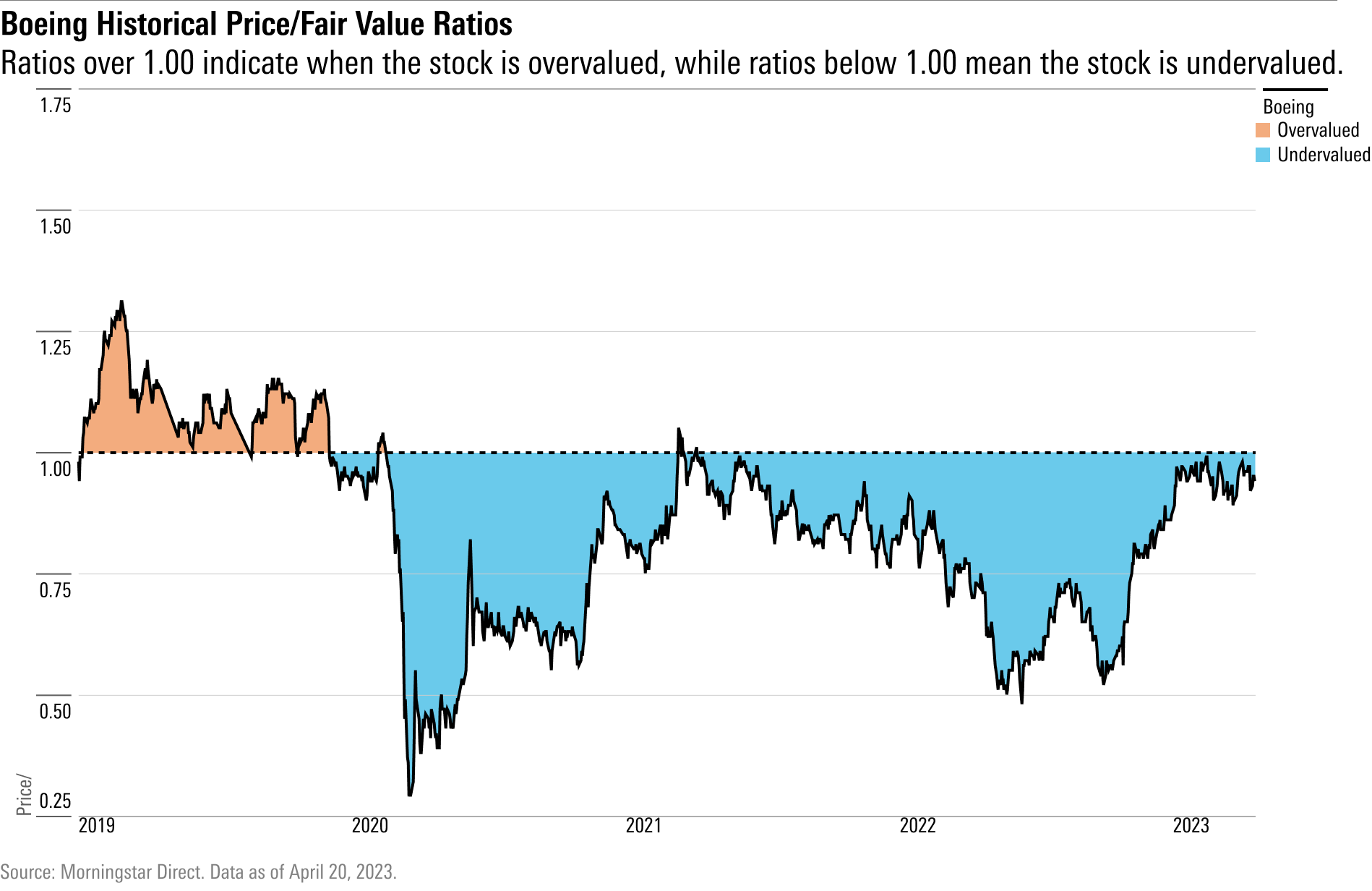

Fair Value Estimate for Boeing

We value Boeing’s stock at $220 per share, which represents 20 times our 2024 free cash flow and 2 times 2024 sales estimates. We really do think the enormous special charges and fleet groundings are behind Boeing, though we forecast a couple of years of hard slogging as it clears up supply chain issues that hamper production pacing. The coronavirus crisis shocked the aviation industry and essentially halved global revenue passenger kilometers in 2020. We assume a replacement cycle among most airlines will take place and that the vast majority of fleet growth will be from narrow-body aircraft as an emerging-markets middle class demands more short-haul and point-to-point medium-haul travel. We expect the firm to return to 2018 levels of 737 MAX production by 2025. Overall, we expect operating margins to improve to about 13% at midcycle, versus 12% in 2018. We’re modeling steady single-digit growth and reasonably consistent margins within the defense business. We expect the services business will be able to regain profitability faster than Boeing as a whole because aftermarket revenue increases directly with flights.

At a 3-star rating, we believe Boeing stock is fairly valued when compared with our fair value estimate.

Read more about Boeing’s fair value estimate.

Morningstar Economic Moat Rating

We think Boeing merits a wide moat rating because it benefits from durable intangible assets and switching costs. Although we think that Boeing has taken some competitive hits in the commercial aerospace duopoly, the commercial airplane market is large enough and so difficult to break into that it supports two wide-moat aircraft manufacturers. In the commercial aircraft manufacturing segment, we believe the technical complexity of aircraft manufacturing and the extensive regulatory barriers to entering the market constitute wide-moat-caliber intangible assets. Further, we see the lack of alternative aircraft suppliers, the criticality of their products to the customer, and very long product cycles as presenting powerful switching costs. We assume Boeing will retain its advantage in wide-bodies as we expect the 787 will remain the dominant small wide-body, the 777X will be launched successfully, and the cargo market remains mostly in Boeing’s hands. Qualitatively, we don’t think Boeing’s intangible assets have deteriorated. And while Boeing has a gap in its product lineup in the workhorse narrow-body market, the firm still has the know-how to develop and deliver aircraft, which is ultimately the valuable intangible asset. We think Boeing’s defense segment possesses intangible assets because of the complexity of manufacturing defense products and from the sole-source contract structure of defense production.

Read more about Boeing’s moat rating.

Risk and Uncertainty

We think Boeing’s biggest risks are macro risks that limit demand and operational risks that constrain supply, both of which it has weathered over the last three years. We think Boeing deserves a High Morningstar Uncertainty Rating, but we note the firm is still working through much higher supply risks than Airbus EADSY as it revives 737 MAX and 787 production and deliveries. On the demand side, the pandemic dramatically reduced air travel and aircraft deliveries. Because high-yielding business travelers are some of the most profitable customers for airlines, any lack of business travel resurgence may damp new aircraft demand. On the supply side, the major risk in the aftermath of the 737 MAX grounding and production rework on the 787 lies in global supply chain disruptions that affect Boeing’s engine and subsystem suppliers. These suppliers may just not be able to ramp up production at Boeing’s desired pace, which would constrain or delay Boeing’s ability to get its assembly up to the volumes where it makes money on every plane it delivers, versus having to continue to take massive extraordinary charges for idle assembly capacity.

Read more about Boeing’s risk and uncertainty.

BA Bulls Say

- Boeing has a large backlog that covers several years of production for the most popular aircraft, which gives us confidence in aggregate demand for aerospace products.

- Boeing is well-positioned to benefit from emerging-markets growth in revenue passenger kilometers and a robust developed-markets replacement cycle over the next two decades.

- We expect that commercial airframe manufacturing will remain a duopoly for most of the world for the foreseeable future. We think customers will not have any meaningful options other than continuing to rely on incumbent aircraft suppliers.

BA Bears Say

- We see substantial operational risk in Boeing’s plans to simultaneously ramp production of the 737 MAX and sell those aircraft in storage as the aviation crisis and supply chain issues unwind.

- Long term, changed consumer behavior, especially among business travelers, could be unfavorable for aviation.

- As recent history has proved, aircraft development is notoriously susceptible to development delays, hiccups, and cost overruns.

Get access to full Morningstar stock analyst reports, along with data and tools to manage your portfolio through Morningstar Investor. Learn more and start a seven-day free trial today.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4c0ebe77-db24-4647-aac9-f4c13027ec2f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K4RTVRPKCVFQBMRNMXPUOHFNLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4c0ebe77-db24-4647-aac9-f4c13027ec2f.jpg)