Consumer Defensive Stock Outlook: Competitively Advantaged Firms Positioned to Withstand Promotional Resurge and Evolving Consumer Behavior

We see opportunities in consumer-packaged goods and the alcoholic beverages space.

This article is part of Morningstar’s Q2 market review and outlook.

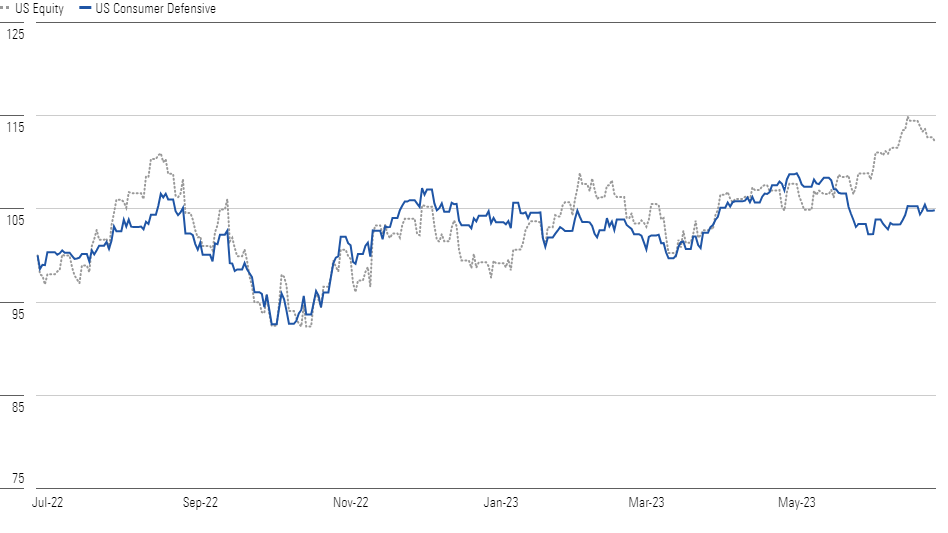

The Morningstar US Consumer Defensive Index retreated 0.3% in the second quarter, a tepid performance compared with the overall market’s 5.4% gain. Despite the pullback, the median stock in the index still appears fairly valued in our view, trading at just a 1% discount to our median fair value estimate. Even so, we see opportunities in consumer-packaged goods, or CPG, where nearly 30% of the companies in our coverage trade in 4- or 5-star territory, and the alcoholic beverages space, where half our coverage looks undervalued. We posit that investors’ perspectives are clouded by unremitting concerns regarding macro uncertainty and inflation’s impact on consumer spending patterns, and that they discount the product innovation and brand strength that command pricing power within the sector.

Consumer Defensive Lagged the Market’s Q2 Gain

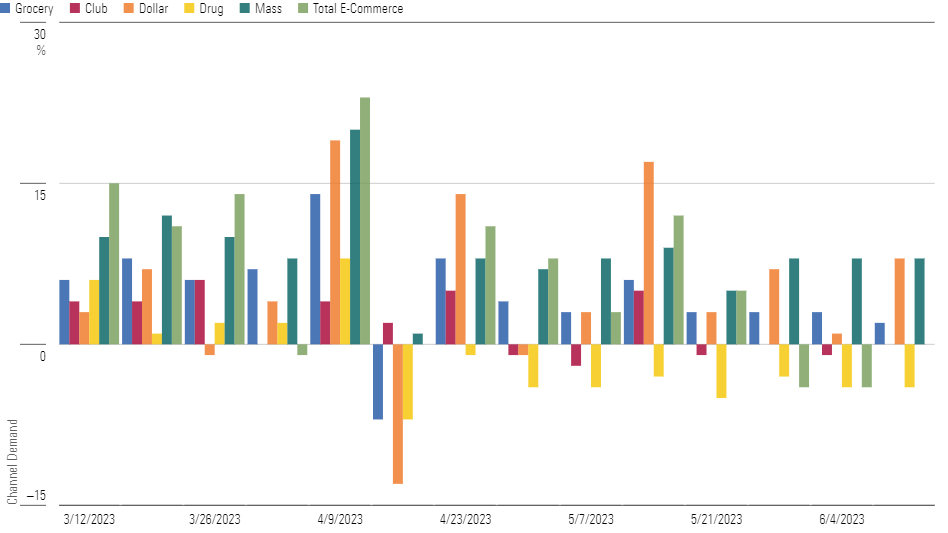

Although inflation appears to be moderating, its cumulative effect has eroded consumer purchasing power. We’ve observed consumers alter their purchasing patterns in their search for value by shifting retail channels. From the first week in May through the week ending June 11, trips and basket size increased at a high-single-digit rate in the value-oriented dollar and mass CPG channels, besting the drug channel’s mid-single-digit decline (it tends to be a more premium-priced channel). Even the e-commerce channel may be losing steam among consumers shopping for packaged food and household and personal care items—up just 2% over the same period—which we think is an indicator of consumers working to avoid additional fees, such as delivery. As cash-constrained consumers hunt for value, we surmise that continued investments in the store experience and omnichannel capabilities will be key for defensive retailers.

Cash-Strained Consumers Shift to Discount Channels Amid Economic Angst

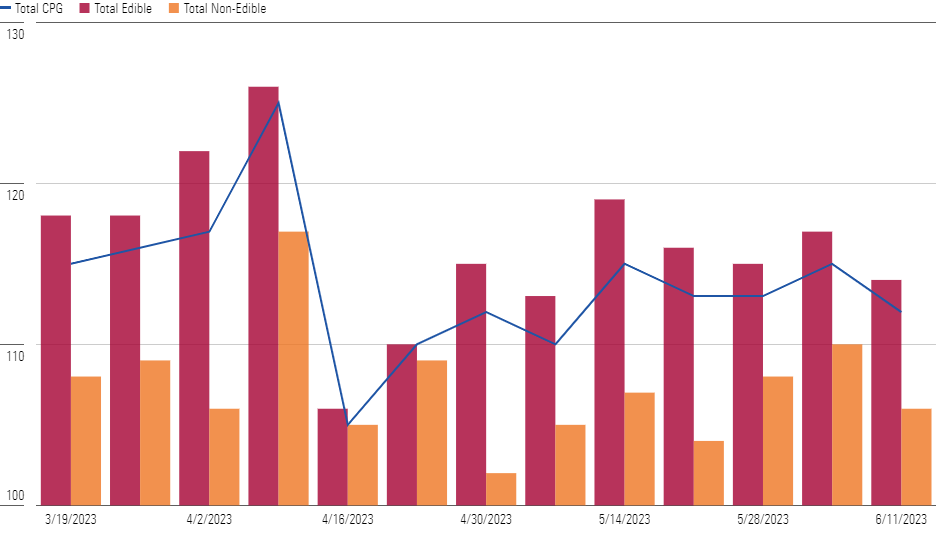

Financial pressures are also prompting consumers to trade down to private-label fare and/or default to products with lower opening price points. After years of being idle, promotional intensity has picked up. We don’t believe such actions stand to juice brand intangible assets in the CPG space. Rather, we contend investments in consumer-valued innovation and marketing are essential, particularly since there are no meaningful switching costs in the space. Further, we think on-trend new products serve to ensure entrenchment with leading retailers by driving traffic to the shelf.

To Thwart Trade Down, CPG Firms Starting to Press on Promotions

Top Consumer Defense Sector Picks

Tyson Foods TSN

- Fair Value Estimate: $96.00

- Star Rating: 5 stars

- Uncertainty Rating: Medium

- Economic Moat Rating: None

Trading at nearly a 50% discount to our $96 fair value estimate, Tyson’s shares are on sale. Stout inflationary headwinds have been impairing demand and degrading margins, with cash-constrained consumers increasingly opting for cheaper cuts of meat. Additionally, increased chicken and pork supplies have capped prices, further eroding near-term results. That said, we’re encouraged that Tyson has prioritized productivity efforts and investments in wages, which should enhance long-term efficiency. When paired with favorable long-term dynamics for protein demand, we think Tyson’s stock will gravitate to our valuation over time.

Conagra Brands CAG

- Fair Value Estimate: $46.50

- Star Rating: 4 stars

- Uncertainty Rating: Medium

- Economic Moat Rating: None

We believe Conagra’s shares are attractive, trading at over 25% shy of our $46.50 fair value estimate. We posit that investors underestimate Conagra’s long-term margin prospects, as the firm expects to realize over $1 billion in supply chain savings by fiscal 2025. We believe this is supported by a stronger sales base. Conagra benefits from years of incremental new buyers, who were exposed to its fare during the pandemic-induced shift to food-at-home consumption. Moreover, the firm has refocused its product mix to higher-growth categories, such as frozen foods and snacks, which now make up 63% of sales.

Kraft Heinz KHC

- Fair Value Estimate: $53.00

- Star Rating: 4 stars

- Uncertainty Rating: Medium

- Economic Moat Rating: None

Kraft Heinz trades 30% below our $53 fair value estimate while boasting a 4% dividend yield. We suspect investors are skeptical that sales growth and margins can hold in a more challenging economic environment (marred by inflationary headwinds and weak consumer spending). We think investors may be wary about the firm’s ability to lean on raising prices without material volume contraction. However, we deem other avenues to upend inflation’s rout as judicious, including unearthing cost savings. Further, we think investments to fuel consumer-valued innovation and tout its fare should support volumes long term.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-22-2024/t_5149c138d4cf43a79de97f899e7ecd1a_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/D2LN64PPEJFUFPSWUNYVGCCDLA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G72FVQEVDVFALKWGMBYTU7K2RE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)