Basic Materials: As Sector Underperforms, We See Strong Opportunities

In this sector, we recommend Albemarle, FMC, and Newmont.

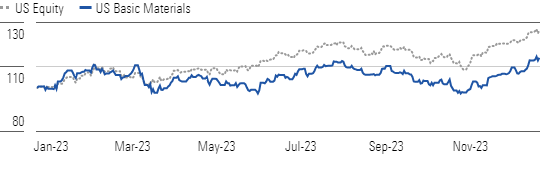

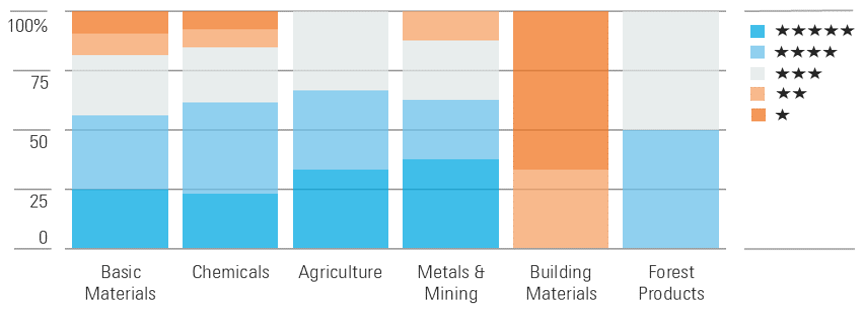

The Morningstar US Basic Materials Index underperformed the broader market during the fourth quarter of 2023. The index was up 10.4% during the quarter, but that rally was 110 basis points below the Morningstar US Market Index, which posted an 11.5% gain. On a trailing 12-month basis, the sector underperformed the market by 1,250 basis points. However, we see opportunities across basic materials, with the majority (56%) of these stocks trading in 4- or 5-star territory. Undervalued industries include chemicals, agriculture, metals and mining, and forest products.

Our top picks among basic materials stocks are:

The Basic Materials Index Underperformed the Broader Market Index

Demand for crop chemicals has declined due to inventory destocking as product availability from disrupted COVID-19 supply chains is no longer a concern among farmers and farm retailers. However, as destocking has largely run its course, we expect growth will resume in 2024 as demand normalizes.

Nearly 60% of Our Basic Materials Names Trade In 5- or 4-Star Territory

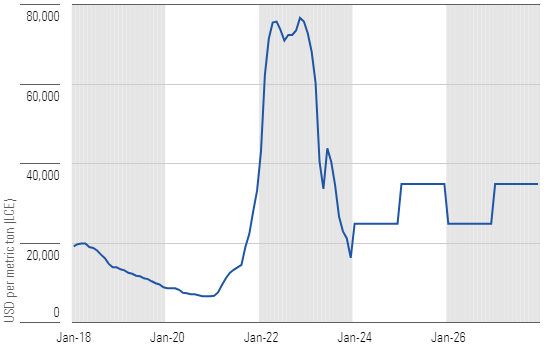

Lithium demand will more than triple by 2030 from 2022, largely due to electric vehicles rising to 40% of global auto sales by 2030, up from 10% in 2022. Over the long term, we view lithium as one of the best ways to invest in rising EV adoption, as all EV batteries require lithium. In the near term, prices have fallen as supply caught up with demand due to inventory destocking among battery producers. Prices are currently around $17,000 per metric ton. However, as destocking ends, we expect prices will stabilize and rise in 2024. As EV sales continue to grow, we forecast demand growth will accelerate, leading to prices rising by the end of the year. We forecast prices will average $30,000 per metric ton from 2023 to 2030.

Lithium Prices Will Rise In 2024 as Demand Growth Outpaces Supply

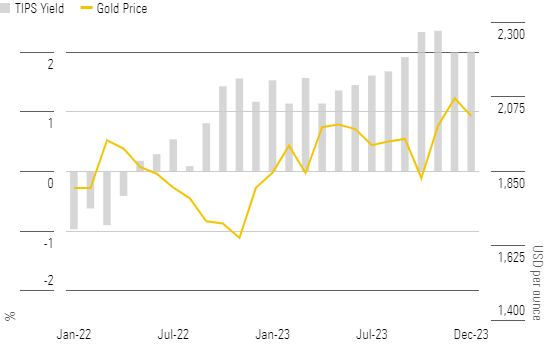

Gold investment lacks cash flow for owners, and rising yields make bonds relatively more attractive, and vice-versa. With the world’s central banks hiking rates in response to inflation, many gold miners have been out of favor. However, spot gold prices have recently risen to around $2,030 per ounce on expectations we are close to peak interest rates, a tailwind to share prices. Over the longer term, we forecast gold prices to decline to roughly $1,740 per ounce midcycle from 2027, based on our estimate of the marginal cost of production.

Gold Prices Rose In 2023 On Expectations of Falling Real Interest Rates

Top Basic Material Sector Picks

Albemarle

- Fair Value Estimate: $300.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

Albemarle is our top pick to play strong lithium demand and rising prices from growing EV adoption. The stock trades at a little less than 60% of our fair value estimate. The firm’s main business is lithium, which generates roughly 90% of its profits. It produces lithium from three of the best resources globally, which creates the cost advantage that underpins our narrow moat rating. Among the lithium producers we cover, Albemarle also offers the lowest relative risk. We think the company can triple its lithium production capacity by the end of the decade by replicating the company’s existing downstream conversion facilities.

FMC

- Fair Value Estimate: $110.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

This is our top pick to invest in the demand recovery for crop chemicals. Its stock trades at around 50% of our fair value estimate. FMC is a crop protection pure-play company. The market is concerned with the industry recovery and the risk of patent expiration for FMC’s diamide products, which currently generate the majority of its profits. However, as the industry recovers and the company develops new premium products from its strong R&D pipeline, we forecast FMC will see profit growth and margin recovery.

Newmont

- Fair Value Estimate: $53.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Medium

Newmont’s acquisition of Newcrest extends its lead as the world’s largest gold miner, with pro forma 2023 sales of roughly 7.3 million ounces of gold. The combined company also has material copper production of roughly 160,000 metric tons, as well as numerous development projects that we think are valuable and perhaps overlooked. We think Newmont’s shares are undervalued, given its weak sales volumes in the first nine months of 2023, which have led to elevated unit cash costs. However, as volumes recover, unit cash costs should fall. The market hasn’t favored gold miners due to rising interest-rate concerns. Rising rates increase the opportunity cost of holding gold.

Top Basic Materials Sector Picks Performance

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5GAX4GUZGFDARNXQRA7HR2YET4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/U746MWXQHFFZPLSMTEJSUD7HLY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)