6 Cybersecurity Stocks to Keep an Eye On

These companies are benefiting as more people work from home.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

At the coronvirus pandemic’s peak, 45% of U.S. workers were working from home. This increased exposure to digital working has made many companies (and their remote employees) more susceptible to cyberattacks. Morningstar equity analyst Mark Cash found there was a 400% increase in cyberattack complaints reported to the FBI from March 2020 to April 2020.

Cybersecurity firms help companies defend against these threats--and they've benefited. "In our view, shutdowns caused IT teams to pivot their security solutions to trusted, more nascent cloud-based versions because of the ease of deployment, management, and protection for remote individuals and resources." says Cash.

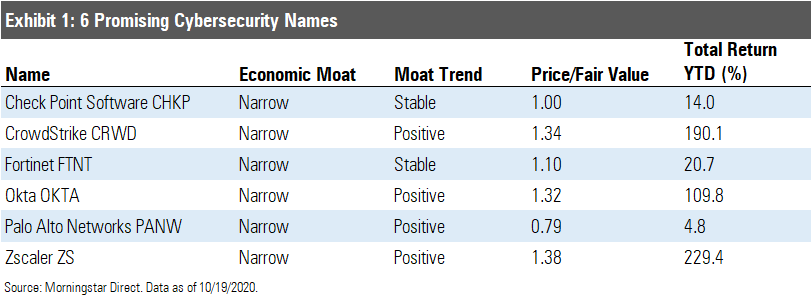

Some cybersecurity names include those with fully cloud-based solutions, with CrowdStrike CRWD, Okta OKTA, and Zscaler ZS among them. All three have experienced at least 40% year-over-year revenue growth.

Palo Alto Networks PANW is the most attractive of the cybersecurity stocks our analysts follow from a valuation perspective, trading at a discount to its $305 fair value estimate. Palo Alto Networks is growing its cloud-based offerings and has generated fine financial results.

Unlike CrowdStrike, Okta, and Zscaler, Check Point Software Technologies CHKP and Fortinet FTNT provide hardware and software solutions. As a result, they have a unique advantage when customers are looking to use the same vendor for physical and digital products.

The stocks of fully cloud-based providers have been on a tear this year, more than doubling in price.

Here’s a deeper look at three stocks from the list.

Palo Alto Networks PANW "We believe that Palo Alto will continue to outpace its security peers by focusing on providing solutions in areas like cloud security and automation. Palo Alto's concerted efforts into machine learning, analytics, and automated responses could make its products indispensable within customer networks. Although we expect Palo Alto to remain acquisitive and dedicated to organic innovation, we believe significant operating leverage will be gained throughout the coming decade as recurring subscription and support revenue streams flow from its expansive customer base."--Mark Cash, Equity Analyst

Check Point Software Technologies CHKP "With a vast customer base of over 100,000 businesses and renowned product leadership for existing threat technology, we believe Check Point's consolidated security architecture provides ample upsell and cross-selling opportunities as enterprises increase their reliance on cloud-based products and distributed networking. Although we expect more competitors within cloud-based security due to the low entry barrier for making SaaS products, we posit a large advantage for Check Point is its ability to position itself as the commonality between on-premises, cloud, and remote security as enterprises expand their networks."--Mark Cash, Equity Analyst

Zscaler ZS "Zscaler wagered heavily on the secular trend of cloud computing and the ways in which this shift would upend the previous paradigms of network and application security. Its bet has paid dividends, as it has leveraged a distributed cloud to deliver a multitenant security platform that offers security capabilities traditionally sold as purpose-built appliances. Although Zscaler has been at it since 2007, we think its business model and security approach are in their early innings, and we see a long runway for growth in an addressable market worth tens of billions of dollars."--Mark Cash, Equity Analyst

/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FJIYHKNZRBM3LAKQL2QEUMDTA.png)

/d10o6nnig0wrdw.cloudfront.net/06-03-2024/t_95520f12571e4d90884ec43592a3ab9c_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PPB6K765QVEN5C6ZRHVEXM3CIQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)