Where International Diversification Works—And Where It Falls Short

Recent diversification and performance benefits of non-US stocks have been muted, but that trend may not persist.

Adding international stock exposure is one of the first steps toward a diversified portfolio. Even minimalist investors usually carve out a portion of their portfolios for non-US stocks as a supplement to domestic stocks and bonds.

At this point, however, even committed globalists have to acknowledge that adding non-US equities has detracted from the returns of a US-only portfolio, even as it has modestly reduced risk. In the 2024 Diversification Landscape report that I recently completed with Amy Arnott and Karen Zaya, we found that foreign stocks’ correlation with the US market has also increased over the past three years.

Whether non-US stocks will fail to earn their keep going forward is an open question, however. As the US market has grown increasingly concentrated in the large-growth square of the Morningstar Style Box, especially in technology stocks, investing in non-US equities provides exposure to sectors that are underrepresented in total US market indexes today. Moreover, developing-markets equities have demonstrated a lower correlation with the US market than the developed markets’ correlation, albeit with higher levels of volatility. This suggests that investors venturing overseas should make room for emerging markets as part of their non-US allocations.

Recent Performance Trends

Even though diversifying into non-US stocks makes intuitive sense and modestly reduced the standard deviation of a US-only portfolio over the past three-, five-, and 10-year periods, doing so has often detracted from returns for US-based investors. In eight of the 10 calendar years from 2014 through 2023, the Morningstar Global Markets ex-US Index lagged the Morningstar US Market Index. Non-US stocks held up better than US stocks in 2022 amid a bear market induced by the Federal Reserve’s aggressive campaign of interest-rate hikes. But that was a modest victory, and short-lived. As mega-cap US technology stocks led the market again in 2023, non-US stock indexes failed to keep up. The Morningstar Global Markets ex-US Index gained about 16% in 2023, compared with a 26% return for its US counterpart.

The Morningstar Emerging Markets Index gained 12% in 2023 versus an 18% gain for the Morningstar Developed Markets ex-US Index. Emerging markets also fared worse than developed-markets equities in the 2022 bear market. Although stocks in Latin America have been a bright spot recently, China’s economic slowdown has weighed heavily on broad emerging-markets indexes.

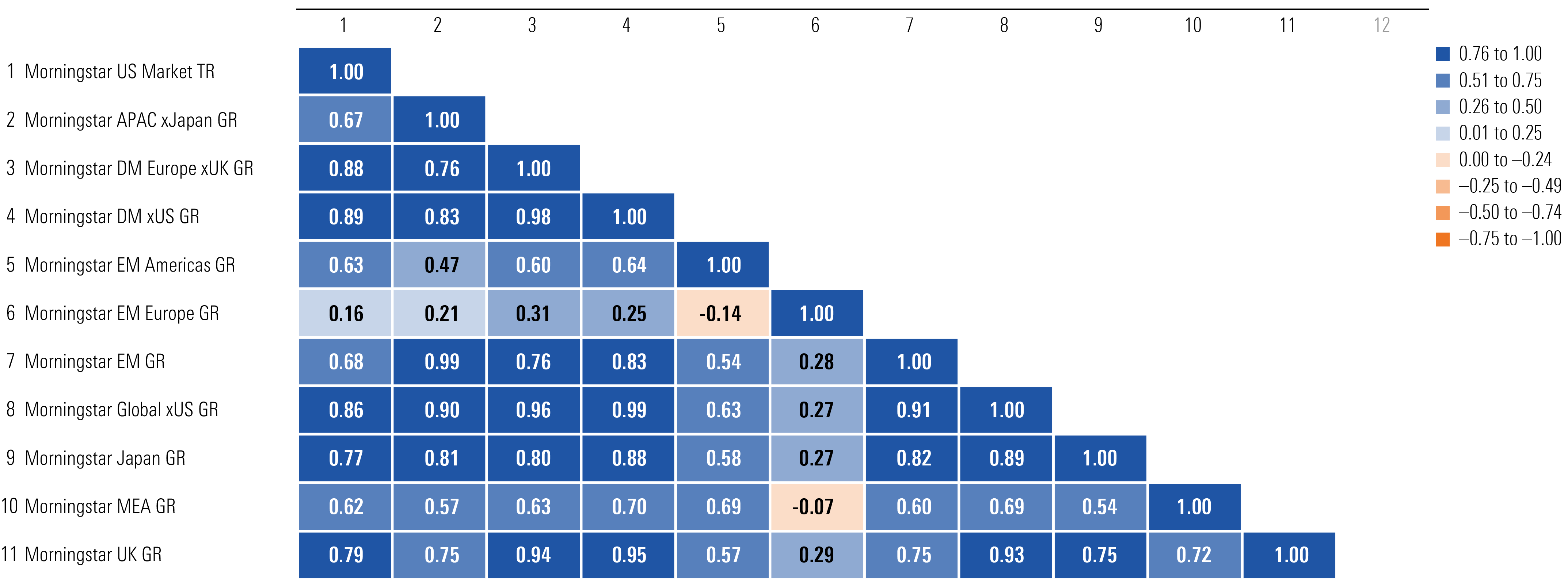

From a diversification perspective, most international-stock benchmarks, especially those in developed markets, have been closely tied to the US market over the past three years, as shown below. Developed-markets equities, especially European stocks, have had the tightest correlation with US equities. Meanwhile, emerging-markets stocks have tended to have lower correlations with US stocks, and those correlations have generally trended down since 2000.

Three-Year Correlation Matrix: International Equity

The small subset of European stocks from markets classified as emerging have had the lowest correlation with the US market over the past three years, with correlations declining significantly in 2022 and falling further still in 2023. (At the end of 2021, the three-year correlation of the Morningstar Emerging Markets Europe Index with the US market was 0.82; by the end of 2023, it was just 0.16.) That steep drop in correlations owed largely to Eastern European equities’ sharp losses following Russia’s invasion of Ukraine in early 2022. Such stocks are just 1.3% of the broader Morningstar Emerging Markets Index, however, and are a negligible slice of the Morningstar Global Markets ex-US Index.

Longer-Term Trends

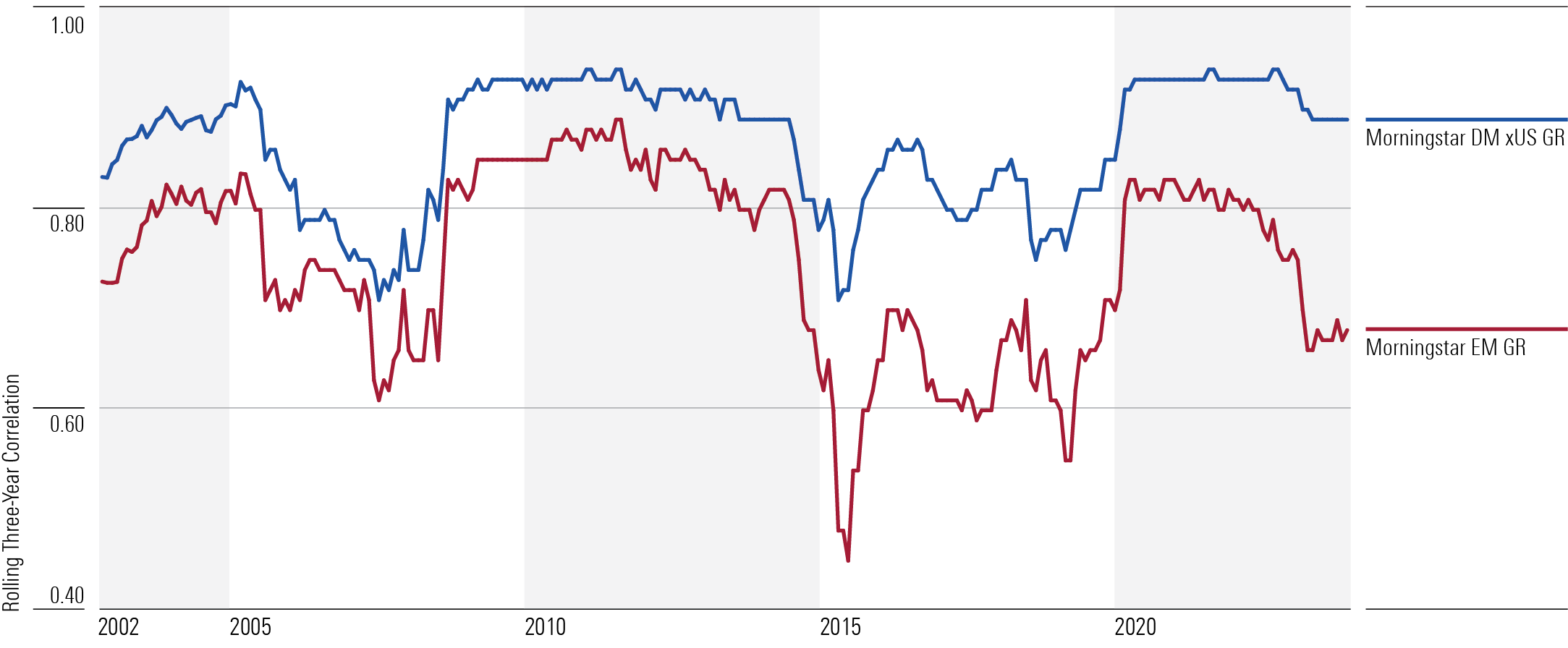

While non-US stocks, especially those from developed markets, have exhibited a high correlation with the US market in recent years, that hasn’t always been the case. As shown below, correlations between the US and international markets have been lower in some previous periods, such as from 2004 through 2008, when the US dollar was generally on the decline. If the greenback goes into another longer-term slump or if the US sinks into recession but other major non-US markets manage to avoid one, it is conceivable that correlations between US and international markets could again drift lower.

Rolling Three-Year Correlations v. US Market Index: International Equity

Longer-term correlations also demonstrate that emerging markets generally have a lower correlation with US stocks than developed markets do. That’s because the types of industries that are especially prominent in emerging markets, particularly energy and basic materials, have declined as a percentage of the US market. In addition, the Chinese economy, which represents roughly 30% of major emerging-markets indexes, follows a different economic cycle than the US does. Finally, emerging markets are more likely than developed markets to be affected by country- and region-specific geopolitical events—political instability, wars, and currency devaluations—that have little to do with the US. Taken together, those features suggest that emerging-markets equities’ low correlation with US stocks won’t be as fleeting as some of the other correlation trends.

Portfolio Implications

While investors who have diversified internationally haven’t much benefited over the past decade, their portfolios have been slightly less volatile relative to a US-only portfolio. The 10-year standard deviation of the Morningstar US Market Index is 15.5, whereas the standard deviation of the Morningstar Global Markets Index, which includes both US and non-US names, is 15.0. Japan, in particular, has exhibited milder volatility than the US market and other major non-US markets.

Moreover, the US market has become increasingly growth-tilted: 29% of the Morningstar US Market Index lands in the technology sector, for example, whereas just 12% of the Morningstar Global Markets ex-US Index does. That has been a boon for US-only investors as technology names soared for most of the past decade. But in a period in which lower-priced stocks lead the way, non-US stocks could outperform and help diversify US exposure. Non-US indexes feature a heavier emphasis on traditional value sectors, including energy, basic materials, and financials.

Because emerging markets have generally had a lower correlation with the US equity market than the developed markets’ correlation, investors seeking diversification may want to make sure their foreign-stock allocation includes at least some exposure to less-developed markets. And while some specific regions have been better portfolio diversifiers than others, most investors will probably want to shy away from investment vehicles that focus solely on a particular geographic region.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)