Top Earners, Businesses Likely to See Tax Increases

We think tax hikes for businesses are inevitable as Democrats seek infrastructure upgrades, healthcare expansion, and other priorities.

Democrats in Washington have a big wish list: major investments in all kinds of infrastructure from broadband, to sewer and water systems, to upgrading childcare facilities; a further expansion of the Affordable Care Act to give more people access to healthcare; and expanding the child tax credit on a permanent basis.

Of course, all these priorities cost a lot of money.

In fact, Morningstar estimates that simply extending the major tax provisions in the recently passed COVID-relief package, called the American Rescue Plan Act of 2021, would reduce federal tax revenue by around $1.6 trillion over 10 years. This estimate includes provisions such as the larger subsidies for health insurance premiums, the more generous child tax credit, and an expanded earned-income tax credit. On top of that, President Joe Biden has proposed another $2 trillion in infrastructure spending.

Democrats may decide that they don't need to pay for all this spending immediately--particularly one-time, once-in-a-century infrastructure upgrades. But they will certainly feel the need to pay for lot of it. We think that could amount to a tax increase of about $2 trillion over the next 10 years.

Democrats hold a razor-thin majority in Congress, along with their control of the White House. And it's unlikely their plans will get any support from Republicans. Still, despite the narrow majority, the chances of a major tax package falling apart is not that high. We think there's about an 80% probability that it passes, and we'll keep refining that number as Congress considers the plans.

Simply put, Democrats have unified control of government for the first time since 2010, and they agree that they should use their majority to make large changes to American public policy while they have it.

What Tax Options Are Available to Raise Revenue?

Biden campaigned on a platform of not raising taxes on families earning less than $400,000 annually, and we think he will keep that pledge. That makes the list of possible tax hikes much shorter.

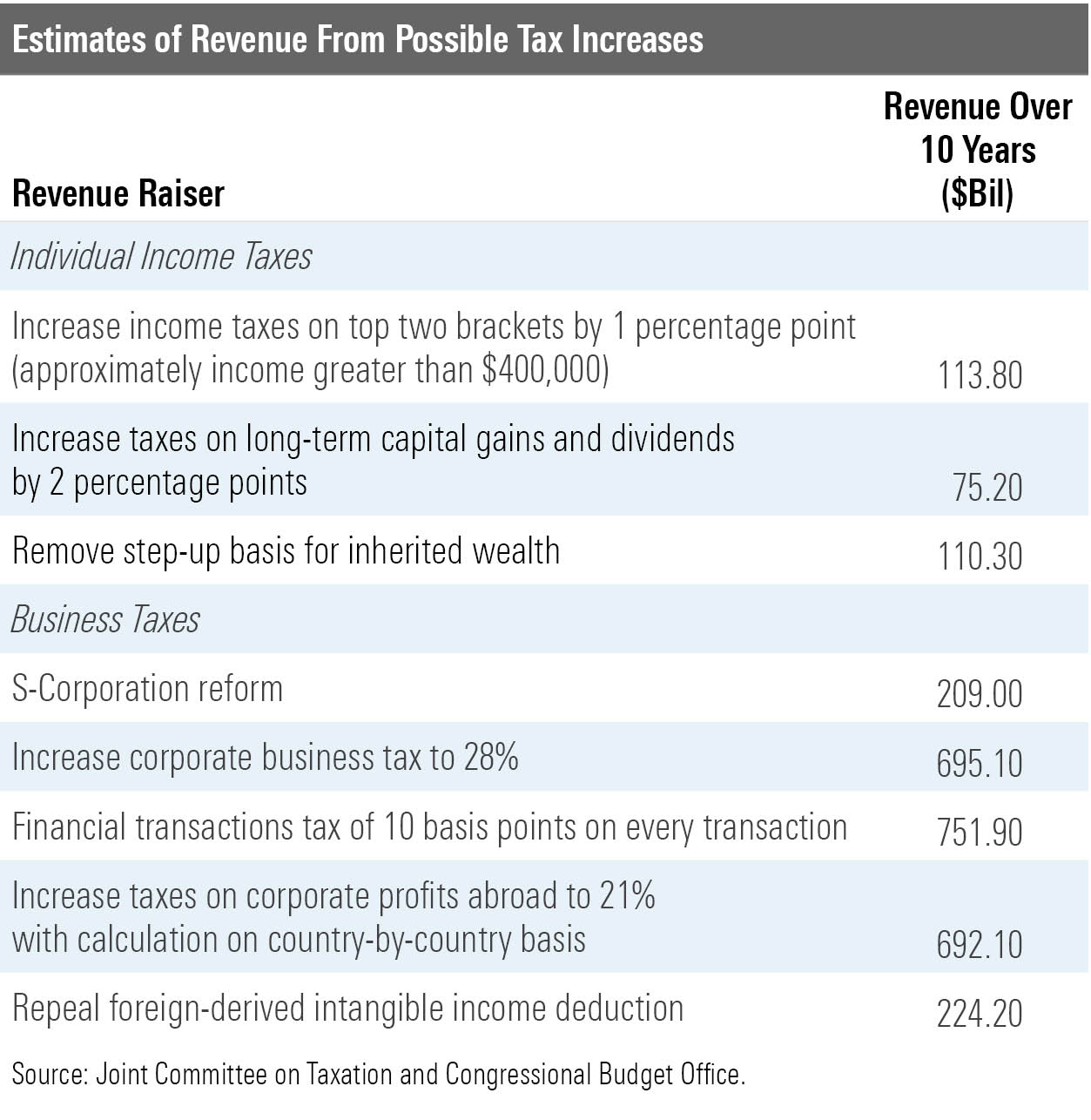

In the table below, we show estimates for various revenue raisers. Keep in mind, taxes on families earning more than $400,000 could be raised by more than 1 percentage point, and we assume the estimates will scale linearly for some time. For the moment, Democrats seem to be saving the changes in the tax code for individuals to pair with legislation that lowers taxes for other people. Biden has only proposed corporate tax increases since becoming president.

What Does Morningstar Think Is Most Likely to Happen?

While we think Democrats will probably increase income taxes for top earners later in the year, any major or new taxes will mostly be focused on increasing the taxes that businesses pay. There are two reasons: politics and cold, hard math.

Let's start with the politics. Every single Democrat voted against reducing the corporate business tax rate from 35% to 21% as well as the current global income tax regime in 2017. Democrats know they can use reconciliation procedures to raise these taxes again. While there are several members who would not be comfortable going back up to 35%, there are enough votes to increase it at least a few percentage points.

Democrats need to raise revenue from somewhere, which brings us to the math. If you look at the list above, there's simply no way to get to $2 trillion in tax revenue without at least a corporate business tax rate increase and, most likely, an increase in taxes on foreign profits. That's why Biden proposed both on March 31; there are not many alternatives available.

The wild-card source of revenue would be a financial transactions tax of 10 basis points on every sale of a security, which the progressive wing of the Democratic caucus has pushed for in recent years. We think that such a tax is less likely, but we never want to ignore a source of $700 billion in revenue that has some Democratic support, particularly from the left wing of the caucus. We'll be publishing a longer paper on this shortly, but there are some political and mathematical challenges for such a tax.

First, if it worked--that is, if investors did not immediately figure out workarounds--it would necessarily reduce securities' values since they would cost more to trade. Democrats would be blamed for falling 401(k) values. It also could create liquidity issues for some securities, potentially destabilizing financial markets. Second, although the tax raises revenue in theory, many other countries that have tried these taxes have found that investors are pretty good at tax avoidance, and the taxes changed behavior more than raising cash.

Finally, regarding individual income taxes, we think some increases are coming for high-income families. There will also be a lot of emphasis on individual income tax loopholes, which are perceived as unfair, but closing these loopholes does not raise that much money. For example, the Congressional Budget Office estimates that taxing carried interest at normal income rates only raises around $14 billion over 10 years. The biggest change would be removing the step-up-basis for inherited wealth, which would increase capital gains for heirs when they sold inherited assets by $110 billion over 10 years if it were enacted.

A Rare Twist: Death or Taxes, but Probably Not Both

We think the biggest source of uncertainty is the possibility that a Democratic senator from a Republican-controlled state dies. There are four senators over the age of 70 from such states. When we look at the actuarial tables and crunch the numbers, it yields a 9% chance of such a death. This wouldn't be unprecedented; Democratic Sen. Ted Kennedy's death in 2009 almost derailed the Affordable Care Act.

Given the uncertainty about the economic recovery and the not probable but still possible fracturing of Democratic consensus, we still peg the probability of a tax increase at around 80%.

What Will It Mean for Valuations and the Market?

All else equal, increases in taxes reduce corporate cash flow, and thus our fair value estimates. But of course, all else is not equal.

Because of the likely increase in taxes on profits recognized abroad, some companies will see much sharper increases than others. Additionally, these taxes are tied to spending, which could boost corporate profits more than the taxes hurt them. Indeed, the market reaction when Biden introduced the infrastructure package last month was positive. It's also worth noting that the massive tax cut in 2017 increased valuations by around 8 percentage points, with some variation between companies.

As we gain more clarity into the shape and probability of the specific tax rates, Morningstar analysts will incorporate these likely tax increases into our fair value estimates.

/s3.amazonaws.com/arc-authors/morningstar/c6d5b386-6df4-434b-bf56-ac0c9546e5aa.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JIZ7XPQ4FK7TGXNX42XRYN4GZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c6d5b386-6df4-434b-bf56-ac0c9546e5aa.jpg)