Will Sweetgreen's IPO Flourish or Wilt?

The IPO market is ripe for restaurants, but the salad chain's future is uncertain.

The restaurant industry is intensely competitive and constantly evolving to satiate customers’ hunger for the next new thing, making it hard for stores to keep their edge.

Salad chain restaurant Sweetgreen has built a following with sustainable and locally sourced foods, healthy offerings, and a robust digital platform. Intense competition and growing pains, however, could make its public debut go sour. After all, the company is not yet profitable, and customers can find other salads.

Sweetgreen started trading Thursday under ticker SG after raising $364 million in its IPO. The company sold 13 million shares for $28 a piece. Sweetgreen had initially marketed 12.5 million shares at a range of $23 to $25.

“Sweetgreen is selling into a really attractive IPO market, with restaurants benefiting from strong comparable store sales growth and swelling demand as consumers shift discretionary spending back toward services and as [COVID-19-related] mobility restrictions abate,” says Morningstar equity analyst Sean Dunlop.

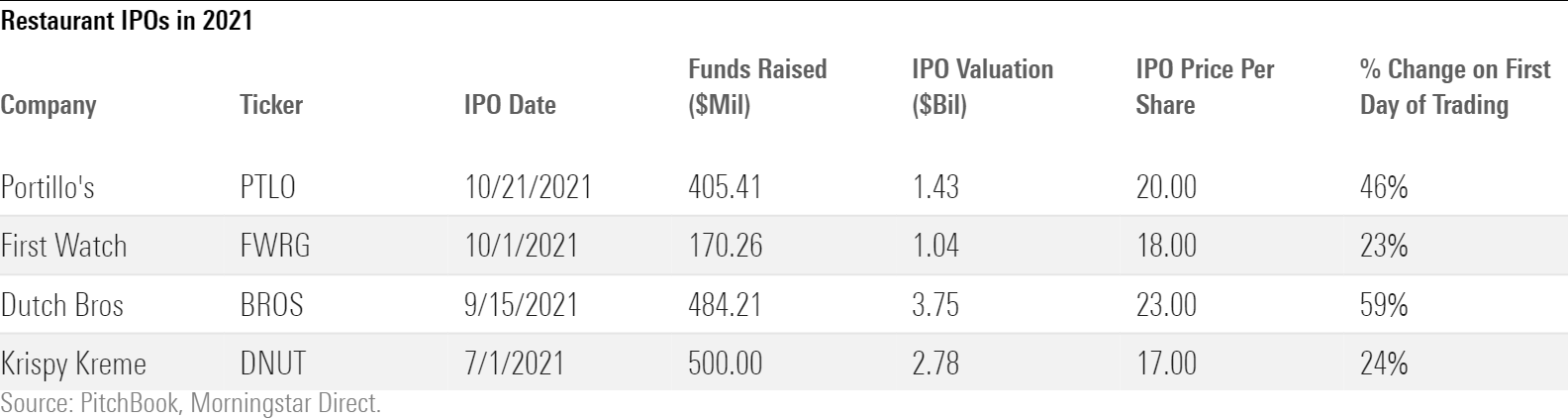

Sweetgreen follows Portillo’s PTLO, First Watch FWRG, Dutch Bros BROS, and Krispy Kreme DNUT as the latest restaurant to tap the public market.

The IPO Window Isn’t Always Open for Restaurateurs

Only two restaurant companies, Kura Sushi KRUS and Fat Brands FAT, went public between 2015 and 2020. And investor appetite can quickly evaporate as soon as a high-profile IPO goes sideways, as was the case with take-and-bake pizza chain Papa Murphy’s and sandwich chain Potbelly PBPB after the 2013-15 IPO surge.

Restaurants that find success in the public markets generally benefit from strong brand awareness, compelling profits at the store level, or scale-driven cost advantages.

According to Dunlop, Sweetgreen faces many of the same challenges as other regional chains trying to achieve scale, including generating strong restaurant-level returns and expanding a new concept into smaller areas beyond urban centers. It must also navigate factors that affect the entire industry, including labor market pressure, cost inflation, and kitchen equipment shortages.

Sweetgreen Needs to Grow to Keep Its Spot at the Table

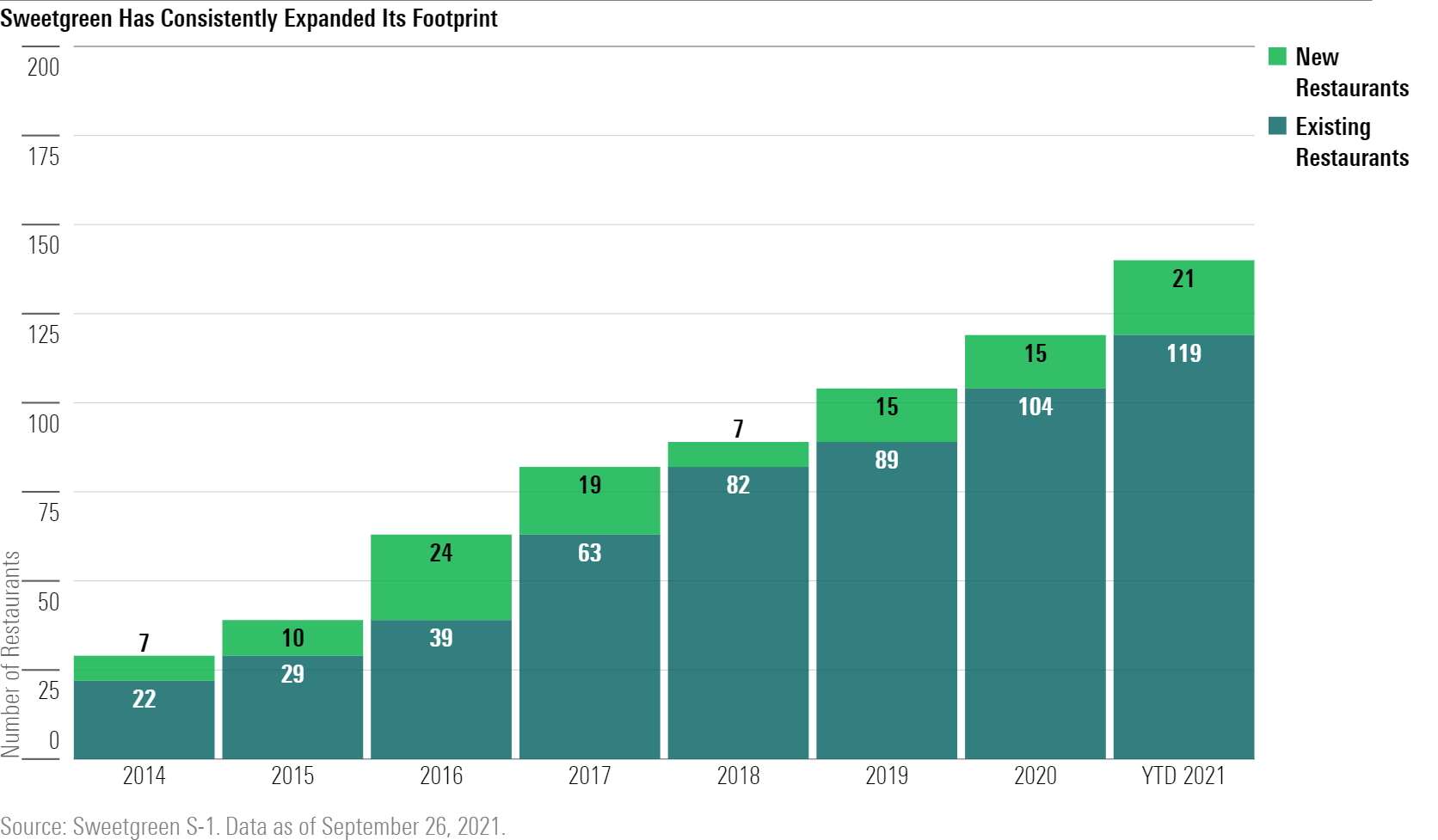

As of third-quarter 2021, Sweetgreen has opened 90 new locations since 2014 to reach 140 restaurants across 13 states and Washington, D.C., and the company plans to double its footprint in the next three to five years. Any change in direction after Sweetgreen’s public launch is unlikely--its founders will keep 60% of the voting power.

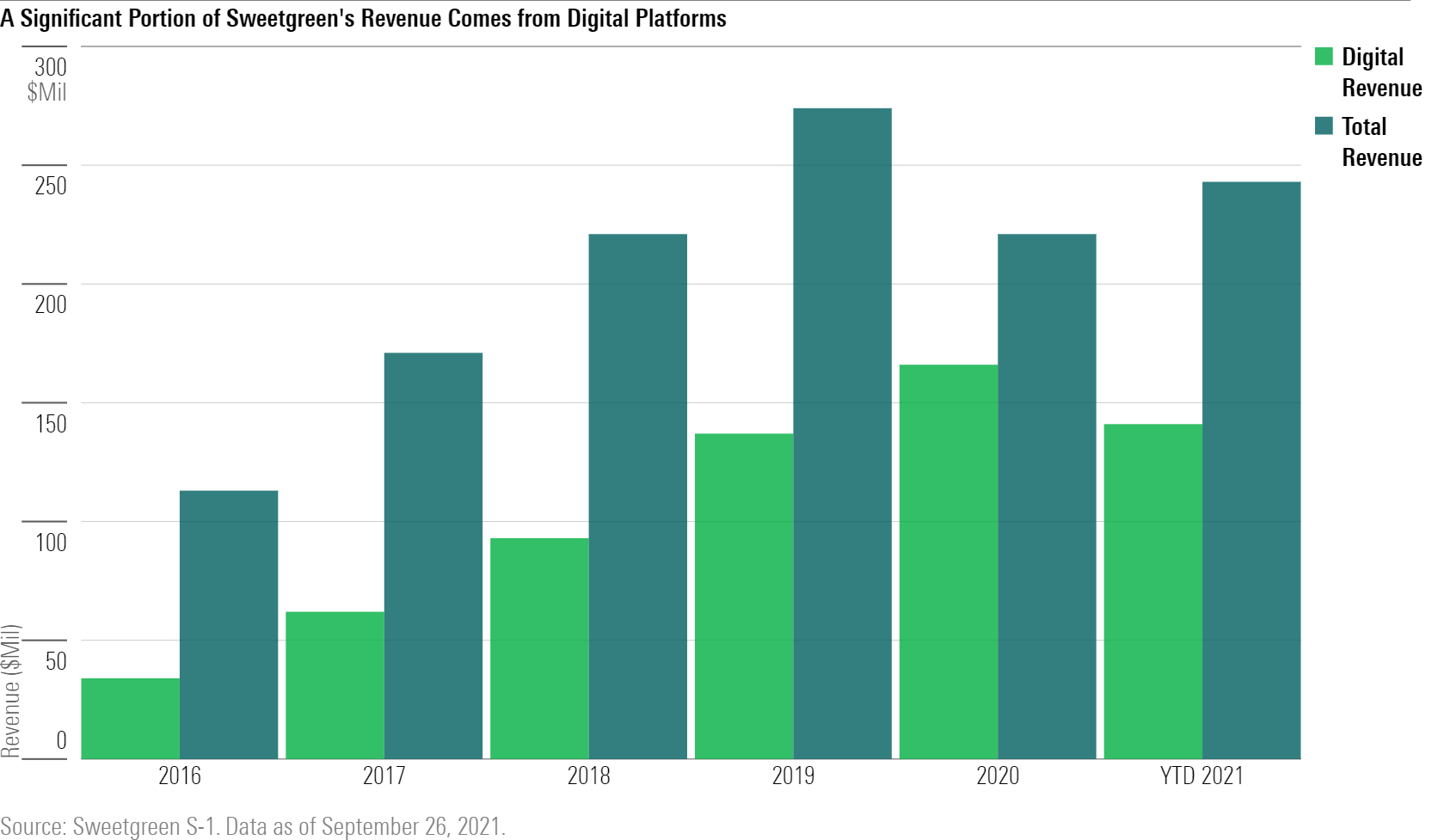

Sweetgreen’s digital platform allows the restaurant to deliver a personalized experience to its customers and drive brand loyalty. The restaurant’s digital share of revenue has grown even as overall revenue has increased. In a highly competitive environment, building brand loyalty can be a key to success.

Despite its expanded footprint and growing revenue, Sweetgreen has never been profitable, and the company will continue to face higher costs as it pursues further growth.

Even as Sweetgreen scales up its business, high menu prices may continue to be a sticking point--not everyone wants, or can afford, a $14 salad for lunch. Dependence on local suppliers will keep Sweetgreen from achieving any kind of cost advantage that comes from working with national suppliers on a large scale. The salad chain will need to persuade customers that its offerings are worth a price that’s higher than many of its competitors.

/s3.amazonaws.com/arc-authors/morningstar/96c6c90b-a081-4567-8cc7-ba1a8af090d1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KIQMCCUZ2RGWZKSCKM2Z4ZULFU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MGEDEFIRZJFHTAFNLDHG46SDXI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6HLXVGQ6DFCQDC3WHBZC6TLS2U.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96c6c90b-a081-4567-8cc7-ba1a8af090d1.jpg)