Maybe 2022 Was ‘the Start of the Return to Normal,’ Aswath Damodaran Says

Markets and companies are facing a long-overdue reckoning, but healthier practices may be the result.

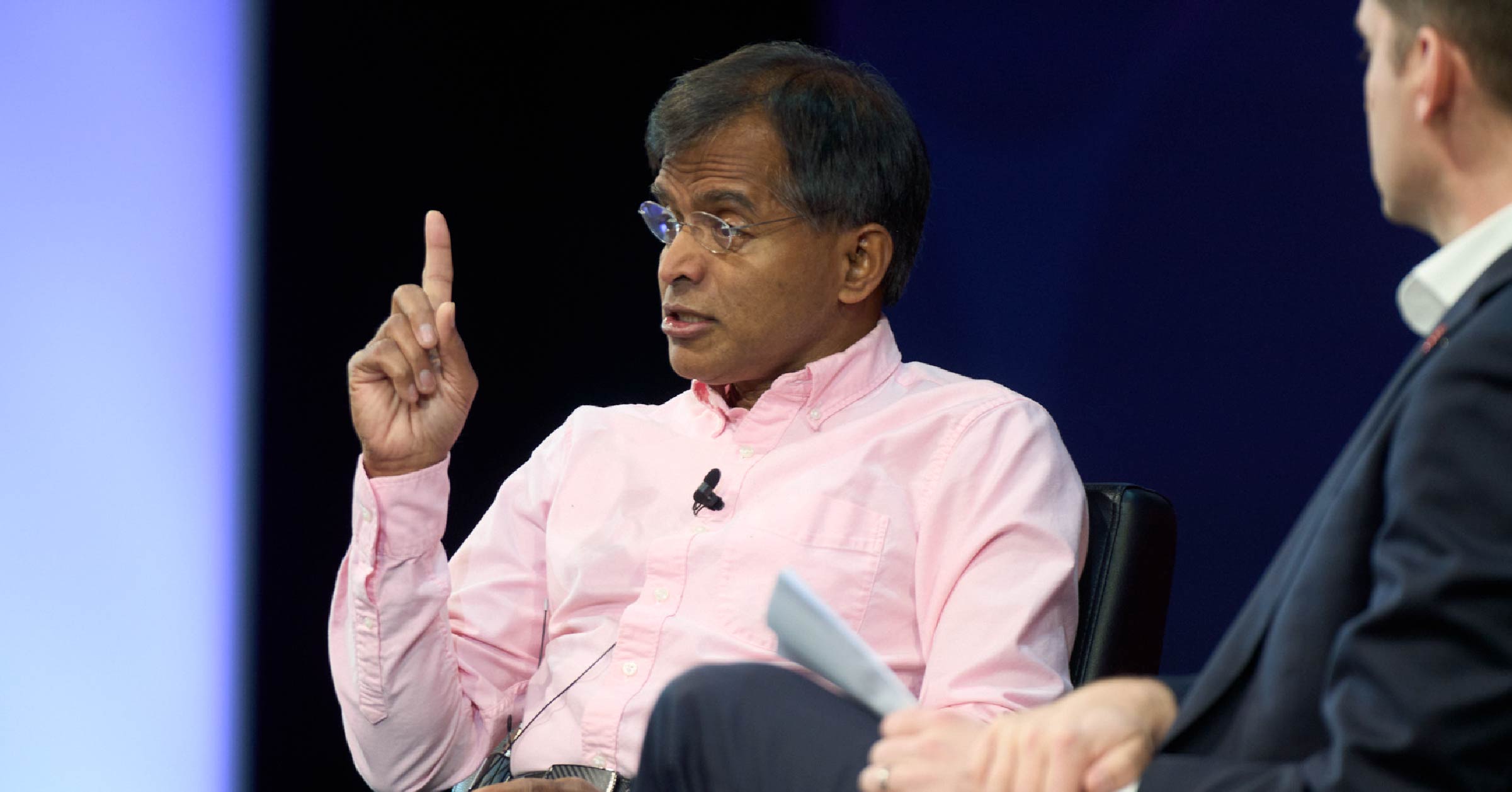

While 2022 saw severe damage inflicted on investors’ portfolios, Aswath Damodaran, professor of finance at New York University, says that in some ways, it may have served as a much-needed course correction for how investors and company managements view the world.

Speaking at the 2023 Morningstar Investment Conference, Damodaran said there may be a temptation to see last year as an “aberration,” as it put a sharp end to the easy money and strong markets of the previous decade.

Now, a critical question for investors, Damodaran says, is whether to be investing “based on the way the world used to look like pre-2022 or the way the world looks like in 2022, which makes it a very different game.”

“Was 2022 an aberration? That really is what’s going to drive investing ... in the next few years,” he says. “Maybe 2022 was not the aberration, but the start of the return to normal.”

This is a positive shift, Damodaran argues. “I think too much money went to firms that didn’t deserve it,” he adds. He points to how many companies grew and expanded rapidly thanks to the relatively low cost of capital over the last 10 years. Coming into 2023, that quickly turned around.

Damodaran calculated the median cost of capital for 47,000 companies to be 6% at the start of 2022. In 2023, just a year later, it jumped to 10%, the largest change he’s seen in a single year. “When your cost of capital is 6%, you can afford to let things slip … at 10% you don’t have that luxury,” he says.

Markets Now Demand Real Business Models

The reckoning companies are now facing was long overdue, he says.

For example, the lower cost of capital of the last decade also lowered the bar for what companies had to accomplish to be profitable. Today, there are many companies that started projects a year or two ago based on lower costs of capital that they now likely wish they hadn’t, Damodaran says.

Ultimately, “a lot of these companies are going to have to fish or cut bait. They have to show they can build a business model that makes money,” he says.

While the change in cost of capital was abrupt, Damodaran says that it was “long overdue, and perhaps because we put it off for so long, I think it was so severe.”

The return to normal of “pre-2008 numbers” is not a bad thing, Damodaran says. “I think it might bring back some healthier practices, not just into public companies, but into private.”

It’s Inflation Uncertainty That’s the Problem

Another key issue of 2022: inflation. As a whole, he argues high inflation is not necessarily a problem if it’s fixed. “It just becomes built into everything; it becomes one more metric you add.”

The key problem with inflation is “when inflation gets high, it’s also more likely to get uncertain,” he says. Part of what kicks off the uncertainty is what economies do about inflation. “Do we let it stay high? Should we drop it down?”

From an investing perspective, Damodaran gave the example of a country where inflation is expected to be 5% and guaranteed to stay at that level. A second country has 2% expected inflation, but it can go from zero to 4%. “Which country would you rather invest in? I’d rather invest in the first country,” he says. “When inflation is high and fixed … it becomes one more metric you add into everything.”

The best thing to do in periods of inflation uncertainty, such as now, is to “control the things you can,” he says. Inflation and interest rates can’t be controlled; as a result, Damodoran says investors should instead focus efforts on working with what actually can, such as devising a portfolio that can adapt to the fact that inflation can change.

“You’ve got to have companies that have pricing power,” he says.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KD4XZLC72BDERAS3VXD6QM5MUY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)