Markets Brief: The Wile E. Coyote Stock Market

Stocks are on less stable ground as ‘normalizing’ rates alter the outlook.

In the classic Looney Tunes Road Runner cartoons, a running gag is the tendency for Wile E. Coyote to briefly defy gravity before plunging into a canyon.

While stocks are certainly not tumbling off a cliff, the fourth quarter is getting underway with investors on less-solid ground, courtesy of rising bond yields and expectations that Federal Reserve rate cuts are not only further off on the horizon, but also likely to be stingier than had been expected just a few months ago.

That’s led to a jump in bond yields, with the U.S. Treasury 10-year note now at 4.57%, up from 3.97% at the end of July and 3.9% at the end of 2022. Beyond that, in Wall Street parlance, the bond market is “normalizing” after a long stretch during which the Federal Reserve kept interest rates artificially low.

Treasury Yield and Federal-Funds Rate

“We’re coming to terms with the free market in fixed income,” says Jason Trennert, chief investment strategist at Strategas Research Partners. “The Fed, really since the financial crisis in 2009, has been suppressing interest rates.” He continues: “What the market is dealing with now is the fact that rates are our variable … and the Fed is not going to bail you out.”

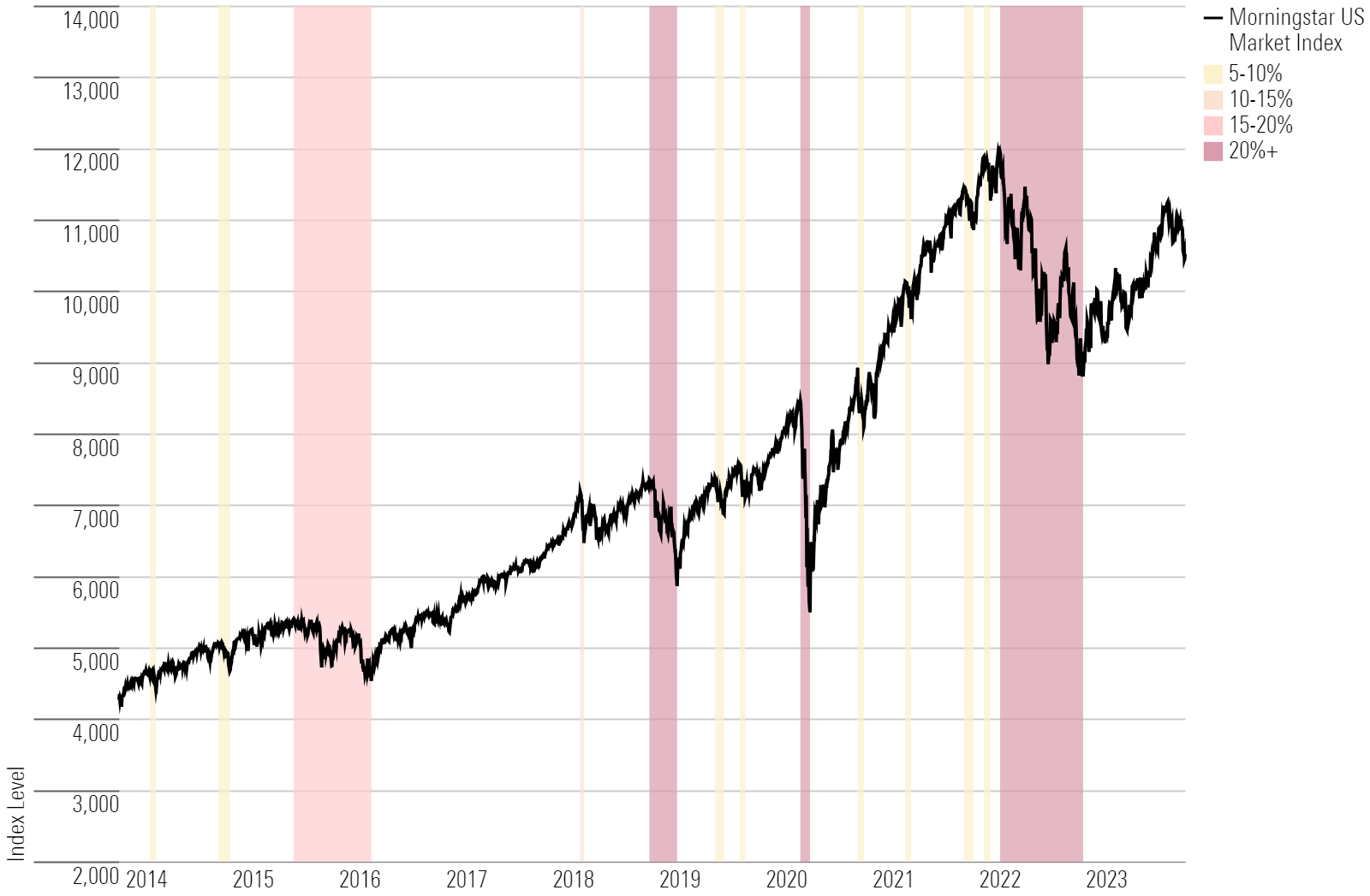

The rally in stocks during the first half of 2023—deemed a new bull market by many—had the Morningstar US Market Index up 20.6%. But since the end of July, stocks are down nearly 7%.

Stock Market Pullbacks

This “higher for longer” (as it’s being called) landscape has taken the wind out of growth stocks, which were the main driver of the 2023 rally. And under the hood of this year’s stock market, gains weren’t reflecting earnings growth. Instead, investors were driving prices higher relative to earnings—a dynamic known as multiple expansion.

“The entirety of the move this year … has been multiple expansion, which is to say that earnings have declined. And long-term interest rates are up a lot,” says Trennert. “If you are given the fact pattern at the start of the year and say, ‘Gee, interest rates are going to be down and long-term interest rates are going to be up,’ what do you think the stock market is going to do? You certainly wouldn’t have come up with multiple expansion.”

This leaves two critical variables for the stock market in the final months of the year: the outlooks for interest rates and corporate earnings.

What Is a Stock Multiple?

The most common multiple is the price of a stock divided by actual or expected earnings. But looking at the bigger picture, P/E multiples reflect the confidence that investors have in a company’s ability to deliver profits. Inherent in a P/E multiple is a reflection of how much investors are willing to pay for those profits. Typically, the fastest-growing companies (such as many technology stocks) will command higher multiples.

But it’s not just earnings that play a role in multiples. When interest rates are low, investors place a higher value on stronger expected earnings. But as rates climb, the relative value of future earnings diminishes the current worth of those stocks.

That dynamic was a major reason behind the drubbing that technology and other prominent high-growth stocks took in 2022. And while it played out on a smaller scale in the third quarter of 2023, it was stocks like Apple AAPL, Tesla TSLA, and Meta Platforms META that played a key role in dragging the overall market back down.

However, for much of this year, the overall market’s P/E multiple was on the rise, from levels that were already lofty by the standards of a bear market. At the end of 2022, the forward P/E—which is calculated using the coming 12 months of earnings estimates from stock analysts—stood at 16.8 according to FactSet, down from 21.5 at the end of 2021. By the end of July, that had risen to 19.7, and it’s now 18. That’s still north of the P/E of 17.5 for the last 10 years.

Stock Market Valuations

One potential reason for the expansion of multiples this year was a belief that not only was the Fed almost done raising interest rates, but also that there would be a quick and aggressive pivot by the central bank to lower them.

Earlier this year, when many investors were looking for an economic slowdown by the third quarter (if not a slide into recession), bond markets were pricing for Fed rate cuts during 2023. Even when it became clearer that a recession was not in the cards for this year, prior to the September Fed policy meeting, bond markets were pricing in as many as five rate cuts in 2024.

Investors now appear to believe those scenarios are off the table, thanks in part to the Fed signaling that most officials expect to cut rates just twice in 2024 for a total half-point reduction, and only after raising rates one more time this year. This leaves investors wrestling with just how much higher bond yields might rise in the short term, and then what longer-term range the bond market settles into.

From 2011 through 2022, the yield on the Treasury 10-year note averaged 2.2%, and from July 2011 through last year, it never strayed above 3.25%. Trennert says that if the bond market is “normalizing,” then yields on the 10-year note should generally be about 2 percentage points above inflation. If inflation hovers around 3%, where it currently stands, “that would suggest rates could easily be over five.” He says, “Unless long-term interest rates are coming down, it’s going to be hard to get multiple expansion.”

While bond yields have been rising, corporate profits have been falling. In the second quarter, S&P 500 profits fell 4.1%. For the third quarter, earnings are expected to fall 0.2%. To some degree, the trend to a smaller decline in earnings is positive, but with rates higher and the economy still expected to slow in 2024, the outlook for corporate profits could remain muddy for some time.

Third-quarter earnings are “going to be pretty good, just because it looks like economic growth for most of the third quarter has been pretty strong,” says Trennert. “But it will be the guidance about 2024 that is really important for the market.”

For the Trading Week Ended Sept. 29

- The Morningstar US Market Index fell 0.6%.

- The best-performing sectors were energy, up 1.5%, and technology, up 0.2%.

- The worst-performing sectors were utilities, down 6.7%, and consumer defensive, down 2.0%.

- Yields on 10-year U.S. Treasuries increased to 4.57% from 4.43%.

- West Texas Intermediate crude prices rose 0.84% to $90.79 per barrel.

- Of the 837 U.S.-listed companies covered by Morningstar, 353, or 42%, were up, and 484, or 58%, were down.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KD4XZLC72BDERAS3VXD6QM5MUY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/A7YHHS6HQJB7RJU76FB5C2TXV4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)