3 Stock Sectors With Big Fair Value Estimate Increases After Q4 Earnings

Basic materials, industrials, and technology stocks saw significant valuation boosts.

While fourth-quarter earnings have been weak, the picture could have been a lot worse.

Against this backdrop, for the first time since the start of 2022, following fourth-quarter earnings Morningstar analysts overall nudged up fair value estimates on the U.S.-listed stocks they cover.

That was especially the case in the basic materials, industrials, and technology sectors, where analysts lifted their fair value estimates by 10% or higher more frequently than in any other sector.

Between Dec. 30 and Feb. 24, fair value estimates increased slightly by 0.22%. That followed back-to-back earnings-season periods where they declined.

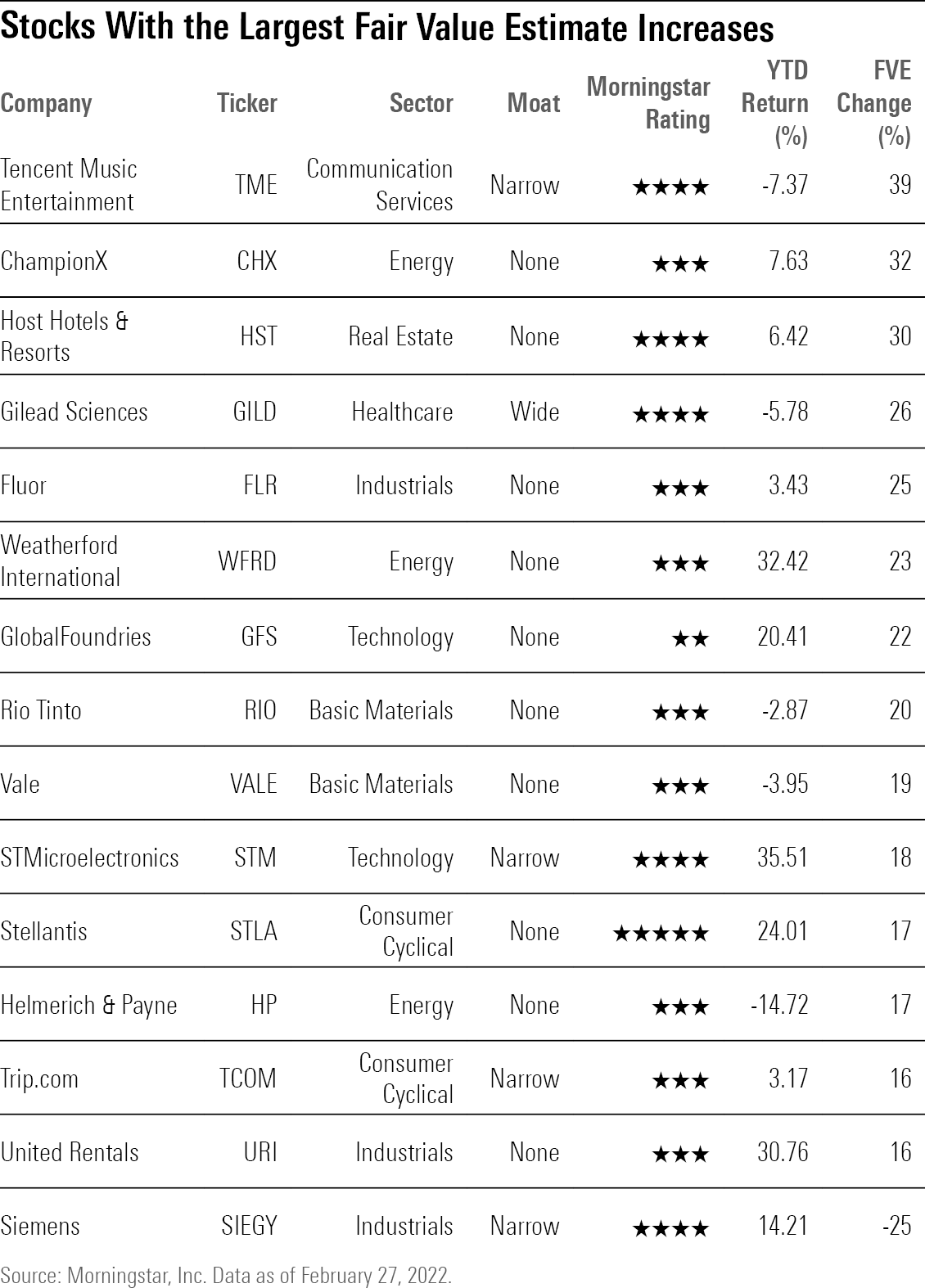

Out of the 843 companies covered by Morningstar analysts, 25% of companies saw their fair value estimates increase, compared with 15% from the previous quarter and a 10-year quarterly average of 21%. Meanwhile, 15% of companies saw reductions to their fair value estimates, down from 24% in the previous quarter but up from the 10-year quarterly average of 8% companies.

Key Takeaways

- Stocks sensitive to economic conditions, such as energy and technology, saw the largest average increases in fair value estimates, by about 0.48%. Cyclicals and defensive valuations were generally flat.

- Energy, industrials, and basic materials stocks experienced the largest average increase in fair value estimates. Communication services and technology stocks saw the largest average reductions.

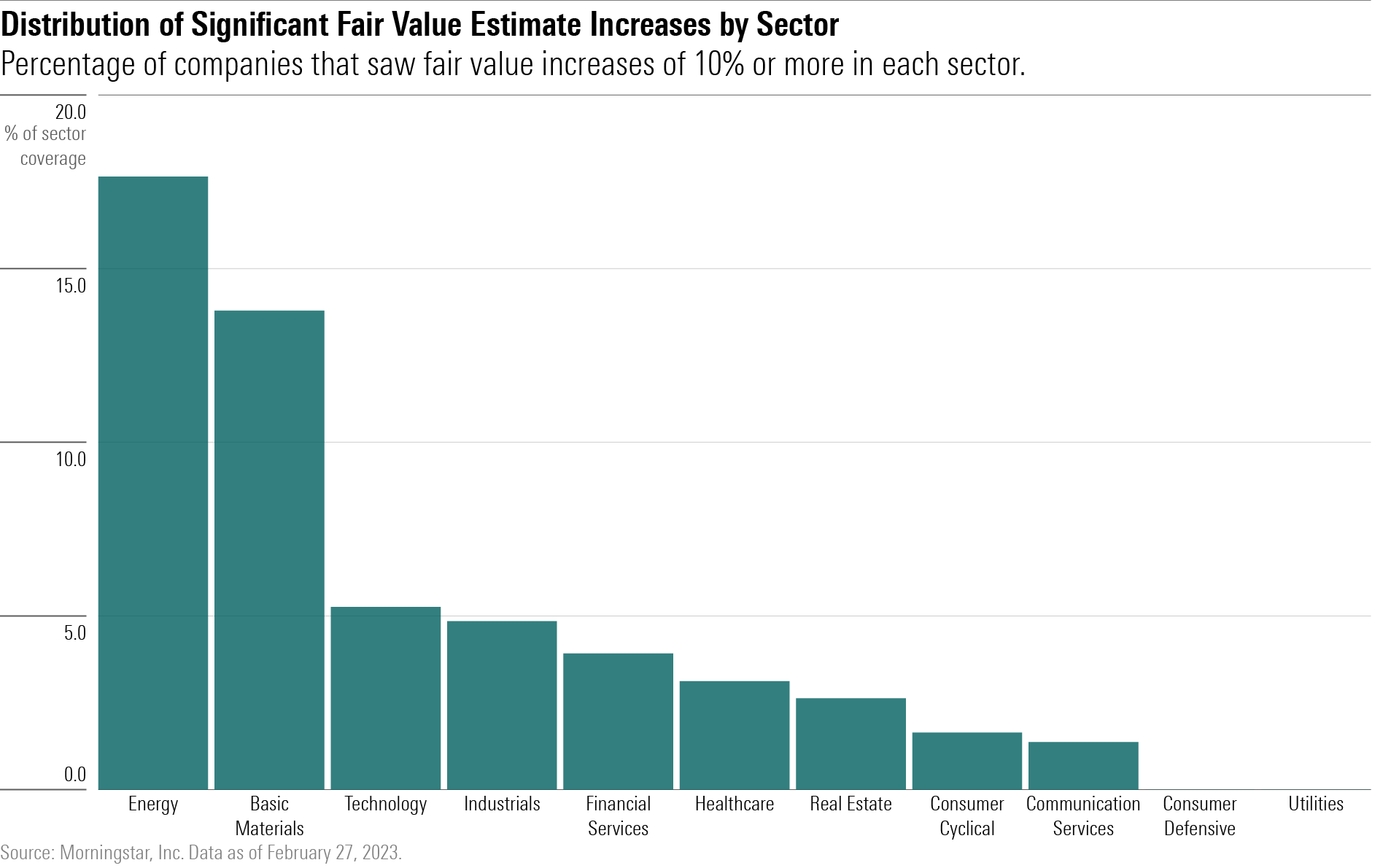

- When it came to fair value estimate increases of 10% or more, technology stocks were third among all 11 sectors, following energy and basic materials. Strong demand in the auto industry helped improve conditions for several semiconductor stocks like GlobalFoundries GFS and STMicroelectronics STM.

- Among the stocks with the largest fair value estimate increases were oil & gas equipment & service providers such as ChampionX CHX and Weatherford WFRD. Meanwhile, China’s dismantling of its zero-COVID policy also improved the outlook for basic materials firms Rio Tinto RIO and Vale VALE.

Sector Valuation Changes

Morningstar analysts conduct a fundamental review and create models to determine a fair value estimate of a company’s shares. While Morningstar analysts take a long-term approach to investment analysis, they monitor quarterly earnings results to update their assumptions and, potentially, their fair value estimates.

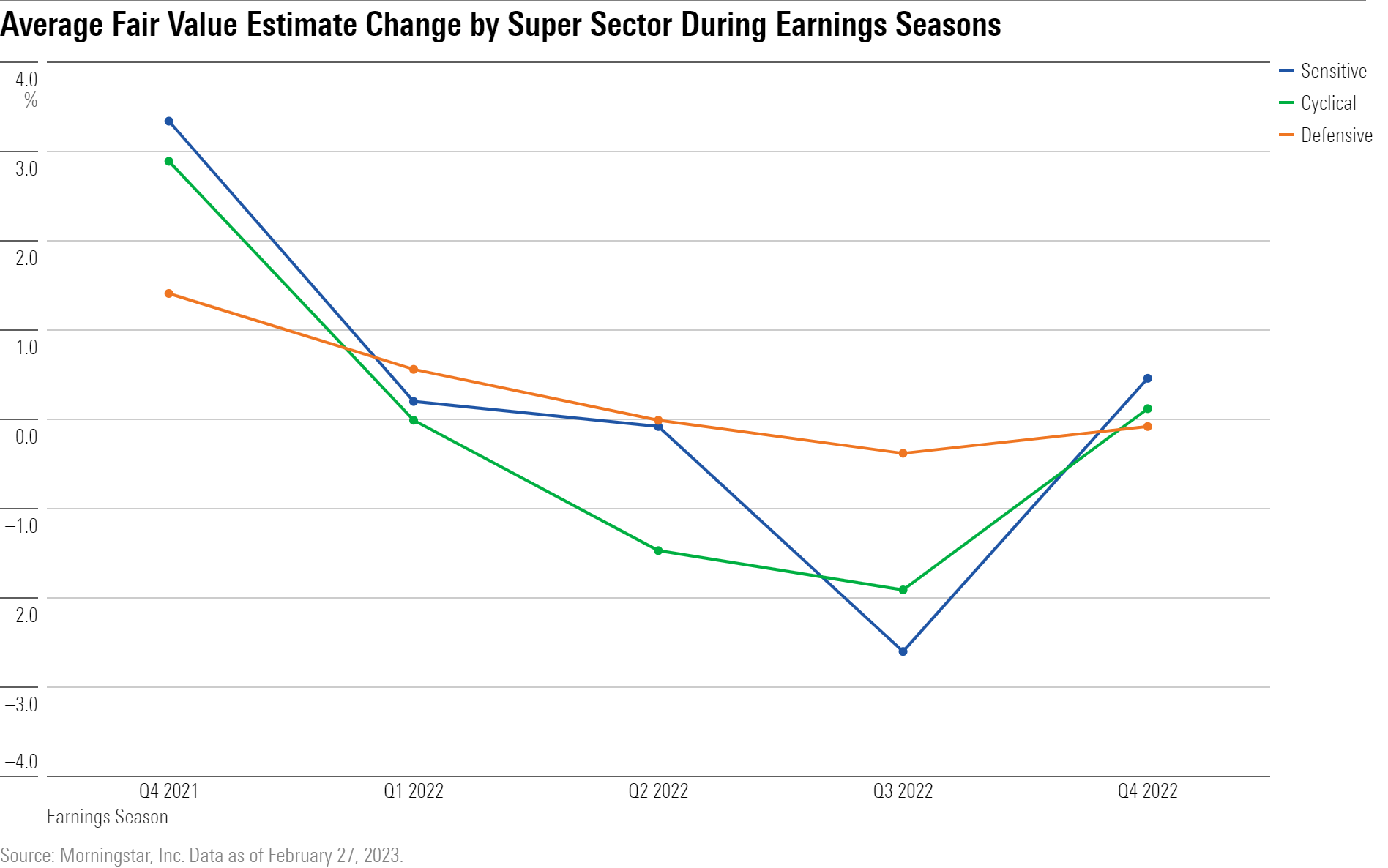

To show high-level trends among stocks, we looked at the average percentage change in fair value estimates following and during earnings for the past five earnings seasons for Morningstar’s Super Sectors: cyclical, defensive, and sensitive stocks.

Both sensitive and cyclical Super Sectors saw improvements, on average, to their fair value estimates during fourth-quarter 2022 earnings season. Sensitive stocks saw fair value estimates increase by 0.48% on average, followed by cyclical stocks’ fair value estimates rising 0.12%.

Changes to defensive stocks’ fair value estimates were essentially flat, with the group’s valuations declining 0.08% overall.

(The fair value estimates were pulled from Morningstar Direct for the end dates of each quarter and compared against the estimates six to eight weeks after each quarter ended to capture changes during each earnings season. More details on the methodology can be found at the end of this article.)

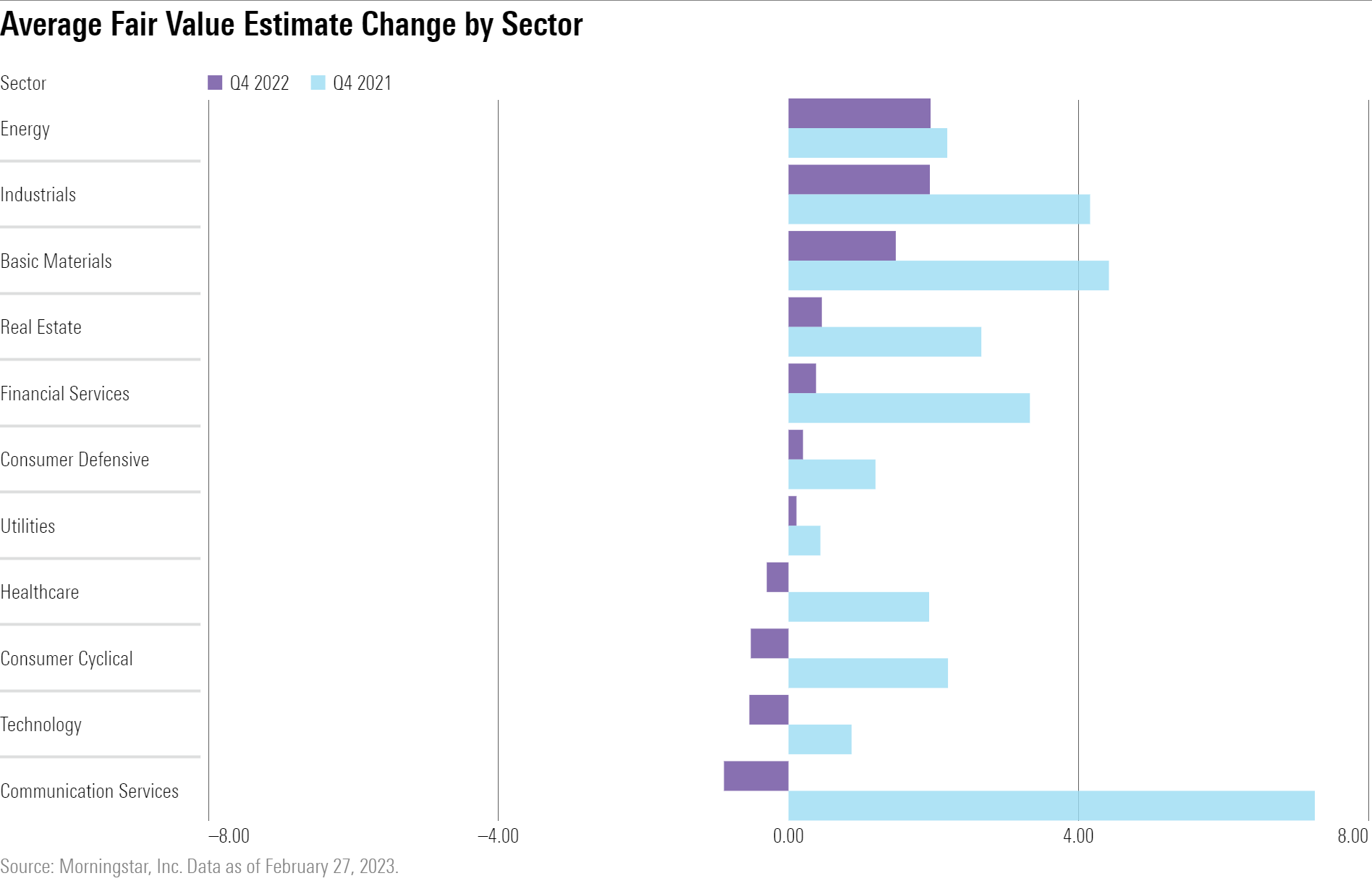

Drilling down, individual sectors with the largest average fair value increases were energy, up 1.96% on average, industrials, 1.95%, and basic materials, 1.48%.

Communication services and technology stocks saw an overall decline in their fair value estimates. Communication services stocks had valuations cut by 0.89% on average, and technology stocks by 0.54%.

However, average fair value cuts don’t tell the whole story. In terms of the sectors where the largest and most frequent fair value estimate increases were located, technology stocks still made it onto the podium.

Even as technology stocks suffered the second-worst average fair value reduction during fourth-quarter earnings, the sector was ranked third in terms of its proportion of fair value estimate increases of 10% or greater to the rest of the sector’s coverage list.

About 5% of technology companies under Morningstar’s U.S.-listed coverage list saw their fair values rise 10% or more, behind energy, where that number was 17%, and basic materials, at 14%.

Energy Stock Valuation Upgrades

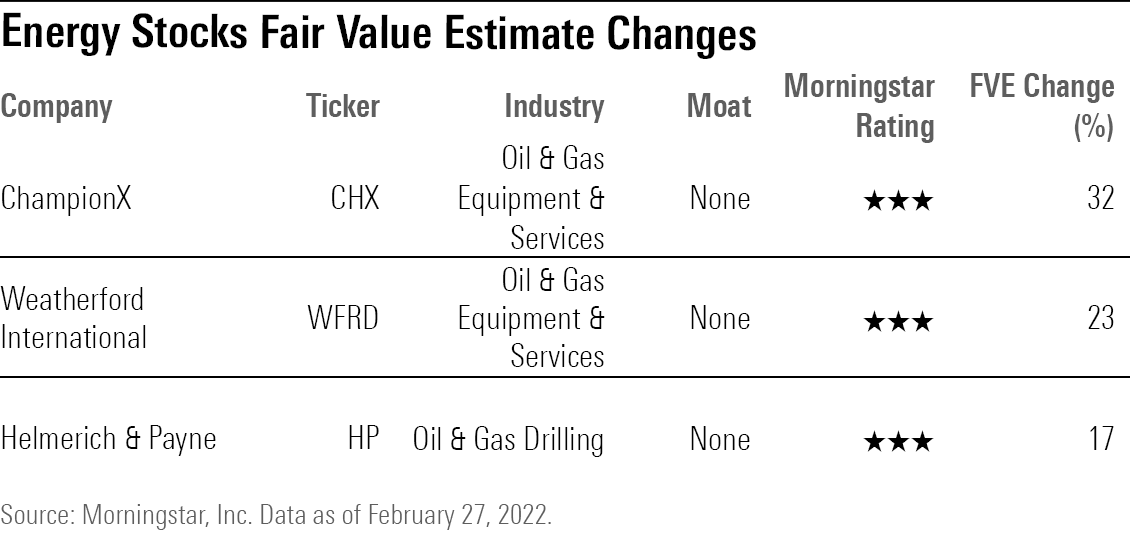

Energy stocks had some of the largest fair value upward adjustments during the fourth-quarter earnings season. ChampionX, an oil & gas equipment & services company, had the second-largest fair value estimate increase in Morningstar’s U.S-listed coverage list.

Morningstar analyst Katherine Olexa raised her fair value estimate for ChampionX to $33 from $25 following fourth-quarter results that showed revenue rising 20% year-over-year because of a favorable pricing environment and increasing production activity worldwide, which she believes will persist in 2023.

Helmerich & Payne HP, a drilling rig provider to oil and gas producers, likewise saw its fair value estimate increase to $49 from $42 because of rising daily rental rates for drilling rigs. Olexa says Helmerich & Payne has “ample runway to realize higher pricing in the near term.” H&P currently averages rig rates around $33,000, despite industrywide rig rates currently priced around $40,000 per day for leading-edge equipment.

“Nearly 60% of H&P’s active rigs currently operate on long-term contracts that feature older, lower pricing agreements. Approximately half of these will roll over between now and December, by our estimate, lifting H&P’s average day rates,” she says.

Olexa also increased oilfield services provider Weatherford International’s fair value estimate to $53 from $43 because of its strong performance during 2022. “Revenue increased 19% year over year while the firmwide adjusted EBITDA margin jumped 300 basis points to 19%, levels not achieved in over a decade,” she says.

All three energy companies have a Morningstar Rating of 3 stars, with shares trading in ranges that Olexa views as fairly valued.

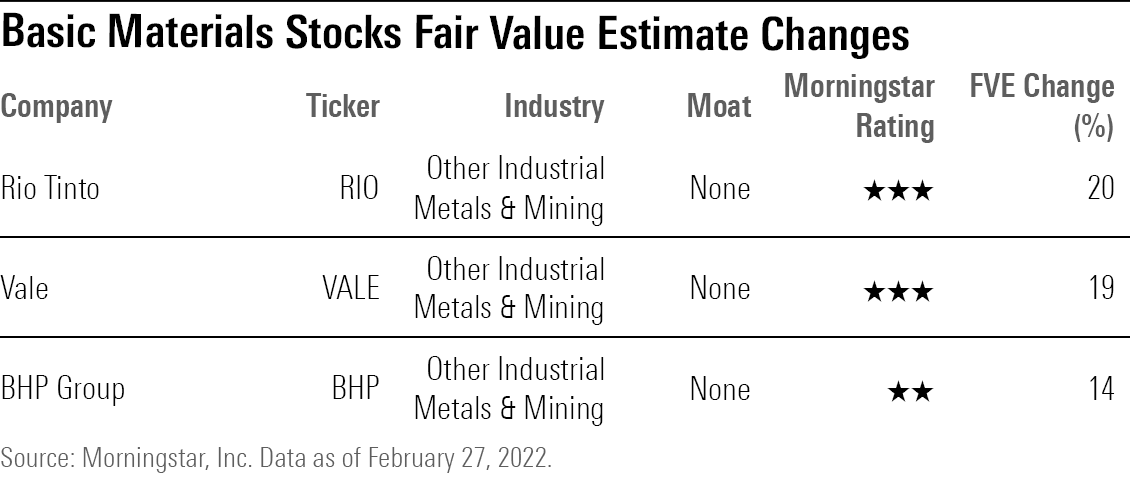

Basic Materials Stock Valuation Upgrades

Morningstar analysts lifted fair value estimates for basic materials companies on the back of higher price forecasts for commodities such as iron ore, copper, and aluminum.

“Commodity prices generally rose over the fourth quarter of 2022 as widespread protests forced China to abandon its zero-COVID-19 policy and reopen,” says Morningstar equity research analyst Jon Mills. “Expectations of increased demand for commodities arising from further stimulus and government financial support for China’s property sector more than offset headwinds as central banks kept raising interest rates to damp inflation.”

Basic materials firms with the largest increases to their fair value estimates were Rio Tinto, which was increased to $75 per share from $62.50, Vale, to $16 from $13.50, and BHP Group BHP, to $54.50 from $48.

Despite the increases, both Rio Tinto and Vale are considered fairly valued, with both company’s stocks trading in the 3-star Morningstar Rating territory. BHP Group, on the other hand, is considered overvalued, with a 2-star Morningstar Rating.

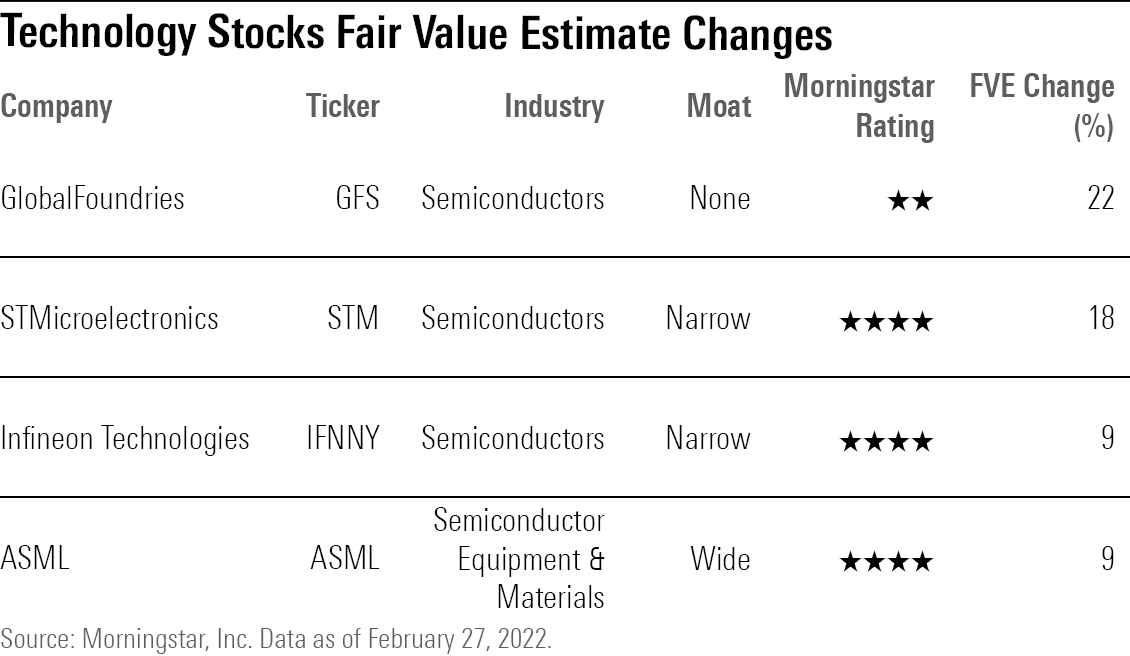

Technology Stock Valuation Upgrades

The technology stocks that saw significant increases to their fair value estimates were mostly semiconductor companies. The stock with the largest fair value estimate increase in the sector was GlobalFoundries, the world’s fourth-largest chipmaker. Morningstar strategist Abhinav Davuluri raised the company’s stock fair value estimate to $55 from $45 after incorporating a strong long-term outlook.

A key tailwind for the stock is the company’s exposure to long-term contracts, which accounts for about 40% of its customers, which is a positive sign for future revenue growth. “The firm also recently announced a long-term agreement with General Motors for dedicated capacity exclusively for GM’s chip suppliers that get their chips made at GlobalFoundries … Following the recent automotive chip shortage, we expect more automotive manufacturers to try to lock in supply with foundries, which bodes well for GlobalFoundries longer term,” Davuluri says.

Davuluri sees GlobalFoundries as overvalued by about 18% at recent prices; the stock has a Morningstar Rating of 3 stars.

Likewise, robust demand for chips in the automotive industry benefited semiconductor firm STMicroelectronics, also known as ST. While overall chip demand may be softening, Morningstar’s director of equity research of technology, Brian Colello, notes sales for automotive chips remain strong.

STMicroelectronics’s fourth-quarter results showed automotive chip sales growing 38% year over year and 8.5% from the third quarter. Colello raised his fair value estimate to $59 from $50 as he now sees “a clearer path to ST achieving its key long-term targets of $20 billion of revenue and 50% gross margins.”

“ST will shift even more of its business toward higher-margin automotive and industrial chip design wins, and based on its backlog and visibility, the company thinks this revenue pipeline is relatively secure, even as macroeconomic headwinds persist,” Colello says. ST is considered undervalued and has a 4-star Morningstar Rating, trading at about a 20% discount to its fair value estimate.

Other semiconductor stocks that experienced recent fair value increases include Infineon IFNNY, to $48 from $44, and ASML ASML, to $760 from $700. Both stocks are undervalued, with a Morningstar Rating of 4 stars.

Data notes: Fair value estimates were sourced from Morningstar Direct for the end dates of each quarter. Fair value estimate percentage changes were then calculated between their value at the end of each quarter, and any new fair value estimates as of six weeks after the quarter ended, which we define as earnings seasons for the purpose of this article. For example, for third-quarter 2022, fair value estimate percentage changes were calculated between Sept. 30 and Nov. 11. For the fourth quarter only, we expand our earnings-season period to eight weeks to adjust for the holiday season. In some cases, fair value estimate adjustments may have also been made outside of these date ranges and would not be captured in this review.

Stocks without a fair value estimate at the beginning and/or end of the six-week period were excluded from data aggregation to account for any changes in our equity coverage list. Stocks portrayed in sector tables may not necessarily reflect those that had the largest fair value moves within the sector. The stocks mentioned in this story were selected to emphasize sectorwide trends and/or at the recommendation of Morningstar analysts.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K4RTVRPKCVFQBMRNMXPUOHFNLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7WLK3HWLZBFR7NKI45PXWUD6OI.jpg)