2016 vs. 2015: A Stock Market Flip-Flop in 5 Charts

Last year's returns were in many ways a mirror image of 2015, writes Morningstar Indexes' Dan Lefkovitz.

If 2015 was all about U.S. large-growth stocks, a quick look at Morningstar Indexes shows how dramatically the story changed in 2016. In fact, last year turned out to be a mirror image of much of the past five years. And it was also a year with reversals among key global markets.

Party in Fama-French Land

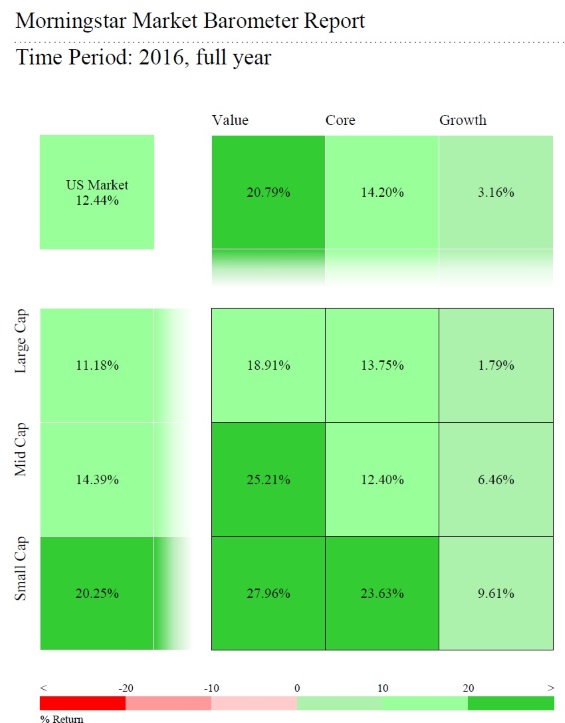

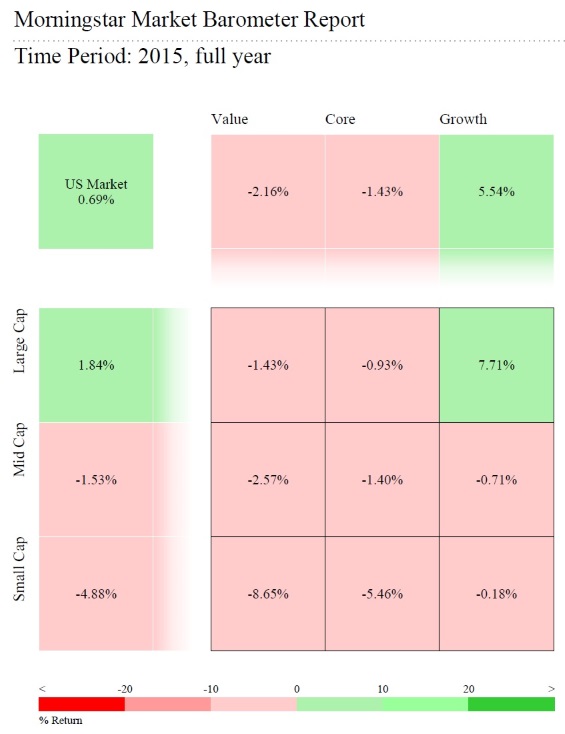

While the overall U.S. market had a good year in 2016, the biggest winners were found toward the lower left-hand corner of the Morningstar Style Box. The US Market Barometer, the heat map version of the style box powered by Morningstar Indexes, shows the biggest gains in small value and mid-value. Stocks like

What a contrast to 2015. Remember the high-flying FANG stocks:

Indeed, the five-year period 2011-2015 generally saw large outperform small and growth outperform value. This reflected a risk-averse, weak economic environment where investors favored established companies possessing secular growth drivers.

Commodities & Cyclicals Rebound After a horrid start to 2016, the market rebounded in mid-February with commodities stocks leading the charge. In fact, the Morningstar Global Upstream Natural Resources Index, essentially a leveraged play on commodity prices, gained 32% in 2016. The commodities rally is commonly explained by resilient Chinese demand and producers' efforts to limit supply.

At a sector level, energy, communications, financials, basic materials, and industrials all did well, especially with post-election expectations of infrastructure spending, tax cuts, regulatory rollback, and interest rate hikes. Meanwhile, the Morningstar US Healthcare Index was in negative territory for 2016.

The sector story helps explains the style box story, as value and smaller caps are heavier on energy, basic materials, and financials, and lighter on healthcare.

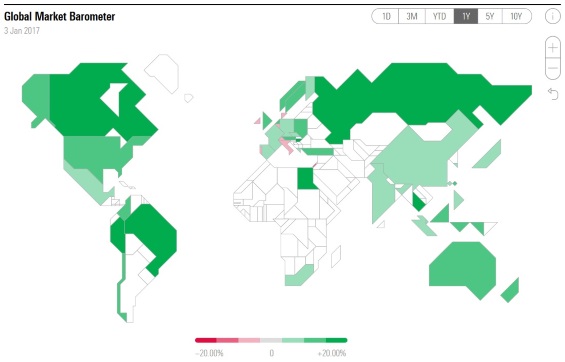

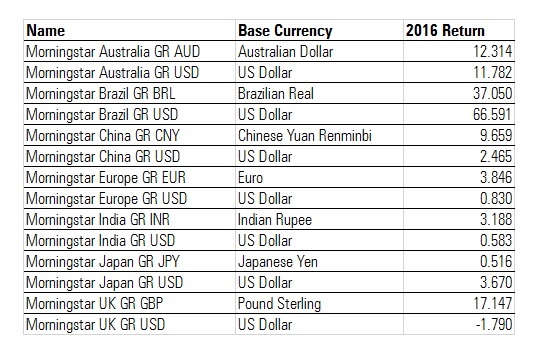

Emerging Markets Rebound (Sort of) The year also saw something of a reversal from a geographic perspective. Most of Morningstar's 45 equity market indexes posted strong gains in 2016, at least in local currency terms. Emerging markets Brazil, Russia, China, South Africa, Poland, Turkey, Thailand, and Indonesia all did well. Natural-resources driven markets Canada and Australia also saw strong gains. Pockets of Western Europe, such as Italy, were the year's trouble spots, though the U.K. market had a good year, despite Brexit.

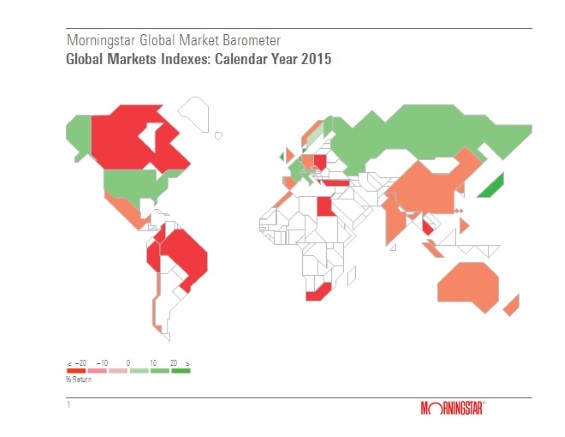

Looking back to 2015, the picture was more mixed. Most emerging markets were in negative territory, continuing a multiyear run of underperformance versus developed markets. Weak commodity prices weighed on Latin America and South Africa, as well as developed markets Canada and Australia. Europe was troubled, with the U.K. and Germany in negative territory, but Japan posted a strong year.

Of course, a key consequence of the election has been the strengthening of the U.S. dollar. From a U.S. investor’s perspective, this counteracts gains in securities denominated in foreign currencies. The differential in returns between local currency and USD variants of the following indexes reflects these currency moves.

The Morningstar Emerging Markets Index USD gained 11.3%, while the Developed Markets Index USD was up 8.5%. The margin was much larger earlier in the year.

Morningstar's equity market barometers were almost entirely green in 2016. It's entirely possible that 2017 will be a more colorful year.

Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. A list of investable products that track or have tracked a Morningstar index is available on the resources tab at indexes.morningstar.com. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/033528a9-55cc-40aa-90a9-8d2d98697cf5.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TNJY62P2RRG2PP5MMRLA5IZXYY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/033528a9-55cc-40aa-90a9-8d2d98697cf5.jpg)