U.S. Value Funds Beat Growth in the First Quarter

The difference between growth and value funds was stark.

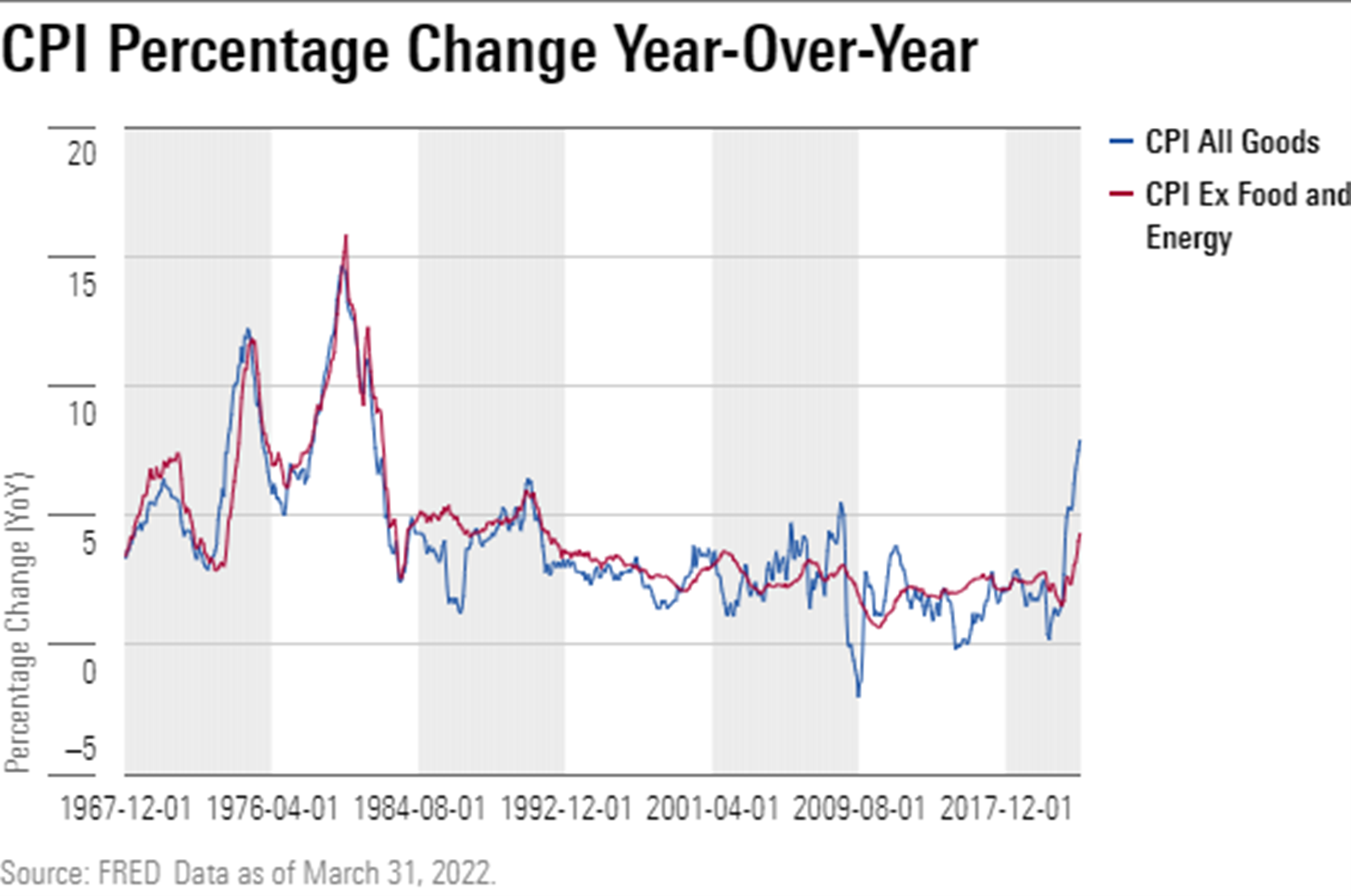

It was a rocky first quarter for U.S. equity funds. Nearly 90% of U.S. equity funds under Morningstar coverage lost money in 2022’s first quarter. Rising inflation and the war between Russia and Ukraine hampered growth and small-cap stocks. The small-growth Morningstar Category lost an average of 12.8%, the largest loss among the Morningstar Style Box categories.

The difference between growth and value funds was stark. The Morningstar US Value Index gained 2.4%, while the Morningstar US Growth Index lost 12.0%. The mid-, large-, and small-cap value categories each retreated but held up better than their blend and growth counterparts. Rising oil prices also helped U.S. equity energy funds, which jumped 32.9% on average. Higher commodity prices and global supply chain snarls also bolstered commodity funds, which rose 24.4% in the first quarter.

Technology stocks bore the brunt of the selloff. U.S. tech funds’ 13.7% average loss was their worst quarter since 2018’s fourth quarter. Small-growth companies also suffered. Small-growth firms in the biotech and pharmaceutical industries fell hard. Kodiak Sciences KOD, MEI Pharma MEIP, and Accelerate Diagnostics AXDX were among the worst-performing constituents of the Russell 2000 Growth Index in the first quarter.

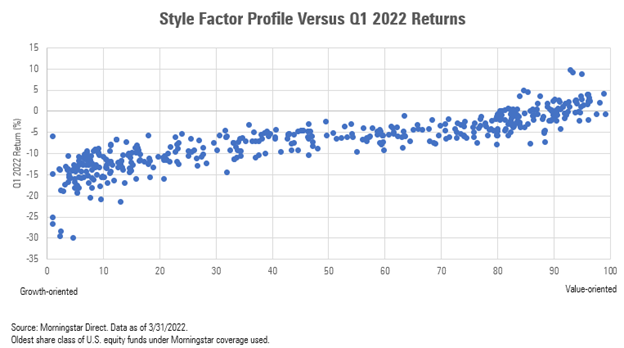

While most U.S. equity funds faced losses in the quarter, funds with a higher Morningstar style factor profile score (value-oriented funds) tended to hold up much better than their growth-oriented counterparts. Indeed, funds with a higher style score, such as Poplar Forest Partners IPFPX, Victory Integrity Discovery MMEYX, and BNY Mellon Opportunistic Mid Cap Value DMCVX, benefited from stylistic tailwinds. Meanwhile, funds with a higher growth profile, such as PGIM Jennison Focused Growth SPFZX, Allspring Enterprise SENAX, and Artisan Small Cap ARTSX, fared much worse.

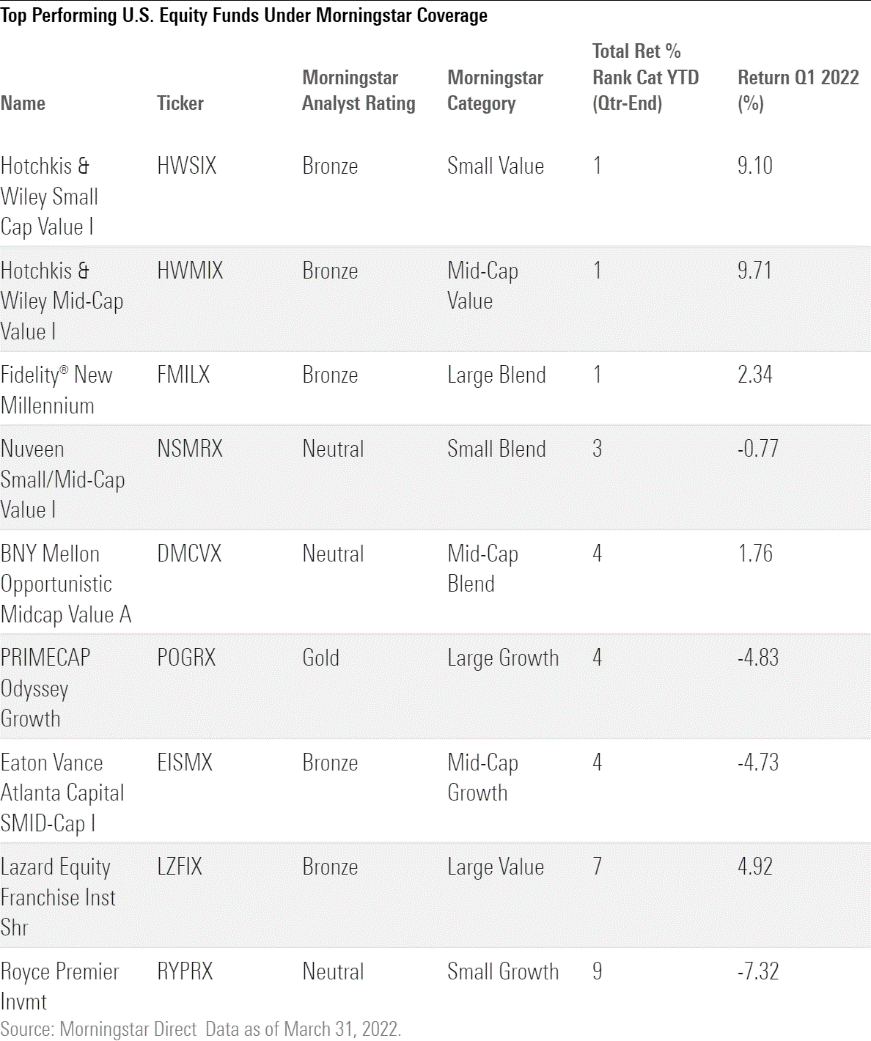

Top-Performing Funds

Fidelity New Millennium FMILX, which has a Morningstar Analyst Rating of Bronze, was among the first quarter’s best-performing large-blend funds, topping the Russell 1000 Index’s 5.1% loss with a 2.3% gain. Manager John Roth is a contrarian whose approach can be volatile. The fund’s 13.4% energy stake--nearly 10 percentage points greater than the index’s--provided a strong tailwind. Financial-services picks, such as Wells Fargo WFC, also boosted returns.

Bronze-rated Hotchkis & Wiley Small Cap Value HWSIX and Hotchkis & Wiley Mid-Cap Value HWMIX both beat 99% of their respective category peers. Large helpings of energy stocks propelled the deep-value funds’ respective 9.1% and 9.7% gains, which swamped the Russell 2000 Value Index’s and Russell Midcap Value Index’s more than 1% losses. Both funds benefited from their stakes in Kosmos Energy KOS, which gained more than 100% during the quarter.

More-conservative growth funds held up better than their aggressive peers. Silver-rated Eaton Vance Atlanta Capital SMID-Cap EISMX managers Chip Reed, Bill Bell, and Matt Hereford favor steady growers that tend to lag when flashier stocks rally but show resilience in drawdowns. The fund lost 4.7% in the first quarter, which was much less than the Russell Midcap Growth Index’s 12.6% drop. Financial-services, healthcare, industrials, and tech picks, such as WR Berkley WRB, Markel MKL, and WEX Inc. WEX, helped buoy the fund.

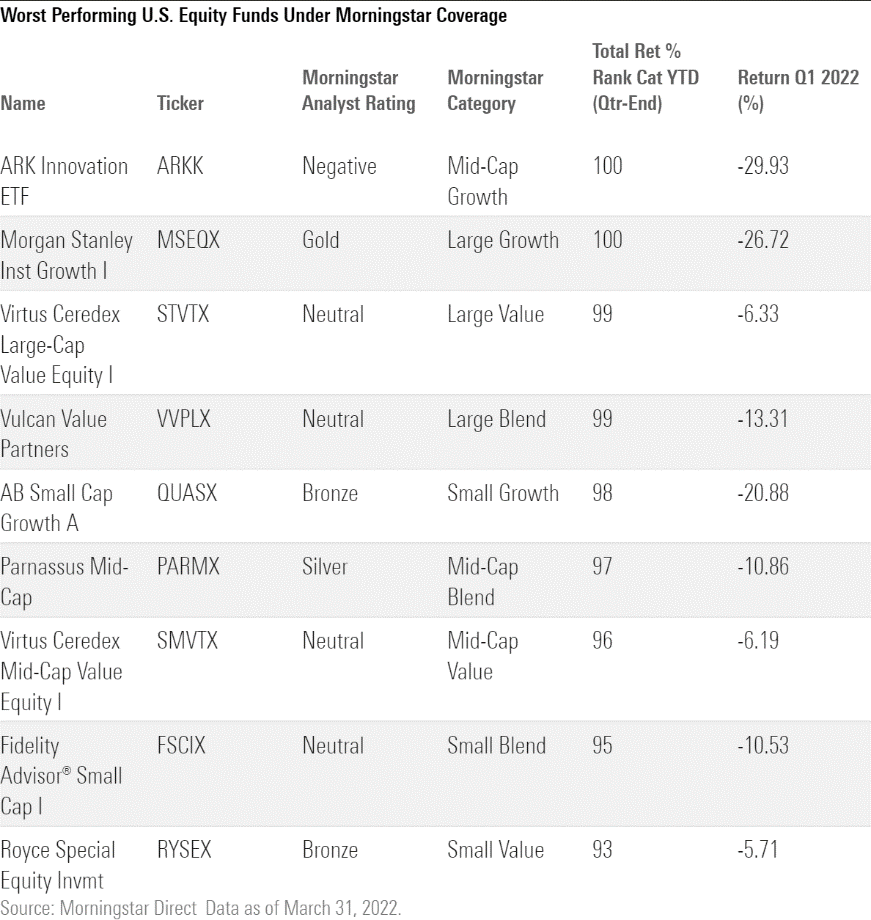

Worst-Performing Funds

Gold-rated Morgan Stanley Institutional Growth’s MSEQX 26.7% nosedive made it one of the quarter’s worst-performing large-growth funds, with a much worse showing than the Russell 1000 Growth Index’s 9.0% loss. The growth-fueled strategy run by Dennis Lynch is prone to ups and downs. The fund’s stake in Snowflake, a 2020 IPO that grew to more than 7% of the December 2021 portfolio, was among the fund’s leading detractors. But this fund has rebounded from steep losses before.

Cathie Wood’s Negative-rated ARK Innovation ETF ARKK continued a sharp decline that started in late 2021. Its 29.9% first-quarter loss more than doubled the Russell Midcap Growth Index’s 12.6% drop. The team’s aggressive-growth tech and healthcare picks have weighed heavily on returns. Roku ROKU, a 6.5% stake in the fund as of March 30, lost more than 45% for the year to date; Zoom Video Communications ZM, a 6.3% position, was down more than 40%; and Shopify SHOP, a 2.7% holding, was down more than 50%.

Some value funds missed the stylistic tailwinds. Silver-rated Oakmark Select OAKLX lost 6.1% in the quarter, worse than 98% of its large-value peers and lagging the 4.6% loss of its S&P 500 prospectus benchmark. Communication services and real estate picks, such as Netflix NFLX and CBRE Group CBRE, weighed on performance. So did the concentration of the roughly 20-stock portfolio assembled by managers Bill Nygren and Tony Coniaris. While the team emphasizes valuation and free cash flow among other metrics, this is not a deep-value strategy. Its high-conviction approach will consider nontraditional value stocks that can make it perform out of step with category peers.

/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-14-2024/t_958dc30e28aa4c8593f13c19505966e3_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)